74452

0

Author of the article:

Sultanov Iskander Anvarovich

Founder of Projectimo.ru

Recent publications by the author:

Systematic labor standardization project

Implementation of a project to transfer accounting to outsourcing

Anticipation of significant changes in investments

Before considering the procedures for executing an investment event, we need to take a brief tour of the processes of its implementation. At the same time, the implementation of the project must be considered both from the perspective of managing a unique task, and from the point of view of real actions taken to achieve the result. International and national standards in the field of project management will help us in this understanding.

Simple project payback period

What is it and what is it for?

A simple payback period for a project is the period of time during which the amount of net cash flow (all the money that came in minus all the money that we invested in the project and spent on expenses) from the new project will cover the amount of money invested in it. Can be measured in months or years.

This indicator is basic for all investors and allows you to make a quick and simple assessment to make a decision: to invest in a business or not. If a medium-term investment is expected, and the payback period of the project exceeds five years, the decision to participate will most likely be negative. If the investor’s expectations and the payback period of the project coincide, the chances of its implementation will be higher.

In cases where the project is financed with borrowed funds, the indicator can have a significant impact on the choice of loan term, approval or refusal of the loan. As a rule, loan programs have strict time frames, and it is important for potential borrowers to conduct a preliminary assessment of compliance with bank requirements.

How is the simple payback period calculated?

The formula for calculating the indicator in years is as follows:

PP=Ko / KFсг, where:

- PP – simple payback period of the project in years;

- Ko – the total amount of initial investment in the project;

- KFсг – average annual cash receipts from a new project when it reaches planned production/sales volumes.

This formula is suitable for projects whose implementation meets the following conditions:

- investments are made at a time at the beginning of the project;

- the income of the new business will flow relatively evenly.

Calculation example

Example No. 1

It is planned to open a restaurant with a total investment of 9,000,000 rubles, including funds planned to cover possible business losses during the first three months of operation from the moment of opening.

Next, we plan to reach an average monthly profit of 250,000 rubles, which gives us a figure of 3,000,000 rubles for the year.

PP = 9,000,000 / 3,000,000=3 years

The simple payback period for this project is 3 years.

At the same time, this indicator must be distinguished from the period of full return on investment, which includes the payback period of the project + the period of business organization + the period before reaching the planned profit. Let’s assume that in this case, the organizational work to open a restaurant will take 3 months and the period of unprofitable activity at the start will not exceed 3 months. Therefore, for scheduling the return of funds to the investor, it is important to take into account these 6 months before the planned profit begins to be received.

Example No. 2

The example discussed earlier is the most simplified situation when we have a one-time investment and the cash flow is the same every year. In fact, such situations practically do not happen (inflation, the irregularity of production, the gradual increase in sales volumes from the beginning of the opening of production and retail premises, loan repayment, seasonality, and the cyclical nature of economic downturns and upswings) influence the situation.

Therefore, to calculate the payback period, a calculation of the cumulative net cash flow is usually made. When the indicator cumulatively becomes equal to zero or exceeds it, the project pays off during this period of time and this period is considered a simple payback period.

Consider the following background information for the same restaurant:

| Article | 1 year | 2 year | 3 year | 4 year | 5 year | 6 year | 7 year |

| Investments | 5 000 | 3 000 | |||||

| Income | 2 000 | 3 000 | 4 000 | 5 000 | 5 500 | 6 000 | |

| Consumption | 1 000 | 1 500 | 2 000 | 2 500 | 3 000 | 3 500 | |

| Net cash flow | — 5 000 | — 2 000 | 1 500 | 2 000 | 2 500 | 2 500 | 2 500 |

| Net cash flow (cumulative) | — 5 000 | — 7 000 | — 5 500 | — 3 500 | — 1 000 | 1 500 | 4 000 |

Based on this calculation, we see that in year 6 the cumulative net cash flow indicator turns positive, so the simple payback period for this example will be 6 years (and this is taking into account the fact that the investment time was more than 1 year).

Calendar-network planning method

In undertakings related to capital construction, and these are the majority of investment projects, the planning method according to a calendar-network schedule is traditionally used. It is a model illustrating how the implementation of the plan will proceed in terms of time and process parameters. In fact, such a chart is a tool:

- analysis, description and agreement by all parties (investor, customer and general contractor) of the technology for carrying out construction work;

- current interaction between project participants;

- managing the initiative according to a number of indicators (resources, time, finances) and making the necessary adjustments;

- predicting potential problems and risks, compensating for them or minimizing their consequences.

