What are junk bonds?

Junk bonds (also known as junk bonds or “junk bonds” in English) were called that only because they were issued by issuers with a low financial rating. This level, according to the international credit rating scale, is Ba / BB or even lower. To simplify the definition, we can assume that if debt obligations are issued by a company with a level of confidence below investment level, then its bonds can be classified as “junk”.

But why do people buy these securities and make money from them? It's very simple - high interest rates on coupons to attract risky buyers. A large percentage of profit provides opportunities for risk (although considered in most cases).

A Brief History of Junk Bonds

This kind of securities began to be issued back in the early 70s by little-known companies that needed money to develop their business. Organizations of this kind did not necessarily do bad business, were unprofitable, or were in a pre-bankruptcy state. They were poorly known in the market, their reputation was unstable, but they needed money. So we had to lure investors with hopes of high profits.

The pioneer was Michael Milken, who calculated the risk of ownership and realized that the possible profits outweighed the risk of issuer default in most cases.

Traditional bonds were much safer but offered lower returns. Therefore, in order to replenish the investment portfolio, attract new investors with a good annual report and profit growth, banks and companies decided to invest part of the money in risky assets with high profit expectations.

The investment boom will continue in 2021: current stock market trends

4960

Svetlana Kryukova

Among the advantages of “physicists” as investors, Bobovnikov noted that they are not bound by regulatory restrictions. They don't have capital regulations like banks do. And there are no requirements for issuer ratings, like non-state pension funds, insurance companies and other financial institutions.

“That is, this investor base is loyal and, one might say, omnivorous,” he described. — If investors make money on bonds, then they believe the organizer and are likely to purchase the next issues. But this places great responsibility on the organizer.”

“The risk appetite is huge. Any SME (small and medium-sized enterprise - Ed.) company can enter the market if it is smart and adequate. “Everything can get its price,” Denis Zibarev confirmed the loyalty of VDO buyers.

But individual investors, of course, are not ideal. They just have different kinds of restrictions. Thus, the volumes of loans that can be sold to them are small. Andrei Bobovnikov estimated the upper threshold at 1.5–2 billion rubles. In order to sell larger issues, it is necessary to attract institutional investors.

At Septem Capital Investment Company, investors in VDOs are conventionally divided into two categories. The first is beginners. “They came from deposits, they don’t want to understand the market. The main thing for them is to buy something so that the profitability is higher,” Denis Zibarev describes them. - Such people, of course, need to be limited in their actions. The amounts at their disposal are small, the portfolios are very wonderful. And most importantly, they do not focus on credit quality. And in the SME sector, each issuer is unique and distinctive. And often it does not have any ratings. Here you need to make an effort, dive deep, and study the reporting yourself. The second category is the so-called activists. These are people who consciously came to the VDO market. They try to read everything about issuers - especially in telegram channels. They learn quickly. The amounts in their accounts amount to millions of rubles.”

Activist investors are active not only on the stock exchange. In April 2021, they created the NGO Bond Owners Association, which declares its goal as “representing and protecting the interests of private investors in bonds in the Russian Federation.”

Issuers of junk bonds

Among them are the following types of companies:

- Start-up organizations that need money but have little or no credit history.

- Former market leaders experiencing financial difficulties.

- Companies on the verge of bankruptcy.

- Organizations that urgently need money, but cannot get a loan from a bank.

As can be seen from the list, junk bonds are mainly issued by companies experiencing difficulties with available funds.

About default in simple words

Default, in a broad sense, is the inability to fulfill one’s obligations.

Default on bonds is the issuer’s refusal of its obligations or delay in their obligations for a period of more than 10 days.

The issuer's obligations include:

- coupon payments;

- redemption of bonds at par;

- repayment by offer.

If one of them is violated, then the securities are assigned default status. But not at once. And after 10 days.

How to calculate the feasibility of purchasing these bonds

You need to start by studying the market segment where the issuer operates. The general state of affairs and development prospects are assessed. If the sector itself is unprofitable or experiencing difficulties, then the difficult position of the company in the crisis segment suggests that the money may not be seen.

