Definition

The Consumer Price Index (CPI) or the Western analogue of the Consumer Price Index (CPI) is an indicator that shows by what percentage the cost of the consumer basket for an average family has changed over a certain period of time (month or year).

For a better understanding, we need to look at one more concept – “consumer basket”. This is the minimum set of products and services that a person needs to maintain normal life. In Russia it includes 156 items. For comparison, in the USA – 300, Germany – 475, UK – 350.

The basket contains 3 categories of goods and services:

- Food;

- non-food products (shoes, clothing, medicines, household appliances, etc.) – 50% of the cost of food;

- services (housing and communal services, transport, cultural and entertainment events, medicine, etc.) – 50% of the cost of food.

According to the law of 2012, the structure of the basket must be reviewed once every 5 years. However, since 2013 it remains unchanged. This will remain the case until the beginning of 2021. I think that I will not be discovering America if I say that in 7 years a lot has changed in the consumption of Russians. Therefore, the relevance of grocery and non-grocery sets is increasingly being questioned by many experts. But for now we have what we have.

For example, doctors do not like the existing list of products and its structure. According to the standards that they calculated for a rational and healthy diet, a Russian should consume 30 kg less bread and bakery products, and 10 kg less potatoes. But we must eat much more than the norms established by law: fruits, vegetables, meat, and fish.

In addition to dividing into 3 categories of goods and services, the basket has a different structure for the working population, pensioners and children. For example, pensioners should consume less than the working population of all types of products. And children should eat almost 2 times more fruit (118 kg compared to 60 kg for adults) and 70 kg more dairy products.

Complete information about current strategies that have already brought millions of passive income to investors

For the purposes of our article, the cost of the basket is of interest. It is calculated for each region by territorial state statistics bodies based on the minimum retail prices for a particular product or service. Then data from all regions is collected into a single database, and the Federal State Statistics Service (Gosstat) calculates the average cost of the consumer basket.

Its growth and decline will precisely reflect the CPI. For example, in September 2021 the index was 104% compared to September 2021. It turns out that the cost of the consumer basket increased by 4% over the year. And, for example, in September 2021, compared to August of the same year, the index was 99.8%, i.e. the cost of the set decreased.

It is clear that in one region the prices and cost of the basket will be one, and in another region it will be different. When calculating the composite index for the entire country, average consumer prices for products and services are taken into account.

Current CPI values can be viewed on the official website of Rosstat. It is more convenient for me to take this data in a table from the regulatory portal “ConsultantPlus”. This is what the CPI looks like in 2021 by month. Values above 100% mean growth, below – a decrease in the cost of the consumer basket.

Calculation formula

In addition to the CPI, the State Statistics Service calculates another indicator - the basic CPI. It differs from the main one in the absence of certain items of goods and services, primarily those that are subject to the influence of seasonality and regulation by the authorities. For example, the basic indicator does not include:

- from food products - bottled milk, potatoes and a number of other vegetables, some types of citrus fruits and fruits, vodka;

- from non-food products - gasoline, coal, firewood, diesel fuel;

- Services include travel on public transport, plane (economy class) and train, communication services, utilities.

The basic indicator is calculated to determine the dynamics of price changes without the influence of seasonal factors and centralized regulation.

A traditional question from a person far from statistics and the economy as a whole: “Why does the government record such low inflation at the end of the year, while prices in stores rise significantly higher over the year?”

First, government inflation takes into account more than just grocery items. And the prices of goods in a nearby supermarket are not yet an indicator of inflation in the country. Secondly, some products and services increase in price, while others may become cheaper (especially seasonal ones). Thirdly, every Russian has personal inflation. And if you eat products that are far from those that are included in the set of the average Russian, and do not use some services at all or use them more often, then your inflation will be different.

Your personal indicator will be as close as possible to the statistical average in one case - when your consumption corresponds to the structure of the consumer basket used to calculate the CPI.

The official index is the average temperature in the hospital. There is a personal inflation calculator on the State Statistics Service website (video instructions for filling it out there). To use it you must register. It may well turn out that your inflation will be several times higher than the official one.

