The key difference between bonds and shares lies in the mechanism of their issuance and, as a consequence, in the nature of profitability.

These factors influence fluctuations in market value and also allow the assets to be properly valued.

Consider in more detail the principle of operation of securities, their differences, similarities and the general taxation procedure.

A share is a particle in the share of an enterprise

The difference between shares and bonds is that the former represent a certain share in the authorized capital of a joint-stock company. They give the investor a percentage of the company's profits, proportional to the number of shares. For example, a certain company produces cars. The number of shares that are available in the share capital is 10 thousand. The investor purchased 10 on the stock market. The company's annual profit amounted to 10 million rubles (multiple figures are taken for ease of calculation). Consequently, one share gives the right to dividends in the amount of (10 million/10 thousand) 100 thousand rubles. The total profit for the investor was 1 million rubles. (10 shares x 100 thousand rubles).

Bonds are debt obligations that are guaranteed by a company through the exchange on which they are listed. In fact, they are no different from promissory notes that one person might write to another when borrowing money. However, the fundamental difference is that bonds can only be bought or sold through the intermediary of stock brokers. This gives additional guarantee to investors and gives the debt obligations the status of securities.

What is the difference between stocks and bonds for the buyer (investor)

The main differences between these securities for the investor are as follows:

- A share presupposes ownership of a share of the authorized capital. The more of these securities an investor has, the more influential he is in making decisions in the company.

- Income from shares depends on stock market fluctuations, speculators, company development, etc. Their rate is different every day, and it is impossible to predict how much they will cost tomorrow or in a month. Bonds are a certain fixed income that the investor knows in advance. It is not subject to any stock market fluctuations. The buyer of bonds already knows in advance how much he will receive after a year of owning them.

These are the main differences between stocks and bonds.

Profitability

The differences between stocks and bonds also lie in the distribution of profits. When purchasing securities of an OJSC, it is necessary to carefully analyze the market and the company: the development of the company, investments, financial indicators, the state of the industry as a whole, etc. It is from the company’s exchange rate, from its profits, that dividends will come, which means the value of securities will increase, and, conversely, the lower the company’s income, the cheaper the rate is quoted on the stock markets.

Return on shares can come from two sources:

- Dividends from company profits.

- When selling securities on stock exchanges, that is, speculative operations.

Bond yield:

- Due to the higher nominal value.

- From the coupon, that is, interest that is paid to investors after a certain amount of time.

- Resale on the stock exchange.

The first and second points are stated immediately, that is, the investor does not need a fundamental analysis of the markets. Prices are fixed and cannot be changed. The only risk is losing capital if the company declares bankruptcy, but when buying shares, this risk is also present.

Differences between stocks and bonds: pros and cons

Pros of shares:

- You can predict the market and buy shares at the minimum price, the quotes of which may subsequently rise.

- Two sources of income, which is a higher percentage compared to bonds.

- They give the right to the authorized capital of the enterprise, and, therefore, the investor automatically becomes a founder.

Disadvantages of shares:

- An investor who does not feel the state of the market, a certain area, and also does not analyze the development of companies, can invest in unprofitable companies that are doomed to ruin.

- There are no guarantees of profit or dividends.

Pros of bonds:

- Does not require fundamental market analysis. The par value of shares and the interest on coupons are fixed and are not subject to market fluctuations.

- Guaranteed profit.

Disadvantages of bonds:

- Low yield compared to other financial instruments, which is slightly higher than bank deposits and inflation.

- Bonds do not imply a share in the authorized capital of the enterprise, no matter how much the investor purchases securities.

Thus, we have tried to explain in general terms what stocks and bonds are and what the difference is between them. Of course, in order to better understand these financial instruments, as well as develop your own stock trading strategies, you need to find fundamental information about them.

Investing in securities is one of the paths leading to material wealth and financial independence. This truth is known perhaps to everyone, and this fact does not leave many indifferent, motivating them to engage in this interesting and potentially highly profitable type of activity.

New investors are often faced with a number of incomprehensible terms, formulations and other financial information that is directly related to investing money in various markets and in various financial instruments. In particular, they may be faced with the question of what securities (financial instruments) they should invest in at the beginning of their activities.

The most well-known and, perhaps, the most popular financial instruments for most private investors are stocks and bonds. Both have their undeniable advantages and disadvantages. Let's look at them in more detail and try, together with you, to decide on the question of which securities are most suitable for you in the early stages of investment activity: stocks or bonds?

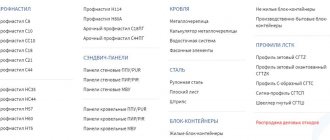

List of all bond mutual funds

In the table I have indicated the indicators of bond mutual funds managed by reliable companies.

| Name of the management company | Sberbank Asset Management | Sberbank Asset Management | Sberbank Asset Management | VTB Capital Asset Management | VTB Capital Asset Management | VTB Capital Asset Management | Alfa Capital | Alfa Capital | Alfa Capital |

| Name of mutual fund | Ilya Muromets | Prospective bonds | Eurobonds | Emerging Markets Eurobonds | Eurobonds | Treasury | Alfa Capital Reserve | Alfa Capital Bonds Plus | Alfa Capital Eurobonds |

| Ticker ISIN | RU000A0EQ3Q5 | RU000A0EQ3T9 | RU000A0JU054 | RU000A0JS9M4 | RU000A0JS9N2 | RU000A0JS9M4 | RU000A0ERNL0 | RU000A0HNSU2 | |

| Registration number | 0007-45141428 | 0327-76077399 | 2569 | 0958-94130789 | 0963-94130861 | 0958-94130789 | 0094-59893648 | 0095-59893492 | 0386-78483614 |

