Last modified: April 23, 2021

Today, against the backdrop of falling deposit rates, falling oil prices and rising real estate prices, Russian citizens are looking for different ways to invest their money to protect it from inflation and generate additional income. Many people have probably heard about investment life insurance (ILI). But few people know what it is and is it even possible to make money on it? Let's figure it out.

Endowment insurance: main points

In the classical sense, endowment insurance is a long-term program , under the terms of which clients regularly replenish their insurance account with the amount previously agreed upon in the contract. As a rule, contributions are made once a year, but options are available - monthly or quarterly replenishment of the account.

During the entire term of the contract, the client is under the protection of the insurance company. It is she who, in the event of an insured event - death or injury of the client, undertakes to pay the relatives the amount of money in the amount prescribed in the policy. Depending on the conditions under which the contract was concluded, either the amount that the client would have accumulated by the time the policy expires is paid, or the amount of premiums already paid .

Some insurance companies offer their clients programs under which the amount of payments increases 2-3 times if the insured event occurred as a result of an accident or road traffic accident. In addition, investors have the opportunity to add a number of additional risks to the program - illness, disability or injury.

Arguments for"

It is worth becoming a participant in the life and health insurance program for a number of reasons:

- The accumulated capital is capable of solving long-term problems - helping with the purchase of housing, paying for a child’s education.

- Insurance protects the family from unforeseen circumstances that are associated with the life and work capacity of the main breadwinner and breadwinner of the family.

- The accumulated capital can be used as an additional pension .

- Clients of insurance companies receive a number of privileges in the legal and tax spheres.

Many investors choose an endowment insurance program due to the fact that all premiums paid will be returned after the end of the policy period. In addition, contracts often also provide for a basic return of 3-4% , which allows not only to save money, but also to partially save it from inflation.

Need to pay attention

Recently, more and more bank clients say that investment life insurance contracts were presented to them as complete analogues of classic deposits, but with slightly higher profitability. A person who understands the difference between these two instruments for accumulating funds is ready to soberly evaluate the option of investing in ILI. If this method of investing is a discovery for you, but you are still ready to consider its possibilities, then you need to pay attention to a number of nuances .

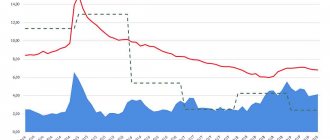

The fact is that greater profitability of ILI programs is achieved by investing the deposits of insured persons. Unfortunately, not all investment strategies offered by insurers are transparent. Policyholders do not have the opportunity to independently track the trend dynamics of a particular fund, so they have to trust the “word of honor” of insurers. As a rule, companies show only part of the indicators, and therefore it is impossible to be 100% sure that the chosen investment strategy will be successful.

In this case, policyholders have only two options :

- Search for products tied to the cost of specific goods or funds yourself in publicly available sources.

- Trust the insurance company's specialists.

Key points

The main metric to look at when choosing an investment strategy is the participation rate , which shows the share of the strategy's growth that the policyholder can receive. This indicator can vary significantly. For example, if the coefficient is 100%, this means that the policyholder’s income is equal to the profitability of the selected fund. Please note whether the percentage of return multiplied by the participation rate will apply only to the portion of funds allocated to investment or to the entire contribution.

Many insurance companies provide clients with the option of changing the investment strategy during the term of the contract or fixing the funds earned . Most often, you can use these services only once a year. I must admit that this is very convenient , because you will always have the opportunity to change the investment fund if the initial strategy does not turn out to be very effective. But it makes sense to resort to fixing investment income when the current profitability of funds is high, but its decline is predicted in the near future.

Choose insurance programs from those agencies whose website provides the opportunity to create a personal account . This will not only simplify control over the dynamics of funds, help to respond to trend changes in a timely manner, but will also provide an opportunity to adjust the initial agreement (increase the deposit amount or change the current strategy).

Savings and investment insurance: comparative analysis of advantages

When choosing endowment life insurance, you will have to deposit your money with enviable regularity into an account opened with the insurance company for several years. After the expiration of the policy, you will be able to return the amount of premiums paid if the insured event never occurred. Please note that some companies do not return the entire amount of contributions, but only a part of it . To ensure that the reality meets your expectations, carefully read the terms of the contract .

The thing is that the more risks your insurance covers, the higher its cost. The difference between the amount you paid and the amount returned is spent on activities related to your insurance.

