Hello, dear readers!

Have you decided to invest your money in securities, wanting to make a profit? Then now you have to make a difficult choice. In this article I will talk about the ALROSA company and reveal whether it is worth investing in it.

ALROSA is a Russian group of diamond mining companies that occupies a leading position in Russia. This alone suggests that it is quite stable, and thanks to the reserves, investors will not be left without their payments.

But it’s still worth understanding in more detail whether it’s worth purchasing the company’s shares. ALROSA dividends – for or against?

All dividends for the last 10 years, including the next ones

| For what year | Period | Last day of purchase | Registry closing date | Size per share | Dividend yield | Closing share price | Payment date |

| 2019 | June 30, 2021 | 4 Jul 2021 | 12M 2020 | 9,54 ₽ | 8,42% | 16 Jul 2021 | |

| 2018 | 9 Jul 2020 | 13 Jul 2020 | 12M 2019 | 2,63 ₽ | 3,99% | July 27, 2020 | |

| 2018 | 10 Oct 2019 | 14 Oct 2019 | 6M 2019 | 3,84 ₽ | 5,25% | 28 Oct 2019 | |

| 2017 | 11 Jul 2019 | 15 Jul 2019 | 12M 2018 | 4,11 ₽ | 4,98% | July 29, 2019 | |

| 2017 | 11 Oct 2018 | 15 Oct 2018 | 6M 2018 | 5,93 ₽ | 5,87% | 29 Oct 2018 | |

| 2016 | 11 Jul 2018 | 14 Jul 2018 | 12M 2017 | 5,24 ₽ | 4,94% | July 27, 2018 | |

| 2015 | July 18, 2017 | July 20, 2017 | 12M 2016 | 8,93 ₽ | 9,3% | Aug 3, 2017 | |

| 2014 | 15 Jul 2016 | July 19, 2016 | 12M 2015 | 2,09 ₽ | 2,96% | 2 Aug 2016 | |

| 2013 | 13 Jul 2015 | 15 Jul 2015 | 12M 2014 | 1,47 ₽ | 2% | July 29, 2015 | |

| 2012 | 16 Jul 2014 | 18 Jul 2014 | 12M 2013 | 1,47 ₽ | 3,06% | 1 Aug 2014 | |

| 2011 | May 11, 2013 | May 11, 2013 | 12M 2012 | 1,11 ₽ | 3,52% | May 24, 2013 | |

| 2010 | May 11, 2012 | May 11, 2012 | 12M 2011 | 1,01 ₽ | 3,7% | May 25, 2012 | |

| 2010 | April 29, 2011 | April 29, 2011 | 12M 2010 | 0,25 ₽ | May 13, 2011 | ||

| 2007 | May 18, 2010 | May 18, 2010 | 12M 2009 | 0,03 ₽ | June 1, 2010 | ||

| 2006 | May 8, 2008 | May 8, 2008 | 12M 2007 | 0,41 ₽ | May 22, 2008 |

Share share by e-mail Twitter Facebook

Print Print

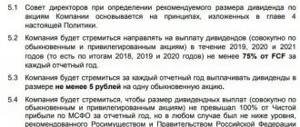

Regulations on the dividend policy of AK ALROSA (PJSC)

Dividend policy

On March 10, 2021, a new edition of the dividend policy was approved in order to clarify the methodology for determining the amount of dividend payments.

The purpose of the policy is to convey to shareholders and stakeholders the Company’s capital allocation strategy as transparently as possible.

Frequency of dividend payments – 2 times a year

Payments are made twice a year - for the 1st half of the year and for 12 months of the year, minus previously paid dividends for the 1st half of the year.

Calculation base – free cash flow

In accordance with the dividend policy, Free Cash Flow (FCF)1 is used as the basis for calculating dividends, which takes into account cash flow from operating activities after deducting the amount of investments (capital investments) in the main production.

Depending on the value of the Net Debt2/EBITDA3 ratio, the amount of semi-annual dividend payments recommended by the Supervisory Board based on the amount of FCF for the corresponding half of the reporting year may be:

- More than 100% of FCF

: if the value of the “Net Debt/EBITDA” indicator at the end of the corresponding period is less than 0.0; - From 70% to 100% of FCF

: if the value of the “Net Debt/EBITDA” indicator at the end of the relevant period corresponds to the range of 0.0-1.0 (not including 1.0); - From 50 to 70% of FCF

: if the value of the “Net Debt/EBITDA” indicator at the end of the corresponding period corresponds to the range of 1.0-1.5.

Minimum level of dividend payments

If the current and forecast value of the Net Debt/EBITDA ratio does not exceed 1.5, the amount of funds allocated for the payment of dividends for the reporting year must be at least 50% of net profit under IFRS for the year.

Notes:

1 Free cash flow (FCF) is cash flow from operating activities, determined in accordance with international standards for the preparation of consolidated financial statements (IFRS), minus cash flow used to finance capital investments (under the item “Acquisition of fixed assets” of the consolidated statement of operations cash according to IFRS standards").