If the sector is developing, then you need to analyze the activities of a specific company. What are the reasons for issuing junk bonds, what does the issuer expect after receiving the money, evaluate the investment program, and whether it can solve the assigned tasks.

It is also worth correlating the risks and the likely profit, what place these securities will occupy in the investment portfolio, what kind of loss they will cause in the event of a default by the issuer.

Experts recommend holding no more than 5% of the total share of all investments in junk bonds.

Dominant class

Most often, high-yield bonds are issued by small and medium-sized companies. On the Moscow Exchange, such securities are classified as the Growth Sector or the IIR Sector (increased investment risk). As Dmitry Taskin, development director of the Growth Sector, said, in this sector individuals occupy 62% of the investor structure, and in the PIR Sector - 69%. For comparison: in the “Main Market” section, where most bonds are traded, the share of individuals is only 7%. Banks dominate there.

The number of private investors on the Moscow Exchange more than doubled last year, reaching 8 million. And in 4 months of 2021 it rose another 33%, to 11.7 million people. However, the number of active investors making at least one transaction per month does not yet exceed 2 million. And less than 1% of them play a significant role in the VDO market.

Denis Zibarev, managing director of Septem Capital Investment Company, shared statistics: according to his data, in the VDO market, approximately 6% of individual investors own 94% of assets. Now the company has more than 10 thousand clients, most of them are focused on investing in bonds. It turns out that among Septem Capital’s clients, the lion’s share of VDO’s assets is concentrated in the hands of several hundred investors.

Similar figures were given to IBC by Andrey Bobovnikov, director of issuer relations at Ivolga Capital Investment Company. The company is organizing the placement of VDOs, and the share of private investors among the buyers of these issues is approaching 100%. Ivolga Capital is focused on working with investors who have sufficiently large resources. According to Bobovnikov, there are not many of them - 300-500 people, and this allows you to communicate with them individually. “You can talk to each of them, understand his investment profile, make sure that he understands that VDO is never a deposit with a higher rate, and does not invest his last money in them,” explained a company representative. He does not sell VDO to everyone, but only to those whose risk profile he considers suitable for such investments.

Large brokers have hundreds of thousands or even millions of investors. But the share of investors in VDO among them is usually small (for the reasons, see the commentary of FINAM Investment Company on page 13). None of the top brokers focuses on high-yield investments. Therefore, we can assume that among them, high-risk lovers make up narrow groups of several hundred, maximum 1–2 thousand people.

The investment boom will continue in 2021: current trends in the stock market Investments

How to buy

There are many junk securities listed on the exchange and over-the-counter markets. But purchasing on the over-the-counter market promises many surprises in the form of illiquidity and inflated prices. When trading on the stock exchange through a broker, you can see quotes and the volume of traded obligations, which is not the case when purchasing outside of stock exchanges.

Where to find information on current issues

- First of all, in brokers' trading terminals, where this information is updated in real time.

- On the website of the exchange that sells these junk papers.

- Specialized websites of news agencies Reuters, Bloomberg, and in Russia RBC and Interfax will help.

Best brokers

The most convenient way to trade is through brokers.

Reliable Russian brokers

| Name | Rating | pros | Minuses |

| Finam | 8/10 | The most reliable | Commissions |

| Opening | 7/10 | Low commissions | Imposing services |

| BKS | 7/10 | The most technologically advanced | Imposing services |

| Kit-Finance | 6.5/10 | Low commissions | Outdated software and user interface |

Is it worth investing in Otkritie securities after the nationalization of the Central Bank?

Bonds of FC Otkritie showed a sharp increase last night after the official announcement of the Central Bank about the beginning of the bank's reorganization. Shares of the financial corporation also jumped 3%. Despite the strong reaction, there is still an opportunity to make money from this story.

The Central Bank will receive at least 75% of the capital of the credit institution, and accordingly will become the guarantor of all Otkritie’s obligations. Regulator guarantees are the most convincing sign of the reliability of debt securities for creditors.

