Purchasing securities is a reliable way to obtain stable profits, characterized by a minimal level of risk. The issue of such assets and transactions with them are carried out on general terms. You need to understand that interest on government bonds is either income or expense. This controversial point causes the population to distrust this form of depositing funds.

Government bonds can provide both income and expense.

What it is?

A government bond is a security that confirms the fact that the government of a certain state (hereinafter referred to as the issuer of the bond) owes the owner of the bond a certain amount of money.

In the Russian Federation, the Ministry of Finance of the Russian Federation is in charge of issuing government bonds; they are called OFZ - Federal Loan Bonds. In the USA, for example, government bonds are issued by the US Treasury, and the bonds are called “treasures”. Government bonds are issued by the Ministries of Finance or Treasury of different countries, thereby providing a guarantee from the state.

Bonds can be not only government bonds, there are many varieties according to different parameters,

Buying and selling

Like any bonds, government securities are purchased and sold on the stock market. The procedure for making transactions is standard and has no special features.

Investors can buy government bonds in two ways:

- By contacting a broker. Other securities are also acquired in this way. There are also no restrictions on their sale. Transactions are made through a special program or by phone.

- By opening an individual investment account (IIA). This option will allow the investor to additionally receive a tax deduction of 13%. But this type of account has a number of limitations.

The first option gives the investor the freedom and ability to dispose of the bonds at his own discretion, and the second option allows him to reimburse tax expenses.

Why does the state release them?

- To cover the government deficit. budget. There is a shortage of financial resources every year, so to compensate for it, the state issues medium- and long-term bonds.

- To eliminate a temporary budget deficit, which occurs when the state has spent part of the budget, but taxes or any other income has not yet entered the treasury (also called a “cash gap”). From time to time there is a budget deficit (usually at the end/beginning of a quarter), and short-term bonds are issued to neutralize it.

- To finance government projects. For example, targeted bonds that are issued for the implementation of specific projects. Federal highway, development of some sector of the economy, and so on.

- Raising funds to pay off debt on other securities. Otherwise it is called refinancing.

- In special cases, states issue bonds in order to pay for government work. order.

Bonds are securities issued by a body authorized by the state. Its issue sets the goal of attracting funds needed in the budget. In the history of the Russian Federation over the last century, before the transition to a democratic society, only government bonds were issued (however, even then they had varieties). These debt securities play an important role in the economy of any country. Their share usually makes up about half of the total amount of bonds.

Objectives of the issue

The issue of government bonds on the Russian or international stock market allows the government to attract additional funds to the budget.

The purpose of issuing and using finance may be:

- Regulation of the volume of money supply in circulation.

- Inflation index management.

- Exchange rate regulation.

- Fulfillment of obligations on other issues.

- Moving funds from one market segment to another.

- Formation of the yield vector of various bonds. The profitability of municipal and corporate bonds is always focused on GKOs.

- Solving various socio-economic problems at the state level.

In simple terms, the government uses money to finance the country and also attracts the population to investment activities.

Bonds are a more profitable option compared to bank deposits, and less risky than investing in real estate or precious metals.

Why does a private investor need this?

Simply put, what can bonds do for me? And it’s very simple - you can make money from it. Any individual can buy government bonds, and thereby become a creditor of the state. Moreover, if you approach it head on (you can always do stupid things), it will always be more profitable than a bank deposit.

Government bonds are the most reliable instrument for investing personal funds. You can only lose them if the state itself goes bankrupt, which is considered extremely unlikely; it is more likely to happen to another bank. So this instrument is suitable for savings investments.

The downside is that you need to figure out how it all works, and not everyone wants to do this. But it seems you are not one of them, since you are reading this on our website. You can buy bonds from any broker by opening a brokerage account.

Investments in bonds of federal subjects

From the point of view of investment reliability, bonds of the constituent entities of the federation are as close as possible to OFZ, while the profitability of such securities for comparable investment periods is slightly higher than for OFZ.

It is also worth considering that 90% of circulating municipal securities are securities with depreciation of their face value. That is, to correctly calculate the yield on them, you also need a special bond calculator, with which you can calculate the normalized yield of securities.

Here we also highlight several of the most interesting securities in terms of the relationship between profitability and investment terms.

In general, at the moment, such securities provide a net return without taking into account reinvestment of 7.5-7.8% per annum.