| Registration date | 18.12.1996 | 02.03.2005 | 26.03.2013 | 13.09.2007 | 13.09.2007 | 13.09.2007 | 21.03.2003 | 21.03.2003 | 18.08.2005 |

| Type | Open | Open | Open | Open | Open | Open | Open | Open | Open |

| Strategy | Investing in bonds of Russian issuers | Investing in bonds of Russian issuers denominated in rubles | Investing in corporate bonds of Russian issuers, Eurobonds | Investing in Eurobonds issued by developing countries | Investing in Eurobonds of Russian issuers | Investing in federal, municipal and corporate bonds with high credit ratings | Investing in federal and corporate bonds with high credit ratings | Investing in government, municipal and corporate bonds with high credit ratings | Investing primarily in foreign currency Eurobonds of states, Russian and foreign issuers |

| Risk | Short | Short | Short | Short | Short | Short | Short | Short | Short |

| Commission | 2,8–5,8 % | 2,8–5,8 % | 2,8–5,8 % | 4–8,5 % | 3,1–7,6 % | 4–8,5 % | 2,4–6,8 % | 2,4–6,8 % | 2,2–5,1 % |

| Profitability for 3 years | 30,78 % | 30,62 % | 13,56 % | 25,39 % | 18,49 % | 33,04 % | 31,82 % | 33,34 % | 25,48 % |

| Minimum initial deposit, RUB | 1000 | 1000 | 1000 | 5000 | 5000 | 5000 | 100 | 100 | 100 |

| Subsequent payments, RUB | 1000 | 1000 | 1000 | 1000 | 1000 | 1000 | 100 | 100 | 100 |

| Number of shareholders | 19 483 | 13 598 | 3065 | 1611 | 2848 | 26 074 | 5969 | 15494 | 6044 |

| Buy online | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Minimum investment period | 1 year | 1 year | 1 year | 1 year | 1 year | 1 year | 1 year | 1 year | 1 year |

| Early withdrawal | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Investing in shares

First, let's define what a security called a share is.

A share is a security that gives its owner the right to a share in the business of the company that issued it (the issuing company).

There are two main types of shares:

- Ordinary;

- Privileged.

Ordinary shares

allow their owner to directly participate in the management of the company. The greater the share of such securities under your control, the greater the number of votes you have at general meetings of shareholders. And significant shares of shares (in the amount of 5-10% or more of their total number) generally allow you to apply for a place on the board of directors of the company.

A very large block of common stock may allow its owner to gain complete control of the company. Such a package is called a controlling stake and, purely theoretically, its size is 50% plus one share. It is this share of the company’s shares that is guaranteed to allow it to gain a global advantage when making all key decisions regarding its activities. Although in practice a smaller share is often sufficient for this, for example, in cases where a large share of securities is in the hands of a company, sometimes a controlling stake consisting of 25-30% of the company’s shares is considered to be controlling.

By investing in common stock, you are essentially investing your money in the business of the company that issued it. If this business is successful, its market capitalization will increase, and along with it, the value of your shares will increase. Thus, after some time, if you wish, you will be able to sell your share at a price higher than the one at which you originally purchased it.

Another source of profit from owning a company's common shares may be the share of profits paid in the form of dividends on them. When the next reporting period ends successfully for the company and it has good profits, the general meeting of shareholders raises the question of dividing its part among all holders of ordinary shares (in proportion to the share of each of them).

If the meeting deems it necessary, dividends on the company's common shares will be paid. But another decision may be made, for example, to use all the profits received for the further development of the company. For many there is a reason for this. Firstly, such a decision will have a beneficial effect on the further growth of market capitalization and the market value of the company's shares (which will increase the value of each shareholder's share). And secondly, you won’t have to pay taxes (which would have to be paid on profits received in the form of dividends).

The main difference between preferred shares

from ordinary ones is precisely the fact that dividends on them are always paid in priority order. The profit, the fate of which is decided at the general meeting of shareholders, no longer includes the amount of dividends on preferred shares, since they are always paid without fail.

In addition, preferred shares give their owners the right to first redemption in the event of a company bankruptcy. In the case, for example, when all the property is sold at auction in order to distribute all the profits among shareholders, the owners of preferred shares receive their share first (but after the bondholders).

However, as you know, everything in this world has its price. And preferred shares, of course, are no exception. The price that the owner of such shares pays for all the privileges received under them is the complete absence of voting rights at the general meeting of shareholders**. But for most private investors this point cannot be called critically important, since the share of shares in their possession, in any case, does not allow them to take any significant part in the process of managing the company.

** However, if for some reason the company is unable to pay dividends on preferred shares, it is obliged to provide voting rights on them. In most cases, they try to avoid this so as not to lead to a scattering of votes.

Advantages and disadvantages of investing in stocks

Main advantages:

- The undoubted advantage of investing in stocks is the possibility of receiving much greater investment income (compared to bonds);

- In addition to income from the increase in market value, a pleasant bonus can be receiving additional income in the form of dividends (and in the case of owning preferred shares, such a bonus will be permanent);

- If you have a sufficiently large block of shares in the company, you will be able to directly participate in its management;

- Almost anyone can afford to buy shares; you don’t need to have astronomical trading capital or be Rockefeller’s favorite nephew. All you need to do is register a trading account with any broker accredited by the stock exchange.

- Shares (especially those that fall into the blue chip category) are a very liquid asset. They can be easily bought and also easily sold (if, of course, we are talking about shares included in the listing of official exchange platforms).

