What is the US balance of payments? What are its features? We will answer these and other questions in the article. America's balance of payments is the ratio between the amount of payments coming from abroad and the amount of payments going abroad.

If funds received by the state exceed payments to other countries and international organizations, the commercial balance is active (positive balance); if, on the contrary, it is passive (negative balance).

A little history

It is known that the structure of the US balance of payments was formed under the influence of the development of US imperialism and is a reproduction of its role as an interethnic exploiter. Already in the 19th century, the American balance of payments bore the stamp of the techniques that US capitalism used to increase its wealth. It consisted of income from colonial oppression of more vulnerable countries and peoples and receipt of loans and borrowings from England and other countries.

In terms of its economic external relations, America remained a Western European debtor for most of the 19th century. After the American Civil War ended, the evolution of capitalism in that country (both in agriculture and industry) accelerated, causing a sharp increase in product exports. According to historical data, the US balance of payments became active in 1873. Its dynamic balance served primarily as a means of paying profits and interest on foreign investments in the United States until World War I.

Thus, for the years 1874-1895, the US balance of payments surplus totaled $2.5 billion, net transport costs amounted to $560 million, and expenses for the payment of interest and dividends amounted to $1.9 billion.

For 1896-1914, out of the active difference in foreign sales of 9.2 billion dollars, three billion went to pay interest and dividends, and 640 billion went to transport costs. During the First World War and after its completion, the active difference in the US balance of payments increased, the balance of current items of this balance became active, which made it possible not only to buy out investments of foreign capital in the United States and pay off all previous debt on external loans and borrowings, but also to become the main creditor of the world of tycoons, widely exporting wealth.

It follows that the functions and meaning of the American trade surplus have changed dramatically. If earlier he expressed the financial dependence of the United States on other states, then after the First World War he began to show the imperialist expansion of the United States, seeking to capture a significant part of the spheres of capital exports and world markets.

The most important indicator characterizing the development of the state is the balance of payments. This is a statistical report that reflects all economic transactions between residents and non-residents that took place during the reporting period.

The difference between the amount of economic transactions between residents of states forms the balance of payments. A positive balance of payments leads to an influx of foreign currency into the country and an increase in foreign exchange reserves. When there is a balance of payments deficit, the Central Bank reduces its foreign currency reserves. In other words, a negative balance of payments indicates that the state is unprofitable in the international arena as a whole: the country spends more than it earns.

Data in the balance of payments are grouped into three accounts: the current account, the capital account and the financial account. The current account is the most significant indicator because it reflects the real economy and not capital speculation.

The current account takes into account: flows of goods, services (exports and imports), taxes, interstate transfers, personal transfers (transfers), wages, investment income, rent, capital transfers between residents and non-residents (grants, inheritance).

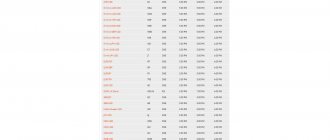

Based on the results of the first and third quarters of 2021, Germany demonstrates the maximum positive balance of payments on the current account: $224.2 billion. Japan is in second place with $151.2 billion. Russia closes the top three with $76.1 billion. (see table 1).

If we take the average annual current account balance over the past 10 years, then a unique situation arises in China: the average current account balance in 2007-2017.

amounted to $230.9 billion (2nd place in the world). In 2021, it fell below zero for the first time, which is explained by a negative balance in wages, investment income and rent between residents and non-residents. This phenomenon may indicate the beginning of the migration of labor resources and savings from China. Whether the trend is stable or not - the near future will show. Table 1. Top 10 countries in the world and China with the largest balance of payments on the current account based on the results of the first and third quarters of 2018.

| № | A country | Balance of payments on the current account based on the results of the 1st-3rd quarters of 2021, billion dollars. | Average annual balance of payments on the current account for the period 2007-2017, billion dollars. |

| 1 | Germany | 224,2 | 251,6 |

| 2 | Japan | 151,2 | 130,7 |

| 3 | Russia | 76,1 | 60,7 |

| 4 | Netherlands | 68,9 | 68,2 |

| 5 | Saudi Arabia | 57,9 | 68,2 |

| 6 | The Republic of Korea | 57,7 | 58,4 |

| 7 | Switzerland | 57,1 | 59,0 |

| 8 | Singapore | 50,5 | 51,1 |

| 9 | Italy | 36,0 | -6,5 |

| 10 | Ireland | 34,4 | 9,2 |

| China | -6,9 | 230,9 |

Source: IMF, Credinform calculations

The United States tops the ranking of countries with the largest negative balance of payments on the current account.

