olegas Jul 2, 2021 / 109 Views

When compiling their investment portfolio, each investor adheres to a specific risk management strategy. Some people take more risks, investing most of their assets in second- and third-tier stocks, some prefer moderate risk and focus on blue chips, and conservative investors prefer to concentrate mainly on bonds and bank deposits.

In order for your portfolio to maintain its original risk level, it requires regular rebalancing.

In addition, there are stock portfolios compiled according to a certain pattern. These include, for example, portfolios of index funds. Their structure completely repeats the proportions of securities included in the stock index, the structure of which is copied by the fund. In this case, rebalancing is carried out if the structure of the index changes (exchange platforms sometimes carry out such adjustments in order to maintain the relevance of indices).

This leads to this simple definition:

Rebalancing an investment portfolio is an action aimed at maintaining the original proportions of the securities contained in it.

Let's say your portfolio is structured so that 70% of its value is in bonds and 30% in stocks. In this case, there is a possibility that over time the shares will rise in price, thereby increasing their share in the portfolio (for example, so that their share is already 40%, leaving the remaining 60% for bonds).

This, in turn, will lead to an increase in the total risk across the entire portfolio. Stocks, compared to bonds, are less reliable and more volatile, and this is fraught with both large drawdowns and direct losses.

In order to return the risk to its original level, it is necessary to rebalance the portfolio. This can be done in three main ways:

- By reinvesting the profits received in assets whose share has decreased (in the example above these are bonds);

- By depositing additional funds. In this case, you will need to purchase additional bonds in such an amount that their share in the portfolio again reaches the initial 70%;

- By redistributing assets within the portfolio. For the example above, you will need to sell part of the shares and buy bonds so that their shares return to the original 70/30.

What is portfolio rebalancing

So, portfolio rebalancing is the restoration of its original structure, aimed at diversifying risks and generating profits. This process is carried out by selling assets that have increased in price and purchasing those that have fallen in price until the original percentage is received. It is recommended to carry out this procedure 1-2 times a year.

Portfolio rebalancing example (in numbers)

Let's say your investment portfolio totals 1,500,000 rubles. ($20,000 or UAH 580,000) was formed a year ago in the following proportions:

- blue chip shares – 30% (RUB 450,000 ($6,000 or UAH 174,000));

- highly reliable government bonds – 35% (RUB 525,000 ($7,000 or UAH 203,000));

- ETF – 35% (RUB 525,000 ($7,000 or UAH 203,000)).

Over time, shares rose in price by 15%, while bonds, on the contrary, fell in price by 20%. ETFs became more expensive by 10%. Accordingly, the value of assets changed as follows:

- shares – 517,500 rub. ($6,900 or 200,100 UAH);

- government bonds – 420,000 rubles. ($5,600 or 162,400 UAH);

- ETF – 577,500 rub. ($7,700 or 223,300 UAH).

The total cost of investments did not decrease and even increased by 15,000 rubles. ($200 or 5,800 UAH). After rebalancing, we will earn 67,500 rubles. ($900 or 26,100 UAH) on the sale of shares and 52,500 rubles. ($700 or 20,300 UAH) on the sale of ETFs. In the amount of 105,000 rubles. ($1,400 or 40,600 UAH) we buy additional bonds and receive 15,000 rubles. ($200 or 5,800 UAH) as profit.

Features and Disadvantages

Many experts argue that rebalancing is an integral part of investing. Despite this, this procedure has several disadvantages:

- It always entails costs in the form of brokerage commissions. In addition, when selling assets that have risen in price, you must pay personal income tax. You can avoid paying tax only if you do not withdraw funds from your account, but leave them for subsequent purchases.

- Rebalancing does not always lead to higher returns. If the investor initially chose the wrong issuer, whose activities decline over time, then purchasing additional assets to adjust the portfolio is very risky.

- By selling shares during periods of active growth and buying bonds with this money, the investor deprives himself of part of the income.