“Starting today, the Bank of Russia is the main financial sponsor of Otkritie Bank... probably, a stronger and more reliable investor in the nature of the economy does not yet exist,” said First Deputy Chairman of the Central Bank Dmitry Tulin.

Using the example of FC Otkrytie as an example, the regulator will “test out” a new mechanism for reorganizing banks, when the role of reorganizer is not another bank, but the Central Bank itself, represented by the Banking Sector Consolidation Fund, the creation of which has been prepared for the last six months. Based on the results of the work of the temporary administration, the regulator will receive from 75% to 100% of the bank’s capital, depending on the current value of the organization’s equity capital.

Bond reaction

Market participants yesterday immediately reacted to the emergence of a new “Megainvestor”. The yield to maturity of FC Otkritie Bank bonds rapidly decreased from pre-default levels to 11%-14% per annum. However, the potential for growth in the value of a number of securities still remains.

The issue of bonds of the bank OtkrFKB-B07 currently offers a yield to put at the level of 13.99% per annum. The duration of this issue is 313 days, that is, approximately corresponds to the expected recovery period announced by the Central Bank. This yield generally corresponds to the value of a similar indicator for private banks whose securities are listed on the stock exchange. Thus, the securities of Binbank and MKB offer yields from 12.5% to 15% for a similar holding period.

The only difference is that the controlling stake in the bank is now in the hands of the state, and bond issues of state banks of the appropriate length offer significantly lower yields in the range of 8.5% -10.5% per annum.

The regulator, as the legal successor of the former shareholders, undertakes to fulfill the bank’s obligations to all creditors and will not apply a mechanism for converting creditors’ funds into capital. I see no reason not to trust the Central Bank. Therefore, in the coming weeks we can expect a gradual increase in the price of the bank’s bonds. And fixing about 12%-13% with low risk now is a good decision.

The bank's bonds maturing in two years, OtkrFKB-BO-P03, already offer a lower yield of 11.7% per annum, the potential for its reduction also looks attractive. In addition, this issue is exempt from personal income tax.

However, not all of the bank's debt securities have such bright prospects. The strongest decline in the run-up to the reorganization was demonstrated by subordinated issues of Eurobonds . Thus, NMOSRM Eurobonds maturing in 2021 were trading at 45% of par yesterday morning. After the Central Bank announced its financial recovery, the price of these securities doubled.

Subordinated Eurobond NMOSRM-19

However, the deputy chairman of the Central Bank, Tulin, at a press conference dedicated to the bank’s reorganization, said that if capital decreases below threshold values, Otkritie’s subordinated bonds, the volume of which is estimated at $1 billion, may be written off. State registration of bonds NMOSRM-19 was in 2012, before the law was adopted on the forced conversion of “sub-bonds” into bank capital when it falls below threshold values.

However, there have already been precedents for writing off subordinated loans registered before the amendments to the law, so these issues of the bank’s Eurobonds cannot be called reliable. And a decrease in capital below the threshold values is a very likely development of events against the backdrop of a powerful outflow of deposits over the past month.

Another example of a high yield to maturity is parent bonds. These securities should not be confused with the bonds of the bank itself. The OtkrHOL-5 bond with a put option in 242 days offers a yield to maturity of around 67% per annum. And this is not surprising, given that yesterday the company practically lost its main asset. The Central Bank said nothing about guarantees for the obligations of the holding itself.

I will add that Otkritie Broker, shortly before the reorganization, became a 100% subsidiary of the bank FC Otkritie, so its obligations are also now guaranteed by the Central Bank, clients can rest assured.

Stock reaction

The bank's shares rose by 3% yesterday amid the Central Bank's entry into the organization's capital. However, I don’t see any special opportunities for making money here. Until today, approximately 66% of the bank's capital belonged to the parent. According to the Cbonds group , the bank's free-float was about 11%. ownership scheme was quite confusing, and there is no point in understanding it now.

According to Tulin, at least 75% of the shares of FC Otkritie will go to the Central Bank, and the former owners, represented by Otkritie Holding, will have no more than 25%, and possibly even “0”, if the interim administration comes to the conclusion that capital is lost.

