Today, the international gold market is a powerful transnational conglomerate, which includes large gold mining enterprises, precious metal refineries, leading banking institutions and exchanges in developed countries. The history of the transformation of gold from a monetary unit into a currency on a planetary scale begins in Ancient Egypt. It was this legendary civilization that first began storing gold bars in order to always have the coveted precious metal at hand. Later, in ancient Greece, gold began to appear not only in the form of coins and jewelry, but in the form of measures measured in talents, which became the ancestors of modern gold and foreign exchange reserves.

Gradually, gold bars became the main means of accumulating wealth recognized by all for the tribes and states of the Ancient World. Today, this metal is the main means of payment for interstate payments, the volume of which convincingly demonstrates the financial power of the possessing country.

What factors determine the price of gold on the world market?

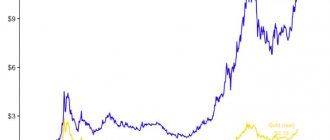

At the beginning of 2021, one gram of gold on the world market cost about 42 US dollars. Until the 70s of the last century, the cost of a gram was about $1.2. However, after the American dollar was abolished from the gold standard, this asset began to rapidly rise in price, reaching a 20th century record price of $2.8 per gram in 1980. According to established traditions, the cost of one troy ounce of gold (31.1034768 grams) is fixed twice a day on the London Precious Metals Exchange. Stock quotes and all participants in the gold market are based on this figure.

A comprehensive analysis of the world gold market over a long period of time (100 years) demonstrates the inevitable growth of this asset, associated with short-term, but quite noticeable declines. Therefore, investments in the main precious metal are often considered only as long-term, ultra-reliable investments. Such a resilient asset clearly protects the investor from steadily growing inflation, which inevitably affects the purchasing power of all monetary currencies.

It is worth especially noting that the factors influencing the cost of a troy gold ounce are also global in nature. The key features of the global gold market are its weak reaction to significant events in the world of high technology, which, for example, can greatly change the price of Apple shares or call into question the size of Amazon's dividends.

Experts name the following factors that can significantly change the value of the main currency of our civilization:

- global economic crisis affecting all developed countries;

- the emergence of a fundamentally new currency pegged to the gold standard;

- large-scale wars, political collapses and natural disasters that can depreciate the national currencies of large states;

- new explored large deposits, for example, in the World Ocean

Obviously, the events listed do not happen every day. However, the cost of a troy ounce over 100 years still increased from $20 to $1,400 by the beginning of 2021. Such significant progress, as mentioned above, was achieved due to the US abandoning the gold standard in 1971. From that moment, rapid inflation of the dollar began with a significant loss of purchasing power, leading to an impressive growth of the “yellow metal” at first glance.

In the 21st century, a world record was reached - $1920 per troy ounce. However, even this impressive rate, taking into account the general inflation of the American currency, if converted to prices of the early 20th century, will turn into approximately $45-50 per troy ounce. But even such figures prove that the price has increased by approximately 2.5 times, taking into account maximum inflation rates.

Dynamics of supply and demand for gold and the potential endgame of the dollar. Part one.

Authors: Joe Yasinski and Dan Flynn .

Part 1 of 3: What is supply and demand? Today it is all stock and flow.

After reading this title, we were convinced that somewhere our university professors of economics are ready to collapse in shame with all these graphs along the coordinate axes, drawn completely in vain. Economists around the world can comfort themselves that the laws of supply and demand still largely govern the market. However, we believe that the yellow and essentially useless metal is an exception. A metal that, purely by chance, has shaped the world's monetary systems for the past few thousand years. The “supply” of gold, traditionally defined as the volume of global production, is virtually irrelevant in determining its price. How is this possible? Analysts proudly proclaim that the dynamics of global supply are inseparable from forecasting future metal prices. We can only attribute this to the fact that these analysts continue to have a short-sighted view of gold as a commodity.

Gold, even when viewed as a commodity, is unique in that it is not consumed. Since there are very few cost-effective industrial applications for the yellow metal, there is virtually no "natural" industrial demand for it. Almost every ounce ever mined from the earth is still on the ground, either in a vault or safe, or in the form of an earring. Approximately 170,000 tons of metal have been mined, hidden, and are clearly owned by someone. Given that the annual supply of mining is approximately 2,500 tons, why is the price of gold not zero? Ultimately, there is an abundance of metal for as many as 65 years! Despite everything we know about the dynamics of supply and demand and the “law” of economics, the price of gold is strikingly far from its all-time high – in every currency on the planet.

The main influencing factor in the price of gold is that most of the supply of physical gold is in very good hands. For the most part, it is privately owned either by very wealthy families or by governments and their central banks. This gold lies very still, and some of it has not changed ownership or location for tens, if not hundreds of years. These giant owners have little need to sell and hold gold as a long-term store of capital or as a central bank reserve asset. Of course, gold appeals to these high-end investors because of its history as the ultimate store of value in the absence of counterparty risk. Of course, you can buy real estate, art or classic cars - just like all super-rich people do. But in addition to the lack of liquidity and subjective risk, these assets themselves can become a cost center for maintenance, storage, insurance, etc. Gold is generally recognized as a capital asset, but beyond that, it is also infinitely divisible, movable and extremely liquid. The value of gold has been established for thousands of years, and it is the asset that forms the face value of everything else.

