What is risk hedging in simple terms? What tools, methods and strategies are there?

Trading on the stock exchange is always a certain risk, but a professional can make this risk predictable and manageable. An investor has plenty of reasons to worry about the constant fluctuation in the value of acquired assets, but this worry can be combated.

The word "hedging" comes from the English hedge and means "insurance" or "guarantee"

In other words, hedging is an attempt to insure against risks when, by purchasing a certain asset, an investor tries to compensate for a change in the price of another.

Also, for example, there is regular property insurance - an insurance policy is purchased for a certain cost, which makes it possible to receive payments if something negative happens to the insured property.

During stock trading, hedging transactions are situations when transactions are opened on opposite market positions in order to compensate for possible losses

Hedging must document the price of the asset. In this case, the investor will be forced to incur small additional expenses in order to insure himself against large losses due to fluctuations in the price of an exchange asset in a negative direction for him.

Hedging instruments allow you to reduce the likelihood of losing funds during exchange trading.

What is hedging in simple words

Hedging transactions in the language of financiers means taking measures aimed at insuring risks that may arise as a result of an undesirable scenario. In this way, conditions are created for the acquisition or sale of assets (goods) in the future, according to a previously agreed upon scheme.

Hedging, in simple terms, is actions aimed at eliminating risks arising from random fluctuations in the price of any asset. The term comes from the English hedging (to limit, to fence).

There are different options to reduce risk. For example, in the foreign exchange market, you can open multidirectional positions on instruments with a high direct correlation and unidirectional ones if there is a reverse correlation. Even locking tactics in Forex can be considered a subtype of hedging. This technique is also used for actual deliveries of goods. In this case, risks are reduced through futures contracts and options. With proper experience, you can not only reduce the risk, but also get additional benefits.

As for the history of this tactic, it originated several centuries ago. Then this technique was used to safely purchase goods in the future.

Essentially, in those days, hedging was the purchase of a commodity in the future at a predetermined price ( this is how the futures contract was invented

). Due to this, the parties regulated risks, and both the buyer and the seller knew the potential loss in advance.

The technique has proven its usefulness, has evolved and is now used everywhere. The hedging participant does not acquire the assets themselves, but the opportunity to sell (purchase) them. The result will be a guaranteed trade leading to a profit or an unfavorable outcome, after which he receives less income from the possible one.

Example 3 - purchasing a Call contract

When it is necessary to insure a trading position against a decrease in asset prices, a trader can sell securities and at the same time purchase a call option. In a situation where stock prices fall, the trader will purchase them on the spot market at a lower cost. Naturally, the option contract will not be implemented.

In a situation where the value of the asset rises and exceeds the strike price of the option, the trader will exercise it. In this scenario, he receives securities at the price fixed in the option. Thus, with the help of hedging, you can neutralize the risks associated with a fall in stock prices.

How does hedging work?

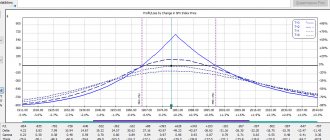

The principle of hedging can be examined using a specific example. Let's start with classic trading - let's assume a long position on EURUSD is open, but there is no confidence in the growth of the chart.

To hedge risks, a pair with high correlation is selected. For example

, USDCHF has a high inverse correlation, that is, the charts move in mirror image relative to each other. To eliminate risks on long positions opened on EURUSD (the dollar is expected to weaken), you need to open a long position on USDCHF (profit will accumulate when the dollar strengthens).

Most likely, one of the transactions will be closed with a loss manually or with a stop, but the profit on the remaining one will cover it. Hedging transactions in this way greatly reduces profits; it is used in cases where the trader is not sure of the forecast, but does not want to miss the entry point.

Now an example closer to reality. An American farmer grows wheat; he plans the harvest to be at 25000

bushels and wants to insure himself in case of an unfavorable decrease in the value of the goods. This scheme uses a futures contract.

In the spring, the farmer sells 5 futures, each for delivery 5000

bushels of wheat. The price of grain at the September futures expiration is $5.0 per bushel. The cost of the entire crop under these conditions is estimated at $125,000.

Let's assume that by fall the price drops to $4.50 per bushel:

- The farmer sells the crop at the current price and receives not $125,000 for his crop, but only $112,500;

- At the same time, an open position is liquidated on the exchange by purchasing 5 counter futures, but at a price of $4.5 per bushel. This operation gives a profit of $12,500 - losses due to the reduction in the cost of grain are compensated.

This scheme also has a downside, with the cost of grain rising to $6.0 per bushel:

- Selling wheat at market price in the fall yields a profit of $150,000;

- On the stock exchange, you need to liquidate the position opened in the spring. Having to buy futures at a price of $6.0 per bushel, as a result of liquidating the spring position, the farmer loses $25,000.

At first glance, hedging turned out to be unprofitable - in the example, the farmer could have taken the risk and received an additional $25,000 if he had not engaged in risk reduction in the spring. But this impression is false.