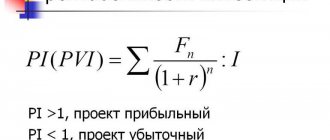

The formula for calculating the CPI is the ratio of the cost of the consumer basket in the current period to its cost in the base period, multiplied by 100%. The following are used as a base:

previous month of the current year;

the same month of the previous year;

December of the previous year.

Since the composition of the basket does not change for several years, the percentage of the index will show how much more or less a Russian spends on purchasing the minimum set. When the government announces at the end of the year that inflation in the country was 4.5%, this means that the index was 104.5%. There is a situation and vice versa, when the index shows a mark below 100%. This situation is called deflation.

Definition of the concept

The consumer price index is one of the important indicators that are used in assessing the domestic economy of a country . Carrying out such an analysis makes it possible to determine the dynamics of growth or decline in the cost of goods included in the basket of the average consumer. Each country uses its own calculation methodology, which is developed by government agencies. In the United States of America, the economic instrument in question is called the “Consumer Price Index”. This indicator is used to reflect the current level of inflation.

Using the CPI provides information about the real level of inflation. This circumstance is explained by the fact that the cost of goods included in the consumer basket depends on whether a particular country is a manufacturer of these products. It is important to consider that in most cases the dynamics of wage growth lags behind the rate of inflation.

An increase in the cost of goods from the consumer basket leads to an actual decrease in the solvency of citizens.

The consumer price index is an economic indicator calculated by Rosstat . The indicator for the previous year is used as the basis for calculations. In addition, when making calculations, the total amount of inflation is taken into account . It is important to note that the CPI is a dynamic value that changes along with rising inflation and the cost of goods from the consumer basket. In European countries, when calculating this economic indicator, the income of citizens is not taken into account. Failure to use this indicator when making calculations leads to contradictory results. In this case, analysts cannot make forecasts regarding changes in the cost of essential goods. In addition, it does not take into account the fact that the average consumer’s basket may include new goods that are currently not on the market.

Today, when making calculations, various methods are used. Financial analysts talk about the high effectiveness of using the Fisher index, which involves combining the cost of essential goods. It is important to note that the use of this method is advisable only when making calculations in the medium term.

Consumer Price Index (CPI) reflects changes in the value of a market or consumer basket over a certain period, taking into account the relative weight of the components included in it

Impact of the CPI on inflation

The consumer price growth index reflects the dynamics of the cost of living of citizens, so it is indispensable when calculating inflation.

Other advantages of the CPI relative to other financial indicators:

- Simple index calculation methodology;

- Monthly construction;

- Timely and accessible publications.

If the index grows, it means that the cost of the consumer basket increases relative to the base value. An index that has reached 100% or more indicates inflation in the country, and as a result, a tightening of monetary policy.

A drop in prices relative to last year indicates deflation, which poses a separate danger for the country’s economy. The Central Bank immediately reacts to this phenomenon by lowering interest rates.

Types of price indices

Price indices are usually distinguished according to the basic objects for calculation.

These basic objects include:

- industrial price index;

- agricultural price index;

- transport tariff index;

- foreign trade index;

- capital investment index;

- consumer price index and deflator indices.

The industrial price index shows the price level of goods and services purchased by industrial enterprises for their production and technical purposes. Such industrial enterprises can be: factories, construction organizations and others.

The agricultural price index shows the dynamics of changes in food prices. transport tariff index consists of prices for cargo transportation and transit payments. These include: transit of gas, oil and other resources.

The foreign trade price index indicates the dynamics of prices for export-import goods. The price of goods produced for own consumption is not taken into account when calculating this index. Thus, if a certain company produces the same product both for export and for the domestic market, then to calculate the index of foreign trade relations, the price indicator is taken into account only exclusively for that part of the product that was exported abroad.

The deflator index shows the fluctuations of one macroeconomic indicator, for example, the national accounts indicator, in the reporting period in relation to the base one.