However, people make schedules, so there are always problems keeping them. For example, if you draw up a scheme based on the development of capital investments, then when carrying out a number of parallel operations, overlaps in a positive or negative direction constantly arise. In this case, the critical path is often derived manually; it is not an economically justified calculated value, but is “drawn” by a certain date, which is regularly not observed.

In fact, schedules of this kind only impose time restrictions on lower-level performers, but are weakly dependent on other factors (readiness of necessary components or structures, logistics problems, availability of qualified personnel). In this case, the project manager cannot accurately predict its course and influence a potential problem in advance. Therefore, delays in the completion of individual stages and construction as a whole with this approach are not uncommon, as is the need for additional financing.

To avoid serious disagreements with contractors regarding the duration of certain operations, many customers hire engineering companies to draw up a plan. They carry out work in advance regarding the compilation of specialized databases or reference books, where the duration of typical or standard work is determined. Such directories allow you to avoid delays in processes on the part of contractors.

Sometimes the customer is forced to make a choice which is better: a fast but expensive option, or a longer but cheaper option. Practice shows that in initiatives in which the ultimate goal is to make a profit, the investor is more often inclined to the first option, because Reducing the duration of the pre-investment and investment phases allows for a faster return on investment. With social projects the situation may be different; here the price of the issue plays a big role.

More effective is calendar and network planning based on the technology for performing the required work. If there is a clearly defined technology agreed upon with the contractors and the investor, then the timing of all processes can be accurately written on the diagram and the critical construction path can be reasonably calculated. This approach helps to avoid delays in work, which entails additional costs for rent, overhead, staff maintenance, equipment maintenance, interest payments on loans, etc. In addition, thanks to this method, you can see who exactly is to blame for the delay due to an incorrect decision or failure to resolve a particular issue.

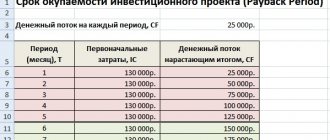

How to calculate simple payback period in Excel

The above examples can be easily calculated using a regular calculator and a piece of paper. If the data is more complex, Excel tables will come in handy.

Calculation of example No. 1

The calculation of the simple payback period is as follows:

Table 1: calculation formulas.

Table 2: calculation results:

Calculation of example No. 2

For a more complex option for calculating a simple payback period, the calculation in Excel is done as follows:

Table 1: calculation formulas.

Table 2: calculation results:

A similar calculation technique is used to calculate the discounted payback period, which will be discussed in the next chapter.

Arbitration robot

Arbitration robots implement a mechanism that allows you to make money on the difference in prices of an underlying asset and a futures contract for this asset, as well as on underlying assets traded on different exchanges. Thanks to a well-functioning mechanism for working with applications, as well as the ability to quote, the robot allows you to minimize time delays between opening a position in one asset and covering it in another, which makes it possible to earn money even on minor price fluctuations.

more details

Discounted payback period

What is it and what is it for?

A simple project payback period does not take into account changes in the value of funds over time. Taking into account current inflation, 1 million rubles today can buy much more than in 3 years.

The discounted payback period allows you to take into account inflation processes and calculate the return on investment taking into account the purchasing power of funds.

How is the discounted payback period calculated?

The calculation formula will look like this:

Calculation example

Despite the much more complex appearance of the discounted payback period formula, its practical calculation is quite simple.

The first thing to do is to calculate the future cash flows from the new business taking into account the discount rate.

Returning to our restaurant example, let's take a discount rate of 10%.

Discounted cash receipts for 4 years after opening a business will be equal (by year):

| Year: | Calculation of discounted cash flows | Calculation result (rubles) |

| 1 | 3 000 000 / (1+0,1) | 2 727 272 |

| 2 | 3 000 000 / (1+0,1)2 | 2 479 389 |

| 3 | 3 000 000 / (1+0,1)3 | 2 253 944 |

| 4 | 3 000 000 / (1+0,1)4 | 2 049 040 |

| Total: | 7 460 605 |

The total amount of cash receipts for 3 years will be 7,460,605 rubles, which is insufficient to return the investment in the amount of 9,000,000 rubles.