Due to hedging, the farmer fixed a convenient price for grain in the spring. He reduced to zero the risks associated with the weather factor, market oversaturation, and falling demand.

Risk management is critical in business. The farmer loses potential profit under favorable circumstances, but what is more important is that he ceases to depend on external factors.

What assets can be hedged?

There are no restrictions here. You can reduce risks when working with any type of asset:

- An investor with a planning horizon of several years can hedge short-term risks using futures and options. In this case, the assets are shares of various companies;

- In the real production sector, this tactic is used to insure against an unwanted change in the price of a product or raw material. An asset can be anything from a soybean crop to complex custom-made industrial equipment;

- Money itself can also act as a hedged asset. In this case, you need insurance in case of unfavorable changes in exchange rates. This technique is used by enterprises working with foreign counterparties.

The goal is always the same, but different ways to achieve it are used.

Timely hedging of risks allows you to minimize losses when purchasing/selling a product that will be purchased/sold in the near future. Applies to any underlying asset, may be:

- Credit rate, mainly in cases with the registration of credit goods.

- In cash in case of transactions on the foreign exchange market.

- Property or consumer goods. Most often, hedging applies to transactions with export/import goods, the price of which may change due to floating exchange rates.

- Agricultural products, when insuring the prices of the future harvest.

- Precious papers.

- Energy sources: oil, gas, electricity.

- Construction and tourism sector, if it is impossible to predict the demand for the product being sold (tour packages, real estate).

Methods for hedging risks

Experience shows that there are many ways on the market to maximize risk management. The choice of method depends on the purposes for which it will be used. Example

: if it is necessary to insure investments in shares of Russian enterprises for a long period (several years), it is recommended to use a full hedging method, in the form of an open currency deposit in foreign currency.

There are several options for classifying hedging methods. So, according to technology they distinguish:

- Long hedge

– a buy transaction is concluded to insure a previously opened short position; - A short hedge

is a mirror situation; by selling a futures contract, the price of one’s products is protected (example with the farmer and wheat above).

Depending on the risk reduction strategy used, there are:

- Classic hedging

is a standard strategy for insuring yourself in case of an unfavorable change in the price of an asset. The example above falls into this category; - Anticipating

. The same purchase of a deliverable futures contract, for example, for sugar, is an example of the implementation of this strategy. Delivery of goods may occur, for example, in the fall, but the buyer fixes the price at the time of purchasing the futures contract; he buys it in advance. The uncertainty factor and associated risks are eliminated 100%, the product is guaranteed to be purchased at a price that suits the buyer. The same scheme works in the opposite direction, when you need to sell the product in advance at a price that suits the seller; - Hedging by direction

. If an investor has a long-term portfolio, then during a crisis you can dilute it with short positions in weak companies (you can use futures and options). Profit on short positions compensates for the drawdown in the value of the underlying shares of the portfolio; - Cross

. This hedging strategy takes advantage of the correlation between assets. For example, long positions are open in shares of a number of Russian blue chips; to reduce risks, you can work with the RTS index. This index is a barometer of the entire stock market of the Russian Federation; if the value of blue chips begins to decline, then the RTS will also fall; - Pure

– insurance is carried out by working with the same asset; - Partial

. The volume of positions is not fully hedged. The volume of hedging transactions differs up or down. - Full

– hedging transactions completely cover the volume of the hedged ones. - Hedging with options

.

If we classify strategies by expiration dates (typical for futures and options), we can distinguish the following types:

- Tape hedge

– a series of futures/options are purchased (for the entire volume of the insured asset or for part of it) with different expiration dates and then they are redeemed sequentially; - A hedge without one

is a mirror scheme, since all hedging contracts have the same expiration date; - Rolling Tape

– Here hedging with futures is done sequentially. The insurance period is divided into equal time periods and contracts with a short expiration are purchased. Due to this, the liquidity risk that arises when working with contracts with long-term expiration is minimized; - Continuous hedge

. The insured asset is divided into parts, the insurance period is set for each, and futures or options with different expirations are purchased with this in mind.

Each of the strategies used can reduce risks. You will have to pay for this by reducing the profitability of hedged transactions. There is no way to simultaneously reduce risk and maintain profitability at the same level.

Full and partial hedging

Full hedging means that the entire value of an asset is insured. It is more convenient to consider this scheme using an example

.

$1 million worth of medical equipment from Europe in the spring.

. Delivery of goods is planned not now, but in 4 months. The buyer does not plan to freeze $1 million by transferring it to the seller's account; the money will be transferred immediately before shipping the goods.

At the time the agreement was concluded, the EURUSD exchange rate was 1.1000. To insure against unwanted changes in the exchange rate, the buyer will use full hedging of the entire amount (€1 million). To do this, open a long position on the EURUSD currency pair at the rate of 1.1000 on the foreign exchange market.

The supply of currency under a hedging transaction is not provided; virtually it looks like buying €1 million for dollars at an exchange rate of 1.1000. This costs $1.1 million, the work is carried out with leverage, so in reality a smaller amount is needed.