- You can trade stocks without leaving your home. To do this, you just need to install it on your computer provided by your broker.

Main disadvantages:

- Well, firstly, the price of shares can change not only up, but also down. That is, having bought shares at a certain price, you may be faced with the fact that after some time (due, for example, to the next economic crisis), this price will decrease, thus bringing a loss equal to the number of shares multiplied by the size of the price decrease. And if the company goes bankrupt, you can lose everything;

- Although the stocks themselves may be relatively inexpensive, it may require a very significant amount of trading capital to make up a well-diversified stock;

- Successful investing in stocks requires certain knowledge and experience. You can’t just go ahead and start trading stocks; first you need to acquire at least basic knowledge in the field of economics, fundamental and technical market analysis;

- Costs in the form of commissions. Trading occurs through the intermediary of brokers, and they, in turn, require a certain payment for their services. In addition, such inevitable costs include commissions of exchange platforms and fees for depositary services.

Mutual Fund: what to expect from active funds?

A mutual fund (mutual investment fund) is a fund that is formed from the money of investors (shareholders) and invests it in various assets (stocks, bonds, currency, gold) in order to obtain profitability.

How it works?

You buy a share in a mutual fund (a share or several shares) with the expectation that in the future its price will increase and after some time you will be able to sell your shares for more than what you purchased. The management company (MC) manages the funds of the fund's shareholders. She decides when and what securities to buy and sell, based on the investment declaration adopted by the fund. The management company receives its percentage for asset management.

How much do bond mutual funds earn investors?

The mutual fund is rightfully considered a veteran of the collective investment industry in Russia. This is actually the first instrument that made the Russian stock market accessible to private investors. And despite the fact that the asset management industry has come a long way in recent years, mutual funds are still quite popular among retail investors.

According to Investfunds, there are currently 69 bond mutual funds on the Russian market. It is bond mutual funds that have been among the leaders among active funds in terms of the volume of funds raised over the past couple of years. For example, in 2021 they managed to collect almost 74 billion rubles, and last year - about 56 billion. However, at the end of 2021, bond funds also experienced the maximum outflow of shareholders’ funds among all mutual funds. The main reasons for the outflow were a sharp drop in OFZ , an increase in the Central Bank rate and an increase in deposit yields.

Due to the negative revaluation of bonds in September 2021, a number of mutual funds suffered losses. At the end of last year, even large players showed low profitability. For example, the Ilya Muromets bond fund of Sberbank Asset Management earned its shareholders only 2.67%, and the corporate bond fund of Raiffeisen Capital Management - 4.7% per annum. Against this background, it is quite expected that funds investing in currency bonds were more fortunate - almost all of them earned investors double-digit returns.

What are the advantages

- Low entry amount: you can enter the market with an initial investment amount of at least 1000 rubles.

- High diversification: by investing in a mutual fund, you actually receive a diversified portfolio of ruble bonds or Eurobonds with small investments.

- Your money is managed by professionals: this means that you do not need to constantly keep your finger on the pulse of the market, independently select securities for your portfolio, assess risks, or analyze issuers.

- Your assets are well protected: the Bank of Russia supervises the activities of management companies that manage the money of shareholders, and the depository stores the fund’s property and monitors the legality of transactions and compliance with investment declarations.

What are the disadvantages

- High costs: despite the clear trend towards a reduction in commissions, which is noted by market participants themselves, the total costs of an investor when investing in mutual funds for some management companies can still reach double digits (!) as a percentage of the investment amount. And every extra percentage of the commission immediately has a significant impact on the final profitability of your investments.

- Lack of guaranteed return on investment.

- Inability to independently control market and credit risks.

- Lack of stable fixed income from investments in the form of a coupon.

- Inability to record the duration of your investments.

- If the mutual fund shares are not traded on the stock exchange (and the majority are), then the investor will not be able to receive an additional 13% in the form of a deduction for the IIS contribution.

EXPERT OPINION

Alexander Abramov, head of the laboratory for analysis of institutions and financial markets at RANEPA:

— The main advantage of mutual funds in Russia, and even more so in the world, is that they help to save private investors’ own costs for monitoring and risk management. The same phenomenon applies here as with personal farming: it’s easier to buy cucumbers in a store than to grow them yourself in the garden. But mutual funds in Russia have serious drawbacks. Their management fees, bonuses and discounts are too high. In addition, the funds lack transparency in terms of strategies and portfolio content. And the technology of their sales, and especially analytics, are very patriarchal and of little interest to private investors.

Alexey Tretyakov, CEO of Arikapital Management Company:

— Mutual funds, especially those investing in foreign currency bonds or shares, have significantly more advantages than disadvantages compared to direct investment from a brokerage account. This includes a preferential tax regime, higher diversification (after all, most private investors can hardly afford to form a portfolio of 10–20 Eurobonds from different issuers, due to the fact that the minimum lot for many securities is $200 thousand), and savings on transaction costs. There are ratings of mutual funds, among which it is easy to identify the funds that are the most effective in terms of commissions and management results. Any investor can view statements that disclose all mutual fund investments down to the last penny (which makes open mutual funds one of the most transparent investment instruments) for each quarterly reporting date.

Sergey Grigoryan, private investment management expert, author of the Capital Tg channel:

— If a mutual fund constantly loses to most competitors and the benchmark and at the same time sets a high management fee , then, of course, there is no reason to be in such a fund. But my experience shows that bond fund managers (not all of them, of course) more often show consistently good results than stock managers. By good, I mean results that, after deducting management fees, consistently outperform the “average competitor” and the benchmark over different time horizons.