The uncovered part will be 1,539,395 rubles. Divide this amount by cash receipts in year 4:

1,539,395/2,049,040 = 0.75 years

Thus, the discounted payback period for this project will be 3.75 years.

Total revenues for 4 years will amount to 9,509,645 rubles, which will allow you to return the investment and receive a net profit of 509,645 rubles.

Custom development

The most important activity of Informicus is custom software development.

The solution ordered from us will meet all your requirements, solve any specialized problems exactly as you need it, and you will own all rights to the created application. The experience and competencies of the company’s specialists, the use of a wide range of advanced technologies, possession of the necessary knowledge in all key IT sectors and a deep understanding of the specifics of project implementation in the Russian market characterize our company as a highly effective supplier of software solutions and services. more details

How to calculate discounted payback period in Excel

To calculate the discounted payback period of a project, you can use mathematical formulas in Excel.

To add a second table with the calculation of the discount factor, where the discount factor is calculated using the formula = DEGREE, which is located in the section Formulas-mathematical formulas-DEGREE.

The calculation of the discounted payback period is as follows:

Table 3: calculation formulas.

Table 4: calculation results:

Development of trading robots

Our company has been developing applications for trading on the stock exchange since 2006. We create trading robots to work with various terminals (Quik, NetInvestor, etc.) and for exchange gateways (MICEX, RTS, PlazaII, Fix). Our specialists have accumulated extensive experience in implementing various trading strategies, creating standard solutions, passing certification of implemented applications and formalizing customer wishes with their strict algorithmic description.

more details

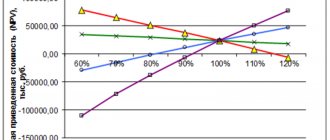

Analysis of the information received

Previously, we studied what the term or payback period of a project is, and also looked at how it is calculated. Next, the investor must make a financing decision. In this situation, it is necessary to rely on indicators such as profitability and profitability.

This is due to the fact that the higher the above-mentioned indicators, the shorter the duration of return of investments, while maintaining other equal conditions. The investor is not always focused on the fastest possible return. Sometimes he funds ideas that provide high returns in the future. And here it is important to consider that depending on the industry, the method and rate of payback period may vary. In any case, a prerequisite for a project start is increased profitability after successfully passing the zero point.

Investments: a specific issue

Methods for implementing investment projects traditionally arouse much greater interest among the public than work on social, industrial or other ones. It’s simple to explain - big money, great prospects, so anyone who plans to start investing and make a profit through it should know what methods of implementing investment projects are applicable in modern times.

Currently, the choice of investment projects is simply huge, and only after assessing the prospects for each available option, you can choose the best one for yourself, one that will lead to a decent profit. Making the right decision requires in-depth research into the issue, accompanied by a risk assessment.

Schedule Options

Main parameters of the calendar schedule:

- start and finish of work

- duration of work

- resource base

Project start date

Start and finish of work. Early start – the official start of work. Late finish – the date on which the work is scheduled to be completed. In addition, there is an even later start and early finish. The period between the initial dates and the closing dates is called slack. As a rule, the duration of the work remains the same, so the slack between early and late starts and early and late finishes will be the same.

Duration of work. Depends on the number of performers and their labor costs, the volume of work, customer requirements and other factors. Critical duration is the minimum within which the bulk of the work or even the entire project must be completed.

If we add up early start/late start and duration of work, we get early finish/late finish.

Resources. Resource constraints are taken into account when project development dates are set. After identifying the needs for all types of project work, the required amount of resources for each of them is calculated. Based on this, a graph of resource levels is constructed, the data of which is compared with the existing amount of resources. If the needs exceed the resource base, then it is possible to change the time in the calendar in order to cover them.

Does it work?

In order to assess how successful and correct the measures to translate the project into reality are, it is necessary to apply generally accepted methods for assessing effectiveness. To do this, they draw up a plan, analyze the project and calculate key evaluation indicators. The main task is to identify the fact of the presence of profit due to the implementation of the planned, and also to compare its value with the costs incurred by the investor.

Typically, investing involves long-term cooperation with the project, which significantly complicates the calculation of efficiency. To evaluate an investment correctly, you need to implement an implementation plan that describes each step of inclusion in the economic environment. The creation of a plan is subject to generally accepted criteria.