In this example, the following options are possible:

:

- The rate drops to 1.0500. The buyer buys euros from the bank at this rate, gives $1.05 million and transfers them to the seller. Due to favorable changes in the exchange rate, a profit of $50,000 is formed. Also, a position on the foreign exchange market is liquidated, the delivery of currencies through it is not provided, so €1 million is virtually sold and they manage to earn $1.05 million for it, resulting in a loss of $50,000;

- The rate rises to 1.1500. When paying for the goods, the buyer already spends $1.15 million; compared to the exchange rate when concluding the contract, a loss of $50,000 is formed. Liquidating a position in the foreign exchange market gives a profit of $50,000, and the buyer breaks even.

This is how complete hedging of currency risks works.

With partial hedging in this scheme, the buyer would not hedge the entire value of the product, but part of it, for example, 50%. At the same time, he consciously takes risks, but controls them.

If insurance was carried out for 50% of the cost of the goods, then under the same starting conditions, if the EURUSD rate fell to 1.0500, a profit of $25,000 would be obtained. If the rate rose to 1.1500, a loss of $25,000 would result.

Pure and cross hedging

The hedging strategy in the classical or pure way is to protect while simultaneously opening several opposing positions. It applies to assets and the derivatives market. This method guarantees the complete safety of capital in the event of downward fluctuations.

Cross hedging refers to the protection of an underlying package that is different from the futures contract. The peculiarity of the method is the high risk and the presence of an indicator, the achievement of which increases the likelihood of failure.

Example

: The seller sells gold and at the same time buys an option on the opposite product, such as oil.

When cross-hedging, 2 assets with a high direct or inverse correlation are used; the higher it is, the lower the probability of receiving a loss on both positions. Futures for an instrument that has a high correlation with the hedged asset act as a hedging instrument.

Example

:

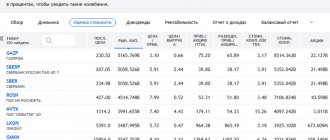

Shares of blue chips Russian companies were purchased. You need to insure against a fall in their value.

The RTS Index is an ideal tool for hedging an entire portfolio of shares; there is no need to select a separate asset to insure the value of company shares. The correlation is high, this index is a barometer of the Russian stock market. To hedge the risk, RTS futures are sold. Due to this, it was possible to go through without losses, for example, a strong drop associated with the pandemic and the collapse of oil prices.

As for pure hedging, work is carried out with the same instrument. For example, purchases of Gazprom shares can be hedged by selling the corresponding futures. If futures contracts for the selected instrument are not available, you will have to either proceed to locking or use a cross-hedge scheme.

Example 4 - selling a Put contract

Let's assume that a trader likes the current market price of ALROSA shares, but does not have the necessary amount to purchase the required quantity. At the same time, he will have such funds in the near future. In order not to miss the attractive price of securities, the trader performs a hedging operation by selling put options.

Such a strategy allows you to effectively insure potential investment risks.

Thus, we can conclude that the option hedging operation is an effective risk countermeasure that an investor can always counteract market uncertainty.

Call option example

Disposition. The American company will purchase equipment from its German partner in four months. For this you will need 10,000,000 euros. At the moment, the euro to dollar exchange rate is 1.1100.

Possible options for the development of the situation:

- No use of hedging. At the time of the transaction, the company simply purchases the required amount of euros. If during this time the rate increases by only 1% (it becomes 1.1200), then the company will already incur losses in the amount of (1.12-1.11) x 10,000,000 = $100,000.

- Using option hedging. To do this, the company is already entering into a call option contract to buy the euro. The cost of the premium, let’s say, is $5,000. If during these four months the value of the euro increases, the company will purchase the euro at the old price based on the contract. Instead of 100,000, the loss will be only $5,000. If the rate falls, then it will be enough to refuse to exercise the option and purchase funds under more favorable conditions.

Example of a put option

Disposition. In four months, the American company will sell the equipment to its German partner and earn 10,000,000 euros from this transaction. At the moment, the euro to dollar exchange rate is 1.1200.

Possible development of the situation:

- No use of hedging. In this case, the company will carry out a transaction in four months and receive 10,000,000 euros, after which it becomes necessary to convert them into dollars. During this time, the rate fell to 1.1100 (by only 1%). Having made an exchange at the new price, the company will incur losses in the amount of (1.11-1.12) x 10,000,000 = $100,000.

- Using option hedging. In this case, the company is already purchasing a “put” for conversion in the euro-dollar direction in four months. To do this you will need to pay a premium. Let's say the cost of the premium was $5,000. After three months, the equipment is sold and if, as in the previous option, the rate drops to 1.1100, then the conversion transaction will still be executed at the old price. Thus, the loss instead of $100,000 will be only $5,000. Moreover, if the exchange rate rises during this time, the company will simply refuse the deal and sell the euro under more favorable conditions.

In this example, you can see the mechanics of put options. The cost of the option itself is an order of magnitude lower than possible losses even with the slightest price fluctuation (by only one percent).