Reasons for rebalancing

The main reason is the increase in investment risk. In the example above, the stock has increased in price, therefore the risk of the investment has increased. It is known that the growth of quotations is often speculative in nature, and under the influence of political factors, certain shares can either soar or collapse in price.

Bonds, on the contrary, are considered low-risk instruments, as they represent government debt obligations. The decline is most likely temporary, so you should buy these securities while their prices are low.

Rebalancing Methods

Two main methods are used:

- The classic method described above: selling instruments that have risen in price and buying those that have fallen in price.

- Purchasing cheaper assets using available available funds. In this case, you increase the cost of investment, but save on the tax that is paid when selling assets.

When conducting transactions, you should keep in mind that any transaction involving the purchase or sale of securities is subject to a broker's commission.

How to best rebalance

1 It is better to rebalance by introducing new funds and additional purchases, rather than selling assets that have risen in price.

Many will say that they do not have the opportunity to add funds in such quantities. Then you can use the coupons received from bonds and dividends. Use these funds to purchase additional assets whose share in the portfolio has become smaller. Over time, even these small funds will allow you to achieve the desired proportions.

2 You can sell part of an asset that is experiencing obvious hype and unreasonable growth. Distinguishing hype from fair growth is not an easy task. Even for an experienced investor this is difficult to determine.

However, most of us like to take risks. Therefore, keep in mind that after the sale of part of this company, its quotes may only increase even without us.

Optimal frequency of investment portfolio rebalancing

Experts at the American investment company Vanguard advise rebalancing once every six months or year if the value of any assets in the portfolio has changed by more than 5%. Of course, you can do this more often - for example, once every 3 months. However, in this case, you will have to pay a commission for each transaction, which is unprofitable for long-term investments. On the other hand, if you rebalance less than once a year, you may miss a profitable trade opportunity.

Rebalancing Goals

So, the main goals of rebalancing are:

Reducing the level of risk. As you know, the more profitable the instrument, the higher the risks (i.e., the higher the potential for its value to fall). Therefore, if some asset in the portfolio is growing faster than others, then there is a high risk that it will also fall rapidly. By rebalancing, you reduce the number of risky assets in your portfolio.

Fixation of profit. When rebalancing, you implement the “sell high, buy low” principle. You sell assets that have risen in price and buy cheaper ones. But you can simply sell the most expensive assets and take the profit for yourself, essentially fixing it. By assembling a portfolio of assets whose profitability is correlated with each other (that is, when one asset rises, another falls - for example, like gold and stocks), you can receive income in any situation on the market.

Increased profitability. I have already described in the example above how, through timely portfolio rebalancing, you can make money literally out of thin air.

Crisis protection. When the markets are stormy, novice investors become confused and panic. If you strictly follow a once defined strategy, adhering to the principles of diversification and rebalancing, you will get a much better financial result than others.

Difficulties in rebalancing a large portfolio

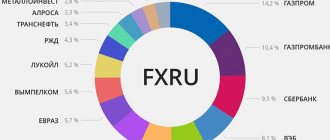

An active investor whose portfolio is dominated by securities of large companies with varying degrees of volatility needs rebalancing to reduce dependence on the economic situation in a particular country or business sector. Consider, as an example, rebalancing a portfolio of securities where the share of each asset is 10%.

A year later, the proportions changed significantly: some assets account for only 2%, others – more than 30%. When rebalancing, an investor will face several downsides:

- a large number of transactions, and, as a result, brokerage commissions;

- tax on income from the sale of shares;

- income from reinvesting dividends and free funds may not be enough to purchase missing assets (if the investor does not sell securities, but only buys more).

Controversial aspects

While savvy investors consider regular rebalancing a must, there are several downsides to this procedure. The main one is due to the fact that you have to spend money on a brokerage commission if you sell assets. In addition, you will have to pay income tax, which could have been avoided by leaving the papers in the account.