If, suppose, a client of the company was insured in case of death, and this insured event occurred, then this means that the beneficiary (the person receiving the insurance) can receive the entire accumulated amount of funds immediately, and not wait until the end of the life insurance contract.

NSJ policy

Is a target insurance premium. That is, it falls under the Article of the Tax Code “ On Social Deductions ”, according to which the investor has the right to return 13% of the total amount of the annual contribution. However, here you need to take into account a number of nuances:

- Only an officially employed client (since a 2-NDFL );

- the tax deduction amount is not taken from an amount exceeding 120,000 rubles (even if more was actually paid);

- the amount of deduction cannot exceed the amount of tax withheld from salary.

It turns out that the maximum deduction for personal income tax cannot exceed 15,600 rubles (13% of 120 thousand rubles). You can return taxes for 1, 2 or 3 years at once. Please note that upon termination of the life insurance contract, tax benefits will have to be returned to the state treasury.

Legal aspects of endowment insurance

The agreement is not without a number of legal advantages. Thus, the funds that are placed in the NJ do not :

- may be confiscated;

- subject to arrest;

- declared;

- are considered property that is divided during divorce proceedings.

An undoubted advantage of the policy is the ability to indicate a beneficiary , who will become the owner of the insured amount if the investor suddenly dies. The first will not need to wait to take ownership and share the insurance funds received with other heirs - all payments are made directly within 2 weeks from the moment of applying for compensation. By the way, the investor has the right to indicate several beneficiaries at once and change their number and composition at any convenient time.

Investment insurance

investment insurance over savings insurance , you also become the owner of a long-term insurance account, which is replenished either with the entire amount at once or with several equal installments. However, in this case, you are not only insured against accidents, but also guaranteed a 100% return of the amount of money you invested , as well as profitability from investment activities.

All money deposited into the account is divided into 2 parts: guaranteed and investment . The first is invested in financial instruments that guarantee additional income (for example, a bank deposit). The second, investment , turns into relatively risky investments.

If the investment strategy chosen by the company is successful, then, in addition to the invested funds, you will also receive additional income.

Advantages of ILI

So that you can decide whether to become a participant in the investment life insurance program or try to make money by investing in other financial instruments, I suggest you evaluate the advantages and disadvantages of ILI. By the way, if, having reached this point in the article, you have managed to understand that investment insurance does not attract you, you may be interested in my article “Where is the best place to open an individual investment account.” In the meantime, let’s look at the advantages of ILI:

- Insurance payments upon the occurrence of risk events are not subject to taxes .

- Policy premiums cannot be seized, seized, or divided because they are not property .

- Insurance payments are not inherited, but are made directly .

- Participation in the ILI program provides the right to receive an insurance deduction in the amount of 13% of contributions for 120,000 rubles deposited into the insurance account.

- ILI contracts are concluded for a long period, and the cost of contributions remains fixed even in cases when the health of the policyholder declines.

- The need to regularly replenish the insurance account and the inability to spend accumulated money ahead of schedule develop financial discipline .

“Weaknesses” of endowment insurance

Speaking about the disadvantages of the NSJ, I would like to note several points:

- Funds deposited by depositors in insurance accounts are not protected by the deposit insurance system . This means that if an insurance company loses its license, all its obligations will be handled by reinsurers - firms (most often foreign) that have entered into an agreement with the company to protect financial risks.

- The insurance contract is concluded for an average of 5-40 years . Unfortunately, not all investors have the opportunity to make an accurate forecast regarding their financial well-being for several years in advance.

- If the client does not have the opportunity to make the next mandatory contribution, the insurance company will first provide him with a “deferment” for 30-90 days. If payment is not made within this period, the policy will be terminated and the investor will receive only the surrender value of the life insurance contract.

In case of termination of the program before its official end, the client will receive a redemption amount . It represents a percentage of the total amount actually deposited into the insurance company's account. Often during the first two years the redemption amount is 0 rubles . In subsequent years, it can vary between 10-40% (in this case, everything depends on the conditions of a particular insurance company).

For clarity, let's imagine the following example :

- You have entered into an agreement for a period of 10 years , according to which you must make an annual contribution in the amount of 100 thousand rubles ;

- Over 5 years, 500 thousand rubles have accumulated in the account ;

- In accordance with the terms of the agreement, in the 6th year the amount of the redemption amount is 40%;

- You decide to terminate the NJ agreement.