Types in the Russian Federation

So, in Russia government bonds are called OFZ. They are issued by the Ministry of Finance, and the regulator is the Central Bank of Russia.

Facts about OFZ

- Government bonds are considered the most “reliable” (but also the “cheapest”) financial instrument of all other financial methods.

- They are often called “risk-free bonds” because the government itself is the guarantor. But sometimes the state declares its default (inability to pay off its debt).

- The yield of government bonds directly depends on the Central Bank rate. At the moment, the yield on government bonds is from 5 to 7% per annum.

- In addition to the Central Bank rate, the income from bonds is affected by its circulation period - the shorter the circulation period, the less risk the owner of the debt security has, and the lower the income. This scheme also works in the opposite direction.

- There is no tax rate on coupon income.

- Income from bonds is taxable.

- According to the terms of circulation, OFZs can be short, medium or long. The longest period of circulation of OFZs can be 25 years.

Government bonds (like all others) can be coupon or zero-coupon (with a fixed constant, fixed variable and floating coupon). They also differ in the method of repayment of the face value:

- Ordinary, when the nominal value is repaid at the end of the circulation period.

- Amortization, the face value of which is paid in installments throughout the entire circulation period of the bond.

Read in a separate article more about OFZs and their types.

OFZ-N

OFZ-N are securities issued by the Russian Ministry of Finance for ordinary citizens: they are easy to buy and the risk is extremely low. By purchasing OFZ-N, a citizen borrows money from the state, receiving interest income. These are three-year government bonds with the highest level of reliability. They are intended for individuals only. You can buy them from agents at branches of VTB 24 and Sberbank banks.

If you are a private investor and have encountered reductions in GKO OFZ , then know that such bonds are no longer issued . This was the name of State Bonds with a short loan period (from a couple of months to 1 year).

A useful video that tells more about OFZ and OFZ-N, how they differ, what is better and how they work:

OVVZ

Bonds of external and internal loans, they are issued in foreign currency by all Russian issuers, including government authorities.

Eurobonds

Eurobonds are bonds that circulate outside the national currency market, but in another foreign currency, for example, dollars, euros, yen. Eurobonds, unlike Russian bonds, are not issued for any one market, but are, as it were, universal for all financial structures of the world.

Let's take a closer look at how bonds differ.

Not only the state can be an issuer of bonds, they can also be:

- Corporate, issued by a corporation, joint-stock company.

- Municipal, issued by local authorities.

- International, which are issued by foreign financial institutions.

Different terms of redemption

There are also various ways to terminate a debt obligation on both sides. For this purpose, several types of bonds have been invented that guarantee the possibility of termination of the contract by one of the parties:

- revocable;

- convertible;

- with the possibility of early sale.

A callable bond provides the issuer with the right to repurchase or call back the debt before the end of the placement period. If this happens, the issuer is obliged to pay a certain fixed premium. There are various conditions for early recall: in America you can only recall at the end of the specified period, in Europe it is customary to recall only on pre-designated days.

A puttable bond provides the owner with the right to urgently sell the bond to the issuer before the expiration of the placement period.

Coupon rate

The coupon rate , or guaranteed interest rate, on a bond is the amount the holder will receive from the issuer as compensation for using the funds.

For government bonds, the size of the coupon rate and the market price on the secondary market mainly depend on the value of the key rate of the Central Bank.

The bet on a bond can be of several types:

- fixed;

- floating;

- reverse float;

- zero.

A fixed coupon rate on a bond involves the payment of static interest upon the expiration of the bond placement period. These percentages do not change under any circumstances.

The floating rate on bonds depends on a specified value, such as, for example, the government bond rate or the national bank interest rate. The change in rate is directly proportional to the change in that value.

The inverse floating coupon rate changes in inverse proportion to a certain value. Typically, it is calculated as a value subtracted from a fixed percentage.

EXAMPLE ! The inverse floating rate may be 15% minus the government bond rate, which depends on the specific bond (for example 7%).

A zero interest rate guarantees no interest payments at all. Bonds with zero interest rates are called zero-coupon bonds. Transactions with such bonds are carried out at a discount price.

There is also such a thing as conversion of a government loan - this is a change in the original terms of the loan. If this happens, the interest rate is usually changed, which affects the profitability of the paper. For example, such a conversion was carried out in 1990, when the yield on government bonds increased from 3% to 9%.

How bonds generate income

There are several ways to make a profit from securities: an increase in the par value, a coupon, a return on investment.