Rebalancing may have a negative impact on portfolio performance. First, if a company's stock price is falling, it may be struggling. There is a possibility that the choice of this issuer was wrong. By blindly following the initial strategy and purchasing additional securities, you are risking your capital.

Second, if you regularly sell stocks during bull markets to increase your exposure to bonds, you are missing out on some of your profits. This will be especially noticeable if the uptrend lasts for a long time, as happened from 1986 to 1999 or from 2010 to 2020. But, if you rebalance during bear market periods and increase the number of shares, buying them at at a favorable price, thereby increasing the profitability of your portfolio over a long period of time.

Therefore, I recommend following a few rules:

- do not “shake up” your portfolio too often (at least more than once a month);

- regularly analyze how the initial strategy corresponds to the current market situation and your needs;

- maintain a balance between two methods of rebalancing: selling assets that have risen in price and depositing your own funds (preferably this should be a priority)

I also recommend reading:

Reviews about binary options: a scam or a way to make money?

Binary options: honest analysis and reviews from real traders

It is also necessary to regularly monitor the success of the portfolio companies. If you see that the financial performance of one of them is falling, you need to sensibly assess its prospects. Perhaps you should not buy additional shares of this issuer, but completely exclude them from the portfolio, replacing them with other securities from the same industry.

Portfolio rebalancing rules

Understand that stock and ETF portfolio rebalancing are very different. Shares have a higher level of risk, but the return on them can be much higher. That is why the first rule is effective diversification. The portfolio should contain securities of various countries and business sectors, as well as gold, currency, and real estate. Each asset should be a small part.

So, let's formulate the basic rules:

- Diversification of securities by companies, countries and industries.

- The share of each company should not exceed 10-15%.

- The amount of funds for investment should be constantly increased.

- Sell assets only as a last resort, after first conducting a detailed analysis of the financial condition of the issuer. This is an important condition for increasing the value of the portfolio.

Rebalancing example

Let's look at a specific example of how rebalancing works.

You have two shares - A with a yield of 9% and B with a yield of 5%. Let's include 50% A and 50% B in the portfolio. It seems that the average return for the year will be (9 * 0.5) + (5 * 0.5) = 4.5 + 2.5 = 7%. However, in reality it will be 13.94%. Why? Because we rebalanced.

Suppose that at the beginning of the year each of the shares cost 100 rubles. We bought 50 shares A and 50 shares B, the total portfolio was 50 * 100 + 50 * 100 = 10,000 rubles. Six months later, share A began to cost 75 rubles, and share B – 125 rubles. In total, the portfolio costs the same 10 thousand rubles, but the ratio of shares in it is different: A takes 37.5%, and B – 62.5%.

We return the portfolio to its original form by selling 10 shares of B for 1,250 rubles and purchasing 16 shares of A. Now shares A and B each occupy 50% of the portfolio, with 66 shares of A and 40 shares of B.

And here’s another interesting article: What is the RUONIA rate, how is it calculated and what is it used for?

Six months later, the shares began to cost: A - 109 rubles (+9% profitability), and B - 105 rubles (+5% profitability). Let's calculate the value of the portfolio: 66 * 109 + 40 * 105 = 7194 + 4200 = 11394 rubles. Yield 13.94%.

If we had not rebalanced, but simply held the shares in the original quantity (50 pieces each), then the price of the portfolio would have been: 50 * 109 + 50 * 105 = 5450 + 5250 = 10700. The yield is only 7%.

I think the numbers speak for themselves.

Comparing the results of portfolios with and without rebalancing

To analyze the results in numbers, let’s take the same time period – a year.