This raises a simple question: where will the Central Bank get even 75% if the former majority shareholder had only 66%? In recent weeks, quite strange transactions in bank shares have taken place on the stock exchange; daily turnover reached 17 billion rubles, which practically corresponds to the entire free-float. Accordingly, we can assume that there are significantly less than 11% of shares in free float, and liquidity will soon be difficult to find there.

In addition, if you evaluate the bank by its multipliers, it simply looks expensive. The P/B value is 1.06, even despite the recent drop in quotes, this suggests a slight discount to Sberbank, which in turn has crazy profitability. At the same time, most domestic banks are trading significantly below capital. The P/E multiplier has cosmic values, due to the fact that the bank has obvious problems with generating profit.

Therefore, we are taking a closer look at the bonds of FC Otkritie. We are waiting for developments with the former mother. The bank's shares, in turn, are not of interest to investors at the moment.

Gaivoronsky Sergey

BKS Express

The best papers for today

In the Russian junk bond sector, it is worth paying attention to:

- bonds from the Agency for Housing Mortgage Lending AHML-26-ob, their yield is 15.3% per annum;

- Binbank-10-1-bob, yield - 13.7%;

- bonds issued by "RSG-FinB7" from the Kortros Group of Companies, yield - 12%;

- Obuvrus LLC region. BO-01, yield - 12.06%;

- "Russian Railways" OJSC 32 regions, profitability - 36.87%;

- APRI Fly Planning JSC BO-P01, yield - 16.11%.

The higher the yield, the higher the risks usually are, but in the case of Russian Railways' junk debt obligations, the risk of default and failure to fulfill obligations is minimal.

The civilized way

However, no matter what status a particular investor has, he, just like everyone else, is subject to the fear of losing money and is overwhelmed by the desire to earn more. So brokers sometimes have to act as psychotherapists.

“You need to be in constant contact with investors. That's why we publish news about issuers and do interviews with them. We are trying to ensure that there is no information vacuum,” said Andrei Bobovnikov.

“VDOs are often misunderstood by private investors,” says Dmitry Alexandrov, Deputy General Director of UNIVER Capital Investment Company. — Under no circumstances should you compare VDO not only with deposits, but also with first-tier bonds. It is rather an instrument of direct participation in business in the form of providing debt - a great opportunity for interested individuals, which was opened several years ago by the Central Bank of the Russian Federation and the Moscow Exchange, to directly give money to small and medium-sized businesses through a strictly regulated instrument. Previously, this could be done privately, through an acquaintance or through an advertisement in a newspaper, with all the attendant risks. This is a giant step towards civilized interaction between investors and small businesses.

For small businesses, a return of 25% per annum is considered excellent. But for the sake of it, people work seven days a week and are at risk of administrative pressure. Anyone who bought a small business VDO can count on a return of 12–15% per annum. And this difference of 10–13% is a payment for the free time that the investor has after studying reports, news and industry analytics, and the absence of administrative risks. He only risks money, and even then not all of it, because if there is a threat of default, he can still have time to sell the paper for part of the face value.”

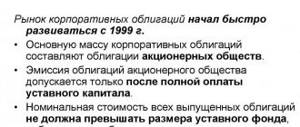

Which bonds are considered high yield and why?

High-yield bonds (hereinafter referred to as HYBs for brevity) are debt securities whose profit is above average. Their credit rating is usually below investment grade (Non Investment Grade). On the scale, it is equal to or less than BB+ for S&P and Fitch, Ba1 for Moody's.

There is no general criterion by which bonds can be considered high-yield. For example, all Russian issuers that are not classified as “blue chips” and do not have government support are classified by foreign investors as “junk”.

Junk bonds carry high risks of default, so their issuers have to attract investment at the expense of increased premiums. It can exceed the key rate by several percentage points and even many times. The more acutely the issuer needs money, the higher the yield of its bonds. VDOs are issued most often in cases where a company cannot take out a loan from a bank, which would cost it much less. This is a signal, because the bank’s analysts have already done the work for the investor and issued a negative decision on the stability and prospects of the business. There are exceptions to this rule when the company experiences temporary operational difficulties. But in order to understand all the parameters of a particular placement, you need skills in analyzing the issuer based on its multiples.

