By mid-April 2021, new events are taking place in Russia on the foreign exchange market - after the next package of American sanctions, the Stock market dropped significantly and, first of all, the ruble exchange rate collapsed at an accelerated pace.

Will the ruble collapse in the near future and whether it is necessary to run to an exchange office to buy another currency - we collect the opinions of experts and figure it out together with the ProfiComment magazine.

Black Tuesday 1994 - 38.5% drop

On October 11, 1994, on the Moscow Interbank Currency Exchange, the ruble to dollar exchange rate fell by 38.5% from 2,833 rubles to 3,926 rubles. Just a day after the interventions of the Central Bank of the Russian Federation, the exchange rate of the national currency almost recovered the entire fall - up to 2,994 rubles. Black Tuesday led to a sharp increase in inflation - in October it jumped from 8% to 15% and caused serious damage to the reform agenda. To investigate the reasons for the fall in the exchange rate, a special state commission was formed, which found that the reasons for the sharp drop were mainly speculative and occurred due to the actions of large commercial banks. Due to the sharp depreciation of the exchange rate, Russian President Boris Yeltsin resigned on October 12. Minister of Finance of the Russian Federation Sergei Dubinin, October 18 - Chairman of the Central Bank of the Russian Federation Viktor Gerashchenko.

What will happen to the ruble in the near future and in the second half of 2021: expert opinions

Against the backdrop of new sanctions and the fall of the ruble, the ProfiComment magazine collected the opinions of prominent economists and representatives of the financial block of the Russian Government.

In particular, the head of the TsSR, Alexei Kudrin , who worked as the Minister of Finance, sees temporary volatility in the situation with the ruble and believes that the Ministry of Finance should focus on inflation targeting. As a result, in his opinion, a further reduction in the key rate of the Central Bank, planned for the second half of 2021, most likely will not happen. Why try to accelerate inflation if a new round of sanctions contradictions itself gave the markets a cure for a too strong ruble.

Chairman of the Central Bank Elvira Sakhipzadovna Nabiullina does not see any particular risks to the financial stability of the state. She spoke about this at the Exchange Forum. The Central Bank has a large set of tools to reduce the appetites of speculators and prevent the ruble from falling. Currently, the head of the Central Bank does not see the need to use any special tools to reduce the risk of the ruble falling. Elvira Nabiullina believes the increased volatility of the ruble is a consequence of new American sanctions and does not see this as a long-term danger for the national currency.

Experts from the banking community agree that the situation with the ruble will clear up depending on the detente of the escalating geopolitical tensions around new sanctions against Russia by the United States against the backdrop of the Skripal case and chemical attacks in Syria. If the United States increases confrontation and introduces restrictions on purchases of Russian debt securities, then there is a risk of further weakening of the national currency. In particular, on April 5, 2021, a bill on exactly this was introduced into the US Congress.

However, such a development of events may not occur, in which case volatility with the ruble will most likely decrease within a month and by the beginning of summer 2021 the dollar exchange rate may return to 60-61.

1998 default - several daily drops to 29.6%

On August 17, 1998, a technical default was declared in Russia on the main types of government debt obligations. At the same time, the government abandoned the fixed exchange rate of the ruble against the dollar and announced a transition to a floating exchange rate within the framework of a new “currency corridor”, the boundaries of which were sharply expanded. The economic crisis and the depreciation of the Russian currency were facilitated by the artificial overvaluation of the ruble in order to reduce inflation and the crisis in the countries of Southeast Asia. World energy prices, which accounted for a significant portion of Russian exports, also fell sharply. From August 18 to September 9, the dollar rose 3.2 times against the ruble: from 6.50 to 20.83 rubles, followed by a short-term strengthening to 8.67 rubles. On August 23, Russian President Boris Yeltsin signed a decree on the resignation of Russian Prime Minister Sergei Kiriyenko, and on September 11, the head of the Central Bank, Sergei Dubinin, left his post. Until the end of the year, several more sharp jumps in the dollar exchange rate were recorded: September 17 (by 29.55%, from 9.61 to 12.45 rubles), September 18 (by 17.27%, to 14.6 rubles), October 17 (by 14.38%, from 13.56 to 15.51 rubles).

High volatility predicted for the Russian market

Finam analysts said that over the next few weeks the Russian market will be characterized by high volatility. Last Friday, the key stock indices of the Russian Federation fell. The dollar RTS lost almost 1.6 percent, and the ruble index of the Moscow Exchange was adjusted downward by 1.3 percent.

