The QUIK trading system provides the ability to operate transactions using stop orders. A stop order in QUIK is an order from a financial market participant that has additional conditions that determine the moment of placement in the TS (trading system).

All available conditional orders are received on the server equipment of the QUIK system and are stored until the specified conditions occur. The QUIK server constantly monitors the execution of stop orders to ensure they are triggered. As soon as its execution time expires, the system gives a signal to the exchange to activate the limited order.

Varieties

The ITS QUIK trading terminal works with the following conditional orders:

- with a related application;

- stop limit;

- stop price for another security;

- take profit;

- take profit and stop limit.

The trader independently sets the validity period of such an order. This parameter is specified when creating an order. There are three options available in Kwik. A stop order can be valid:

- during the current trading session;

- before the specified calendar date;

- until canceled, when the trader cancels the placed order.

Naturally, if the specified condition is met, the application is automatically executed by the trading terminal.

Setting the order lifetime allows you to automate the trading process. It is not at all necessary to be in front of a computer monitor and control the market situation. The trading participant sets the terms of the transaction once at a convenient time. For example, the levels of purchase and sale of an asset. Kwik will do the rest.

There are several ways to place a conditional order in the QUIK ITS. The easiest one is to press the F6 key. This action will display a window for entering a stop order on the monitor screen.

Is it possible to reduce the spread

Every trader should strive to reduce costs, and spread is one of them. How to reduce it? One option is to choose a broker with conditions that suit you.

Let’s make a reservation right away - you can’t do without a spread at all, brokers are people too and want to make money. But so that their earnings do not interfere with yours, you need to understand how the spread is built. There are three types:

- fixed. This spread is constant regardless of market conditions;

- conditionally fixed (or spread with extension). The spread size is formally fixed, but it can change unilaterally - simply at the request of the broker;

- floating (Variable). The size of the spread depends on the stock and the market situation, in particular on the volume of a particular asset offered for sale. You can see the difference between fixed and floating spreads more clearly in the illustration.

In practice, brokers often use the latter type of spread. Sometimes brokers offer a conditionally fixed spread - it is better to stay away from them, because such a spread on the exchange will work against you and increase at the most inopportune moment. Despite the fact that semi-fixed spread conditions may seem more favorable, you should not work with such brokers. A fixed spread is only suitable for trading short-term positions, and even then it is not always profitable.

The size of the floating spread depends on the market situation. The less activity on a given position, the higher the spread will be. Therefore, to reduce it, it is worth trading during periods of optimal activity.

How to choose a broker with the lowest spread

You may have seen offers from brokers with a “zero” spread. Such brokerage companies exist and are often not scammers - the lack of a spread is just a publicity stunt. The broker will simply make money in a different way - through an increased commission or other fees. Whether such a strategy is beneficial for you personally is up to you to decide.

To decide which broker's spread is more profitable for you, pay attention to:

- at the minimum spread. Some brokerage, although this is not quite the correct term - the usual spread is significantly higher than the minimum;

- spread boundaries. Few bookmakers indicate strict limits within which the spread can fluctuate. If they exist, this is a big plus;

- formulations of situations when the broker can intervene and change the spread size. As a rule, they are very vague, but if you see a clear definition of such a market situation in the broker’s terms and conditions, that’s good;

- presence of intermediaries. Everything is simple here - the more organizations there are between the broker and the exchange, the higher his services will cost you. This will also affect the size of the spread.

Stop limit

This is a conditional order that helps the trader solve 1 of 2 problems:

- sell an asset below the current price;

- buy an asset above the current price.

The main purpose of using such an order is to limit the amount of loss if the quotes of the selected trading instrument move in the direction opposite to expectations. In traders' slang, this operation is called placing a stop loss.

For a better understanding, consider an example from the Russian stock market.

On April 10, 2021, the trader bought shares of Sberbank PJSC. The acquisition price of the asset is 242.78 rubles. The trader assumed that the security's quotes would continue to move within the growing trend. To protect against negative developments, the trading participant entered a conditional stop limit order. Indicating the duration of the order - until cancellation. The stop price was set at 242.5 rubles.

From the beginning of the next trading session, quotes for Sberbank's ordinary shares continued to move upward. However, then they turned around and began a downward movement. When asset prices dropped to 242.5 rubles, the stop order was triggered. This limited the loss on the transaction to 28 kopecks.