True, investors in such mutual funds should carefully monitor whether their fund manager, whose results they are accustomed to, has changed. Unfortunately, transparency requirements do not imply the need for management companies to disclose information about a change of manager. I know of cases where a management company, having decided to replace a long-standing and successful manager with a “dark horse”, did not consider it necessary to inform its clients about this. As a result, for many investors in bond mutual funds, the results of the next 6-12 month periods became an unpleasant surprise, and they, albeit belatedly, “voted with their feet.”

Oleg Yankelev, senior partner at FinEx Investment Management LLP:

— For private investors, mutual funds have become too expensive a package for simple investment ideas. This is clearly illustrated by funds that invest their assets in transparent and efficient foreign exchange-traded funds (ETFs). The commissions are off the charts: even without discounts and premiums, the cost can exceed the commission of the “basic” ETF by 30 times! In addition to high commissions, such nesting doll funds suffer from incomplete and untimely investment of investor funds. The mutual fund is required to hold a ruble “cushion” to ensure the issue and redemption of shares, and it, of course, does not allow for normal tracking of the benchmark ETF. As a result, the annual yield of “stock” mutual funds lags by 4–8% per annum in foreign currency from the yield of the corresponding ETFs in which the funds themselves invest.

When investing in the local market, Russian mutual funds can partially provide diversification, but it will be too expensive for investors. Therefore, ETFs and individual bonds are a reasonable alternative.

*Broker's commission for completing a bond transaction (as a rule, does not include depository fees and exchange commissions, which the investor pays additionally). **Annual management fee in total (including remuneration of the management company, depository, registrar, auditor, other expenses), according to Investfunds ***Total level of expenses, annually. ****Only for funds whose shares are traded on the Moscow Exchange. ***** In addition to the benefit for long-term ownership of securities within the framework of the investment tax deduction, the following are not subject to personal income tax: - coupon income on bonds issued after 01/01/201 - income in the form of a discount received upon redemption of bonds issued after 01/01/2017.

Investing in bonds

A bond is a debt security that confirms that its issuer has borrowed money from you. In fact, this is some kind of analogue of a receipt, only this receipt is issued not by a specific person, but by an entire company or even the state. And it is not issued to anyone specifically, but is produced on a serial basis (it is issued).

We can say that a bond is a simple way to borrow money without collateral or guarantors. When a company needs money, for example, to introduce new production facilities or conduct scientific research, in other words, for its further development, the need for lending arises. You can, of course, go to the bank, but they will definitely require collateral. Or you can simply take and issue bonds for the required amount.

By purchasing bonds, we thereby act as a creditor for its issuer. Remember the old pawnbroker from Dostoevsky's Crime and Punishment? So, when buying bonds, each of us, to a certain extent, acts in its role.

All bonds can be divided into two main types (depending on the form in which income is paid on them):

- Coupon bonds;

- Discount bonds.

Profit on coupon bonds

obtained at the expense of a set interest rate on their nominal value. This rate can be either fixed or floating. With a fixed interest rate, you know in advance the level of income that you will receive as a result of owning the bond. A floating rate, as a rule, is tied to something (to the Central Bank rate or, for example, to the LIBOR rate), and therefore does not accurately predict the level of income on such bonds.

Such bonds have been called coupon since the time when they were issued on paper and had tear-off spines - coupons on which interest was paid at specified intervals.

Profit on discount bonds

is obtained due to the fact that the cost of their acquisition is obviously lower than the nominal value (redemption cost) by a predetermined amount. That is, they are purchased at a discount, hence the name.

Let's say if you buy a discount bond for a period of five years for 10,000 rubles, then after the specified period you can sell it, for example, for 15,000 rubles (depending on its face value). However, in order to make a profit on them, it is not at all necessary to wait for the established repayment period. A discount bond is, as a rule, a fairly liquid asset that can be sold on the stock exchange at any time. And the closer the maturity date is, the closer to the face value the price of such bonds will be.

Advantages and disadvantages of investing in bonds

Advantages:

- Minimal risk. The owner of a bond does not have to worry about its value decreasing because by its very nature it is a simple debt obligation with a guaranteed interest rate on it. That is, the issuer of a bond (which can be banks, commercial companies, or even the state) undertakes to repay its debt to its holder (which arose at the time the bond was purchased), plus pay him certain interest;

- You can invest in bonds denominated in foreign currency and thus receive income that is much higher than bank interest on foreign currency deposits;

- Payments on bonds are always made in priority order (before payments on ordinary and even preferred shares). This also applies to payments made in the event of bankruptcy of the issuer;

- This is a fairly liquid financial instrument that, if necessary, can be sold on the stock exchange before the established maturity date;

- Income received from some types of bonds is not subject to taxation.

Flaws:

- Relatively low profitability. The profit on bonds, although it exceeds, for example, the interest on a bank deposit, is noticeably inferior to shares. This can be called a kind of payment for their reliability;

- The bond does not give its owner either a share in the company's business or the rights to manage it. It is simply a promissory note;

- Unlike, for example, a bank deposit, money invested in bonds is not subject to the compulsory deposit insurance program. This means that if the issuer defaults, they can be lost. However, in the case of stocks the situation is similar.

What type of bonds to choose

There are four main types of debt securities on the Moscow Exchange:

- government bonds - OFZs and COBRs, and individuals can only buy OFZs;

- municipal bonds , which are divided into municipal bonds proper (issued by cities, districts and individual municipalities) and subfederal (issued by constituent entities of the Russian Federation);

- corporate , which are issued by Russian companies;

- Eurobonds , which are also issued by Russian companies, but not in rubles, but in another currency.

Which bonds to choose depends on the type of portfolio you have and your ultimate goals.

