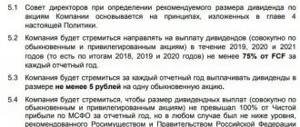

On May 27, 2021, by decision of the Board of Directors, the new edition of the Regulations on the dividend policy of OJSC Magnit was approved (Minutes No. b/n dated May 30, 2021), developed in accordance with the current legislation of the Russian Federation, the Code of Corporate Conduct, the Company Charter and others internal documents.

The dividend policy of PJSC "Magnit" is aimed at increasing the welfare of shareholders and ensuring growth of the Company's capitalization.

On December 24, 2021, the Extraordinary General Meeting of Shareholders decided to pay dividends on ordinary registered shares of PJSC Magnit based on the results of 9 months of the 2021 reporting year in the amount of 24,999,874,495.05 rubles, which is 245.31 rubles per ordinary share. January 8, 2021 is set as the date on which persons entitled to receive dividends are determined.

Documentation

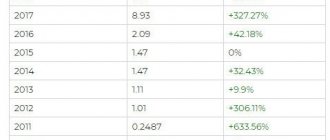

Dividend history

Download table xlsx 9M 2020245.3124 999 874 495.052019304.1931 000 415 077.459M 2019147.1915 000 332 342.452019157.0016 000 082 735.00201 8304.1630 997 357 736.809M 2018137.3814 000 581 949.902018166.7816 996 775 786.902017251.0124 731 770 718.551P 2017115.5110 922 782 116.052017135.513 808 988 602.502016278.1326 300 349 666.151P 201684.67 999 890 633.009M 2016126.1211 926 078 092.60201667.416 374 380 940.552015310.4729 358 463 886.851P 201588.48 359 223 782.009M 2015179.7716 999 294 788.35201542.33 999 945 316.502014362.9 434 320 098 183.701P 201478.37 404 154 096.509M 2014152.0714 379 945 254 ,852014132.5712 535 998 832.352013135.2112 785 640 809.551P 201346.064 355 496 011.309M 2013152.0714 379 945 254.85201389.1 58 430 144 798.25201281.357 701 566 229.251Kv 20125.18498 827 818.901P 201221 ,151 999 972 658.25201255.025 202 765 752.10201122.932 142 203 933.21201118.261 726 690 342.301Kv 20114.67415 513 590.91201 06.57584 566 229.61200914.821 291 338 575.981Kv 20094.76396 249 341.60200910.06895 089 234.3820081.46121 538 663.60 Download table xlsx

Change of owner

Magnit is included in the list of the largest companies in the Russian Federation according to the expert agency RAEX. Formation of the company

Service name

By the end of 2021, Magnit saw a decline in the growth rate of net retail revenue, store traffic, and average check growth. The company has reduced its ambitions for opening stores: instead of 1,500 new “convenience stores,” only 1,200, instead of 2,021 pharmacies — 1,200.

The total number of retail outlets reached 3228. At the same time, the company enters into contracts for direct supply of products and cuts out intermediaries, thereby reducing costs and increasing profits.