As we can see, the trader’s decision was correct. Subsequently, the asset's quotes continued to decline. The trader promptly closed the losing position.

The same principle applies to limiting losses on shorts or short positions. Only in this case, in the conditions for activating the order, we select not the sale, but the purchase of the asset.

Another reason for using stop limit orders is to implement a breakout trading strategy. The point of this approach is that the trader finds a strong level (support or resistance) that limits the movement of quotes. The idea is simple: if the price overcomes this level, it will move further in the same direction.

However, not all so simple. After a breakout, quotes often make extremely sharp movements. The trader simply runs the risk of not being able to keep up with such a movement. Stop limits solve this problem. Such orders allow you to place an order to buy or sell an asset in advance and not miss the price movement.

Learning to exhibit

To place a stop limit order, use the algorithm below.

1. Press the F6 key on your keyboard.

2. Select the stop limit order type.

3. Set the expiration date for the order.

4. In the order activation conditions, select Buy or Sell.

5. Determine the price level at which the order will be activated. For longs, this indicator is set below the buy level. And vice versa. For shorts, this indicator is indicated above the sell level. In our example, the trader bought Sberbank shares at 242.78 rubles, and set the price to activate the stop limit at 242.5 rubles.

6. We set the price at which the application itself is submitted. When selling, this parameter is set below the activation price. And vice versa. When purchasing, it is correspondingly higher. This is necessary to avoid the so-called price slippage, when quotes make sudden movements and some orders remain unfulfilled. In our example, this is 242.2 rubles.

7. Set the number of lots.

8. Select your Client Code.

9. Press the enter key and confirm the application in the window that appears.

Is it possible to reduce the spread

Every trader should strive to reduce costs, and spread is one of them. How to reduce it? One option is to choose a broker with conditions that suit you.

Let’s make a reservation right away - you can’t do without a spread at all, brokers are people too and want to make money. But so that their earnings do not interfere with yours, you need to understand how the spread is built. There are three types:

- fixed. This spread is constant regardless of market conditions;

- conditionally fixed (or spread with extension). The spread size is formally fixed, but it can change unilaterally - simply at the request of the broker;

- floating (Variable). The size of the spread depends on the stock and the market situation, in particular on the volume of a particular asset offered for sale. You can see the difference between fixed and floating spreads more clearly in the illustration.

In practice, brokers often use the latter type of spread. Sometimes brokers offer a conditionally fixed spread - it is better to stay away from them, because such a spread on the exchange will work against you and increase at the most inopportune moment. Despite the fact that semi-fixed spread conditions may seem more favorable, you should not work with such brokers. A fixed spread is only suitable for trading short-term positions, and even then it is not always profitable.

The size of the floating spread depends on the market situation. The less activity on a given position, the higher the spread will be. Therefore, to reduce it, it is worth trading during periods of optimal activity.

How to choose a broker with the lowest spread

You may have seen offers from brokers with a “zero” spread. Such brokerage companies exist and are often not scammers - the lack of a spread is just a publicity stunt. The broker will simply make money in a different way - through an increased commission or other fees. Whether such a strategy is beneficial for you personally is up to you to decide.

To decide which broker's spread is more profitable for you, pay attention to:

- at the minimum spread. Some brokerage, although this is not quite the correct term - the usual spread is significantly higher than the minimum;

- spread boundaries. Few bookmakers indicate strict limits within which the spread can fluctuate. If they exist, this is a big plus;

- formulations of situations when the broker can intervene and change the spread size. As a rule, they are very vague, but if you see a clear definition of such a market situation in the broker’s terms and conditions, that’s good;

- presence of intermediaries. Everything is simple here - the more organizations there are between the broker and the exchange, the higher his services will cost you. This will also affect the size of the spread.

Take Profit

This is a conditional order, which was invented to close a position on an asset with the maximum possible profit. The name of such an order speaks to this as well. Translated from English, take profit means to make a profit.

The set take profit is executed if the asset price deteriorates from the local maximum by the amount specified by the user of the trading terminal.

