Acceptance is the response of one of the parties involved in the transaction about acceptance of the offer. In other words, this is acceptance of all the terms of the contract or a means of guaranteeing settlement of payment documents.

Quite often, acceptance is positioned as one of the methods of payment for work performed, services provided or goods provided. The acceptance philosophy assumes that when the mandatory payments become due, the payer will make payment in accordance with all payment documents.

Description of acceptance in simple words

You agree to enter into any agreement and do not change its terms, but accept everything as is. You write a letter about your consent. It will be called acceptance. If you have been issued an invoice and you agree to pay it in full and on time, you write “accepted” and sign or stamp it. This inscription is also called acceptance.

Meanwhile, acceptance cannot be considered as a guarantor of receipt of monetary debt by the borrower upon first demand. To resolve this issue, the recipient of the funds must first fulfill its obligations, which are specified in the adjacent cooperation agreement.

The peculiarities of acceptance are that the return of the agreed amount of money occurs in non-cash form. In this case, a certain amount is debited from the payer’s account in favor of the recipient.

All operations must be carried out through the cash settlement center of the financial organization.

What is a bill of exchange and why is it needed?

A bill of exchange or draft is a debt paper that, unlike a regular bill, changes the payee.

A bill of exchange is used to borrow funds with their subsequent collection. This securities (security) can be used in various trade transactions, both domestic and international. In this case, any person, including the drawee, can act as a remitee.

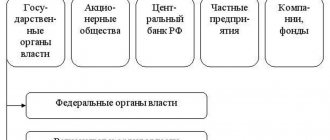

A transferable bill of exchange debt Central Bank simplifies the process of modern trade, because in its essence it is also a valid payment instrument on a par with cash. At the same time, information about the circulation of promissory notes and bills of exchange can be obtained from the relevant Russian law (No. 48).

Acceptance of bill

Subject to acceptance of bills of exchange, such a procedure is possible only if the bill is transferable. At the same time, the inscription left on the bill does not carry any legal value or semantic load, which is due to the condition that the rights to receive the debt during the entire valid period of the bill will belong to one person.

Acceptance gives the payer’s full consent to all terms of cooperation specified in the contract. It must be complete and unconditional. If the parties do not agree on any nuances or if there are additional conditions of the partnership, a new offer must be drawn up, where all the metamorphoses being implemented will be spelled out. When signing all the papers, you should be aware that the conclusion of an agreement is possible only if the person sending the offer, in turn, receives its acceptance.

A request for the provision of a service can be considered as an acceptance of an offer, provided that a separate credit institution offers one of its banking products and all the terms of the partnership are agreed upon at the initial stage.

Basic Concepts

To understand what the term “accepted bill of exchange” means, it is necessary to consider first of all the types of this security. There are two main ones: simple and transferable. The first option will not be able to carry acceptance initially. This is because in this case the drawer and the payer are one person.

And when a bill of exchange is created, it contains an offer (or order) to make a settlement on it. It is organized by the drawer and addressed to another person, who will have to become the payer.

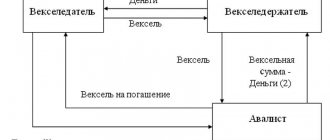

If in a promissory note two persons are necessarily recorded: the drawer and the holder of the bill, then in a bill of exchange a third person is added to it. The acceptor of a bill is the party who gives his obligation to pay it. It is he who is called upon to become the payer, having previously given a guarantee to make payment on the paper.

It is worth noting that the acceptor has no bill of exchange obligations to the drawer. He undertakes to pay for the paper for other reasons that lie in a different business area. Accordingly, acceptance is the consent of a person to pay a bill of exchange within the specified period.

This procedure should not be confused with collection, when the bank gives an obligation to present the paper on time for payment to the drawer if its location is inconvenient for the drawer. Although there are some similarities, it also differs from the operation in which a bill is valued. An aval is a confirmation by a person (usually a bank) to pay a bill of exchange, provided that the drawer himself will not be able to pay it within the established period. That is, in this case it is assumed that after payment the drawer will be obliged to repay the debt to the avalist. This is not assumed upon acceptance.

