Visual Capitalist conducted research in 2021 according to which the most visited website in the world by a wide margin is google.com. The world's main search engine is visited approximately 60.5 billion times a month. Next up, YouTube is more than double behind (24 billion visits). Google is so closely associated with search that the verb denoting the process of finding the necessary information on the Internet is “Google.” Google supports and develops many different services and products and makes a lot of money from it. The company brings the most profit from contextual advertising implemented through its Ads. How much is Google worth now? Let's figure it out

About company

First, you need to decide what Google does and what it sells. Advertising. In fact, the world's largest Internet platform, on the basis of which many of the services we are familiar with exist, is a large Internet advertising agency. Google's revenue generation statistics show that the share of advertising did not fall below 85% of total revenue. That is, the services we are familiar with are just a tool to attract the attention of users in order to show them another advertising video.

In 2014, the owners of Google reorganized and the company became part of the newly formed Alphabet Inc. In addition to Google, the management company also included other Internet assets of the same owners. In addition to the purpose of the merger, the reorganization was also necessary for the future diversification of the business. Now Alphabet includes companies operating in areas other than the Internet. Google shares, however, are still publicly traded.

What Google Offices look like

The company's headquarters located in Washington is called Googleplex. It is considered the best technology campus in the world. Google was one of the first to pay great attention to the environment that surrounds employees. Therefore, all Google offices look very impressive. The company has focused on creating creative, very stylish and completely unusual work spaces. Moreover, each decision is individual and Google offices are different from each other.

In addition to salary, Google employees receive many additional options and bonuses. Many of them are hiding in the office itself. These include massage services, sports grounds, swimming pools and even climbing walls and mini golf courses.

It's no wonder that so many young professionals strive to get a job at Google.

Main shareholders

The creators (founders) and main shareholders of the Google project were (in 1998) Larry Page and Sergey Brin. Since 2006, they have pursued a policy aimed at refusing to pay any dividends on securities. Management prefers to invest all profits received in the development of the company and in the acquisition of new projects.

2014 was marked by a split. In return for the expected, at least partial, distribution of net profit among Google shareholders, the dividends resulted in a change in the types of Google shares: instead of Type “A” securities, shareholders were provided with Type “C” securities with the following restrictions and bonuses:

- For these shares (class C), voting rights were lost.

- However, the company's management committed to artificially maintain (guarantee) the price of the securities at a level not lower than before the replacement. To be precise, an additional payment is made if the exchange rate falls by more than 1% from the replacement price level.

In addition, Type “B” shares were also issued. If A and C are freely traded on the open market, then class B cannot be purchased by a private individual. One share corresponds to 10 votes (that is, ten - class A), and their entire issue belongs to the “founding fathers”:

- Larry Page;

- Sergey Brin;

- Eric Schmidt;

- some other persons (a few minority shareholders).

Important! The owners focused on the attractiveness of the enterprise, based precisely on the increase in the market value of shares. Therefore, they made sure that control over the company did not disappear from them.

Dossier

| Name | Public limited liability company Yandex N.V. |

| Registration date | September 4, 1998 |

| Founding Fathers | Sergey Brin, Harry Page |

| Industry | Internet |

| Place of registration | California, USA |

| Equity | for 2021 – $80 billion |

| The number of employees | more than 115,000 people |

How much does Google cost?

Security data

Here's some data on Google stock:

- Full name: Google Incorporated;

- Year of foundation – 1998;

- Headquarters location: Mountain View, California, USA;

- The platform on which the shares are listed is NASDAQ (since 2004);

- Tickers – GOOG (Type “C”), GOOGL (Type “A”);

- Number of shares (A + C) outstanding – 515,922,000;

- Number of shares (B) – 52 million;

- Face value: $85.

If you are wondering how to buy Google shares as an individual, it is definitely recommended to focus on buying class C securities. The securities classification system was created in order to exclude even the hypothetical possibility of an aggressive takeover of the enterprise. But at the same time, the founders are betting on the maximum possible increase in the price of securities. Therefore, the price of Google shares of different classes is approximately the same.

Important! It turns out that investing in Type A shares only makes sense if you want to participate in voting at the general meeting of shareholders. However, even if you buy all Google A-class shares, you still won’t gain control over the company, because management has 520 million votes on class B securities.

History of Google

Student search engine

Google was originally a research project of Stanford students Sergey Brin and Harry Page. Young people have developed a new search algorithm. The essence of the algorithm, if simplified, was that pages to which there are many links from other sites are obviously, all other things being equal, sites with less link mass that are more interesting. Therefore, they should be the most relevant in the search and should rank above others in the sample.

Google.com

At first, the student-developed search engine ran on Stanford's website. In 1998, Google, created by Brin and Page, received funding and the search engine switched to the Google.com domain. By the end of the year, it had already indexed more than 60 million pages. Over the next couple of years, Google grew rapidly and gained popularity among users around the world. The new search engine had a very simple and intuitive interface and a really good search algorithm. People started using Google and never returned to other search engines.

Advertising revolution

In 2000, Google began selling text ads that were directly linked to search keywords. This type of advertising loaded quickly, did not clutter the page, did not irritate the user, but at the same time worked effectively. That rare type of solution that everyone in the process liked. Google had been a rapidly growing company up to this point, but now the company’s revenues have become sky-high.