Key dates

for the year April 9, 2020 June 5, 2020 June 19 20203 July 2020 - to nominal holders, 24 July 2021 - to other persons2018 9M30 October 20185 December 201821 December 201814 January 2021 - to nominal holders, 4 February 2021 - to other persons2018 for the year24 March 201930 May 201914 June 201928 June 2 021 - to nominal holders , July 19, 2021 — to other persons 2017 1H July 27, 2017 September 1, 2017 September 15, 2017 September 29, 2021 — to nominal holders, October 20, 2021 — to other persons 2017 for the year May 17, 2018 June 21, 2018 July 6, 2018 July 20, 2021 — to nominal holders, August 10, 2021 — to other persons2016 1H1 August, 20168 September 201623 September 20167 October 2021 - to nominal holders, 28 October 2021 - to other persons2016 9M31 October 20168 December 201623 December 201613 January 2021 - to nominal holders, 3 February 2021 - to other persons2016 for the year28 April 20178 June 201723 June 20177 July 2021 - to nominal holders, June 28, 2021 - to other persons2015 1H30 July 201524 September 20159 October 201523 October 2015 - to nominal holders, 16 November 2015 - to other persons2015 9M29 October 201522 December 20158 January 201622 January 2016 - to nominal holders, 12 February 2021 - to other persons 2015 for the year7 April 20162 June 201617 June 20161 July 2021 - to nominal holders, July 22, 2021 - to other persons2014 1H31 July 201425 September 201410 October 201424 October 2014 - to nominal holders, 18 November 2014 - to other persons2014 9M29 October 201418 December 201430 December 201422 January 2 015 — to nominal holders, February 12, 2015 — to other persons2014 for the year7 April 2015 4 June 201519 June 201519 June 20153 July 2015 - to nominal holders, 24 July 2015 - to other persons2013 1H31 July 201326 September 20139 August 201325 November 20132013 for the year4 April 201429 May 201413 June 20142 June 7, 2014 - to nominal holders, July 18, 2014 - other persons2012 1Q April 20, 2012 May 28, 2012 April 13, 2012 June 27, 2012 June 19, 2012 September 14, 2012 July 27, 2012 November 13, 2012 2012 for the year March 25, 2013 May 24, 2013 April 19, 2013 July 23, 2013 2011 1 Q25 April 201123 June 20116 May 201122 August 20112011 for the year20 April 201228 May 201213 April 201227 June 20122010 for year25 April 201123 June 20116 May 201122 August 20112009 1Q28 April 200925 June 200925 June 20098 May 200924 August 20092009 for the year26 April 201024 June 201024 May 201023 August 201023 August 20102008 for the year28 April 200925 June 20098 May 200924 August 2009 Download table xlsx Information is provided as

of the date of disclosure of information in accordance with the Regulations on disclosure of information.

Excess retail is consolidating: Magnit is buying up Dixie

The retail chain Magnit announced its intention to buy the Dixy chain, and Lenta announced its intention to buy Bills.

In the post-Covid Russian economy, inflation, especially food inflation, has become the largest socio-economic problem. In our article “Excess Retail,” the behavior of large retail chains was named as one of the key factors of inflation. The number of stores in large chains increased by 2-3 times over the decade of the 2010s, while incomes and expenses of the population stagnated, the same number of customers is distributed over twice the number of stores, and retail chains factor their costs into the rapid rise in prices.

This is clearly evident from Magnit’s presentation to investors on the results of the first quarter of 2021, which shows a drop in traffic by 9.4% and an increase in the average check by 14.9% (compared to the first quarter of 2020). It was the rapid rise in prices that allowed Magnit to restore, after the failure of the pre-COVID 2021, sales per square meter (202-193-206 thousand rubles per meter) and net profit (33.6-17.1-37.8 billion rubles). ) according to data for 2018-2019-2020.

Russian food retail is rapidly moving towards the dominance of literally a few retail chains with a common business model. The largest food chains in Russia are X5-Pyaterochka with a market share of 13%, Magnit - 11%, Dixie - 7%, Lenta - 3%, Auchan - 2% (according to the X5 report for the first quarter ). These data slyly underestimate market concentration so as not to cause complaints from government agencies and instill confidence in investors in the further growth of market share. The underestimation occurs due to data for Russia as a whole, including a large number of small settlements and remote regions where it is not profitable for networks to operate. And in large cities of the European part of Russia, these chains have turned into an oligopoly - there are very few independent stores and local chains left.