For the first and third quarters of 2018, the value reached an impressive value of -350.7 billion dollars, and the average figure for the last 10 years is -436.1 billion dollars. The state is chronically unprofitable. Table 2. Top 10 countries in the world with the smallest balance of payments on the current account based on the results of the first and third quarters of 2018.

| № | A country | Balance of payments on the current account based on the results of the 1st-3rd quarters of 2021, billion dollars. | Average annual balance of payments on the current account for the period 2007-2017, billion dollars. |

| 1 | USA | -350,7 | -436,1 |

| 2 | Great Britain | -50,2 | -111,5 |

| 3 | India | -48,1 | -41,5 |

| 4 | Canada | -37,7 | -46,5 |

| 5 | Türkiye | -29,9 | -43,8 |

| 6 | Argentina | -25,8 | -8,3 |

| 7 | Australia | -24,6 | -48,0 |

| 8 | Indonesia | -22,4 | -11,5 |

| 9 | France | -19,3 | -23,8 |

| 10 | Mexico | -17,0 | -19,0 |

Source: IMF, Credinform calculations

In Russia, over the entire period of observation, the current account was negative or equal to zero only in 1997-1998. (see Figure 1).

Figure 1. Dynamics of Russia’s balance of payments on the current account

Growth of gold reserves

What was the state of the US balance of payments at the beginning of the 20th century? Until the collapse of 1929-1933, due to the significant export of short-term and long-term capital in America, this balance did not show a large surplus, and often (in 1925, 1927, 1928, 1919, 1920) was even passive.

The inert balance of the US balance of payments was compensated by the export of gold from this country. When the world economic crisis ended, under the influence of the deep contradictions of American imperialism, aggravated by the subsequent complication of the general depression of the imperialist world system, the commercial balance of the United States acquired new features. After 1933 and until early 1942, it became permanently active, causing enormous imports of the yellow metal into America. During 1934-1941, gold imports into this country amounted to $15.7 billion. During the same time, America's gold reserves grew from 7 to 22.75 billion dollars, that is, more than three times. This was the process of gold “obesity” of the United States.

The commercial balance of America during this period was active due to the following reasons:

- a sharp increase, starting in 1930, of state super-patronage, which reduced the access of foreign products to the US market and the import of goods into this country;

- a decrease in the export of capital from the United States under the influence of the collapse of 1929-1933 and the upcoming narrowing of the area for application of exported wealth;

- the influx of short-term Western European capital into the United States under the influence of the threat of World War II.

Specific features of the US dollar and trade balance

The extent to which the US dollar will adjust to current account imbalances depends largely on the elasticity of the demand and supply curves and the nature of the occurrence of current account imbalances. Let's explain both the concepts in the next part of the article.

The following diagram shows two pairs of supply and demand curves for the US dollar, De$ and Se$ are elastic curves and DI$ and SI$ are very rigid curves. Assume that q1 is the prevailing exchange rate for the US dollar. The distance between points A and B is the estimated US trade deficit. To restore equilibrium, the US dollar must depreciate to the point where the supply and demand curves intersect, that is, C or C' in the case of extremely tight supply and demand curves.

The elasticities of US exports and imports are estimated to be quite small, being approximately -1.0 for exports and -0.3 for imports. Based on these low elasticities, the US dollar exchange rate adjustment required to restore the current account balance would be quite large. Therefore, the inelastic supply and demand curves on the graph represent the fairly significant extent to which the US dollar must depreciate in order to restore the current account balance at the new exchange rate at point q2.

The nature of the current account deterioration also affects the path that the exchange rate will take. In fact, a current account deficit can also lead to an appreciation of the exchange rate. Evidence of this can again be found in the US dollar, which rose sharply between 1995 and 2001 despite record-high current account deficits.

Current account imbalances can occur not only due to changes in the value of exports and imports, but also due to shifts in national saving and investment, as the identification of economic adjustment in the first part of this article shows. Indeed, the trade balance may worsen but still cause the exchange rate to appreciate. This is why traders need to be aware of the larger fundamental picture of a particular currency when trading the Trade Balance Sheet. In the long term, fundamentals are the main driver of any currency, but technical analysis should be used to support research into fundamentals and provide clues to the market.

If a country has undergone a major investment boom or undertaken a long-term fiscal expansion policy, both of these actions will lead to an appreciation of the exchange rate, despite the widening of the current account deficit. Increased investment at the expense of national savings leads to an increase in the current account deficit and at the same time creates pressure on the domestic currency. This is what happened to the US dollar during the period 1995-2001, when US domestic investment largely exceeded saving.