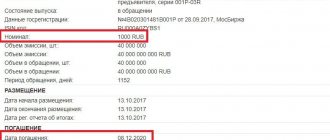

Price growth

Each paper has a face value. Most often this figure is 1000 rubles. The government returns this amount to the investor after the OFZ expires. However, such round numbers are not available in the stock market.

The market value of assets is constantly changing, although not as pronounced as the price of shares. During periods when the parameter increases, the bond can be sold profitably without waiting for the repayment period.

Coupon

This is the main way to make a profit. The holder of the paper is paid a small part of the face value for lending money. The size of dividends most often does not change throughout the entire period of validity. However, there are assets with a floating coupon yield. The investor will learn about changes in the amount of payments before the start of the next billing period. Interest accrues daily but is paid every 3, 6 or 12 months. When a bond is sold, the coupon is not lost. When purchasing paper, interest is added to the market price.

Bond income is made up of several components.

Return of face value

The owner of the bond receives the invested funds on the maturity date. This method is beneficial for the investor who purchased the paper at a price below par. In other cases, the return of value helps preserve capital.

Profitability

The yield on OFZ depends on the key rate of the Central Bank. To make it easier to understand, it will always be slightly higher than bank deposits. For example, if the key rate is 7.25%, then the bond yield will be between 7% and 8% per annum. While deposits in the bank will be 5-6% per annum.

At the moment, the key rate is 5%, and the yield is 5 - 7% per annum.

In addition, the income also depends on the market price of the bond (how much you buy it for), the size of the coupon and the maturity period. Typically, the longer you hold the paper, the more income you will get.

As an alternative to foreign currency deposits, foreign currency OFZs are widely popular among bank clients. The profit from these securities also depends on many factors, and foreign currency OFZs on the secondary market can be sold significantly more than their nominal value.

Calculation formulas and calculation examples

Current profitability is calculated as follows: TD = (N * Kd)/C, where:

- N—nominal price;

- Kd - coupon yield, expressed as a percentage per annum;

- C is the market value of the asset.

As the latter decreases, the bond's efficiency indicator increases. As an example, you can take paper that costs 950 rubles. with a coupon yield of 7.5%. The actual profitability is TD = (1000 * 7.5)/950 = 7.89%. To calculate the yield to maturity, use the formula: DP = (N - C + NKD)/CP * (365/Dn) * 100%, where:

- N—nominal price;

- C—purchase cost of the asset;

- NKD - accumulated coupon income;

- Day - maturity date.

To calculate the effective profitability, use the formula: EDP=((N-CP)/L+NKD)/((N+CP)/2*100%), where:

- N - denomination, most often equal to 1000 rubles;

- CP - purchase cost;

- ACI - accumulated income;

- L is the number of years until OFZ maturity.

Risks

Don't forget that there are risks everywhere and always. Even depositing money is not always reliable. Let's look at the dangers of investing in bonds.

Liquidity in the market

Bonds can be sold early, but the price will be lower due to low demand.

Interest rate

When interest rates rise, bond prices fall. Therefore, if you decide to sell bonds ahead of schedule, then due to the increased interest rate, the price of the bond will be lower than the price at the time of purchase. Even if the issuer’s paying ability has not decreased (more precisely, it has worsened due to the increased rate). If the rate has fallen, then there is no risk; you will receive additional income from an increase in the price of the bond (if it is sold ahead of schedule).

Currency

If you buy bonds in dollars, euros or other currencies, do not forget that the value of bonds may decrease due to fluctuations in exchange rates.

Definition of the concept

Government bonds are a type of debt securities issued by the state, the Central Bank of the Russian Federation or another body on behalf of the government of the Russian Federation. The holder of a government bond has the right to receive payment from the issuer of par value and coupon interest, if any. Payment is made in cash or property equivalent.

The state issues securities to attract free money from the population, legal entities or individuals. The funds received are used for public, state or social needs, eliminating budget deficits, cash gaps, and repaying debts.

In simple terms, the state issues bonds to the market, borrowing available funds from individuals and legal entities. Once the money is used for government purposes, it depends on the type of security.

Government bonds are traded on the Russian or foreign stock market. It follows from this that there are both ruble securities and government Eurobonds. In addition to the state, other participants in the financial market (municipalities, commercial companies) are also involved in issuing the latter.