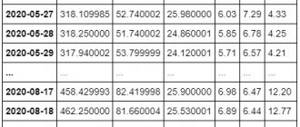

Portfolio with rebalancing

| Asset name | Cost when forming a portfolio, $ | % (asset share) when forming a portfolio | Cost after a year, $ | % (asset share) after a year | Profit or loss, $ |

| Currency (€) | 6000 | 20 | 5928 | 17 | -72 |

| Gold | 3000 | 10 | 3487 | 10 | 487 |

| Stock | |||||

| company A | 2400 | 8 | 4185 | 12 | 1785 |

| company B | 2400 | 8 | 3139 | 9 | 739 |

| company C | 2400 | 8 | 1744 | 5 | -656 |

| company D | 2400 | 8 | 2093 | 6 | -307 |

| company E | 2400 | 8 | 2790 | 8 | 390 |

| Total for shares | 12000 | 40 | 13951 | 40 | 1951 |

| ETF S&P 500 | 9000 | 30 | 11509 | 33 | 2509 |

| TOTAL | 30000 | 100 | 34875 | 100 | 4875 |

Although the deviation was a maximum of 4%, the investor decided to sell part of the shares of company A, buy additional shares of company C so that the share for these two companies was the same - 8.5% or 222,300 rubles. ($2,964 or 85,956 UAH).

Portfolio without rebalancing

When forming a portfolio worth RUB 2,625,000. ($35,000 or UAH 1,015,000) assets were distributed as follows:

- shares of a domestic company – 30% (RUB 787,500 ($10,500 or UAH 304,500));

- shares of a large US company – 20% (RUB 525,000 ($7,000 or UAH 203,000));

- OFZ – 40% (RUB 1,050,000 ($14,000 or UAH 406,000));

- gold – 10% (RUB 262,500 ($3,500 or UAH 101,500)).

A year later, the value of the assets changed as follows:

- shares of the domestic company began to cost 1,204,875 rubles. ($16,065 or 465,885 UAH) (35.3%)

- shares of an American company – 756,000 rubles. ($10,080 or 292,320 UAH) (22.2%);

- OFZ – 1,134,000 rub. ($15,120 or 438,480 UAH) (33.3%);

- gold – 315,000 rub. ($4,200 or 121,800 UAH) (9.2%).

Methods of carrying out

Rebalancing can be done in two ways:

- Sell some of the increased assets and use this money to purchase the missing type of securities.

- Top up your trading account from your savings and increase the required share in your portfolio with them.

Let me give you a clear example.

The investor’s portfolio contains shares of two companies - A and B. He invested 100 thousand rubles in each. Accordingly, the ratio of these securities is 50/50. The total capital is 200 thousand rubles.

A year later, the asset prices of these companies changed. Shares of issuer A began to cost 140 thousand rubles, and issuer B fell to 90 thousand.

Thus, the value of the portfolio is now 230 thousand rubles. To bring it to its original state, you can use the first or second method.

Then:

- Option 1 . The investor sells shares of company A for 25 thousand rubles and uses this money to purchase shares of company B. Thus, the 50/50 balance is restored in the portfolio. The shares of each company in the portfolio now weigh 115 thousand rubles.

- Option 2 . 50 thousand rubles are deposited into the brokerage account, with which the investor buys additional shares B. Now the total portfolio will be 280 thousand rubles, and the balance will return to the original 50/50 ratio.

The advantage of the first method is that it allows you to regularly record profits. Even if stock prices decline to previous levels, the overall portfolio value will be higher due to the increase in the number of assets.

The second method will be more profitable for those who reinvest dividends and coupons. Since payments can be received up to 4 times a year, it is logical to adjust the portfolio quarterly.

However, it is not so convenient due to the need to introduce new funds. And if quotes fall, the value of the portfolio may be lower than the invested capital.

In general, depending on the financial capabilities of the investor and the current situation with quotes, these two methods can be combined.

Personal experience of rebalancing an investment portfolio

Let us cite the experience of a private investor. The investor is active and in the redistribution of assets is guided by the following rules:

- Buy at the maximum, sell at the minimum. As practice has shown, the value of an instrument that has fallen in price is more likely to rise than the price of an asset that has shown growth will fall.