Producer price indices indicate price fluctuations in a particular economic sector. Unlike the industrial price index, which tracks the dynamics of company expenses, the producer index shows the dynamics of profits received as a result of the sale of manufactured goods and services.

It is in the interests of each state to form a certain set of goods and services that are necessary to sufficiently ensure a minimum standard of living. It's called the consumer basket. An index showing fluctuations in the price of the consumer basket is the consumer price index. The consumer price index is an index indicator of the price of a typical market basket of national and foreign consumer goods and services purchased on the domestic market of the state. When calculating it, the cost of a basket of goods and services of a fixed composition in the current and base periods is compared.

Each of the price indices is taken into account when tracking fluctuations in prices and tariffs on the market, studying its conditions, to calculate the standard of living and the impact of price changes on it. Also, all indices are taken into account when analyzing the macroenvironment and are the basis for calculating various indicators of the system of national accounts. Among them are gross external product (GDP), gross domestic product (GNP), national income and others. Each of these indicators is used to select and adjust macroeconomic policies for the entire country. The inflation index is taken mainly from two price indices: the consumer price index (CPI) and the GDP price index, that is, the GDP deflator (Defl).

Purpose of the indicator

The CPI is used in determining inflation. Another indicator is involved in this process – the GDP deflator. It includes all goods and services that were produced in Russia during the reporting period and in one way or another affected GDP. Unlike the CPI, the deflator takes into account only domestic products produced in the Russian Federation.

Using the price index, the state monitors changes in the cost of living of citizens, makes decisions on increasing social benefits, and indexing the salaries of public sector employees. The Central Bank studies the dynamics and decides to increase or decrease the key rate. And this, in turn, leads to changes in interest rates on loans and deposits.

Investors also monitor changes in the CPI, trying to build a forecast of inflation, the exchange rate of the national currency and predict the actions of the Central Bank to regulate monetary policy. If we continue to talk about investments, then information about changes in consumer prices will help predict the situation regarding the cost of bonds.

Benefits of Price Stability

To contents

Price stability is the Central Bank maintaining stable and low inflation. At the same time, there is a slight increase in prices, which does not affect the consumer’s refusal to purchase the product. This is the goal of states linked by trade and political relations.

Low growth makes it possible to plan large-scale development programs, and banks can provide loans to production for long periods at reduced rates. It becomes possible to develop capital-intensive areas and increase social spending. Experts consider the most optimal growth of the Russian CPI to be about 4% per year, this is justified by the calculations of the Central Bank and is supported by the state. A reduction to 2% will increase economic costs, reduce enterprise profits, and lead to job losses.

What does the PPI show?

It is not a direct indicator of inflation (unlike the CPI), but its growth may be its precursor. After all, increased selling prices will lead to an increase in the cost of manufactured products and manufacturers will try to shift these costs onto the shoulders of their end consumers (that is, you and me).

Thus, the producer price index can be called an early indicator of inflation.

But, on the other hand, an increase in the PPI does not always mean that the consumer price index will increase and the inflation rate will rise. There are three main reasons for this:

- An increase in prices for raw materials, materials or components can be compensated by the manufacturer by reducing any other cost items;

- In the event that a manufacturer nevertheless increases selling prices for its products, this will not necessarily lead to an increase in retail prices for them. Retail chains can also compensate for this increase in price by reducing their other expenses;

- An increase in the producer price index does not necessarily lead to an increase in the consumer price index for the simple reason that they are calculated based on different sets of goods. The PPI includes price dynamics for industrial goods, and the CPI for a certain basket of consumer goods, and in addition also includes services.

The difference between the PPI and the consumer price index

The PPI measures changes in prices from the point of view of the seller and this is its fundamental difference from a similar indicator called the consumer price index (CPI) and reflects changes in prices from the point of view of buyers (end consumers of goods and services). In other words, this index tracks changes in production costs.

Another difference is that the PPI takes into account only the prices of goods (and only at the wholesale level), while the consumer price index includes both prices of goods and prices of services.