Loans

Government loans can be internal, external, and foreign currency can be distinguished separately. According to the legislation of the Russian Federation, internal government borrowings are those loans that attract funds in Russian currency from both individuals and legal entities, as well as from international financial organizations and foreign states. Bonds are just a tool for the government to obtain loans.

Foreign exchange domestic

It is important to remember that foreign currency government bonds are not identical to each other. There are bonds that are denominated in foreign currency (US dollars) and those that are indexed to the exchange rate (denominated in hryvnia). Their circulation period also differs – it can be from 1 year to 3 years.

The yield on bonds offered by the Ministry of Finance in a particular bank may vary by several tenths of a percent.

The Ministry of Finance publishes fresh bond issues at auctions a couple of times a month; the placement schedule can be found on the ministry’s website.

External

External loans for developing countries are provided under the “official development assistance algorithm”. The following benefits are provided:

- term up to 50 years;

- interest rate from 0.5 to 2% per annum.

An external loan for 1-2 years is usually issued by private companies (company loan) and depository financial institutions, as well as short-term lending banks. Loans for a period of more than 5 years are provided by financial organizations specializing in long-term lending (for example, insurance companies, banking houses, international investors).

In the USA and Japan, large external loans are provided by export-import banking institutions.

Legal regulation

State and municipal loans are carried out in the form of issuing various securities, among which domestic government bonds are widespread. loans, which certify the debt obligation of the state and give its holder the right, after the specified period, to receive the entire amount of the debt and interest on it back.

The legal basis for the issue and placement of debt securities is described in the Federal Laws: “On the Securities Market” of April 11, 1996 and “On the Peculiarities of the Issue and Circulation of State and Municipal Securities” of July 17, 1998.

Based on their duration, loans are divided into short-term (up to 1 year) and medium-term loans (from 1 to 5 years).

Investments in corporate bonds

The specificity of corporate bonds today is that almost all bonds of this type have a variable coupon. This means that the coupon rate for them is determined only until the date of the next offer. Therefore, the most correct calculation of the yield on such securities must be carried out before the date of the nearest offer on the securities.

Among corporate securities at the moment, we can single out several bonds that have a certain investment idea and are capable of giving, in the current conditions, a yield above the state level. papers

Let's look at the bonds of PJSC Gazpromneft BO-02. The specificity of this paper is that at the moment there are 2 offers for it at once.

That is, the security will either be redeemed early by the decision of the enterprise on 03/23/18, or will continue to exist and can be presented for redemption by the investor on 03/19/21. When redeemed in 2021, the paper is capable of generating a yield of 9.73% per annum, which is significantly higher than the state market average. papers.

However, at its core, this bond is a kind of structured product that has a certain “fork” of profitability.

In this case, we see that with early repayment on the part of the enterprise, the investor receives a minimal profit, which is equal to a yield of 2.2% per annum. Moreover, after repayment by the enterprise, the money immediately goes to the brokerage account and the investor can invest in other alternative assets. If the company does not announce the repurchase of bonds on its part, then the investor remains the owner of a highly profitable and reliable corporate paper.

We also currently highlight securities such as TGK-2 BO-02. These are certainly risky securities to invest in, but they can also bring significantly higher returns to investors if the outcome is favorable.

Energy is one of the most sustainable industries. They will always have clients. In Russian conditions, this sector has no competition. In addition, this is a socially oriented industry and a default here is a problem that could be followed by severe social consequences for the entire region. And this is already the zone of interests of the authorities.

For analysis purposes, we look at the IFRS statements for 2021 and 2021. At the end of 2021, the company's revenue is growing, operating profit is growing the same way, at the end of the year the company has a net loss, but it is significantly less than a year earlier. Total debt exceeds equity by almost 4 times - this is a critical value, indicating that this was a risky investment at the end of 2021.

Profit and loss statement of TGK-2 as of December 31, 2016:

Balance sheet of TGK-2 as of December 31, 2021:

At the same time, according to the company’s IFRS reporting for the first half of 2021, the company is demonstrating strong growth dynamics. The company's revenue is growing, gross, operating and net profit are also growing. Net profit is growing multiple times. The company's total debt continues to significantly exceed its equity capital, but this ratio is improving, that is, equity is growing and debt is decreasing.

Profit and loss statement of TGK-2 as of June 30, 2017:

Balance sheet of TGC-2 as of June 30, 2021:

All this indicates that the situation in the company is changing significantly in a positive direction, and as a result, the risks on its bonds are decreasing.

