Hello!

Corporate bonds are a tool that companies use to raise capital. Money is taken for various purposes: be it expansion, increasing turnover, reorganization or covering old debts. For an investor, the only important thing is that money is paid for these securities (CB). They pay consistently, sometimes very well, with a guarantee of return at par.

An alternative to bonds for companies is to participate in an IPO and increase capital by selling shares. But this is a relatively long and expensive procedure. Selling bonds is a much faster and easier way to raise capital to expand your business. And it’s much more pleasant for the investor himself to work with them.

What it is

In general terms, it is a debt obligation that a business company sells to an investor. The basis of cash security is the profit that will be received as a result of future transactions. In many cases, an additional guarantee for the investor is the obligation to repay the deposit through the sale of company property in the event of default.

Why are they released?

Corporate bonds are a form of debt financing. They can become the main source of capital for many businesses, along with shares or bank loans. A company must have some earnings potential to offer debt securities at a favorable coupon rate.

More often, bonds are issued when corporations need to quickly raise capital to implement their strategies. In this case, they can sell commercial paper with a maturity of one year or less.

Emission

The issue of securities is carried out in the form and sequence established by law. The decision to issue corporate bonds is made and approved by the board of directors or the body performing its functions in accordance with the law. When they are issued, one or more liquidity providers (financial institutions or intermediary banks) buy the entire pool and resell them to investors through the exchange.

How to trade in the over-the-counter market

To begin with, ask yourself again, do you need this? Financial instruments presented on the over-the-counter market are potentially riskier, and in addition, due to low liquidity, they have fairly wide spreads. Here, for example, is an excerpt of indicative quotes on the over-the-counter market:

Obviously, with such spreads there is no point in short- and medium-term trading. That is, the over-the-counter market is more likely the lot of long-term investors, rather than traders. Here, not so much shares are purchased as shares in the business of their issuing companies. When investing money in a particular company, investors are ready to wait for an increase in its price for many years, counting all this time only on its dividend yield.

In order to be able to make transactions on the over-the-counter market, it is enough to register with one of the brokers accredited in the RTS Board system. Finding such an intermediary is not a problem, since almost every more or less well-known Russian broker is a participant in the above-mentioned information system. What can I say, take a look at this list for yourself:

However, before you buy certain shares (or other valuable securities), you need to obtain all possible information about the issuing company. There may be some difficulties with this. The fact is that, unlike the exchange market, where listing rules oblige all issuers to disclose financial information based on the results of their activities, there are no such rules on the over-the-counter market. That is, you will have to look for all the necessary information through your channels. Start by studying the company’s official website, and then, if possible, try to communicate directly with its employees.

Having chosen shares to purchase, you need to contact your broker and give him an order to complete the transaction. The transaction application must include the following information:

- Financial instrument (selected shares or bonds);

- Type of transaction: purchase or sale (in this case purchase);

- Transaction volume - the number of shares purchased;

- The transaction price is the quotation interval within which you are ready to make a transaction (in this case, buy the shares you are interested in).

One of the nuances of over-the-counter trading is that a significant part of transactions here are concluded not through a trading terminal, but through a telephone conversation with a broker. You can also find out current quotes by phone, or you can access the RTS Board information system (by connecting to the “RTS Board EQ” terminal). However, you should keep in mind that this access is paid and it makes sense to connect to it only if the volume of planned operations is large enough.

After the transaction to purchase shares is completed, information about it will be reflected in the register of the issuing company. And from this moment you are officially a shareholder with all the ensuing rights, such as:

- Participation in general meetings of company shareholders;

- Receiving part of the company's profit in the form of dividends.

Types of corporate securities

There are different types of corporate bonds depending on their risk, profitability, and other parameters. Each of them has its pros and cons.

Firstly, the repayment period. If we divide corporate bonds according to this criterion, we can distinguish three types:

- short-term (maturity three years or less);

- medium-term (repayment period 4-10 years);

- long-term (with a maturity of more than 10 years).

Secondly, risk. Everything here is very flexible. The market offers both stable, predictable investment-grade bonds and risky high-yield bonds, also known as junk bonds. Ratings from Moody's and Standard & Poor's will help sort your options.

Thirdly, payment of interest. The fixed coupon rate is the most common. This means that the investor will receive the same payment every month until maturity. There are also floating rate, zero coupon, and convertible securities.

Value investing

Value investors behave like real traders in the market. They look for securities that they believe are undervalued. This approach involves selecting securities whose market price is below their true intrinsic value. The school of value investing was founded in 1928 by Ben Graham.

and

David Dodd

.

And Graham's student was the legendary investor Warren Buffett

, who today runs the investment company

Berkshire Hathaway

.

His net worth in 2021 is estimated at $67.5 billion .