Unlike X5-Pyaterochka and Magnit, Dixy is a mysterious company that discloses little information about its activities. On the Dixy website, in the “Investors” section, annual reports for 2021 are posted, and quarterly reports are posted only for the first quarter of 2019. There are no consolidated statements in open sources for either 2021 or 2021. Reasonable investors are wary of companies with such secrets, assuming there are "skeletons in the closet." The title of the article on the Forbes website on the transaction in question is eloquent: “There is no more attraction: why are the owners of Dixie selling the chain to Magnit,” as well as an indication in the text of the article about the problems of Dixie, starting with the crisis of 2014 and the company’s departure due to this from the stock exchange. The BFM.RU website contains the opinion of one of the analysts (Maxim Tishchenko) that “Dixy” is currently feeling the worst on the market, the network does not have a very bright future.”

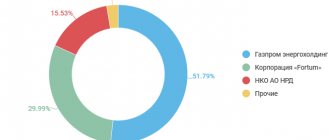

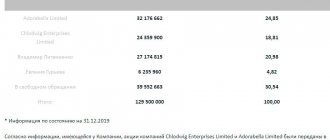

It is interesting that the presence of Americans among the dominant shareholders of Magnit also began to be hidden over the last quarter, although at the time of writing the January article “Excess Retail” such information was in reports for ordinary investors on the website of Magnit itself. Based on that article and the dominance of the Americans, deputies from A Just Russia during the parliamentary hour asked a question to the Minister of Economic Development M.G. Reshetnikov. At the time of writing this article, the largest shareholder of Magnit is already presented as the state bank VTB with a share of 17.3% and VTB Capital with a share of 8%, and 64% of the shares are, as it were, in free circulation without disclosing the names of investors. Only in the Issuer’s Quarterly Report for the first quarter of 2021, which Magnit submitted to the Bank of Russia, on page 127, one of the largest American banks JP Morgan Chase Bank with a 28% share and the American company Dodge with a share are indicated among the shareholders shares 5%. Moreover, of the 11 members of the Board of Directors of Magnit, five are foreigners, including the Chairman of the Board of Directors and the Chairman of the Board, another three with Russian surnames, according to their resumes, have worked in London for decades.

It turns out to be a politically nasty story that, despite tightening sanctions from the United States, one of Russia’s two largest food chains not only continues to be run by Americans, but also announces the purchase of a third chain and becomes clearly dominant in the Russian market. Many years ago, there was a persistent version among professionals that Magnit was grown for sale by the American Walmart (occupies 26% of the American market). This version is supported by similar marketing techniques of the companies, formats and design of Magnit and Walmart stores. State-owned VTB appeared among the shareholders of Magnit after the Americans became the largest shareholders with a total share of 33% and with dominance in the management, in order to somehow try to balance the American influence.

In the announced deal, Magnit is overpaying tenfold for Dixy, which is clearly evident from the assessment of the opportunity cost of opening stores in leased premises. The announcement of Magnit’s purchase of Dixie indicated the transaction amount of 93 billion rubles. through a credit line, that is, 52 million rubles. per one of 1,787 small-format stores. Stores are mainly leased, with goods for sale, and only own retail equipment. On the Internet, on specialized websites, you can easily find information about the cost of a Magnit franchise or another large chain, and about typical capital investments in store equipment. According to the Magnit franchise, the initial investment in store equipment is 5 million rubles, Pyaterochka - from 8 to 22 million rubles, Vkusvilla - from 2 to 3 million rubles.

It is difficult to find information about Magnit's creditor banks in open sources, but there are some clues about state banks. Magnit's debt on loans and borrowings amounts to 166 billion rubles. at the end of 2021, plus 220 billion rubles. current accounts payable. To repay only existing loans, Magnit needs 4.5 years with inflationary inflated profits in 2021 and 10 years with profits in a disastrous 2021. Another 93 billion rubles have been announced for the purchase of Dixy. loans, and it is unlikely that any of the private banks will be ready to allocate such huge amounts of money. Even before the purchase of Magnit shares in 2021, VTB was the largest creditor bank of Magnit, reports of Magnit bond issues mention Gazprombank as the organizer of the issues, there were reports of cooperation agreements between Magnit and Rosselkhozbank and the SME Development Corporation small and medium enterprises). The agreement with the latter, by pure coincidence (!?), was published on May 18, the day of the news about Magnit’s purchase of Dixie.