At the same time, the current net yield on these securities excluding reinvestment is 12.55%. Which is significantly higher than the market average.

Thus, given the high yield of the paper, as well as the fact that the paper has depreciation at par, the yield in this case covers the potential risks of investing. However, we usually include securities such as TGK-2, that is, with a higher risk, either in widely diversified portfolios, or we try to cover the risks of such securities in our portfolios.

Bond currency

The vast majority of bonds traded on the Moscow Exchange are denominated in national currency - about 1,640 issues (93%), half of which are liquid. A bond issued by a Russian issuer and denominated in a foreign currency is called a Eurobond. (see article “How to buy Eurobonds”). Trading in Eurobonds takes place mainly on foreign exchanges. Some securities are also available on the Moscow Exchange: 110 issues in dollars (6%), of which 52 are liquid, and 15 in euros (1%) - 7 transactions are made. The average denomination of such bonds is 1000 dollars or euros. However, there are exceptions, both larger and smaller. Let's consider an example of a Eurobond - Sovkom 2B3, the par value of which is $100.

The issuer of this issue is the large Russian commercial bank PJSC Sovcombank. It is denominated in dollars, as a result all transactions are made in the same currency.

Conclusions: you need a widely diversified bond portfolio

Bonds are certainly a more stable instrument compared to stocks, however, even here the situation can change quite quickly. New issues of securities appear, profitability changes and existing issues are canceled. All this tells us that in this market it is also worth keeping your finger on the pulse and following events. This approach will help you avoid bad bonds in time and purchase good ones at the best possible prices!

Although bonds seem at first glance to be a simple and unambiguous financial instrument, they are fraught with many hidden pitfalls, therefore, in order to achieve a stable and predictable investment result, it is necessary, first of all, to form an effective diversified bond portfolio, and then manage it.

Advantages and disadvantages

I have already indirectly talked about the advantages: this is unconditional reliability, mainly a high level of liquidity, and a tax shield.

The disadvantage of government bonds is that you have to pay for reliability with yield: corporate bonds of Russian companies often have more attractive coupon rates and more regular payments, unlike government bonds, where payments are made mainly once a year.

Sometimes specific properties of bonds can be considered as advantages and disadvantages, for example, with or without an offer, with a variable or fixed coupon, etc.

Conclusion

A large number of different debt assets are traded on the Russian bond market. Any new investor may find it difficult to find quality bonds for their investment portfolio.

We talk about how to choose the best securities and avoid all the pitfalls of the bond market in our “School of the Smart Investor”. You can start learning with free lessons and webinars. You can sign up for the next open lesson using the link – https://mk.fin-plan.org

If the article was useful to you, like it and share it with your friends! Have a profitable investment!

Where and how can I buy

You can purchase government bonds through a bank or a Russian broker. For those bonds that are traded on the secondary market, the second method is preferable. Government bonds can be purchased in the form of structured products, providing wide diversification with a minimum entry threshold.

Independently on the Moscow Exchange

To do this, you need to open an account with a licensed brokerage house. Nowadays this can often be done online. Next, you need to download a trading platform where you can make a transaction with suitable government bonds.

As part of the mutual fund

Mutual investment funds include many instruments; the entry threshold is minimal. The disadvantage of such products is the lack of online quotation, i.e. all asset prices are calculated only after the end of trading. An example of such instruments on the Russian market, which includes government bonds, is the Sberbank Mutual Fund “Prospective Bonds Fund”, the Alfa Bank Mutual Fund “Alfa Capital Bonds Plus”, etc. The minimum investment threshold in both examples is set at 1000 rubles.

ETF

ETF, or market traded fund, is another type of structured product with a low financial entry threshold and wide diversification across instruments. They are superior to mutual funds in all respects, but the choice of such structured products is not very large. As an example, I will give the FinEx Cash Equivalents UCITS ETF, which includes short US government bonds with a ruble hedge.

Best brokers

Reliable Russian brokers

| Name | Rating | pros | Minuses |

| Finam | 8/10 | The most reliable | Commissions |

| Opening | 7/10 | Low commissions | Imposing services |

| BKS | 7/10 | The most technologically advanced | Imposing services |

| Kit-Finance | 6.5/10 | Low commissions | Outdated software and user interface |

The largest representatives of the industry are rightfully leading and popular because, along with competitive commissions, they provide a high level of service and first-class reliability ratings.