We count: 500,000 * 0.4 = 200,000 rubles . Thus, in the event of termination of the contract, you will be returned only 200 thousand rubles and earned investment income, if any was provided for by your program.

How to receive payments under the NSL?

When an insured event occurs, the insured person or his chosen beneficiary must submit a claim for payment of funds to the insurance company. Your application must be supported by the following package of documents :

- a statement about the occurrence of an insured event;

- a certificate from a medical institution confirming the fact of harm to the investor’s health;

- death certificate of the investor (in this case provided by the beneficiary);

- original agreement between the investor and the insurance company, policy .

Most often, the contract specifies a period during which the insurance company must check the documents received and make a decision regarding future payments. The agreements provide for both one-time and installment payments in the form of a pension; immediate or deferred payments.

What do insurance companies offer today?

Finding a reliable insurer with a truly advantageous offer is not an easy task and no less responsible than choosing a bank to open a deposit account. By the way, for those who are just looking for the most favorable conditions for investing free funds, I have an article “How to choose a reliable bank for deposits.”

As for the private insurance policy, large insurers offer their clients a variety of different programs with various conditions . The size of the minimum deposits directly depends on the degree of reliability of the company, the region in which the contract is concluded, and the data of the policyholder. To understand the pricing policy of agencies and build your own rating of companies that you can trust with your future, I bring to your attention the following comparative table .

| Insurance Company | Service cost | Payment amount | Peculiarities |

| Sberbank | From 900 to 4,500 rubles | From 100 to 500 thousand rubles, depending on the chosen program |

|

| Rosgosstrakh | Starts at 5 thousand rubles per year. The company’s official website presents a special insurance calculator that allows you to choose the optimal insurance program | Vary between 500-1000 thousand rubles |

|

| Ingosstrakh | The cost depends on the choice of the policyholder and is calculated for each client individually | Over 1 million rubles |

|

| Alpha Insurance | From 30 thousand rubles per year or six months | Up to 12% per annum |

|

| Sogaz | From 5 thousand rubles per year | Up to 1 million rubles |

|

| RESO-Garantiya | From 3 thousand rubles per year | Over 1 million rubles |

|

I would like to highlight separately the proposal from BKS :

- You can invest in both rubles and dollars;

- the account is replenished every six months, year, or the entire amount is paid in one payment;

- There are 4 types of investment programs - adult, children's, pension (5-30 years) and health. The latter, in addition to direct investments, also offers a comprehensive medical examination, which makes it possible to identify diseases at an early stage;

- within 14 days after concluding the contract, you can terminate it and get your money back.

Compared to its analogues, NSZH from BCS stands out for its flexible investment terms (5-30 years), the ability to work not only with rubles, but also with dollars , as well as additional services. the health-check offer - in fact, the client receives a top-level medical examination and the opportunity to diagnose health problems at an early stage, when diseases are easier to treat.

Otherwise, the BCS offer is at the level of other players in the endowment life insurance market.

Answers to awkward questions or what banks are silent about

Everything that was written above is how managers present information to clients. Praising and singing this wonderful fabulous product. And a little silent about some nuances.

But in practice, it completely confuses the client. And they even deliberately mislead.

Let's go find where the dog is buried.

This is not a contribution

The vast majority of ILIs opened are in banks. Managers, by hook or by crook, talk their way out of clients. Describing all the delights. They are presented as an alternative to a bank deposit, but with a higher return.

But...by opening an ILI you are not entering into an agreement with the bank. And directly with the insurance company.

So what do we have? The safety of deposits in banks is guaranteed by the state represented by the DIA. Amounts up to 1.4 million are insured.

In the case of ILI, you are left alone with the insurance company. What could this mean? Agreements can be concluded for decades. And what happens if the company goes bankrupt?

You are left alone with your problems and complaints. And you stand in line to receive the funds due to you.

Early termination or redemption amount

What will happen to your money if you suddenly want to terminate the contract and take everything back?

By opening a bank deposit, all accrued interest would be burned. But you are guaranteed to receive the invested amount in full.

Any ILI has prescribed conditions for early termination. The client will receive only part of the funds (redemption amount), the rest remains with the insurance company in the form of a fine.

The largest fines apply in the first 3 years from the date of conclusion of the contract.

On average, with early withdrawal of funds, the client receives:

- after 1 year - 50-70%;

- 2 year - 70-80%;

- 3 year - 80-90%.