Magnit shares have not been trading very well on the stock exchange in recent months, and speculators need to raise their quotes. A year ago, against the backdrop of a lockdown, stock markets around the world experienced a huge drop, but then investors’ fear passed, and stocks recovered their fall over the fall, even surpassing pre-Covid levels. Magnit shares, after peaking at the beginning of 2021 at 5,785 rubles, then fell to or below a price of 5,000 rubles. A fall in shares, especially among large owners, be it the Russian VTB or the American JP Morgan Chase, causes losses that are quite unpleasant for bonuses, especially at VTB. The announcement of the deal with Dixy should give ordinary investors hope for further growth in shares, which will extend the post-Covid rally and resell even more shares to ordinary investors.

As for Dixie, its “skeletons” can also hit the profits and bonuses of the largest Russian banks that provided loans to this network. It is impossible to increase the number of stores by about a thousand in a few years without borrowed money, however, there is no information in open sources about at whose expense Dixy’s rapid growth was such. Previous crises and bankruptcies of large retail chains were painful for creditors: Ramstore, Seventh Continent, BIN-Petrovsky, Stockman, Spar, Kopeika, as well as a number of large sellers of consumer electronics had significant debts. Now the troubled Dixie should leave the market, and not burden the already redundant retail sector and certainly not be supported by gigantic infusions of new loans.

The state has all the leverage to block the deal between Magnit and Dixie. State-owned VTB is the second most important shareholder and could simply vote against the deal at a shareholder meeting or board of directors. The unnamed creditor banks of this transaction can at least be reminded that a loan for the purchase of shares or an investment in the authorized capital immediately requires a reserve of 20%. The antimonopoly service has sufficient grounds to refuse to create a clearly dominant player. Considering the increase in American sanctions against Russia, as well as the lack of parity in the volume of Russian business in the United States, promoting the development of a company with controlling American shareholders and the potential for sale to Walmart looks generally politically unacceptable.

The redundancy and problems of food retail are evidenced by the second announced mega-deal, namely the merger of Lenta and Billa (the fourth and eighth chains in terms of market share, in total as half of Dixie). Billa is owned by one of the largest German retailers REWE Group and is significant for the Moscow region; Lenta, through a chain of offshore companies, has the dominant shareholder of the owner of Severstal. At a minimum, the departure of one of the largest German retailers from the Moscow market indicates the difficulties of retail trade in general, since good or promising businesses are usually not sold.

The deal between Lenta and Billa is even more mysterious in terms of amount: the buyer pays 153 million rubles each. on average for each store in the rented premises. Lenta share prices also passed their peak of 274 rubles at the beginning of 2021 and are trading at 234 rubles as of May 19. The profit of Lenta for 2021 is completely accidental, like that of Magnit - 33 billion rubles, with a profit drawdown similar to Magnit in 2021 to 9 billion rubles. and straightening out profits in 2021 due to an increase in the average ticket by 12% with a decrease in traffic by 6%. But still, the merger of Lenta and Billa does not have American interests and prospects for dominance in the market.

As a result, Magnit’s purchase of Dixie turns out to be a bad story. To please American shareholders, a monster is being grown with Russian money, which is a generator of rising food prices and the resulting social tension. If the Dixie chain is not ready to reveal its “skeletons in the closet,” then why is it necessary to pay tenfold for its expansion and mistakes? Shouldn't excess retail itself answer to the notorious invisible hand of the market?

Subscribe to our channel in Yandex.Zen!

Click “Subscribe to channel” to read “Tomorrow” in the Yandex feed

Advantage when collaborating

Note.

Similar franchise offers

Note! To improve the range of semi-finished products, the chain of stores has its own processing plant.