Value investing is based, in part, on the idea that there is a certain degree of irrationality in the market. This irrationality, in theory, makes it possible to obtain assets at a reduced price and make money from them.

Value traders devote personal time and energy to combing through vast amounts of financial data, studying company statements, in order to select the true “diamonds” and make a profitable deal. The use of the method of comparative coefficients (multipliers) makes the assessment much easier.

If you decide to become a value investor, it doesn't mean you have to evaluate hundreds of companies and manually sift through financial statements. A much simpler option is investing in mutual funds and ETFs that follow this methodology. Thousands of value ETFs give traders the opportunity to own a basket of securities that are considered undervalued. The Russell 1000 Value Index, for example, is a popular benchmark for value investors, and several mutual funds follow the index.

Pros:

- allows you to receive high returns (up to 100 percent per annum);

- in the long term, it exceeds other approaches in terms of profitability;

- you can rely on your own assessments and calculations and not depend on expert forecasts

- the ability to always exit an overheated market on time.

Minuses

- Value investing only works in the long term with a horizon of at least 5 years;

- Labor intensity

- Requires an analytical mind, perseverance and balance

- You need to master all the basics of financial accounting

Tools

For those who haven't done extensive research, the price-to-earnings (P/E) ratio has become the go-to tool for quickly identifying undervalued or cheap securities. It is a single number that comes from dividing a stock's share price by its earnings per share (EPS). A lower P/E ratio means you are paying less per $1 of current income. This approach involves looking for companies with low P/E ratios.

While using the P/E ratio is a good start, some experts caution that it alone is not enough to make this technique work.

A study published in the Financial Analytics Journal found “that” quantitative investment strategies based on such ratios are not good substitutes for value investing strategies, which take a holistic approach to identifying undervalued securities. “The reason, according to their work, is that traders are often lured by the low P/E ratio of securities based on temporarily inflated company reports. These low rates are in many cases the result of a falsely high level of income (denominator). When actual earnings are reported (rather than simply forecast), they are lower. This results in "reversion to the mean." The P/E ratio rises and the value that was initially sought has disappeared.

If using the P/E ratio alone is wrong, what should a trader do to find securities with true low valuations? The researchers suggest that it is necessary to use quantitative valuation methods that will eliminate these 'value traps.'”

The idea here is that value investing can work as long as the trader is in it for a long period of time and is willing to put some serious effort and research into asset selection. One study from Dodge & Cox found that value investing strategies almost always outperform growth tactics over time horizons of 10 years or longer.

Risks and returns

Corporate bonds offer attractive returns. But there are also risks, the main ones being credit and market.

Credit risk

This is the risk of default by the issuer that issued the shares, due to which the payment of coupons and return at par become impossible. The yield of bonds and the level of reliability of the issuer are closely related. The less risk, the lower the profitability. The higher the risk, the more money the paper brings. Special agencies assess the solvency of issuers.

Market risk

In simple terms, market risk is the likelihood that the price of the bonds you buy will fall. Of course, in comparison with the same stocks, the market risk is much less, but it still exists. Corporate bonds are not as volatile as stocks, but they have their ebbs and flows.

Taxation

Certified Russian brokers are tax agents. They calculate the trader's results for all transactions, withholding tax. When purchasing from a partner bank, the depositary itself acts as a tax agent. As for specific numbers, in 2021 the old 13% tax was abolished.

Now trading in securities on the Moscow Exchange is tax-free if the coupon interest does not exceed the current Central Bank refinancing rate by more than 5 points. Therefore, investing has become more profitable.

There is an option to avoid hassle with the tax authorities altogether - trade through an offshore broker who is not a tax resident and does not transmit data to the fiscal services of the Russian Federation. Whether or not to register your income is at the discretion of the trader.

How to choose an approach and where to start?

Starting point A

Before you begin exploring your investment tactics, it's important to gather some basic information about your financial situation. Ask yourself these key questions:

- What is your current financial situation?

- What is your cost of living, including monthly expenses and debts?

- How much can you afford to invest both initially and on an ongoing basis?

- Even if you don't need a lot of money to get started, you shouldn't start if you can't afford it. If you have a lot of debt or other obligations, consider the impact investing will have on your situation before you start putting money aside.

Make sure you can afford to invest before you start saving.

Formulate your goals

Next, formulate your goals.

. Everyone has different needs, so you must determine what yours are. Are you planning to save for retirement? Do you want to save money for big purchases like a house or car in the future? Or are you saving for your education or your children's education? This will help you narrow down your options.

Risk test

Find out what your risk tolerance is. This is usually determined by several key factors, including your age, income and how long until you retire. In theory, the younger you are, the more risk you can take on. More risk means higher return, while lower risk means that profit cannot be realized too quickly. But keep in mind that high-risk investments also mean that there is a greater chance of losing some of your savings.