The application in question works in Kwik on the sliding stop principle. This approach helps to close a trading position without determining a specific price level in advance. When quotes move in the direction desired by the trader, the stop will automatically move to the same side. However, if prices reverse and reach the set rebound value, the order will be closed.

The trader sets the magnitude of the rebound from the reached extremum (from the maximum during long or minimum during short) in percentage or absolute values.

Let's look at a specific example.

On May 14, 2021, the trader bought shares of PJSC Gazprom at a price of 165 rubles. At the same time, the trading participant entered the market at the beginning of a powerful upward movement. By the time the trading session closed, the issuer’s quotes soared by tens of percent to the level of 190.9 rubles.

The trader found himself in a difficult situation. On the one hand, he was already in good profit. On the other hand, the potential for growth in Gazprom shares has not been exhausted. The trader set a take profit. The rebound value was 5%.

As you can see, the trader who acted this way was right. Long closed on June 3, 2021. At that trading session, quotes showed a maximum of 251.65 rubles, and then sharply corrected downwards. The system closed the trader’s position at the level of 239 rubles. Everyone will assess the size of the profit independently.

Learning to exhibit

Follow this algorithm.

1. Press F6 and call the order entry window.

2. Select the type of stop order – take profit.

3. Set the expiration date for the order.

4. Choose between the Buy and Sell items.

5. Set the price, upon reaching which QUIK activates take profit. This is the same local extremum that we were talking about.

6. Determine the number of lots per order.

7. Set the Client Code.

8. In the Offset from max/min window, set the rebound value for triggering a stop order. Set this parameter as a percentage or price currency. It is important to correctly determine this value. A small indent will work with the first small correction. A large one will interfere with profit maximization.

9. Set a Protective Spread. This is a guarantee of the sale of the entire volume of shares upon request and protection against slippage.

10. Press the enter key and agree to activate the application in the window that appears.

Practical part

Let's move from theory to practice. Let's learn how to place market orders in the QWIK trading terminal (Kwik). Use any usual method to open the window for entering application parameters. For this purpose, Kwik provides several solutions:

- button on the top panel Submit a new request;

- double-click with the left mouse button on any line of the order book;

- single right-click on any candle on the trading chart and select the appropriate item from the drop-down menu;

- F2 key on the keyboard.

After this, the necessary window for entering order parameters will appear in front of the trader. Now you need to check the Market box, select the Buy/Sell option and indicate the desired number of lots.

Click on the Yes button. Then click OK in the confirmation window. The transaction will be completed instantly. This is the main difference between a market order and a limit order. A limit order is executed only when the price reaches the level specified by the trader.

With linked application

This is a combined application. It consists of 2 orders for one asset. The first is the stop limit. The second is a standard limited order. When any of the placed orders is executed, the other one is automatically canceled. Such orders are used to close a trading position. A limit order specifies the price level for the planned closing of a position. The stop limit limits possible losses in case of negative market conditions.

When placing such a linked order, the money in the brokerage account is blocked once.

If the stop limit is executed, the associated limit order is completely canceled. When the associated limit order is partially executed, the stop limit is either completely removed or reduced by the appropriate amount. This is determined by the conditions specified by the trader.

The order in question is valid until the end of the trading session.

Let's look at an example.

On June 5, 2021, a trader bought shares of PJSC LUKOIL at a price of 5,100 rubles. A long trading plan was drawn up with an estimated profit of 5%. The level of falling quotes for fixing losses is set at 2%. To implement the trading plan, the trader used a stop with a related order.

As you can see, in the example considered, the trader recorded the estimated profit. Using a connected stop is justified.

If the trader instead used two separate orders with the same conditions, this could lead to negative consequences. Suppose Lukoil stock prices fall by 2% or more and then rise by 7%. What will happen? The trader will first take a stop loss and then open a short in a bull market.

To prevent this from happening, use a tool with a linked application. Its main specificity is the automatic cancellation of the second order when the first one is executed.

Learning to exhibit

We adhere to this algorithm.

1. Press F6 and call the order entry window.

2. Select With associated order.

3. Decide between Buy and Sell.

4. Set the price to activate the stop limit.

5. Determine the number of lots of the asset.

6. We determine the price below for placing the application itself. This is still the same insurance against slippage problems.