“After a very optimistic opening, a rather negative news background stimulated the closing of positions following the results of three days of recovery. Trade turnover continued to decline, but still remained above the average for the past few months. Investors continued to see an increased risk of conflict unfolding in the Syrian state, where the likelihood of bombing by the Americans and their allies is extremely high today,” Finam said in its review.

Against this background, Brent oil remained above the closing level of the previous session. Discussions on retaliatory sanctions have added to the global market's nervousness, and this has increased the risk that the “sanctions spiral” will only deepen in the future.

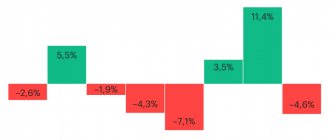

The crisis in the foreign exchange market of 2014-2015 - a drop in the stock exchange by 48%

In 2014, the ruble was under serious pressure from the unrest and subsequent coup d'etat in Ukraine, and then sanctions imposed against Russia by the United States and other countries. Since the fall, the main role in the fall of the ruble has been played by the reduction in oil prices: from $107 per barrel of Brent oil in August 2014 to $60 in December. A critical situation in the market arose on December 15, 2014. Against the backdrop of cheaper oil, the main factor contributing to the devaluation of the ruble was the rush demand for foreign currency. The decisions of the Central Bank of the Russian Federation to raise the key rate (to 17% per annum) did not have an immediate effect. On December 16, exchange rates on the stock exchange jumped sharply: the dollar reached 80 rubles (an increase of 48%), the euro - 100 rubles (38%). At the same time, the official exchange rate as of December 17 was raised to 61.15 rubles (an increase of 10.86%), and the euro to 76.15 rubles (11.08%). The second major drop during that period was recorded on January 12, 2015, the first day after the end of the New Year holidays. Due to the continued fall in the price of oil on the world market, the Central Bank fixed the dollar exchange rate on January 13 at 62.73 rubles (11.53%), the euro at 74.35 rubles (8.74%).

The ruble fell again. Causes

The significant weakening of the ruble that occurred this business week puzzled many. The dollar was trading around 77 rubles, the euro broke through the 91 ruble mark. The volatility is quite significant. Over the week, the Russian national currency sank by 4%. Last year, let me remind you, the devaluation was 20%. What are the reasons for this decline? What is causing prices to rise now?

Let us highlight the key reasons for the fall of the ruble. Investors and traders are nervous people, so the threat of introducing new anti-Russian sanctions is very annoying for them, and they are massively getting rid of rubles and Russian government debt securities.

Russia's internal debt now stands at 14.9 trillion rubles. Foreign speculators control almost a quarter of all Russian debt obligations. Their share is 23.4%, or 3.2 trillion rubles. Specifically, investors from the UK and the USA, according to the Russian Central Bank, control 12.6% of all investments in domestic bonds, i.e. 1.9 trillion rubles. If they begin to exit our debt securities en masse, this will be a painful blow for the Russian economy. Moreover, according to experts, the population will also be under attack due to the depreciation of the ruble. Devaluation will immediately affect prices, and therefore the purchasing power of households.

However, not only the ruble, but also other significant force majeure factors affect price increases. We all know about food, but the situation, for example, with electronics is developing much more dramatically.

Electronics prices have already increased in March, with new models entering the market at prices 15-30% more than could be predicted. This is not directly related to the ruble exchange rate, since it makes an insignificant contribution to price growth. Today we see a shortage of components, a shortage of electronics in production. There are several problems with this. This is climate change. Several factories that produce processors in Texas stopped working. We see the same thing in Taiwan, there is no water, there is literally no water to start production, and there are restrictions,

– Eldar Murtazin, leading analyst at Mobile Research Group, explains the situation.

Plus the US trade war against China. Plus, we have problems with logistics, which began in December last year, the cost of freighting a container increased from 4 thousand dollars to 12. Due to the incident in the Suez Canal that happened the other day, we are losing approximately 6% of the containers that were in circulation, simply because they are delayed by at least a week, and the cost of logistics increases even more as a result. That is, there are a huge number of negative factors from different sides. But the fact is that even in a falling market, in falling markets in the world, this year the smartphone market will noticeably decline compared to last year. Because there is nothing to make electronics from. And the second point, if you look at futures for the materials from which electronics are made, starting with silicon, sand, ending with copper, nickel, and other materials, prices for them have already increased at least twice, or even three, the expert believes .