If you want to put together a completely conservative portfolio purely to save money, then just choose the most profitable OFZ at the moment - naturally, taking into account the period when you plan to enter the cash. It makes no sense for you to buy a long OFZ with a maturity in 10 years if you plan to get into money in three years - look for an OFZ with a maturity in the next three years.

To generate a stable cash flow using OFZs, you can buy 6 issues of government securities with a coupon that is paid every six months - this way you can receive money every month.

If you need a higher yield than the OFZ can offer, then you need to increase the level of risk and choose corporate and municipal bonds for purchase.

It is advisable to buy Eurobonds to diversify the currency risk, but there is a fairly large entry threshold - from 1000 units of currency.

Next, I will talk about how to correctly select the right bonds and what to pay attention to, and these rules apply mainly to corporate bonds. But they are quite applicable to municipal and any foreign debt instruments, for example, Eurobonds.

Let's sum it up

Since each investor is, first of all, a person with his own individual psycho-emotional characteristics, it is definitely impossible to recommend everyone to invest in bonds (due to their high reliability) or shares (due to higher potential profitability). However, having familiarized yourself with the above-described advantages and disadvantages of each of the financial instruments discussed here, you can draw certain conclusions for yourself and understand which of the described types of securities is closer to you personally.

For people who are risk-averse and/or highly sensitive to even small losses, it makes sense to invest their money in bonds. For those who are willing to take on a certain risk (and this does not cause severe mental discomfort), and in addition, have the ability to analyze and quickly assimilate new information, it makes sense to try investing in stocks.

It should be noted that in most cases, a well-balanced diversified investment portfolio contains both stocks and bonds. At the same time, conservative (low-risk) portfolios are characterized by a balance shift towards bonds, and for portfolios of aggressive investments, the emphasis shifts towards increasing the relative share of stocks.

Good day to everyone, dear readers! You are greeted as usual by Ruslan Miftakhov, and today we will look at how a stock differs from a bond.

I think you hear these concepts quite often everywhere, but not everyone knows what their differences are.

And if you are going to start investing in securities and make a profit from it, you should know the main features of their most basic types (these also include a bill of exchange, a check, a bill of lading, and others, but they are less common).

Stocks and bonds are both instruments of the securities market and an effective means of increasing the capital of enterprises. For investors, these are means of making a profit, with a different mechanism of action.

A share is a security issued by a joint stock company upon creation, which has a certain value and confirms the investor’s ownership of part of the company’s authorized capital, depending on their total value.

The shareholder has the right to receive dividends from it - part of the enterprise’s profit (we discussed this process in detail in the article “”, remember?), or part of the property, in the event of liquidation of the joint-stock company.

In simple words, by purchasing a share, an investor receives a share of the organization's property.

They are common

(give the right to vote in the management of the organization, and the opportunity to receive dividends) and

privileged

(the shareholder has priority rights when receiving dividends, the amount of which is fixed, or property in the event of bankruptcy of the joint-stock company).

The buyer of shares is primarily interested in their market value, which can either increase or decrease based on the company’s position in the market. It's no secret that Gazprom's shares will be higher and more profitable than any little-known plant.

How bonds work

A bond is issued by the issuer to improve its financial position. In other words, when a company needs additional money, it issues bonds and issues them to individuals and legal entities for a certain period, while receiving the necessary financial resources.

The owner of this security has the right to receive income in the form of fixed interest on it, and at the end of its validity period, returns the security to the issuing company, in return receiving the initial amount spent on its purchase.

A bond is a fixed income debt instrument, and the process of such investment can be called lending.

And there is always a possibility that the company may go bankrupt and not pay its creditors.

Having understood the mechanisms of action, we can move on to comparing them.

About companies

Sberbank Asset Management

Sberbank Asset Management is a leader in the market of open mutual funds. The value of assets under management of the company is more than 1 trillion rubles. The analytical team was recognized as the best according to the Extel Pan-Europe Survey rating.

VTB Capital Asset Management

A management company with the highest reliability rating A++ according to Expert RA. Offers various investment instruments: hedge funds, closed mutual funds, venture and retail funds. You can purchase a share at one of 600 sales offices throughout the Russian Federation.

Alfa Capital

Part of the Alfa Group consortium, operating since 1992. Trust management company No. 1 according to NAUFOR 2021. Investment capital over 380 billion rubles. Received the highest reliability ratings according to the National Rating Agency (AAA) and Expert RA (A++).

Main differences

The difference between these securities is as follows:

- Shareholders can influence the organization's policies, as they have the right to vote at the annual Council of Shareholders on the company's activities. Owners of bonds, being creditors, do not participate in management.

- Dividends on stocks are higher than interest on bonds, and these concepts are not comparable.

- In the event of bankruptcy of the issuing company, they first settle accounts with creditors, and then with shareholders, who risk receiving nothing if there is no money and property left for this.

Thus, we can conclude that shareholders can either receive a large income (for example, as in Apple), or suffer losses if the joint-stock company goes bankrupt.

Bonds are more reliable, their income is stable, albeit small. Mostly experienced and advanced investors become shareholders, while beginners choose bonds.

How to purchase them for investment?

To purchase them, you need to have a brokerage account, which can be opened with the Otkritie company, the largest broker and leader in the domestic market.

And it’s quite simple to do this: register in the system, spend a few minutes on it, open a brokerage account, then fund it in any convenient way, and start investing.

To get a more profitable result and maximum profit, use the investment options offered by the broker Otkrytie - in which specific securities to invest your funds, based on the available amount and the goals set by the client.