History of success

The company's founders initially viewed the project not as organizing just another Internet search engine, but as creating a multifunctional platform that could be of interest to users in several directions at once. This was the only way to count on an increasing flow of requests to the platform, and therefore to guarantee an increase in advertising revenue.

The chosen development strategy fully justified itself - the market appreciated the efforts of the organizers and Google’s capitalization only grew until 2007 (especially against the backdrop of the failure of many virtually fake projects in the field of high technology). Only in 2007 did a correction begin: stock quotes reached their bottom in the fall of 2008.

But after the problems of Fannie Mae and Freddie Mac (the largest US mortgage agencies, which became synonymous with the 2008 financial crisis) were stopped with government assistance, growth began in the IT sector. Until February 2014, the upward trend continued. Then, until June 2015, there was a long sideways movement of the trend due to a significant outflow of funds from US stock exchanges.

But already, starting in July 2015, Google shares have been demonstrating a long-term upward trend with elements of short-term corrections. As of today (November 2021), the stock is priced at over $1,300 per share and has a long-term growth outlook. Not a bad reason to buy Google shares.

Affiliated companies

Mentioning Google Incorporated, one cannot help but list Google’s subsidiaries, focused on providing “niche” Internet services, which are included in its structure:

- DoubleClick;

- Google Voice;

- YouTube;

- Google Foundation;

- On2 Technologies;

- Aardvark;

- AdMob;

- Zagat Survey;

- FeedBurner.

We can rightfully talk about the successful implementation of the idea of a multifunctional Internet platform.

How much does Google cost?

| Indicators | Value, dollars |

| Company's net worth in 2021 | ~80 billion |

| Google turnover | ~140 billion |

| The company's net profit in 2021 | ~33 billion |

| Total value of company assets | ~235 billion |

| Total capitalization at the beginning of 2021 | ~1.05 trillion |

Climbing wall at Google headquarters

How to buy shares?

If you are an individual, then the easiest way to buy Google shares in Russia is to work with a broker (with an SEC license) on the St. Petersburg Exchange PJSC platform. In this case, purchases/sales of shares are made online through an account opened with a broker using software installed on your computer. Payments for securities are made in USD.

And, of course, you can buy Google shares by gaining access (again, through a broker) directly to NASDAQ.

Features of dividing Alphabet shares into classes

The number of Alphabet shares of different classes is not constant. Google plans to issue GOOG shares (Class C) to reward its employees.

The number of Class B shares is not static either. Their holders periodically convert shares into classes traded on the exchange and sell them. For example, in 2015, Sergey Brin converted 48,998 Class B shares into Class A shares (GOOGL) to sell them. Accordingly, the weight of his vote at shareholder meetings decreased proportionally.

Ultimately, it doesn't make much difference to the average investor which Google stock to buy. If you do not plan to attend shareholder meetings and vote with your shares, then GOOG shares (Class C) are suitable for investment. And if you have serious plans for the development of the Alphabet holding and you are eager to share them with other shareholders, then it is better to choose GOOGL shares (class A).

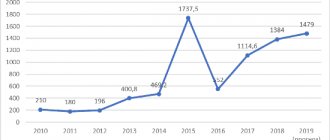

Cost chart, technical analysis

The prospects for the near-term price movement of Google's stock are best understood by comparison with past performance and data on how much the stock is worth now. This comparison is best done on graphs.

Google Class A stock price chart

Google Class C Stock Price Chart Below are trading recommendations for Class C shares based on technical analysis.

Carefully! The recommendations shown in the diagram above are only a guide. The decision to buy or sell shares must be made independently and responsibly.

What is the difference between different classes of Google shares?

As a result of the 1-for-1 split in 2014, the number of Alphabet shares doubled, and their price correspondingly halved. The shares obtained during splitting received a fundamental difference:

- Class A shares (GOOGL) – one share = one vote;

- Class B shares – one share = ten votes;

- Class C shares (GOOG) – do not have voting rights.

This means that the owners of class A shares, of which there are 298.3 million issued, have exactly the same number of votes, and the owners of class B shares, of which there are 47 million, have 470 million votes, which corresponds to 61%.

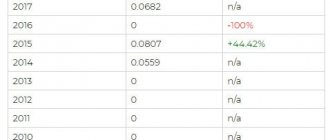

Due to the fact that GOOGL shares (class A) give the right to vote at shareholder meetings, their price on the market is always slightly higher than that of GOOG shares (class C). The exchange rate difference between them fluctuates, but it is always there.

Exchange rate difference between GOOGL and GOOG stock prices

Analytics and prospects

You can view Google's financial indicators for fundamental analysis in the box below. The stock price chart shows that starting in 2021, growth alternates with deep corrections. However, Google management is not sitting idly by. Competition on the Internet between serious players for the attention of users is increasing, and a qualitative change in the structure and system of displaying advertising to users is on the agenda. According to experts, this will lead to greater efficiency, and therefore to a new round of income growth for Internet services. And if you are an investor with “long-term” money, then buying Google shares is a completely logical and logical decision.

(

2 ratings, average: 5.00 out of 5)