Negative consequences of high inflation

To contents

As already mentioned, the Central Bank of the Russian Federation, using various tools, maintains the inflation rate at an optimal level. Both the complete lack of growth and irregular surges are unprofitable for the state and citizens. The powers of the Central Bank are limited to influencing monetary factors, since the agency cannot directly influence production, international economic changes, or mass sales of shock goods.

Inflation is the key to business activity and production growth. But when it is high and unpredictable, entrepreneurs cannot make long-term forecasts. They spend what they earn as quickly as possible, investing it not in development, but in foreign currency, real estate, and valuables. Without long-term investments, the development of science and technology is impossible. Some projects require decades of research and development, and capital protection for the entire period.

In conditions of high inflation, citizens find themselves unprotected, lose their savings, the standard of living is constantly declining, as a result, GDP is falling, unemployment is rising, and the crime rate is rising. Stabilization, even with effective government work, takes years.

By what principle is CPI calculated in the USA?

In English-speaking countries, the consumer price index is abbreviated CPI. The American Bureau of Labor Statistics calculates the CPI every month and publishes the results. The first count was carried out in 1913 - more than a century ago. The index is based on the average of 1982-1984. The base value is 100. Thus, a number of 100 indicates zero inflation since 1984, while a value of 150 or 200 indicates an increase in inflation of 50% and 100%, respectively. The mentioned inflation rate is considered to be the change in the index compared to the previous time period.

Although the CPI measures fluctuations in the cost of many items paid by consumers, certain categories of spending are not taken into account. This includes investments, savings, and so on. Financial expenses of foreign nationals are generally excluded. To form the index, a consumer basket is used, containing 8 main types of household expenses:

- Food;

- Health care;

- Cloth;

- Rest;

- Housing;

- Telecommunications services and education;

- Transport;

- Other services and goods.

Features of the consumer basket in Russia

The complete list of necessary goods and services included in the consumer basket is approved by Federal Law. It is formed as a list of goods and services typical of a typical consumer in a certain period. Consists of 156 points.

The list of goods and services in the consumer basket must change once every five years. In Russia, the current list of goods and services was approved in 2013. The next adjustment is planned for December 2021. This is due to the economic problems of 2014.

The basket includes 3 categories of goods and services: food, services and non-food products.

- The majority of the consumer basket consists of food products. Prices for this category change very often and depend on many factors: seasonality, weather conditions, demand.

- The list includes those goods and services that are regulated by administrations at various levels. Prices for some goods directly depend on excise tax rates.

- The basket includes imported goods and services. The cost depends on the exchange rate.

In addition, an individual basket structure is determined for different categories of citizens: the working-age population, children and pensioners. For example, a children's basket contains 2 times more fruit and dairy products. And the pensioner’s basket is 2 times less compared to the basket of working citizens.

The filling of the food basket and the cost of each item is directly related to the determination of the minimum wage.

What's wrong with inflation

A shortcoming of the CPI that many economists often point out is its measurement of the “average hospital temperature.” The main subject of controversy is the composition of the consumer basket. For the poor it will be one thing, and for the wealthy it will be another. For low-income citizens, the share of the food component inevitably increases, which can reach ¾ of the basket. Wealthier people spend less than half of their expenses on food.

I also recommend reading:

What is ROE and how is it calculated

ROE - return on capital: why should an investor know this?

This affects the public's perception of official statistics. It is no coincidence that the concept of “personal inflation” appeared. It just so happens that in Russia it usually exceeds the official one. For example, the CPI December 2021 to December 2021 was published with a value of 102.51%. It is unlikely that any of the readers felt that their consumer basket grew by 2.51% over the year. Of course, one can object to this that citizens give only everyday assessments based on sensations. But I think that in such cases a personal calculator works more accurately than an official one.

The second point is related to the cost of living, which, according to Rosstat’s methodology, actually reflects the threshold of human survival. Let's look at the latest data from Rosstat:

In developed countries, this indicator is measured to determine a “decent standard of living.” From this point of view, the index should include, in addition to the basic set, visits to restaurants, beauty salons, keeping pets, spending on taxis, tutors, etc. That is, factors without which it is impossible to imagine the life of a modern person.