Payment by a third party of a bill of exchange constitutes acceptance

There are two mandatory rules for drawing up an acceptance:

- Its legal force takes place only on a security that is issued in compliance with all prescribed rules.

- Acceptance of a bill of exchange can be executed only after the payment document itself has been created, but not earlier.

The rules provide that there may be partial or full acceptance. This means that in the first case, the party undertakes to pay the amount of the bill only partially. If the specified acceptance takes place, then it must be certified by a protest.

Definition

The concept of “acceptance” is familiar to everyone who works in the field of economics, law and finance.

The word comes from Latin and literally means “acceptance.” We are talking about full acceptance of all proposals put forward by the opposite party to the contractual process.

Acceptance is the approval of all conditions put forward during the conclusion of the contract by the other party to the contractual process.

If we are talking about the financial environment, then the bank issues a guarantee to the client to carry out all kinds of manipulations with documents. Please note: acceptance strictly applies to all positions specified in the contract and proposals being implemented, but not to any individual part of them.

Reasons for use

It is difficult to quickly obtain a loan from a bank to increase working capital: the credit institution needs time to consider the application; the amount requested by the client is not interesting to the bank or a deposit is required. With bill settlements, enterprises can provide each other with a commercial loan, eliminating the hassle with bankers.

You issue a document for the amount you need and agree on a payment period. For the remittor, such settlements for the transaction are more reliable than installment payment, since the bill is an unconditional monetary obligation.

Results

So, acceptance is a positive response from a citizen or company to whom a commercial offer is made. In some cases, it means agreement to enter into a contract, in others it means to purchase goods or services, and sometimes it means approval of a settlement. To give acceptance, you must first receive an offer.

Special rules and deadlines are established for acceptance. If they are violated, the contract is considered unconcluded.

In everyday life, we often come across offer and acceptance. This happens when making purchases, when ordering air tickets and many other everyday situations. However, in colloquial speech these terms are practically not used. These are more legal concepts, which, nevertheless, are useful to know for people far from jurisprudence.

Video for dessert: Squirrel knocked on the window every day

In accounting

All invoices that have already been accepted, agreed upon and must be paid are recorded by the accounting department in account 60. For example, the supplier provided the goods and, of course, issued an invoice in written or electronic form. He has 5 days to issue an invoice.

The buyer can place the acceptance directly on a paper document or send it to the supplier via email. In this case, the terms of payment do not depend on the period of transfer of acceptance. They are agreed upon earlier in the supply contract and specified in the terms of the transaction. Acceptance simply becomes a guarantee that the buyer has no complaints and intends to transfer the money within the agreed period.

What details should a bill of exchange contain?

To be recognized as a legitimate, valid bill of exchange, the specified Central Bank must have the following information:

- name (the name of the Central Bank must indicate “bill of exchange”);

- data on the existence of a direct instruction to pay the applicant (the one who presents the Central Bank) a certain amount of money (besides this data, it is not necessary to indicate the history of the debt);

- the name or name of the remittor, that is, the person who first received the right to demand repayment of the debt;

- the period within which the monetary debt must be repaid;

- the place where the transfer of money will be made from the debtor to the holder of the draft for the satisfaction of debt obligations;

- name of the person who must pay the debt amount;

- place and calendar date of drawing up the document, as well as the signature of the drawer.

This is interesting! Initially, the rules for issuing bills of exchange were regulated by the Geneva Uniform Bill of Exchange Law, which is a set of rules that was compiled specifically to simplify the regulation of the circulation of debt obligations without the constant circulation of banknotes.

Endorsement

An endorsement is an endorsement on the reverse side of a bill. An endorsement records the transfer of the right to claim under a bill of exchange from one person to another. Typically the endorsement is in the form “Pay to the order of...” or “Pay to the benefit of...”.

When endorsing, the full name of the person in whose favor the bill is transferred is indicated. Such a person is called an endorser

, and the person transferring the bill is

an endorser

.