And so on. The insurance company always sets various obstacles to withdraw funds from accounts. And most who know how to count will not want to lose extra money (although money is never extra).

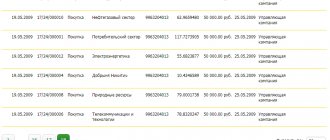

An example of the redemption amount from the life insurance contract of one well-known insurance company.

Maybe that's a good thing. We leave the capital, let it work and make a profit. But there is a catch here too.

It's called.....

Participation rate

The money allocated for the investment part and invested in securities is completely yours. And the income (if any) will only partially belong to you. The insurance company takes a certain share.

This is called the participation rate. What share of the total profit will go directly to you.

How much do you think the insurance company takes?

5, 10-15%, or maybe 20%?

From 30% (and this is at best) to 50%.

For example, an income of 30% was received on invested funds. With a participation rate of 50%, you will receive only half the profit - 15%. And considering that only a small part of your capital is allocated to the investment part, in relation to the entire amount, the real additional profitability will be 2-3%.

Leading insurance companies have a participation rate of:

- VTB - 51%;

- Alpha - 50.13%;

- Renaissance - 78%.

Real example

Let's imagine the following situation. A mother wants to save 10,000,000 rubles before he comes of age, which will take place only in 15 years . It turns out that annually the amount of her insurance premium should be equal to 637,315 rubles . After 7 years of regular payments, a woman unexpectedly gets into a car accident, as a result of which she becomes a group 1 disabled person.

In accordance with the terms of the insurance contract, the company is obliged to make insurance premiums instead of its client until the policy expires. It turns out that by the child’s 18th birthday, his account will have 13,310,000 rubles , taking into account the income received from investment activities.

Will the money be returned for sure?

The insurance premium consists of two parts:

- The risky part. This is the so-called risk fee, which makes up a smaller share of the total premium. It is the risk part that is withheld from the client upon early termination of the contract.

- Accumulation part. This is the main part of the premium, subject to return in full upon expiration of the policy.

Provided that you have made payments on time and in full, you are guaranteed to be paid the entire portion of the insurance premium. In this case, the risk part is covered by guaranteed investment income.

Who should open an NSJ?

To be completely frank, I believe that endowment life insurance is a program that everyone needs , in particular:

- The main breadwinners of the family , whose income forms the basis of the family budget;

- New parents who seek to create capital for their child, thereby ensuring his future and protecting him financially;

- Middle-aged people who are thinking about their upcoming retirement, but do not have the opportunity to invest large sums of money;

- For those who adhere to a conservative investment strategy and seek, first of all, to protect their savings for a long period. By the way, I strongly recommend that this category of investors think about opening an individual investment account. You can read about where it is better to open an individual investment account in one of my previous articles.

- Those who want to get “ two for the price of one ”: both insurance and savings.

Why do you need life insurance?

Our plans for the future, the well-being of our families, are based on the assumption that we will be alive and healthy. And we can earn enough money to provide for our family.

But remember my story. Chance can suddenly interfere with our plans.

There are events that we cannot control. For example, illness or accident. Suddenly they can cancel all plans and put the family on the brink of poverty.

Life insurance eliminates these severe risks from life. This is how we guarantee financial security to our loved ones. Play my video talking about this:

Who is not suitable for NSJ?

Don't waste your time and money on NJ:

- For investors who strive to get maximum income in the shortest possible time and are ready to take any risks for this. For such investors, investing in securities or playing on the currency exchange is more suitable. You can learn about the difference between a stock and a bond, and how to start making money on the purchase and sale of these securities in my separate article.

- For those whose investment horizon is limited to 5 years, since NJ is one of the most long-term instruments .

Drawing conclusions

In general, I can say that NJ is a good option for accumulating funds in the long term. However, I personally am more inclined to save through a deposit account . This investment option not only guarantees you profitability, but is also protected by the state. In addition, you can withdraw your money at any time without worrying about losses. Previously, I wrote an article about debit cards with interest on the balance. So, having created such a plastic assistant, you can test the capabilities of a deposit account , since both cards and accounts work on approximately the same principle. And, of course, don’t chase the amazing numbers that insurers show you. Remember that you can only invest in what you know and understand 100% . That's all for me, see you soon!

If you find an error in the text, please select a piece of text and press Ctrl+Enter. Thanks for helping my blog get better!