Apart from supply in the traditional sense, the price of gold is determined by the proportion of the existing supply (170,000 tons) offered for sale on a given day. The quantity of stock available for purchase constitutes the “flow.” If you divide the flow by the stock, you get the stock-to-flow ratio (STF ratio). A low ratio demonstrates a very high proportion of existing physical stock available for sale, and a very high STF ratio indicates that owners are choosing to hoard physical metal rather than exchange it for dollars. So, for example, if all available ounces of gold were put up for sale tomorrow, the stock-to-flow ratio would reach one, and the price would likely collapse to almost zero. But what would happen if, instead of selling all existing gold, all owners of the physical metal decided to keep it for themselves? Could this ever happen? Doesn't conventional wisdom and the "laws of economics" tell us that as prices rise, fewer buyers are able to buy and more sellers are willing to get rid of the product?

We believe that traditional thinking simply does not work here. Gold, we think, is what is often considered a Giffen commodity. A Giffen good is a good for which demand increases as its price increases. The opposite is also true: as prices fall, demand also decreases. While the concept of a Giffen commodity is well known, the number of real-world examples is few and usually limited, at most, to localized commodity markets. The beautiful, brilliant exception is the massive example playing out right before our eyes. In typical Giffen commodity behavior, gold was despised, dumped by both individuals and central banks when the price hovered below a hundred dollars an ounce. Fast forward to today, and demand for gold is now at or near all-time highs, even as the price sets new records against all world currencies.

Many prominent members of the gold community insist that gold will rise significantly in price because it will receive a huge influx of investment dollars in the next few years. They may well be right, and we at the GBI certainly hope so. But we also see the opposite scenario. We believe that a large-scale increase in the price of gold against the dollar could happen quite unexpectedly, almost overnight. But not because of any sustained long-term demand for gold, but simply because owners of the metal will withdraw it from sale, sending the stock-to-flow ratio to infinity. This is why it is so important to understand this relationship.

Can you imagine if a car manufacturer (or any other producer of a good with decreasing marginal utility) decided to simply keep the cars they just produced and let them accumulate indefinitely, or would he offer them for sale for the maximum number of dollars he could get? Of course he would sell them for dollars because he has to monetize his products. As with almost every product, device, or car, the supply/demand dynamics work in a very simple way. The manufacturer needs to trade these cars in for cash or they will be worth nothing to them. There is no need for a gold holder to exchange his stock for dollars, especially if there is an avalanche of dollars hunting for this stock of metal.

If there is a dollar avalanche, is it conceivable that someone with a lot of gold—perhaps a country's central bank with a positive current account or a billionaire family—would choose to hold gold as a reserve rather than the current supply of dollars? Or do you expect these sophisticated economic actors to divest themselves of their store of value in exchange for rapidly depreciating dollars (like the automaker)? Once you can understand why one thing makes sense and another doesn't, you will make significant progress in understanding gold pricing and why large price movements may have little to nothing to do with traditional supply and demand dynamics. It doesn't take a massive influx of dollars to make gold rise to unimaginable levels. Existing owners only need to withdraw their stock from sale. And if we return to Giffen, when physical gold goes underground, the demand from people offering their dollars will increase in accordance with the rising price.

It is important to realize that dollars are competing for assets. When dollars compete again and again to buy the supply (high velocity of money), the price rises. If all the dollars stop competing for Apple Computer, Inc. stock, the price drops to zero. In reality, Apple shares are valued in dollars. Gold is a unique asset in the sense that it itself determines the value of currencies. Dollars are not fighting for gold. This gold is offered for dollars. If you have difficulty understanding this idea, think about an emergency situation such as Weimar Germany or Zimbabwe. The owner of gold accepts or refuses a dollar amount as a suitable substitute for his metal. When they reject this offer, the stock-to-flow ratio increases. Why should a gold owner stop fighting for dollars? For the same reasons we all hoard gold - to protect real purchasing power from a fall in the value of a fiat currency. Where will this flow come from? Obviously, central banks have no intention of selling anything anytime soon, and neither do our Asian friends. On a micro level, we've seen recently in places like Greece and Spain that a finite amount of gold comes into the market when times get tough. What happens when the population runs out of gold bracelets to sell and everyone else starts hoarding? What happens at the macro level when surplus countries no longer save in US dollars but instead hoard gold? What happens if the “flow” of gold slows to a crawl or even stops altogether? We can easily imagine many scenarios that do not require much imagination. Will dollars frantically chase gold? Probably, but will gold owners offer it for those dollars? What will this mean for the purchasing power of the dollar relative to other goods and services?

Will people realize that their dollars are getting cheaper?

The reader must decide for himself which of the following two turns of events is more likely. Is it more likely that people will realize that their dollars are getting cheaper and will gradually turn more of their assets into gold, or is it more likely that existing gold owners who came to this conclusion a long time ago and most likely bought gold to hedge From such a development of events, will they first decide to withdraw it from sale?