The endorsement must be simple and unconditional.

Transfer of part of the amount of the bill, that is, partial endorsement, is not allowed.

The endorsement must be personally signed by the endorser, and if the endorser is a legal entity, a seal is required next to the signature of the first person.

The endorsement must be dated.

The endorser is responsible for acceptance and payment of the bill of exchange and payment of the promissory note. However, he can also relieve himself of responsibility for acceptance and payment if he makes the clause “without recourse to me.” In this case, he is excluded from the chain of persons obligated under the bill. Obviously, such a clause will significantly reduce the liquidity of the bill. The holder of the bill may exclude the possibility of further endorsement of the bill by including the words “not to order” in the text of the bill. In this case, the bill can only be transferred by assignment.

Types of endorsements

- The personal endorsement

contains the name of the endorser, signature and seal of the endorser. Such an endorsement records the transfer of ownership of the bill from one person to another. - A blank endorsement

differs from a registered endorsement in that it does not contain the name of the endorsee, and in fact, a bill with such an endorsement is bearer. The endorser has the opportunity to independently enter the name of the new bill holder or transfer the bill without making any further entries. A blank endorsement becomes personal after the name of the bill holder is entered into the text of the endorsement, usually this is done when the payment deadline arrives. - A collection endorsement

is an endorsement in favor of a bank, authorizing the latter to receive payment of a bill. Such an endorsement has the form “for collection” and gives the bank the right to present the bill for acceptance or payment, and in case of non-acceptance or non-payment - for protest. Typically, bank collection operations are formalized in a separate agreement and paid for by the client. Further endorsements on such a bill can only be of a guarantee nature, that is, not giving ownership rights to the bill. - Collateral endorsement

is done when the holder of the bill transfers the bill to the lender as collateral for the loan issued. Typically, such a bill is accompanied by the clause “currency as collateral” or another equivalent phrase. A collateral endorsement does not give ownership of the bill to the endorser. Moreover, all further endorsements, as in the case of collection, can only be of a guarantee nature. Endorsement may be made at any time after the instrument is made, even after the due date, and it will have the same effect as if it had been made before the due date. However, an endorsement made after the bill of exchange has been protested cannot be considered an endorsement and has the force of assignment. Accordingly, in such a case, the endorser cannot be held liable for payment of the bill. The date of the endorsement is of great importance, since an undated endorsement is automatically considered to have been completed before the protest, unless otherwise proven.

Table 1. Types of endorsements.

| Endorsement Nominal | What does the endorsement “pay to the order...” indicate, the signature of the endorser | Details of the endorser Name of the endorser | Rights of the endorser All rights of the owner (presentation for payment, further endorsement, and so on) |

| Blank | One signature of the endorser on the form of the bill is enough | Details are not specified | Can make an endorsement (by putting his or any other name) on the personal endorsement form or use the bill as a bearer security |

| Preferential | “for collection”, “for pledge” or any other order indicating who is entrusted with this or that action, the signature of the endorser | The name of the endorser is indicated | Receives rights by order (for example, to receive a bill of exchange), which can be transferred to another only by way of reassignment |

Where and when is acceptance used these days?

Now acceptance is used in banking payments, lending, and business. The rules for concluding public contracts in online trading also require issuing offers and receiving acceptances. Let us consider the conditions for the use of acceptance in various fields of activity.

Acceptance in lending

Bank acceptance, or loan acceptance, is the conclusion of a loan agreement. The bank transfers funds to the borrower on the terms previously determined between the parties. How does this happen in practice?

You applied for a loan by filling out a form on the bank's website. You indicated the required amount and loan term, indicated your monthly income, and selected additional options in the form of insurance or bank cards.

The bank regards such actions as your desire to enter into a loan agreement. After the system processes the questionnaire, a bank employee will call you and inform you about the offer that has been created for you - an offer to sign a loan agreement under certain conditions or about the bank’s unwillingness to lend to you. Next, you will be invited to the branch to sign a loan agreement. By signing a loan, you accept the bank's offer to provide a loan.