Learn the basics of investing

Finally, learn the basics. It's quite important to have a basic understanding of what you'll end up getting so you don't have to invest blindly.

Where to see the list

There are many sites for monitoring, collecting analytics, and selecting corporate securities. They provide:

- charts, quotes;

- financial news;

- comparison, analysis;

- calculations, forecasts.

A good option is to get information from the primary source (Moscow Exchange listing). There you can find out the history of quotes for any period, current conditions and other details.

I myself also use screeners from Rusbonds, Cbonds, Smartlab.

Precious metals market

The precious metals market can be identified as another component of the global financial market. It carries out transactions both directly with precious metals and with securities tied to them (futures, bonds, options quoted in gold, as well as gold certificates).

Based on the type of precious metal traded, this market can be divided into the following main components:

- Gold market;

- Silver market;

- Platinum Market;

- Palladium market.

Based on the type and volume of transactions carried out, the precious metals market can be classified as follows:

- International precious metals market;

- Domestic precious metals market;

- Black (underground) market for precious metals.

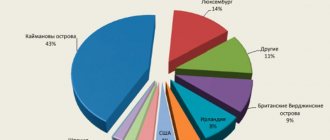

The international market has the maximum trading turnover; large investors, international funds, as well as central banks trade on it. The largest international trade centers are located in cities such as London, Zurich, New York, Hong Kong, Chicago, and Dubai.

Domestic markets for precious metals involve trading operations within the country. They are characterized by certain government regulation, expressed in the setting of taxes, quotas, trade rules, etc.

A black or underground market for precious metals occurs when the government places severe restrictions on such transactions. When, for example, the trade in gold is prohibited, it begins to be sold illegally (by smuggling into the country).

In addition, this market can be classified according to the purpose of the purchased precious metals:

- For investment purposes;

- For industrial use (for example, in electronics).

Corporate bond market in Russia

Expert opinion

Anna Ovchinnikova

Private investor, entrepreneur and founder of the portal fonda.pro

Ask a Question

The domestic bond market is relatively young and small. They began trading on the Moscow Exchange in the early 90s, and until recently tax fees made it not very attractive. Today it makes up no more than 20-21% of total turnover. Regulated by the norms of the Civil Code of the Russian Federation, the Law “On the Securities Market”.

Foreign exchange market (FOREX)

The international currency market Forex (Foreign exchange market) is a system of financial relations, the purpose of which is the purchase or sale of some foreign currencies for others. In terms of the volume of transactions performed, the FOREX market significantly exceeds all other financial markets.

The FOREX market does not have any specific trading platform (such as an exchange), it is rather the entire set of communications connecting its largest players (banks, transnational corporations, brokerage firms, etc.).

The main participants in the foreign exchange market are:

- Central banks of countries. Their main activity here comes down to managing national foreign exchange reserves in order to regulate the exchange rate of their currency. For this purpose, they can conduct so-called currency interventions;

- Banks (mostly international). This is one of the types of institutional investors in the Forex market. It is through them that the bulk of all financial flows pass here;

- Companies engaged in import-export operations, for example, for the purpose of purchasing raw materials and selling finished products;

- Various types of funds (investment, pension, hedge) and insurance companies. They conduct operations here in order to diversify their portfolios as much as possible by purchasing various types of securities outside their country;

- National currency exchanges. These operate in a number of countries and their main purpose is to quote their national currency against a foreign one, as well as currency exchange for legal entities;

- Brokerage firms and dealing centers acting as intermediaries for carrying out trading and exchange operations on FOREX;

- Finally, private individuals. The contribution of each of them individually may be completely insignificant, but in total, the financial flow from international tourism, simple exchange transactions and speculative currency transactions of individual citizens can reach very impressive volumes.

Advantages and disadvantages

Advantages of corporate securities:

- Bonds typically offer more guaranteed returns than stocks.

- Payments on coupons are known in advance and are structured.

- Corporate bond prices tend to be stable.

- Corporate bonds generally have better yields than other bonds.

Disadvantages of corporate securities:

- Corporate bonds do not have the same growth potential as stocks.

- Not all bonds can be freely resold on the stock exchange.

- Higher interest rates may make corporate securities less profitable.

What is investment in bank bills

Since investors in the Russian securities market do not really like promissory notes due to the traditional distrust of Russians towards banks, most potential investors do not really understand what a promissory note is.

A bill is a debt obligation of a bank.

The bank is not necessarily in crisis; any bank always needs money.

To do this, he issues bills, which he undertakes to repay on terms favorable to the buyer - at a higher fixed price or in percentage terms. The bill also has a “expiration date”, including the possibility of repayment on a specific specified date. Or not earlier than a specific specified period.

