Funds have gained great popularity among investors. Thanks to this tool, it is possible to diversify your portfolio with minimal capital investment. Most ETFs do not pay dividends, but reinvest them in other securities. But there are also those who charge interest to their investors. Investors find out which ETFs pay dividends, buy shares of these funds, not only increasing the diversity of their holdings, but also receiving additional income.

ETFs pay dividends by increasing their holdings.

Vanguard Dividend Appreciation - ETF VIG (A)

- Assets under management: $39.2 billion.

- Expense ratio - 0.06% per year.

- Dividend yield - 1.77%.

- Average dividend growth rate for 5 years - 7.98%

- The number of companies included in the ETF is 182.

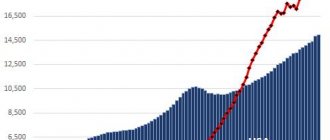

- Profitability over 5 years - 71.8%.

Vanguard's fund is one of the largest and most liquid ETFs. The strategy is based on selecting American companies that have been paying and increasing dividends for at least 10 years in a row. The ETF mainly invests money in the largest companies that are more resilient and stable. A little less than two hundred companies in the composition provide good diversification across sectors of the economy.

How to choose a fund

Analysts recommend buying dividend ETFs for those investors whose strategy is based on continuous cash flow. Such funds will ensure a regular flow of passive income into a brokerage account, which in the future can be used at your own discretion (reinvested or withdrawn to a debit account).

In order to choose the right ETF, you need to pay attention to the overall level of portfolio diversification. If the majority of your basket is occupied by companies from developing countries, then it is better to buy securities of funds of American companies. If your investment portfolio consists mainly of bonds, then it is recommended to dilute it with ETFs with shares.

The selection of a fund is always carried out based on the investor’s investment goals, his capital and strategy.

Vanguard High Dividend Yield VYM (A)

- Assets: $26.7 billion.

- Expense ratio - 0.06%.

- Dividend yield - 3.15%.

- The average dividend growth rate over 5 years is 8.66%.

- The number of companies in the ETF is 405.

- Profitability for 5 years - 57.53%.

ETF VYM partially overlaps in composition with the previous fund (VIG). The same investments in the largest US companies. Only, unlike its brother, the criterion for joining the fund is the size of the company’s dividend yield. Of all the stocks under consideration, companies are selected from the top list based on profitability.

Also excluded from consideration are REITs (which generate high dividend income). For them there is a separate fund from Vanguard - VNQ.

SPDR S&P Dividend - ETF SDY (B+)

- Assets: $19 billion.

- Expense ratio - 0.35%.

- Dividend yield - 2.42%.

- The average dividend growth rate for 5 years is 7.83%.

- The ETF includes 113 companies.

- Profitability over 5 years - 58.3%.

Dividend aristocrats are selected based on the S&P Composite 1500 index (consisting of 1.5 thousand companies). Companies that have been paying and increasing dividends for at least 25 years. The SDY ETF covers large, mid- and small-cap companies.

The weights in the fund are distributed more or less evenly. For each company, the weighting in the ETF averages 1 - 0.5%.

Advantages and disadvantages

Using a dividend strategy has both positive and negative sides.

The advantages include:

- receiving stable passive income;

- stability and good financial reporting of companies paying interest to their shareholders;

- greater reliability of dividend stocks during a crisis than growth stocks;

- increased percentage on annual payments to foreign enterprises;

- the possibility of reinvesting profits in other assets.

Earning passive income is an advantage.

Disadvantages of the strategy:

- the high level of risk that accompanies large dividends;

- a drop in asset prices in the event of dividend cancellation, depriving the investor of passive income;

- additional expenses (in particular, withholding personal income tax on interest);

- slow growth of capitalization of companies paying large dividends compared to others.

iShares Select Dividend - ETF DVY (B)

- Assets: $17.8 billion.

- Expense ratio - 0.39%.

- Dividend yield - 3.38%.

- The average dividend growth rate over 5 years is 7.9%.

- The number of companies in the ETF is 100.

- Profitability for 5 years - 59.42%.

The strategy for selecting shares for the fund is a combination of factors: dividend yield, dividend growth rate, Payout Ratio and other factors. The main goal of the fund is to provide a stable growing yield on dividend payments.

The DVY ETF covers all sectors of the US economy (with a slight bias towards utilities). Includes shares of companies with different capitalizations.

Investor Rules

I recommend:

- Look for opportunities to purchase at the lowest price

; - Increase shares

in purchased assets; - Avoid bias in favor of one asset, even if it looks attractive. Diversification is the key to success

; - Don’t take risks

, our choice is only reliable companies with a stable, established business; - Sometimes stocks are sold at a discount

, so buy them at such times.

Similar services are offered by the BCS broker

; - Priority should be given to companies with growing dividends

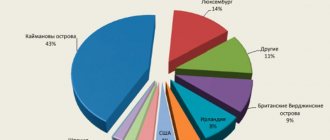

. This indirectly confirms management's confidence in the future of the business; - Diversification

should be not only between individual companies, but also

across

different

industries

and

countries

.

Schwab US Dividend Equity ETF SCHD (A)

- Capitalization - $10.6 billion.

- Expense ratio - 0.06%.

- Dividend yield - 3.02%.

- The average dividend growth rate for 5 years is 9.75%.

- There are 100 companies in the ETF.

- Profitability for 5 years - 67.89%.