The company also offers free training, various seminars and trial accounts for beginners to test their strength. Agree, this allows novice investors to learn and reduce the risk of financial loss!

Watch a short but cool video :)

Today’s article has come to an end, I hope you found it interesting and received useful information! And we will be waiting for your ratings and comments.

Best wishes, Ruslan Miftakhov!

principled.

While the promotion

is a security that certifies the ownership share of its owner (shareholder) in the company and gives the shareholder the right to participate in the management of the company and/or to receive dividends,

bond

records the company's debt obligations to the bondholder and has no relation to the share in the company and to the distribution of profits and management of the company.

Accordingly, based on the nature of these securities, their owners have different rights and opportunities regarding the income provided by these instruments, its size, frequency and order of payment, as well as guarantees of income and risks, as well as the possibility of influencing the company’s activities. Shareholders are co-owners of the company, bondholders are creditors.

PAYMENTS ON SECURITIES

Holders of securities periodically receive payments provided directly by each security (issue documents).

Shareholders

receive dividends determined by the decision of the general meeting. There are no other periodic payments on shares. On liquidation of a company, the shareholder is paid a portion of the funds, if any, after the claims of all creditors have been satisfied.

Bond holders

Interest income is paid at the frequency specified in the document regulating the issue of bonds (

issue decision

or

prospectus

) and at the end of the bond's circulation period, upon redemption, the nominal value is paid. There are no additional payments on bonds.

REGULARITY OF PAYMENTS

The timing and frequency of payments for shares and bonds differ and are determined for each security separately.

Payment of dividends on shares

usually occurs once a year. Some companies pay dividends quarterly. The timing of dividend payments is established separately by each decision on the distribution of enterprise profits to shareholders.

Payments to bondholders

occur regularly on a periodic basis - once a month, a quarter, a half-year, a year. The frequency of payments remains unchanged during the circulation period of the bond issue.

How to select bonds: basic principles

Bond selection consists of three sequential steps:

- evaluating the bond itself (i.e., its parameters to determine whether the bond is suitable for your portfolio);

- assessment of the issuer’s reliability (so that it does not collapse);

- bond yield assessment.

Let's go through these steps sequentially. First, let’s decide what kind of bond we actually need.

Bond face value

Contrary to popular belief, the par value is not the initial price of the bond. This is the payment you will receive when the bond matures. The initial price is determined during the initial placement of debt securities and, as a rule, it is slightly lower than the par value.

On the Russian debt market, the most common denomination is 1,000 rubles, but there are bonds with a denomination of both 1 ruble and 100,000 rubles. So check it just in case.

The market price of a bond is usually somewhere around the par value, changing depending on economic rates, accumulated coupon income, news about the issuer and other factors, more details here.

You need to know the price of a bond in advance to plan your purchase. It is clear that if you do not have 100 thousand rubles, then you need bonds with a lower entry threshold.

If you bought a bond at a price below par and sold it at a higher price or waited for redemption at par, then you will need to pay income tax on the profit received.

Coupon type

One of the basic principles for choosing a bond for investment is the order of coupon payment. Bonds have several types of coupons.

The most understandable and simple payment option is a permanent coupon, i.e. a situation where the coupon rate is fixed for the entire life of the bond. For example, the Alfa-Bank-002R-03-bob bond has a constant coupon of 9.2%. Every six months, the issuer transfers 46.13 rubles to investors for each security.

But there are other schemes:

- fixed constant coupon - the rate changes according to a predetermined plan;

- variable coupon - the rate is changed by the issuer at his request (and depending on the market situation);

- floating coupon - the rate changes depending on external indicators, its value can be tied to the RUONIA rate, the dollar exchange rate, the key rate, the rate of inflation, etc.

If a stable income is important to you, then it is better to choose a constant or fixed coupon, so you can predict your profit. It is better to take bonds with a variable coupon if you plan to get rid of the bond before the rate changes.

The most interesting option is with a floating coupon. If you buy such a bond, you can hedge against a number of risks, for example, against a sharp increase in inflation if the coupon size is tied to the consumer price index. But you may lose profitability if inflation decreases.

And here’s another interesting article: “People’s” bonds will become even more popular

Frequency of payment

Issuers typically pay coupons at annual, 6-month, quarterly, and monthly intervals. Other schemes are rare, but also used.

Here the choice is entirely at your discretion: whichever is more convenient for you to receive the payment, leave that bond. I will only note that bonds for which the coupon is paid more often, other things being equal, are less volatile, since the accumulated coupon income does not have time to influence the price of the paper significantly.

Maturity

To choose the right bond for your portfolio, you need to know when to exit it. The best option is to wait until the paper matures. This way you will know exactly how much you will receive at the exit. It is not a good idea to buy bonds maturing in 10 years if you need cash in 3 years, as long securities have increased volatility and you may have to sell your bonds below the purchase price.

Please note that when you select suitable bonds on specialized websites, for example, rusbonds.ru or cbonds.ru, when searching, do not specify the “Circulation period”, but rather the maturity date of the bond. If you select Maturity Period, you will simply sort 1-year, 3-year, 10-year, and other bonds without regard to the maturity date. It may turn out that you received a list of 3-year bonds, half of which mature in the next year, but in fact you were looking for bonds that mature in three years.

Another point is that there are perpetual bonds on the market that have no maturity date. For example, Rosselkhozbank has these. These bonds can only be redeemed by offer, if there is one at all.

Subordinated and ordinary bonds

There are subordinated bonds on the market - it is better for a novice investor to stay away from them. In the event of bankruptcy, the issuer makes payments on them last, i.e. after repayment of ordinary bonds, bills and debts to banks and other creditors. It is not a fact that any money will reach the owner of the subordination. In addition, in some cases, subordinated bonds can simply be written off - without declaring bankruptcy.