Therefore, we see huge problems. First of all, they concern small manufacturers who have short contracts, that is, they buy components once a month. Today they have nothing to produce their devices from. This is a very wide range of devices: from “smart home” to literally doorbells,

– Eldar Murtazin summarizes.

Relations have worsened not only between Washington and Beijing. The United States is preparing another “pig” for Russia. In addition to sanctions regarding our national debt, an extremely radical sanction may follow - disconnecting Russia from the SWIFT international banking system. In general, Moscow is ready for this; an alternative payment system has been created and is working. However, not all so simple.

If the radicals win in Washington, then disconnection from SWIFT could become a kind of mark: Russia is a rogue state with all the far-reaching consequences for the ruble, the financial market, and the economy as a whole. At one time, the Iranian currency exchange rate collapsed 25 times after such sanctions. This does not threaten Russia; after all, our gold and foreign exchange reserves amount to almost $600 billion, but the situation will be extremely difficult, especially at first.

And another key factor is the volatility of the ruble and the constant dynamics in price growth. We are talking about oil, which continues to play a significant role in the economy and finance. The fall in prices from $70 to $62 per barrel of Brent had a very negative impact on the exchange rate of the Russian national currency. The main factor here is the volume of foreign currency inflow into the country, which, in turn, depends on hydrocarbon prices. Any downward correction is immediately reflected in the ruble exchange rate. The situation is aggravated by the so-called budget rule, which does not allow the ruble to strengthen. All additional income is spent on purchasing foreign currency, which creates pressure on the ruble exchange rate. As long as this so-called rule remains in effect, there is no need to talk about any stabilization, much less strengthening of the Russian currency. Force majeure, coupled with a vicious financial policy, are the key reasons for the disastrous situation in which our economy, the Russian ruble, and with them each of us find ourselves.

What do we have to do?

And here we smoothly move on to the question of how to act in this situation:

- Firstly, there is no need to panic and frantically buy dollars and euros, thereby you only push up the exchange rate of these currencies, lowering the value of the ruble. After all, as you know, it is demand that creates supply.

- Secondly, you should transfer your ruble deposits to multicurrency ones in order to somehow benefit from exchange rate changes. You will learn more about what multi-currency deposits are on this page.

- Thirdly, if possible, you should refuse loans, and follow the simple formula that our grandparents adhered to: “Be patient, save up and buy.” This way you will protect yourself from thoughtless spending and fabulous overpayments, which will be inevitable in the new economic conditions.

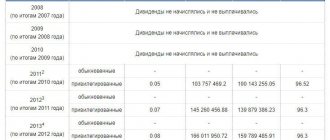

Investing is very important because... in conditions of high inflation, your savings annually lose about 10% of their purchasing value. This is why it is necessary to invest them correctly in various investment products in order not only to save money, but also to increase it.

Loan without refusal Loan with arrearsUrgently with your passportLoans at 0%Work in Yandex.TaxiYandex.Food courier up to 3,400 rubles/day!

You might also be interested in these articles:

The most popular way to invest is to make a bank deposit. Of course, a small yield is offered here (no more than 6-8% per annum), however, here your funds will be protected by the state if the bank you choose cooperates with the DIA.

The deposit is profitable because you will know for sure that the amount you originally invested will be saved and returned to you in any case, and you will receive income exactly on time and in the amount specified in the contract. And even if the bank loses its license, you will be paid compensation from the state budget.

Currency risks for the ruble remain

At the same time, the risks of investing in the ruble have not disappeared.

Dollar income in Russia depends on the dynamics of oil prices by approximately 60%. This is already enough to make the assets of some countries in Central and South-Eastern Europe look more attractive. The smaller interest rate difference, within 1-2%, is compensated by much lower currency risks. For the ruble, one of the key risk factors remains the possibility of new economic sanctions from the United States, which completely prohibit investing in the Russian debt market.

The US Treasury Department has already received instructions to prepare the appropriate regulatory framework by March 2018. Need I say that if such sanctions come into force, carry trade operations will be immediately stopped and a massive outflow of capital will begin?

The risks for the ruble are not limited to sanctions alone. In addition to them and the fall in oil prices, risk factors are the situation with North Korea, Ukraine, as well as the future presidential elections in Russia.

Is it time to run to the exchanger? What if we go on vacation in the summer?