Global demand for VDO is growing in times of low rates from leading central banks - the Fed, the ECB, the Bank of Japan. During such periods, it is difficult to make money on bonds with near-zero rates. Therefore, the demand for riskier assets is growing. Now that the Fed is raising rates, liquidity is flowing from emerging markets to the United States. Thus, American Treasuries (UST) are becoming a more attractive alternative for investors. As a result, the popularity of VDOs in the stock market is falling, and the demand for protective USTs is growing.

Among government securities, the first place in terms of profitability are bonds of countries experiencing financial difficulties. Greek Treasuries reached yields of 25% during the 2010–2012 debt crisis. Now they have “calmed down” and give a little less than 5.5% for the 25-year issue. For comparison, government bonds of Germany and Japan yield no more than 1% for a period of 30–40 years. The most profitable to date are debt bonds of Argentina, which is experiencing a financial crisis (28.5% for 4-year securities).

Technical default

Before an issuer declares default or bankruptcy, a technical default is first assigned. It occurs the next day after the delay in payment of coupons or redemption of bonds. The company is given 10 days to resolve the financial difficulties that have arisen and pay off creditors.

Usually, companies of their own free will try not to bring the matter to default. They are aware of the difficulties that have arisen in advance and by the time of payments they are planning with all their might to find free cash flows to pay investors.

Failure to fulfill its obligations on time can cost the company dearly in the future. With the subsequent new issue of debt securities, it will have to raise money at a higher interest rate. Investors, other things being equal, will not want to have in their portfolio securities of companies that have defaulted on previous issues. Therefore, in order to motivate them to buy, it will be necessary to offer a higher income than for similar securities of other “pure” companies.

The second factor is the decline in the issuer's reputation as a stable operating enterprise.

Debut issue of secured bonds from Uniservice Capital

The Uniservice Capital company placed its debut issue of secured bonds in the amount of RUB 90 million.

with a maturity date of 8 years. The collateral for the debt was a commercial building in the center of Novosibirsk, the rental income from which is planned to be used to pay coupons. The coupon on the bonds is paid monthly at a rate of 8.8% per annum. The securities are available for trading on the Moscow Exchange, in which qualified investors can participate. Apart from classical securitization, no one has ever offered such financial instruments before. This is the first experience that may open up a new format in the bond market. For investors, it means higher guarantees of return of funds, and for the issuer - a lower funding rate.

History of junk bonds

The junk bond market really developed in the 1970s, when the famous US financier Michael Milken conducted an analytical study on unrated bonds. He proved that a diversified, long-term portfolio of low-grade bonds can produce greater dividends over the long term, despite a high probability of default, than a comparable portfolio of high-grade bonds. In addition, the yield of securities is cyclical; in the event of a decline in the market for reliable securities, junk bonds may receive a serious rise.

Inflation exceeded the Central Bank's forecasts. Transition to strict monetary policy

The Bank of Russia is implementing an inflation targeting policy.

This means that with the help of the key rate the regulator is trying to maintain a stable level of inflation. The target is an annual inflation rate of 4%. When inflation decreases, the Central Bank reduces the rate, when it rises, it increases it. Since the beginning of the year, inflation in Russia has been growing rapidly. According to the Central Bank, the peak in inflation should have occurred at the end of February - beginning of March and should have been no more than 5.5%. However, inflation already reached 5.8% by mid-March.

At a meeting on March 19, the Bank of Russia raised the key rate from 4.25% to 4.5% and announced the possibility of further tightening. This opportunity was successfully implemented on April 23, when the rate was increased by another 0.5 percentage points. up to 5%. Its further growth is expected on the horizon of the year.

A rise in the key rate means that bond yields will rise. Issuers will have to offer higher yields in the future to attract investors. At the same time, now borrowers in the high-yield segment can still count on comfortable conditions, since there are not many fixed-income instruments that can provide income above inflation, and demand from investors still remains high.