- Rebalance once a year at the same time as reinvesting.

- 20% of the portfolio consists of cash in foreign currencies and gold. Rebalancing does not apply to these assets.

- The remaining 80% are evenly distributed among issuers of securities of domestic and foreign companies. Over the past year, absolutely all shares have increased in price, so there was no need to sell anything. By depositing free funds, the investor only purchased additional securities of those issuers for which the deviation was more than 5%.

However, next year you may have to sell some shares, depending on how much free cash can be reinvested and how much the portfolio value increases.

MONEY OUT OF AIR or the theory of portfolio rebalancing.

Have you been told that there is profitability in the market “out of thin air” ? Most likely not, but she is. Now, as always, clearly and without any fuss, we will reveal all the “secrets” that are not secrets at all. It’s just that people in the industry want you to feel like it’s all complicated and you can’t do without them. In reality, portfolio investments are usually much simpler.

“Money out of thin air, real and without SMS!”

There are two chairs of investment instruments, in one the yield is 9% per annum, in the other 6%, we take 50% of the first and 50% of the second. What is the average portfolio return? (9 * 0.5) + (6 * 0.5) = 4.5 + 3 = 7.5%, right? No, the yield will be 8.5%! How is this possible?

Example: we bought 100 shares of two companies worth $0.5 per share, in total we have a portfolio worth $100 and each company has a 50% share or $50 for each company. The number of shares of the first company is 100, the number of shares of the second company is also 100.

After half a year, the first instrument costs $0.25, and the second $0.75 per share , in total the portfolio still costs $100, but the ratio of companies in it is already 25% to 75% or 100 securities at $0.25 ($25 ) and 100 papers for $0.75 ($75).

Now let's bring the portfolio back to the 50% to 50% ratio , sell a third of the expensive shares at $0.75 and use all this freed money to buy more cheap shares at $0.25. This resulted in 67 shares of $0.75 each with an amount in the portfolio of $50, and 200 shares of $0.25 each with an amount of $50 in the portfolio. The total value of the portfolio has not changed and costs the same $100.

After another half a year, the securities at $0.25 rose to $0.5 back, and those at $0.75 fell to the original $0.5. We have 67 first securities at $0.5 and 200 second securities at $0.5, or $33.5 in the first security and $100 in the second. In total, the portfolio now costs $133.5!

Where does the money come from? After all, the papers again cost $0.5 for both! Everything is correct, now we’ll figure it out and learn how to do the same.

“I buy low and sell high. That's all."

Carefully study the example above, or even better, recalculate it yourself on a calculator and you will understand one feature. By rebalancing the portfolio from 25% to 75% back to 50% to 50%, we sell what has become more expensive and buy what has fallen in price. Thus, we fulfill the main postulate of trading “buy low, sell high . That's it, nothing more is needed.

The most important requirement is that the instruments we trade move as differently as possible, preferably even in the opposite way, as in the example. Are there any instruments that often move in the opposite direction? Yes, I have. In the American market paradigm, these are stock indices and US government bonds. Now we will figure out why this happens and how we can use it.

A highly simplified theory: when business and the economy grow, banks, trying to make more money from loans, increase their interest rates on loans. And when lending rates in the economy rise, the state statistically increases rates on its bonds following them, which leads to a drop in their exchange value on the market, because the bulk of past and outstanding coupons have a rate lower than that of fresh, current issues. Consequently, the business and its shares rise, rates rise, and Treasury bonds statistically fall in value.

Then the interest rates rise so much that it becomes difficult for business and the economy to pay loans with such a rate, and as soon as the economy becomes over-lendered, a crisis occurs and the prices of company shares fall very quickly. Therefore, the central bank needs to reduce the interest rate and restructure problem loans in order to be paid at least some money on loans. Rates in the economy go down and the government then also reduces rates on its bonds, which is why prices for government bonds issued in the past at a higher rate than now are statistically rising.