Particular changes in the nature of economic adjustment may cause the exchange rate and current account imbalance to move in the same direction, for example, a deterioration in the trade balance leading to a weakening currency. Other disturbances may cause the exchange rate to move in the opposite direction than the trade balance suggests. The relationship between various economic conditions and their relationship with the current account and exchange rate is shown in the following table.

A popular method used to increase exports and reduce trade deficits is to deliberately devalue the currency, for example through monetary easing. In the case of the US dollar, this will likely cause serious problems. As recent labor data shows, as of this writing, it is likely that the United States is approaching full employment. Weakening the currency to increase exports under such conditions would take the US below full employment and create inflationary pressures. This, in turn, will require the Fed to tighten monetary policy, causing the US dollar to rise again.

Peculiarity

Many experts analyze the US balance of payments. It is known that the disorganizing role of American imperialism affected it with unusual force after the Second World War, when its dynamic balance not only did not decrease, but increased even more. Exports outweighed imports by more than two to one in some post-war years. Today, the active difference in America's commercial balance is about $5 billion annually (compared to a couple of hundred million dollars before the war).

This specific quality of US imperialism, arising from the entire system of domination of US monopolies in the economic life of this country, consists in replacing multifaceted economic communications between countries with one-sided ties with the USA. It is this nuance that leads to disorganization of the trade balances of other capitalist states.

Post-war period

In contrast to the pre-war phase, after World War II the United States carried out a significant export of both loan and operating savings. The general compression of zones for the export of valuables did not make it possible to cover the dynamic balance of real items of the US commercial balance, as happened after the First World War. The outflow of capital abroad each year amounted to less than $1 billion.

As a result, America resumed its intensive pumping of gold from other countries. It did not take on a larger scale only due to the bankruptcy of other capitalist states, where the regular inertia of commercial balances led to a decrease in gold reserves.

In this environment, “irrefundable subsidies” under US “support” became the way to operate the US trade surplus. These “subsidies” covered up to 75% of America’s dynamic trade balance. It is significant that the US monopolies combined their “subsidies” to other countries with the most zealous pumping of gold from other countries.

Current account balance and exchange rate

The current account balance can be used to forecast the long-run equilibrium exchange rate.

According to this model, the equilibrium exchange rate is what ultimately creates the current account balance, which consists of the trade balance. A country's trade balance can affect its exchange rate in several ways.

First, external or trade imbalances can affect the flow and demand for currency, and this way directly affects exchange rates.

If the current account (trade balance) exhibits a high trade deficit relative to historical levels, the real exchange rate must depreciate to restore current account equilibrium. Likewise, if the current account shows a high surplus, the real exchange rate should restore equilibrium.

A good example of the relative current account surplus and exchange rate reaction would be that of Japan and its large trade surplus and the United States. The country generated an extremely high trade surplus with the United States from the 70s to the 90s, which required a significant appreciation of the yen exchange rate to restore current account balance. Indeed, the dollar/yen exchange rate reached a record high of 79.85 by the end of the period. The following chart shows the relationship between the Japanese trade balance and the Yen during that period.

Second, external imbalances can shift financial wealth from deficit countries to surplus countries, which can lead to changes in global asset preferences. This, in turn, may affect the equilibrium exchange rates of the included currencies. Greater external volatility may affect the market's perception of what exchange rate represents the real long-term equilibrium level of the currency. A sustained increase in the country's trade deficit and external debt will cause downward revisions in the perception of the long-term equilibrium exchange rate of the currency.

Negative consequences

The chronic activity of the commercial balance of the States has the following unfavorable outcome for the interethnic economic relations of capital countries:

- pumping gold from other states deprives their currency of any stable, strong base;

- the dynamic balance of commercial balance of the United States and the decrease in gold accumulations of a number of countries prevent the balancing of the trade balances of most capital countries with the help of the yellow metal;

- “non-refundable subsidies”, which are a method of applying the dynamic balance of America's commercial balance, reinforce the one-way nature of communications between the United States and other capital countries;

- The constant activity of America's trade balance weakens the position of the United States itself as an exporter of products, because other states are not able to pay for goods purchased in the United States with counter deliveries of their own products.

It follows that the American balance of payments is a specific mirror that reflects the disorganizing role of American monopoly capital in the economic relations of the world, its tendency towards a one-sided course of foreign economic communications between capital countries, as well as the growth of contradictions and unevenness in the system of imperialism.