Tander JSC processes personal data on a legal and fair basis. The legal basis for the processing of personal data is a set of legal acts, in pursuance of which and in accordance with which Tander JSC processes personal data:

Household appliances and electronics

"M Video"

M.Video is actively growing through M&A. In the spring of 2021, the retailer acquired the Eldorado chain. By that time, M.Video owned 424 stores, Eldorado - 415. In September of the same year, the deal to purchase Media Markt was completed (42 Media Markt stores will have to move under the new brand in 2021). Within three months after the purchase, 46 stores under the M.Video and Eldorado brands were opened on the site of the Media Markt hypermarkets.

In 2021, the merged company increased its network by 102

stores (87 of them were opened in the fourth quarter), including 51 M.Video stores, 46 Eldorado stores and 5 m_mobile stores.

The total number of group stores as of December 31, 2021 reached 941.

Let us remind you that in 2021 it opened 27 new stores and closed one. By the end of 2021, the chain consisted of 424 stores in 169 cities in Russia.

"Positronics"

Open in calendar year 2021 56

stores: "Positronika" full-format - 13, POINT (point of issue and online ordering) - 43. The total number of stores at the end of 2021 is 182.

Perfumes and cosmetics

Lush

In 2021, the Lush chain continued to optimize. As Varvara Afanasyeva, brand manager of Lush Russia, said, the main indicator is still the profitability of stores; the company does not seek to expand the network. A stable financial result and high-quality locations are much more important when it comes to opening new stores.

One of the pleasant events of 2021 is the opening of a store in Mega Samara. “This was the first opening of our store in the region in five years,” says Varvara Afanasyeva. “So far the store is showing good results.”

In terms of the number of stores in Lash Russia LLC’s own network, there were 43 stores in December 2021, and 44 stores in December 2021.

Fashion

Familia

Off-price chain Familia opened in 2021 48

stores, which became a record annual figure for openings for the company: in 2021 it was 46, in 2021 - 41. In total, since the beginning of 2021, the chain has more than doubled, opening 135 new stores.

In 2021, Familia expanded significantly in both the western and eastern parts of the country. In particular, the company appeared in Arkhangelsk, increased its presence in Smolensk and opened 6 stores in St. Petersburg and the Leningrad region, with the new store in Gatchina becoming the westernmost point of the chain. In the eastern part of the country, the company was actively developing the Siberian territory: it opened three new stores in Novosibirsk, and entered Barnaul, Novokuznetsk, Kemerovo, Nizhnevartovsk and Krasnoyarsk, which became the easternmost point in Familia’s geography.

In total, the company has 240 stores in 46 regions of Russia (86 cities), the total retail area exceeds 300 thousand square meters. m.

Melon Fashion Group

The group, which owns and manages the Zarina, befree and Love Republic brands, opened 34 own and 26 franchise stores in 2021, relocated 38 own stores and 11 through the franchising program. At the end of the year, the united network of Melon Fashion Group consisted of 575 stores (416 own and 159 franchised), which is 24

more than a year earlier.

The group continued to implement the network renovation project, the essence of which is to transform small, “outdated” stores into new large and designer spaces that are comfortable for customers and attractive for developers.

"Stockmann"

In 2021, the network of the Finnish brand, developing in Russia under license, consisted of 7 department stores, by December 2021 there were already eight of them - in Moscow, Kazan, Krasnodar, St. Petersburg and Yekaterinburg. Plans for the coming year include opening three more stores.

Books

"Read-city - Bukvoed"

The united retail chain “Chitay-Gorod - Bukvoed” has 577 stores. Revenue at the end of 2021 is about 24 billion rubles.

The main driver of growth is the active opening of new stores throughout the country. In 2021, a record number of 100 new stores were opened, and in 2018 - over 70.

The retailer is actively searching for suitable offers in places where the chain is not yet represented. Last year was marked by interesting discoveries in the Caucasus region, in particular in Grozny, which is showing good results.