TOP 5 most reliable

According to the ACRA rating, the most reliable among large Russian issuers are:

- Rosneft (Rosneft04). Posted: 10/29/2012. Repayment: 10/17/2022. The current coupon rate is 7.9%. The frequency of payments is 2 times a year.

- VEB.RF (VEB.RF-06). Posted: 10/26/2010. Repayment: 10/13/2020. The current coupon rate is 8.38%. The frequency of payments is 2 times a year.

- Russian Railways (RZD-32). Posted: 07/20/2012. Repayment: 06/25/2032. The current coupon rate is 5.9%. The frequency of payments is 2 times a year.

- Sberbank (SBERBANK-001Р-03R). Posting: 10/13/2017. Repayment: 12/08/2020. The current coupon rate is 8%. The frequency of payments is 2 times a year.

- Transneft (TRANSNEFT-BO-001R-01). Posting: 06/10/2016. Repayment: 06/02/2023. The current coupon rate is 9.9%. The frequency of payments is 2 times a year.

Not far behind them were Gazprombank, Rosselkhozbank, Otkritie Holding, and Gazprom Neft. According to the domestic agency, they best meet the reliability criteria, provide acceptable returns and high guarantees of return of deposits.

Clearing organizations

Every day, every hour, every minute, many operations for the sale and purchase of securities are carried out on the stock market. In order not to get completely confused in all this mess, there are clearing organizations whose purpose is:

- Collection of information on all ongoing exchange transactions and their accounting;

- Determination of mutual obligations between counterparties for all transactions conducted on the controlled exchange platform (platforms);

- Ensuring timely settlements for all these transactions. One party must receive the securities being purchased, and the other must receive the money for them;

- Providing guarantees for all transactions carried out with derivative financial instruments on the derivatives market (using leverage).

TOP 5 most profitable

If the main criterion is profitability, pay attention to the following corporate securities:

- SUEK-Finance-5-ob (18.65% per annum);

- PR-Leasing-001R-02 (12.72%);

- PR-Leasing-001R-01 (12.5%);

- Uralvagonzavod NPK-2-bob (11.97%);

- Mostotrest-7-ob (11.26%).

At the moment, these are the most profitable offers on the Russian stock market. They will provide greater returns than bank deposits or blue-chip bonds, but investments in corporate paper are not immune to losses.

Capital market

This branch of financial markets includes long-term financial transactions (loans, investments, etc.). In essence, this is the same money market described above, but only with financial maturities exceeding one year.

So-called long-term money circulates here; capital is invested in various kinds of long-term financial instruments (stocks, long-term bonds, etc.).

The capital market has the following structure:

Where can I buy

An unqualified investor can trade on the stock exchange with the help of an intermediary - a broker. Most Russian brokers provide access to government, corporate, and Eurobonds.

Best brokers

Choosing a broker is a matter of preference. Explore reliability ratings, pricing policies, available asset classes, account types and properties to find the perfect option for active trading or long-term investing.

Opening of Promsvyaz by Rick BKS Keith Tinkoff Finam

One of the mastodons of the market. Excellent web portal, very low commissions and adequate support. I recommend!

Investment department of a famous bank. There are no particular advantages, but there are no disadvantages either. Average.

One of the very first Russian brokers. The commissions are high, but there are interesting auto-following strategies.

Another very large broker. Good support and low commissions are their strong point.

Small but reliable broker. It is great for beginners because it does not impose its services and the commissions are very low. I recommend.

The youngest broker in the Russian Federation. There is a cool app for investors, but the fees are too high.

The largest investment company in Russia. The largest selection of tools, your own terminal. Commissions are average.

Dividend

This investment strategy involves choosing stocks with the highest dividend payouts. Dividend yield is calculated by dividing dividends by the cost of 1 share. This approach guarantees predictability and stability of financial income. At the same time, reinvesting dividends allows you to increase the value of your portfolio and make compound interest work for you.

When choosing dividend stocks, it is important to consider the following aspects:

- features of the dividend policy, in particular, what percentage of the company’s profit is allocated to paying dividends;

- stability of payments over the last 5 years;

- size of dividends and frequency of payments;

- rate of increase in payments;

- current financial indicators of the issuer's activities.

Disadvantages of the dividend method:

- payment of dividends is not guaranteed (at any time the company may decide to freeze payments);

- too high dividend payments may indicate irrational business practices and lead to limited growth;

- in pursuit of cosmic dividends, there is a high probability of acquiring illiquid assets, which will be very difficult to sell in the future.

To reduce your risks, it is more advisable to diversify your portfolio by selecting at least 10-15 dividend stocks from different industries (not only Russian, but also foreign).

Note: Dividend gap – what is it?