2 Net debt is an indicator determined in accordance with international standards for the preparation of consolidated financial statements (IFRS) as the amount of debt liabilities minus cash and cash equivalents, as well as bank deposits at each reporting date.

3 EBITDA is the Group’s profit or loss for the previous 12 months, adjusted for income tax expense, finance income and expenses, share of net profit of joint ventures and associates, depreciation and amortization, impairment and disposal of property, plant and equipment, gain or loss on disposal of subsidiaries enterprises, revaluation of investments, one-time effects.

| Year | Period | Dividends per share, rub.1 | Declaration date | Amount of dividends, million rubles. | Dividends to net profit | Dividends to free cash flow |

| 2019 | Year2 | 2,63 | 24.06.2020 | 19 370 | — | 100% |

| H1 2019 | 3,84 | 30.09.2019 | 28 281 | — | 100% | |

| 2018 | Year | 4,11 | 26.06.2019 | 30 270 | — | 100% |

| H1 20183 | 5,93 | 30.09.2018 | 43 674 | — | 70% | |

| 2017 | Year | 5,24 | 26.06.2018 | 38 592 | 50% | 52% |

| 2016 | Year | 8,93 | 30.06.2017 | 65 769 | 50% | 59% |

| 2015 | Year | 2,09 | 30.06.2016 | 15 392 | 50% | 37% |

| 2014 | Year | 1,47 | 25.06.2015 | 10 826 | 4 | 26% |

| 2013 | Year | 1,47 | 28.06.2014 | 10 826 | 35% | 70% |

| 2012 | Year | 1,11 | 29.06.2013 | 8 175 | 24% | 68% |

| 2011 | Year | 1,01 | 30.06.2012 | 7 439 | 28% | 27% |

| 2010 | Year | 0,25 | 30.06.2011 | 1 833 | 16% | 7% |

| 2009 | Year | 0,03 | 26.06.2010 | 250 | 7% | 0,02% |

1 The indicator is adjusted taking into account the stock split carried out in 2011.

2 The amount of dividends paid based on operating results for 2019, excluding dividends paid based on operating results for the first half of 2021. The total amount of dividends paid based on the results of 2021 amounted to RUB 47,651 million.

3 Amount of dividends paid based on operating results for 2018, excluding dividends paid based on operating results for the first half of 2021. The total amount of dividends paid based on the results of 2021 amounted to RUB 73,944 million.

4 According to the Consolidated financial statements of AK ALROSA (OJSC) and its subsidiaries, prepared in accordance with IFRS, for the year ended December 31, 2014, the loss for the year amounted to RUB 16,832 million. The loss occurred due to the revaluation of liabilities denominated in US dollars. According to the accounting (financial) statements of AK ALROSA (OJSC), the Company’s net profit amounted to RUB 23,469 million. At the annual General Meeting of Shareholders of the Company, it was decided to allocate for the payment of dividends based on the results of the Company’s activities for 2014 in absolute terms at the level of the amount of funds allocated for the payment of dividends based on the results of the Company’s activities for 2013, which amounted to 46% of the net profit calculated in in accordance with Russian accounting rules.

Questions and answers

Question: Who decides on the amount of dividend payments?

Answer:

The amount of dividends paid is approved by the general meeting of shareholders of the Company on the recommendation of the Supervisory Board.

Question: How can I contact Shareholder Relations?

Answer:

E-mail Phone: + 7 495 745 5876

Question: When does the register of shareholders close?

Answer:

The closing date of the register of shareholders (the “cut-off” date) is determined by a decision of the Supervisory Board. At the same time, in accordance with Russian legislation, the “cut-off” date cannot be set earlier than 10 days from the date of announcement of the decision on the payment of dividends and later than 20 days from the date of such a decision.

Question: When can I receive dividends?

Answer:

The period for payment of dividends to a nominee holder and a trustee who is a professional participant in the securities market, who are registered in the register of shareholders, should not exceed 10 working days, and to other persons registered in the register of shareholders - 25 working days from the date on which persons entitled to receiving dividends.

Question: Are dividend payments subject to taxes?

Answer: In accordance with Russian legislation, dividend payments are taxed. The tax rate on dividend payments for legal entities - owners of shares who are residents of the Russian Federation is 13%, for non-residents of the Russian Federation - 15%, for individuals - 13% and 15%, respectively.

The page was last updated on September 27, 2013 at 10.59

What dividends will be paid in 2021?

According to forecasts, ALROSA will pay interim dividends in the amount of 4.211 and 5.31 rubles. respectively. In connection with the revision of the dividend policy and its editing, ALROSA intends to allocate up to 100% of free cash flow to pay them (taking into account the restoration of the mine, the percentage of deductions to investors may decrease to 70%).

The growth potential is estimated to be 15–20% of the current value. The price per share today is 88.9 rubles, and dividends are 4.11 and 5.31 rubles.

Dividend policy

In 2021, ALROSA’s dividend payment system was revised (the calculation methodology was clarified). On June 24, 2019, the updated Regulations on Dividend Policy were adopted. Payments are made 2 times a year. The amount is approved at a meeting of shareholders in accordance with the recommendations of the Supervisory Board (it also sets the dividend cut-off date).