Therefore, subbords are considered second-class debt securities. If you don't know how to work with them and are not willing to accept the additional risk, it is better to abandon them.

How to find out if a bond is subordinated? This is indicated in the issue prospectus and in the issue card on specialized websites such as cbonds.ru.

Conversion

Some bond issues can be converted into something else, such as shares. If you don’t need such a “surprise,” take bonds without conversion. If necessary, look at the conditions and into what asset the bond can be “converted”.

Depreciation

Some issuers pay the bond's face value in installments - for example, first 10%, then 20%, then another 20% and finally the balance - 50%. Sometimes these parts can be equal - for example, the LSR Group redeems its bond Group LSR-BO-001P-02 in equal shares, 20% of the face value.

Accordingly, the investor will receive 200 rubles along with the coupon with each payment - until the bond is fully repaid.

Depreciation is convenient if you need to gradually release funds and transfer them to some other assets. If you just need to hold money for a certain period, choose bonds without amortization.

Keep in mind that 99% of municipal bonds come with amortization. Among corporate bonds, the share of bonds with amortization is approximately 30% of the total.

Offer (call and put)

Another parameter that is worth paying attention to when choosing bonds for investment is the availability of an offer. In simple terms, an offer is a redemption of a bond at par before its maturity. For example, the Gazprombank bond GPB-16-bob has a maturity date of April 18, 2024, but the bank issued an offer for it on October 20, 2020. Consequently, on the day of the offer, you can sell the bond at a par value of 1000 rubles, without waiting for 2024.

There are two types of offer:

- irrevocable, or an offer with a put option - the investor himself decides whether to present his existing bonds for redemption or to keep them for himself;

- revocable, also known as an offer with a call option - the issuer has the right to redeem its own bonds without asking investors about it or obtaining their consent.

After the offer, the coupon usually changes. Sometimes down to 0.01%.

Therefore, when choosing a bond, be sure to check whether it has an offer. Otherwise, it may happen that you buy a bond with maturity in 5 years, and after 2 years the issuer will present an offer with a put option and reduce the coupon from 7% to 0.01%. If the investor does not know about the offer, he may miss the offer date and end up with a bond with a penny return.

Duration

This parameter allows you to more accurately assess the risks of a bond. To put it simply, duration shows how many days it will take for an investor to break even by purchasing a given bond. The lower the duration, the lower the risks. Longer bonds with infrequent coupon payments have a longer duration than shorter bonds with frequent coupon payments. Duration also takes into account inflation and discounting of cash flows (reinvestment).

And here is another interesting article: Investment portfolio: report for August 2021

In addition to simple, there is a modified duration. It shows how the price of a bond will change if its yield changes by 1%, and this relationship is inverse. In practice, this means that if the value of the modified duration is 2, then if the yield changes by 2%, its price will fall by approximately 4%. In short, the higher the modified duration value, the more volatile the bond.

In general, if you are going to hold a bond until maturity, then you don’t have to look at the duration. If you are going to sell it without waiting for maturity, then, other things being equal, it is better to give preference to bonds with a shorter duration (for example, if you have two bonds with an equal coupon and approximately the same maturity).

Liquidity

Another parameter that investors forget to pay attention to. Liquidity measures how easy it is to buy and sell a bond. If the trading volume of a bond is small, then you may not buy the required volume or buy at inflated prices. And you will be forced to sell for a long time and at a lower cost.

Liquidity can be assessed by trading volume. If several million “representatives” of a certain issue circulate on the market every day, then you don’t have to worry about liquidity. If the turnover volume is low (for example, less than 100 thousand rubles per day), and you decide to buy bonds for 500 thousand rubles, then the transaction simply will not take place.

Compare weekly trading turnover for different bonds. For example, the liquidity of the Avtodor GK-001R-01-bob issue leaves much to be desired - only 6 transactions per week in the amount of 60 thousand rubles. But the Alfa-Bank-002R-03-bob issue looks much more interesting.

PAYOUT SIZE

Earnings per share paid out

determined annually by the general meeting of shareholders, depends on the financial results of the company and may vary significantly from year to year. If the financial result is unsatisfactory, dividends may not be paid, that is, the return on the investment for the period may be zero.

Interest income paid to bondholders

, is regulated by the issue documents. They clearly state the yield and the procedure for changing it, if such a change is provided for by the issue of bonds.

TOP 5 most profitable

If the main criterion is profitability, pay attention to the following corporate securities:

- SUEK-Finance-5-ob (18.65% per annum);

- PR-Leasing-001R-02 (12.72%);

- PR-Leasing-001R-01 (12.5%);

- Uralvagonzavod NPK-2-bob (11.97%);

- Mostotrest-7-ob (11.26%).

At the moment, these are the most profitable offers on the Russian stock market. They will provide greater returns than bank deposits or blue-chip bonds, but investments in corporate paper are not immune to losses.

PRICE OF SECURITY

Both shares and bonds have a par value established by the issue documents at the time of issue. In an initial offering, securities are usually bought and sold at par. During the circulation of securities on the secondary market, their value may differ significantly from their nominal value.

Share price

in the market depends on the financial performance of the issuer, the level of dividends paid per share and expectations of the issuer's future financial results. The better the financial performance and expectations, the higher the share price. The value of shares, depending on the results of operations, can either increase or decrease.