The fund selects a company with a 10-year history of paying and increasing dividends. Unlike VIG (with a similar strategy), SCHD includes only 100 companies. The reason is an additional filter for getting shares into the ETF. Companies are considered in terms of parameters: div. profitability, growth rate, revenue-to-debt ratio, return on equity.

Investment object: mainly the largest US companies (portfolio share - about 85%)

Instead of output

Naturally, these are not all ETFs with monthly dividend payments - there are more than 200 of them. But these seemed to me the most interesting and promising. You can build a portfolio of these ETFs to suit almost any investment strategy.

How to buy these ETFs? Unfortunately, this cannot be done through a Russian broker. You need to open an account with a “foreigner”, for example, UT or Saxo Bank. As far as I know, these securities are not available on the St. Petersburg Exchange.

What do you think – is it worth stocking up on such ETFs or is it better to give preference to more classic options? Or is it better to buy individual stocks altogether or build a portfolio with monthly coupons? Write in the comments. Good luck, and may the money be with you!

Rate this article

[Total votes: 5 Average rating: 5]

iShares Core Dividend Growth - ERF DGRO (A)

- Assets: $9.1 billion.

- Expense ratio - 0.06%.

- Dividend yield - 2.27%

- Average dividend growth rate for 3 years - 7.79%

- The number of ETFs is 460 companies.

- Profitability over 5 years - 77.5%.

The fund includes only those companies that:

- They have been paying and increasing dividends for the last 5 years.

- The total amount of dividend payments should not exceed 75% of the company's profit.

The combination of two factors ensures sustainability and increased dividends in the future. The investment target is American companies from various sectors. The share of large grains is 82%. The rest falls on medium and small companies.

First Trust Value Line Dividend Index - ETF FVD (C+)

- Under management - $8.5 billion.

- Expense ratio - 0.7%.

- Dividend yield - 2.19%

- Average dividend growth rate for 5 years - 8.35%

- The number of companies in the ETF is 189.

- Profitability for 5 years - 70.83%.

ETF with a mixed management style (passive and active). It is based on the analysis of companies (including fundamental indicators) using our own method. In simple words, stocks with strong performance and potential for further growth are pre-selected. Among these companies, stocks with the highest dividend yield are selected and included in the ETF.

The peculiarity of the fund is that all companies in the ETF have the same weight.

The disadvantages of FVD include high commission costs. Many times higher than competitors' rates.

iShares Core High Dividend - ETF HVD (A)

- Assets: $7.5 billion.

- Expense ratio - 0.08%.

- Dividend yield - 3.34%.

- The average dividend growth rate for 5 years is 6.77%.

- The ETF includes 73 companies.

- Profitability for 5 years - 50.23%.

How can a company get into the HDV ETF?

You need to go through a triple filter.

- Companies that have some advantage over competitors are selected. This provides stability and potential for future development. And it helps to survive market crises.

- Comparison of assets and liabilities. Companies with a high share of debt load, being riskier, do not advance further.

- From what's left. Companies are ranked by the amount of dividends they pay. And the best ones from the top of the list are selected. In our case, there are 75 companies that passed the selection.

The last point does not evaluate the relative dividend yield per share (as a percentage), but the absolute value. How much money (millions or billions) does the company send out per year in the form of dividends?

Therefore, priority places in ETFs are occupied by the largest companies (95% of the total weight).

The fund will be of interest to those who primarily value capital protection. With an acceptable level of dividend yield.

What is the procedure for paying dividends on ETFs?

There are several options for paying dividends on ETFs:

- Monthly;

- Quarterly;

- Once a year.

If dividends are not paid, they are reinvested in the purchase of new funds.

If you choose funds and ETFs where dividends are reinvested, then compound interest also works for you and you do not have to pay taxes annually. A distributing ETF pays out all dividends or interest, while an accumulating ETF reinvests this income back into the fund , so the investor automatically benefits from compound interest (earning interest on interest).

Dividend ETFs are suitable for those who want to receive stable and regular income. Reinvestment is aimed at long-term prospects and is suitable for investors who have large assets and expect a significant increase in profits in the future.

ProShares S&P 500 Aristocrats - ETF NOBL (B)

- Assets: $5.8 billion.

- Expense ratio - 0.35%.

- Dividend yield - 1.96%

- The average dividend growth rate for 3 years is 12.97%.

- The number of companies in the ETF is 58.

- Profitability for 5 years - 69.45%.

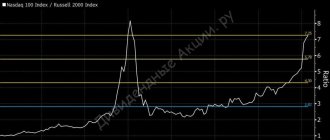

The NOBL ETF has a similar strategy to the SDY fund. The fund includes only dividend aristocrats (25-year dividend growth). But unlike the latter, NOBL only considers companies included in the S&P 500 index. This allows you to target your investments only at the largest companies in the United States.

Statistically (I wrote about it here), aristocrats over the long term outperform the S&P 500 in terms of profitability.

The composition of the index is reviewed every quarter. For the inclusion of new companies (according to the conditions described above) and exclusion (if the company lowered or simply left the divs unchanged).

All companies in the fund are in approximately the same proportions.

Where do you receive dividends every month?

For investors who are interested in regular monthly income, we have compiled a list of such ETFs:

- SDIV – Global X FDS SuperDividend;

- US DIV – Global X USSuperDividend ;

- SPHD – PowerShares S&P 500 HighDividend;

- DHS – Wisdom Tree US High Dividend;

- PGX – PowerShares Preferred;

- KBWD – PowerShares KBW Hidh Dividend;

- PFF – iShares US preferred Stocks;

- Average DIA – SPDR Dow Jones Industrial.

You can do your own analysis using the services mentioned above.