In the current economic situation, there is no point in rushing to either buy or sell currency, unless, of course, you are a professional stock speculator. Savings for the long term should not suffer from such fluctuations, and those who were planning to buy currency for a vacation abroad can buy it without paying too much attention to the exchange rate, and still do it when it is more convenient for them. Moreover, few ordinary Belgorod residents spend around hundreds of thousands of dollars on vacation. Typically, the average Russian family's expenses for a vacation abroad range from 1.5–2 thousand euros. With such volumes, it doesn’t matter whether you bought these euros for 80, 81 or 82 rubles. In any case, exchange rate losses will be non-critical and will not compensate for the hassle that a person will experience trying to track exchange rates and waiting for the most favorable moment for themselves.

Why did the ruble fall so much?

The main reason for the sharp collapse lies in the fact that it occurred at the very moment when all other world markets were working, and we were resting. Domestic stock exchanges were closed, government institutions did not work. In other words, neither the Bank of Russia nor the Ministry of Finance had any physical ability to influence the situation. At some point, the ruble was left to its own devices, finding itself in a sea of “oil” problems. And on the Forex market, which operates around the clock, investors began to actively sell Russian currency, and not only Russian currency, getting rid of riskier instruments in favor of more reliable ones. Already on March 10, the situation began to rapidly improve - timely actions of the Central Bank and the Ministry of Finance made it possible to win back a significant part of the losses incurred on March 9. As for the impact of the collapse of the ruble exchange rate on the daily lives of Russians, according to the expert, it will not be as significant as it seemed over the weekend.

The ruble will “jump”

But the ruble, unlike real estate, became cheaper in 2021. There is no hope for a rapid recovery of the Russian currency next year.

The ruble is a raw material currency, our budget is set based on the cost of black gold. According to Vladimir Grigoriev, leading finance teacher at MIRBIS Business School , you shouldn’t expect much support from rising oil prices.

“The recovery of the global economy, if it happens at all, will be long and, accordingly, oil will not soon return to the price level desired by exporters. <…> In 2021, there will also be a delayed negative effect from the poor economic results of the current year, large budget expenditures and lost revenues (tax holidays), and the deterioration of the situation of business and the population. To this should be added the inevitable problems in the banking system due to the deterioration in the quality of loan portfolios,” the expert warns. All these are negative factors for the ruble.

On the other hand, our currency will be supported by the recovery of the global economy, hopes for which arose against the backdrop of news of the creation of vaccines that can stop the spread of coronavirus and cope with the pandemic. “But we should not expect that this will be rapid growth comparable to 2000-2007. The stabilization of financial markets will increase the risk appetite of international investors and bring them to the Russian market, which will certainly strengthen the ruble. <…> But you need to be prepared for the instability of the ruble throughout the year,” says Grigoriev.

In what currency should you store your savings? Expert advice Read more

Are there any prerequisites for devaluation in 2021?

Russia is in a difficult economic situation and the population justifiably has a question about whether to expect a devaluation of the ruble in 2021. The precondition for the unrest was a decline in GDP, despite the fact that its growth was predicted, while retail trade did not move towards positive dynamics.

Imports of goods have decreased greatly and their growth is not expected in the near future. The imposed sanctions significantly complicate the work of the country's economy, and if everything continues further, this could indeed lead to the devaluation of the Russian monetary unit.

This economic phenomenon will be significantly affected by inflation and the state’s inability to repay its own debts.

Within the framework of this issue, it is worth mentioning that devaluation can be both open and hidden. In the open form of the phenomenon, the Central Bank officially makes a statement and makes a complete replacement of money. At the same time, credit rates are updated and depreciated bills are withdrawn.

Of course, experts do not expect devaluation in this form, but in a hidden form it is possible, in which case it will be possible to observe a decrease in the value of the currency, but without removing it from circulation. As a result of this financial policy, the standard of living becomes more expensive, which can already be observed today.

It is impossible to say with 100% certainty that the country will face a similar path of development. Oil prices began to rise and positive economic growth dynamics became noticeable. The devaluation will be significantly affected by inflation and financial shortages, but so far there is no talk of this. The first indicator is expected to remain at the level of 5%, and there are still enough reserve funds in the budget.

There is little cause for concern, the currency has stabilized on the market, and all problems are so far being resolved through the reserve fund, and sanctions have not weakened their impact on the country’s economy.