There is another flaw in the CPI index: it does not take into account asset prices. And this doesn't just apply to investors who will buy more or less shares with spare cash. The cost of real estate, securities, and credit resources make significant adjustments to the consumer behavior of the entire population. Thus, increasing loan rates reduces consumer demand, and rising housing prices make rent more expensive. Therefore, the CPI should not be looked at in isolation from other important indicators - stock market indices, the key rate, the level of housing prices (the American analogue is HPI, Housing Price Index).

Features of the Russian consumer basket

In Russia, as in countries with emerging markets in general, a characteristic feature of the consumer basket is a fairly high share of food products in it (36.5% in 2014). Their prices are quite variable. To a large extent, fluctuations in inflation in the food market are determined by changes in supply volumes, primarily the crop yield in our country and in the world, which significantly depends on weather conditions. Since the share of food products in the consumer basket is high, fluctuations in their prices can have a significant impact on inflation as a whole.

Another feature of the Russian consumer basket used to calculate the CPI is the presence of goods and services in it, the prices and tariffs of which are subject to administrative influence. Thus, the state regulates tariffs for a number of public utility services, passenger transport, communications, and some others. In addition, prices for tobacco products and alcoholic beverages significantly depend on excise tax rates.

Consumer demand is satisfied through goods and services of both domestic and foreign origin. There are no statistical data on the share of imports in the CPI, but the share of imports in the structure of retail trade commodity resources can give an idea of it in terms of goods (in recent years - about 44%). The significant share of merchandise imports in the consumer basket determines the significant impact of changes in the ruble exchange rate on inflation.

Index calculation

The calculation is carried out based on current prices of industrial goods related to their prices in the base period. First, the change in price is calculated for each individual component of the index:

PPIi—change in price for individual i-th industrial product;

Ct is the price of the i-industrial product in the current period of time;

CB is the price of the i-industrial good in the base period.

Then its value itself is calculated:

n – the number of industrial goods included in the index;

Zi is the specific weight of each product that makes up the index.

In Russia, the calculation of the index is carried out by the Federal State Statistics Service (Rosstat). It is published monthly on the official Internet resource of the department https://www.gks.ru/bgd/free/B00_24/IssWWW.exe/Stg/d000/I000870R.HTM. Moreover, the current index is calculated based on the index of the previous month.

Methods for calculating the price index

The methods and methods used to calculate the price index are the same for each type of index.

When calculating price indices, the actual index and the average price index are obtained. The actual index indicates the absolute deviation of the price level, while the average price index includes the share of each product in a representative sample, adjusting both the price level and its structure.

Price indices are usually divided into two types:

- individual price index;

- group price index.

The individual price index includes exclusively the price dynamics for one specific type of product.

The group price index includes fluctuations in the prices of all goods in the sample, and is calculated as the sum of prices of the current reporting period in relation to the sum of prices of the base period.

To calculate the price index in economics, it is customary to use the following methods:

- Paasche index;

- Laspeyres index;

- Fisher index.

The Laspereys price index indicates how the prices of goods or services sold in the base period fluctuated. In other words, when calculating the index, the cost of a product or service sold in the previous reporting period is compared, but in prices of the current period and in relation to a similar quantity of products, only in prices of the previous period.

The Paasche price index shows how the prices of goods or services sold in the current period have changed, compared with the prices of the base period, by the quantity of products sold in the same period.

It is worth mentioning that, in the Russian Federation, since the beginning of 1991, the Laspeyres price index has been used to calculate price indices. Because the Paasche index does not include the decline in demand for specific goods during periods of economic crisis and inflation. Because of this, its use becomes impractical.