7. Set the Client Code.

8. Place a related purchase order at a specific price.

9. We determine the conditions for removing a stop order when a limited order is partially executed.

10. Press enter and activate the application.

Conclusions: basic rules for using protective orders

Please note that professional and effective trading requires the mandatory use of a stop loss tool. Always use!

trader's insurance , protecting against losses that may not be noticed simply because you went away for a couple of minutes to make yourself a coffee. Even if this protective order is not required. He will still complete his task. The investor will be calm and will be able to pay more attention to analyzing the general situation on the market.

In order for the deposit to be used with maximum efficiency, you should not set the SL level too low, which does not correspond to the main real quotes. It is necessary to analyze the market situation, and if it is possible to regularly enter the quick terminal, “ pull up ” the stop loss level to the current quotes so that the order is triggered in the profitable zone.

Using take profit in QUIK allows traders to take control of risks and create conditions for accumulating profits. Thank you for your attention, always your Maximum income!

Stop price for another security

This is a conditional order of the stop limit type, the stop price condition of which is checked for one asset, and another asset is specified in the executed limited order.

Such orders are used by traders who work with arbitrage strategies or hedge risks. Simply put, when one position is defended with the help of another positioned in the opposite direction. In addition, such orders are used by traders who see a connection in the market movements of 2 different instruments. For example, ordinary and preferred shares of one company.

Let's give an example of using a stop price order for another security.

The trader identified a pattern in the movements of quotes for ordinary and preferred shares of Sberbank. First, the movement is made by the habit. Then the prefs join it. In other words, if ordinary shares of Sberbank are growing strongly, then the trader wants to buy preferred securities, predicting their imminent increase in price.

Please note that this is an example and not a description of a trading strategy.

Learning to exhibit

Let's take the example discussed above as a basis. Now let’s look at the algorithm for placing a stop price order for another security.

1. Press the F6 key on your keyboard.

2. Select the stop price order type for another security.

3. Set the expiration date.

4. In the Instrument window, select the asset with which the transaction is planned. In our case, these are preferred shares of Sberbank.

5. In the Take a stop price for an instrument window, select the asset for which we are interested in the change in quotes. In our case, these are ordinary shares of Sberbank.

6. Select Buy or Sell.

7. In the If price >= window, indicate the specific value of the quotes. Please note that this refers to the Instrument from point 4. That is, ordinary shares of Sberbank.

8. We set a price for purchasing preferred shares of Sberbank. This is a regular limit order, which is activated when the stop price for another asset is reached.

9. Set the number of lots for purchase.

10. Select or set the Client Code.

11. Press enter and confirm the application.

Concept

A limit order (order) is an indication for the purchase or sale of a specific number of lots of an investment asset at a given price, which the trader gives to the broker.

Such orders represent a public offer for each player on the exchange. As soon as there is a bidder who is satisfied with the offer made, the submitted application will be implemented.

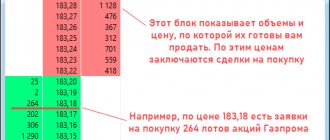

Let's look at the order book. Prices above the current value are limited orders from sellers who are trying to sell assets at a higher price. And vice versa. Prices below current quotes are limited orders from buyers who are trying to purchase assets cheaper.

Take profit and stop limit

Another combined application in Kwik. It consists of two orders, which are discussed above: stop limit and take profit. This order is intended to close a trading position. Either with a profit according to the take profit, or with a loss according to the stop limit. When one order is executed, the second one is automatically canceled. Please note that cash limits are blocked for each of the named applications.

These tools are discussed in detail at the beginning of the article. The joint use of such orders guarantees the sale of an asset without opening a new position.

Learning to exhibit

We follow this algorithm.

1. Press F6. and call the order entry window.

2. In the input window, select the type of stop order - take profit and stop limit.

3. Set the expiration date for the order.

4. Select a specific trading asset.

5. Set a Buy and Sell position.

6. Set the price to activate take profit.

7. Set the price to activate the stop limit.

8. To protect against slippage, fill out the Price window. The number here should be slightly less than in point 7.

9. In the Indent from min window, set the rebound value for triggering the order. This value is set as a percentage or price currency.

10. Set a Protective Spread.

11. Determine the number of lots.

12. Select Client Code.

13. Activate the application by clicking on Enter.