The answer lies in the following question: who values gold more? New buyer or existing owner? Of course, we can achieve astronomical gold prices with an influx of new buyers, but gold could become even more expensive overnight if existing owners stop offering their gold for dollars. Some combination of the first and second options is also possible. The only problem for a new investor is that one of these scenarios can play out over many years, while the other can happen in almost a day.

What happens to the “price” of gold when it is no longer offered for dollars? Nothing. Or infinity. Make your choice.

Key problems of the global gold market

- Increasing scale of smuggling and illegal gold mining in developing countries.

- A decrease in the volume of legal gold mining with the complication of the procedure for obtaining licenses.

- A general drop in demand from private investors for gold bars and coins offered by banks.

- Low activity in the jewelry markets due to a decrease in the solvency of the population as a whole.

- Many countries have large public debts, requiring a radical reduction in the expenditure of reserve funds, which reduces the free circulation of physical bullion.

The prospect of new long-term stability in the gold rate is also chilling for investors accustomed to making a lot and quickly on short positions. So gold again becomes a cozy long-term investment that will never lose its value.

How to evaluate and where to buy shares of gold mining companies?

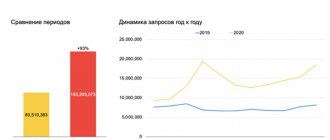

There are several services where you can evaluate companies before purchasing. I consider the stock screener from Smart-lab to be a convenient tool. Go to SmartLab smart-lab.ru/q/shares_fundamental and select the “Mining” Sector in the section. The following visualization appears before us:

It can be seen that the companies' debt/EBITDA ratio is at an acceptable level (about 2), and EV/EBITDA is very high relative to the Russian mining sector (about 9). This is noticeable in comparison with Alrosa (diamonds), Raspadskaya (coal) and MMC Norilsk Nickel (rare earth metals). A cautious conclusion is that companies are now too expensive to buy. However, relative to the market of Western gold miners, the Russian one is still undervalued. You can purchase shares for the long term through any Russian broker.

I also recommend reading:

Do Kondratieff cycles work in market forecasting?

Kondratieff cycles indicate an imminent crisis

Shares of Polyus Gold (PLZL) and Polymetal (POLY) are traded on the Moscow Exchange, the minimum lot is 1 piece. It is important to know one nuance: Polymetal pays dividends in dollars. They will have to be converted into rubles or transferred to a foreign currency account of a Russian broker for further reinvestment.

Companies with foreign participation and assets in Russia are also located on foreign sites. Thus, Polymetal Int. Plc, in addition to the domestic MOEX, are traded on the London Stock Exchange (LSE) and the Kazakhstan AIX. Petropavlovsk PLC is listed only on the London stock exchange, Kinross Gold Corp is listed on the American NYSE and Canadian TSE, Auriant Mining AB is listed on the Stockholm Stock Exchange and the American NASDAQ. Their purchase is possible either through the St. Petersburg Exchange (most domestic brokers offer access) or through a foreign broker (for example, Interactive Brokers).

Global gold market 2021. What awaits the main currency in the near future?

Leading countries will continue to accumulate gold and foreign exchange reserves while maintaining the leadership of the United States, which today has at its disposal more than 8 thousand tons of bullion. China and India, which are quickly becoming the leading players in the gold and foreign exchange championships, can have a significant impact on market activity. Having successfully overcome the crisis of 2009-2012, Russia can reach the figure of 2,200 tons of gold reserves. In general, there are no reasons for the rapid rise and fall in the rate of this asset, with the exception of the alarming political horizon.

The current state of the world gold market allows us to draw an unambiguous conclusion - only a new global economic crisis can significantly shift the gold rate towards the horizons of rapid appreciation. It is quite difficult to predict how far these horizons will be. Because high technology can confuse all forecasts with the discovery of some synthetic method of producing gold or new unexplored deposits in the ocean depths.

Gold mining in the world

By the end of 2021, the global reserves of mined gold were about 150 thousand tons, which were distributed as follows:

- state and transnational financial holdings - about 30 thousand tons;

- jewelry industry - 79 thousand tons;

- electronics products, nanotechnology products, dental products - 17 thousand tons;

- investor savings - 24 thousand tons.

An analysis of global trends in the development of mining and exploration of precious metals over the past few decades indicates that there are trends for both increasing and decreasing volumes of precious metals production, incl. gold. A significant increase in the market value of gold in the 70s of the twentieth century influenced the activity of its producers in most of the countries of the world community. At that moment the most profitable were:

- processing of difficult ores;

- involvement in exploitation of off-balance reserves that were previously recognized as unsuitable for production;

- resumption of exploitation of abandoned and so-called “mothballed” quarries and mines;

- processing of man-made dumps from mining and processing plants, which contain a certain amount of precious metals.

It is worth noting that significant changes in gold mining technology through heap, heap with cyanidation and biological leaching in columns, methods, improvements in other popular methods (for example, autoclave enrichment of refractory ores) have radically increased the profitability of secondary processing of low-grade ores and surviving mines and quarries.