Payment terms:

- availability of net profit and/or retained earnings according to RAS;

- current and projected ratio of net debt to EBITDA up to 1.5;

- no legal restrictions.

The basis for calculating ALROSA dividends is free cash flow (FCF). The flow from ALROSA's operating activities is taken into account without taking into account investments in creating a production base. Depending on the ratio of net debt and EBITDA, the following is distributed among shareholders:

- > 100% SDP – < 0.0;

- 100% SDP – 0.0–0.5;

- 70–100 % – 0,5 1,0;

- 50–70 % – 1,0–1,5.

How to buy shares and receive dividends

You can purchase ALROSA shares in several ways:

- with the help of Russian brokers;

- banks that act as a broker;

- directly from the issuer, as well as from other shareholders.

In all cases, the tax on dividends and sales will be 13%.

Best brokers

Choosing a reliable broker is a very important point for any trader. Below is a rating of the best.

Reliable Russian brokers

| Name | Rating | pros | Minuses |

| Finam | 8/10 | The most reliable | Commissions |

| Opening | 7/10 | Low commissions | Imposing services |

| BKS | 7/10 | The most technologically advanced | Imposing services |

| Kit-Finance | 6.5/10 | Low commissions | Outdated software and user interface |

A Caution About Forex and Binary Options

Forex and BO have nothing to do with the stock market, shares and dividends. Don't fall for scammers' tricks! Forex is an unregulated currency market that typically trades CFDs, but by purchasing this contract you will not become a shareholder of ALROSA. BO is an ordinary casino under the guise of the stock market, here it is worth understanding that the casino never loses, and therefore you are guaranteed to remain in the red.

When will dividends be paid in 2019?

ALROSA dividends for the second half of 2018 will be paid no later than July 26 (10 business days from the cut-off date) to professional participants in the securities market (brokers, trustees) and no later than August 16 (25 business days from the date of closure of the register) to individual shareholders .

The cut-off for dividends for the first half of 2021 is October 15. Persons who purchased shares on July 12 and October 12, respectively, have the right to receive payments (trading is conducted in T+2 mode).

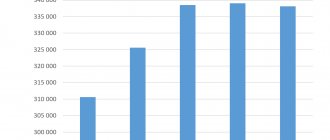

Alrosa's dividend history

Alrosa has been paying dividends consistently since 2009. At the same time, the amount of payments mainly increases. As such, there is no stable growth - rather, there are jumps, and at the end of this year, even a decline (due to the fact that overall diamond prices fell + Alrosa had difficulties, but more on that later).

And here is another interesting article: Which shares to choose: preferred or ordinary?

Alrosa strives to increase dividends both in absolute terms and as a percentage of cash flow. If you look at the dividend history from the company's website, this is clearly visible.

Stock return

ALROSA aims to increase dividends in absolute terms and as a percentage of free cash flow. Over the past 3 years, dividend yield has been slowly growing (2016 – 9.3%, 2021 – 10.81%, 2021 – 11.67%). Previously, the annual yield did not exceed 3.06%.

In absolute terms, payments are also growing. For 2021 – 38.5 billion rubles, for 2021 – 73.9 billion rubles. (almost double growth). Based on the results of 2019, success may not be repeated. This is due to the fall in prices for rough diamonds and a serious accident at the Mir mine (providing 11% of revenue).

ALROSA is not among the top companies in terms of dividend yield. Analysts rank it as one of the most undervalued mining companies around the world. Nevertheless, the following factors indicate that the dividend level will be maintained:

- stable demand for products abroad;

- growth in net profit, EBITDA and free cash flow;

- the debt to EBITDA ratio is one of the lowest in the industry (0.4 according to IFRS for 2018);

- resumption of operation of the MIR mine in 2021 and restoration of sales volumes of rough and polished diamonds;

- repayment of short-term debt of $300 million and restructuring of a similar amount.

How and when to buy Alrosa shares for dividends

Alrosa shares are traded on the Moscow Exchange under the ticker ALRS, but are sold not individually, but in lots. One lot contains 10 Alrosa shares. Thus, to purchase Alrosa you need to have at least 846.7 rubles in your brokerage account (excluding purchase commissions).

You can buy shares of the company through any Russian broker, for example, Tinkoff. The algorithm is simple:

- open an account (you can do it online) – it takes 1-2 days;

- replenish your account using the details through any online bank;

- download the program or use the web terminal for trading;

- find Alrosa using the ticker ALRS, select the required amount of lotto to purchase and click “Buy”.

And here’s another interesting article: Central Telegraph and its dividends of 37.5% per annum: is it worth buying shares

The dividend cut-off is set for July 15. Taking into account the T+2 trading mode and weekends, the last day for purchasing with dividends is July 11.

Consider the tax. 13% will be withheld from dividends received, i.e. in fact, not 4.11 rubles will come to your account, but only 3.5757 rubles. Well, or 35,757 rubles per lot.