The Paasche index also somewhat underestimates the level of inflation, since it does not take into account assortment fluctuations in the reporting period in relation to the base one. The Laspeyres index, on the contrary, overestimates the level of inflation, because it does not take into account the effect of substituting expensive products with similar cheap products. To level out this conflict, it is proposed to use the Fisher index. This index is calculated as the geometric mean of the Laspeyres and Paasche indices. However, calculating the Fisher index is a rather labor-intensive process. Because of this characteristic, in economic practice this index is calculated very rarely.

We briefly looked at what a price index is, its definition and calculation methods. Leave your comments or additions to the material.

MHIF inflation targets

The Federal Reserve Bank and the MHIF's voting members generally believe that a moderate amount of inflation is a good thing because it indicates a steadily growing economy. And so, they usually set and publicize a rough target for the inflation rate in the US economy that they are aiming for.

Inflation targets of two percent per annum appear to be fairly common among central banks in major developed countries, although this figure is subject to change.

In the case of the United States, the MHIF notes in its September 2021 rate statement: “The panel notes that inflation of 2 percent (as measured by the annual change in the price index for personal consumption expenditures, or PCE) is the most consistent over the long term with the target law mandated by the Federal Reserve System."

If the FOMC announces any decision to change its inflation target, such a change will typically be accompanied by a shift in the value of the US dollar relative to other currencies, especially if the change is not entirely expected, it will be a "big surprise" for currency traders and economists .

For example, if the MHIF raises its inflation target, it will tend to lower the value of the US dollar because real interest rates are likely to rise, while a reduction in the MHIF's inflation target will tend to make the US dollar rise because real interest rates will most likely be reduced.

Typical Reactions of Forex Traders

When forex traders see a strong US CPI reading - with the word 'strong' - it means that the result of the monthly percentage change in the CPI was higher than expected and this 'strength' will be seen as a sign of monetary policy tightening and therefore more high US dollar levels in the future.

As a result of a strong CPI number, market participants will push the US dollar higher in various crosses, and forex traders will typically buy the US dollar against other countries' currencies as an initial reaction to the high CPI number.

Conversely, when currency traders see a weak CPI number released that is the bottom of market expectations, they will be inclined to look at this as possible expectations of higher benchmark interest rates and a lower value of the US dollar in the future. This result will cause the value of the US dollar to fall in the forex currency market and traders will sell the US dollar.

CPI values that come out more or less in line with market expectations have little impact on the foreign exchange market for the US dollar, since the level of the observed result is already factored into the exchange rate of the US dollar against other currencies.

Online price index calculator

To calculate the aggregate price index and consumer price index, we provide a simple form of an online calculator, using which you can independently calculate these indicators and fill out the table. To obtain correct results from the online calculator during data entry, you must carefully observe the dimensions of the fields , which will allow you to perform the necessary calculations quickly and accurately. Fractional values must be entered with a PERIOD, not a comma! The presented form of the online calculator already contains data from a conditional example so that the user can see how the online calculation of the consumer price index works. To calculate these indicators based on your data, simply enter them into the appropriate fields of the online calculator form and click the “Run calculation” button.

Online calculator:

Messengers:

Or send the terms of assignments for evaluation

Remember page Calculation of price index: examples, formulas, online calculator

Examples of using CPI

The CPI is a common economic indicator. It allows you to set the level of currency depreciation and the economic efficiency of the government. Thanks to the CPI calculation, politicians, ordinary citizens and business participants are able to track changes in value. Some index indicators can be used to measure retail sales, weekly or hourly profits, and purchasing power. The index is used to change the level of the cost of living and give citizens the right to receive government assistance.

According to statistics, the cost of living of more than 50 million people has been revised. Provisions for federal employees, military personnel and retirees are directly linked to the consumer price index.

Why is an index needed and where is it used?

The CPI is the most used measure of inflation and government performance. It gives an idea of changes in the economy and serves as the basis for decision-making by both authorities, producers, and consumers.

When drawing up a business plan, the consumer price indicator is often used to forecast business cash flows, pricing and sales planning.

The Consumer Price Index can also be used to determine the types and amounts of government assistance to the population, including social security and subsidies. The CPI is one of the main macro indicators of economic growth of any country.