So we have a model: business shares rise - bond prices fall, business shares fall - bond prices rise.

This is a highly simplified example; in separate articles we will analyze this mechanism and the relationships within it in more detail. The most important thing now is that, on average, stocks and bonds move in seemingly opposite directions. Let's take a look at the graph:

Both assets are growing, but on impulse they begin to move in different directions. Sipi500 - blue, 20 year bonds - red.

If you look closely, you will see that although both graphs show growth, at the moment of local market growth and decline they begin to move approximately in the opposite direction. This is exactly what we need. Now let's look at the returns of each instrument separately and their portfolio 50% to 50%.

The combination of stocks and bonds produces a very interesting effect. Sipi500 - blue, 20 year bonds - red, 50/50 - yellow.

Read more about the trading style that beats the market SEVERAL TIMES: https://vk.com/veryeasytrade

Pay attention to the amount of account drawdown “Max. Drawdawn”, it is almost at the level of bonds (-22%), while the profitability of such a portfolio is significantly higher than theirs (5.8% versus 7.5%)!

But why is the return on a 50/50 portfolio equal to 7.5% and close to the average between the returns on stocks and bonds, although at the beginning of the article it was said about returns higher than their average? The answer is very simple: we did not activate the rebalancing rule. Under the given conditions, our portfolio was 50/50 only at the very beginning.

Now let's add a rule to rebalance the portfolio weights 50/50 times a year and see the result:

One small condition brings us $4000! Sipi500 - blue, TLT bonds - red, 50/50 with rebalancing - yellow.

Now everything is as it should be, just one rebalancing condition brought us an additional 0.8% per annum and reduced the maximum drawdown by more than 3% against bonds.

Against naked stocks, things look even steeper now. Yes, we earn about 0.5% less than naked shares, but the maximum drawdown on our portfolio has decreased by almost 3 times and is less than 20% during the most destructive crisis of the last 100 years. Now you will definitely be able to sleep completely peacefully and not worry about any crises. Portfolio drawdowns reach a maximum of 25% and they last a year or two versus drawdowns of 30-60%, lasting 5-10 years in naked stock indices.

Is there any way to do this so as not to pay this -0.5% return for small drawdowns against SIPI500? No problem. Our old friend from the previous article “Beating the profitability of the S&P500 in 15 minutes” - the mid-cap 400 index of mid-cap companies and its ETF - “IJH”. I won’t bore you, let’s quickly see what happens:

sipi500 - blue, 50/50 with rebalancing - red, 50/50 with rebalancing and midcaps - yellow.

So what do you think? The return of the new portfolio is even slightly ahead of the SIPI500 , and the maximum drawdown has decreased by more than 1% compared to the previous 50/50 portfolio with rebalancing.

Read more about the trading style that beats the market SEVERAL TIMES: https://vk.com/veryeasytrade

With these “extremely complex” methods, we built a portfolio that exceeds the profitability of Sipi500 in all respects. Now you can say with 100% confidence that you can manage your money better than 99%+ of investment funds. Their task is to convince you that investing is difficult and you won’t be able to do it without them, in order to get a management commission on your money, don’t believe them.

Finally, let's look at how this portfolio has behaved since the 70s against the returns of the securities market in order to rule out as much as possible the possibility that we were just lucky. The data set is a little different, the one above from 2003 is slightly more accurate than this one from 1978.

Blue chart - SIPI500, red - 50/50 midcaps/long treasuries.

As you can see, over a horizon of more than 40 years, the situation has not changed much and we continue to have a portfolio with characteristics much better than those of Sipi500. Or maybe there is some way to rebalance a portfolio that is better and more profitable than just 50/50 “once a year”? Yes, we will definitely talk about this in the easytrade group or in future articles. For the impatient, I will say that the profitability in this article is far from the limit of what is possible)

Manage your money yourself and be rich. Good luck to all)