Bond price

is directly related to its nominal value, provided for payment at maturity, the nominal yield of the issue, maturity, and also significantly depends on the general interest rate in the economy. When the cost of funds in the economy increases, the price of bonds, regardless of the financial results of the issuer, decreases, and when it decreases, on the contrary, it increases. That is, it is inversely related. A change in market price may be significant, but does not affect the nominal yield or redemption payout.

Dynamics of share value and NAV

The value of the share is the amount of the deposit. NAV is the value of net assets, calculated using the “assets – liabilities” formula. It directly affects the value of the share (the profitability of the mutual fund). I will look at graphs of NAV and the cost of deposits of the most profitable bond mutual funds.

Sberbank’s Ilya Muromets, despite the decline in NAV, has shown a stable increase in profitability over three years.

“Treasury” demonstrates an almost straight line of profitability, which indicates the reliability (growth without significant drawdowns) of the instrument. The increase in the value of the share is supported by the growth of NAV.

The most profitable mutual fund managed by Alfa Capital was Alfa Capital Bonds Plus. Yields of over 33% are shown against the backdrop of a temporary drawdown in NAV.

PAYMENT GUARANTEES, RISKS

Like all investments, investments in securities involve risks for the investor. Shares are a riskier financial instrument.

To shareholders

do not guarantee a return on their investment or any payout per share.

Bonds

are secured by the property and assets of the issuing company, or other collateral and guarantee the payment of par value and regular payments of interest income.

In the event of liquidation of the issuing company during the division of property, shareholders can only rely on that part of the property that will remain after the payment of all debts, including bonds.

What will be the yield when selling the bond?

The current yield shows the ratio of coupon payments to the market price of the bond. This indicator does not take into account the investor's income from changes in its price upon redemption or sale. To evaluate the financial result, you need to calculate a simple return, which includes a discount or premium to the nominal value when purchasing:

Y

(yield) - simple yield to maturity/put

CY

(current yield) - current yield, from coupon

N

(nominal) - par value of bond

P

(price) - purchase price

t

(time) - time from purchase to maturity/sale

365/t

— a multiplier for converting price changes into annual percentages.

Example 1

: an investor purchased a two-year bond with a par value of RUB 1,000 at a price of RUB 1,050 with a coupon rate of 8% per annum and a current coupon yield of 7.6%. Simple yield to maturity: Y1 = 7.6% + ((1000-1050)/1050) * 365/730 *100% = 5.2% per annum

Example 2:

The issuer's rating was increased 90 days after purchasing the bond, after which the price of the security rose to 1,070 rubles, so the investor decided to sell it.

In the formula, we replace the par value of the bond with its sale price, and the maturity date with the holding period. We get a simple return on sale : Y2 7.6% + ((1070-1050)/1050) * 365/90 *100% = 15.3% per annum

Example 3:

The buyer of a bond sold by a previous investor paid 1,070 rubles for it - more than it cost 90 days ago. Since the price of the bond has increased, the simple yield to maturity for the new investor will no longer be 5.2%, but less: Y3 = 7.5% + ((1000-1070)/1070) * 365/640 * 100% = 3, 7% per annum

In our example, the bond price increased by 1.9% over 90 days. In terms of annual yield, this already amounted to a serious increase in interest payments on the coupon - 7.72% per annum. With a relatively small change in price, bonds over a short period of time can show a sharp jump in profit for the investor.

After selling the bond, the investor may not receive the same 1.9% return for every three months within a year. However, the yield, recalculated into annual percentages , is an important indicator characterizing current cash flow . With its help, you can make a decision on early sale of a bond.

Let's consider the opposite situation: as yields rise, the price of the bond decreases slightly. In this case, the investor may receive a loss upon early sale. However, the current yield from coupon payments, as can be seen in the above formula, will most likely cover this loss, and then the investor will still be in the black.

Bonds of reliable companies with a short period until maturity or redemption under an offer have the lowest risk of losing invested funds during early sale Strong fluctuations in them can be observed, as a rule, only during periods of economic crisis. However, their market value recovers quite quickly as the economic situation improves or the maturity date approaches.

Transactions with more reliable bonds mean less risk for the investor , but the yield to maturity or put on them will be lower. This is a general rule for the relationship between risk and return, which also applies when buying and selling bonds.

DEADLINES

Promotion

is a perpetual security, that is, it exists until the liquidation of the joint-stock company.

Bonds

are issued for a period determined by the issue documents.

As a result, when making an investment decision regarding an investment instrument, all the pros and cons of stocks and bonds are weighed in relation to the individual situation of each investor. There is no single “right” solution, and many individual factors must be taken into account. After determining the type of investment instrument, you need to make a choice among the many securities available on the market. Several recommendations useful when choosing

specific issue of bonds for investment is proposed

.

Where can I buy

An unqualified investor can trade on the stock exchange with the help of an intermediary - a broker. Most Russian brokers provide access to government, corporate, and Eurobonds.

Best brokers

Choosing a broker is a matter of preference. Explore reliability ratings, pricing policies, available asset classes, account types and properties to find the perfect option for active trading or long-term investing.

Opening of Promsvyaz by Rick BKS Keith Tinkoff Finam

One of the mastodons of the market. Excellent web portal, very low commissions and adequate support. I recommend!

Investment department of a famous bank. There are no particular advantages, but there are no disadvantages either. Average.

One of the very first Russian brokers. The commissions are high, but there are interesting auto-following strategies.

Another very large broker. Good support and low commissions are their strong point.

Small but reliable broker. It is great for beginners because it does not impose its services and the commissions are very low. I recommend.

The youngest broker in the Russian Federation. There is a cool app for investors, but the fees are too high.

The largest investment company in Russia. The largest selection of tools, your own terminal. Commissions are average.