From this article you will learn:

- Oil as an investment asset

- Factors influencing oil prices

- How to invest in oil

- Conclusion

Specifics of investing in oil

Prices for oil, as well as other natural resources, largely depend on what is happening on the world market. This means that even a high demand for energy resources will not protect investors from traditional risks, so energy investors always need to be aware of the latest events and closely monitor the state of affairs in the global economy and even politics. Investing in oil is considered a fairly liquid investment, but not in the short term, but in the long term.

Investments in oil do not imply the direct purchase of “black gold”. Today there are many options for investing money. For example, you can purchase futures or shares of a company that extracts raw materials. Some investors prefer mutual funds and other financial instruments.

Investment methods

How to invest in oil?

Oil production

Direct investment in own production.

The good thing about this method is that you will get a guaranteed source of income and quickly recoup your investment. Whatever the spot price on the market, it is still cheaper to simply pump out oil.

The minimum investment amount is from 100 thousand dollars (the cost of the field plus investments in development and equipment). A good project with several towers and a transport network will cost you $5 million. A lot, but not exorbitant. Disadvantage: tough competition for promising deposits (the weakest one drops out).

Oil refining

Direct investments in production and processing.

The demand, cost and profitability of subsequent processing products (for example, gasoline) are significantly higher than those of pure raw materials. Prices are much less volatile. Thus, during a period of subsidence in oil prices, the cost of gasoline does not change as much or does not change at all. The markup forms your income. The option is characterized by ideal reliability, payback and profitability. Disadvantage: building your own refinery will cost you at least $100 million.

Strategic Portfolio Investments

Long-term investments in shares of oil companies.

You have access to blue chips or shares of young companies with good growth potential. The spot price of shares depends on the price of oil and the prospects of the investment object (for example, access to new fields). Since the price of oil is a poorly predictable factor, investments only in oil-producing assets carry a high degree of risk. Investments in oil refining structures are more justified. Below is the TOP 10 largest oil and gas companies in the world (according to Forbes for 2021):

| Company | A country | Capitalization, billion dollars |

| Exxon Mobil | USA | 363,3 |

| Royal Dutch Shell | Netherlands | 210,0 |

| PetroChina | China | 203,8 |

| Chevron | USA | 192,3 |

| Total | France | 121,9 |

| Sinopec | China | 89,9 |

| Gazprom | Russia | 57,1 |

| Rosneft | Russia | 51,1 |

| Reliance Industries | India | 50,6 |

| Lukoil | Russia | 36,8 |

The largest foreign companies are listed on the New York or London stock exchanges and are united in the Amex Oil Index (XOI). Among the Russian oil assets traded on the Moscow Exchange, one can also highlight: Surgutneftegaz, Transneft, Tatneft, Bashneft.

Financial speculation

Direct investment is not for everyone. Long-term portfolio investments are less reliable. What remains? Short- and medium-term investments in shares of oil companies and their derivatives. The most popular and accessible way of investing, since the minimum entry threshold starts from $100. The investor has access to:

- operations on the spot market;

- games with derivative financial instruments (futures, options).

Any financial instruments based on this underlying asset are widely used because:

- the oil market is global in nature and its turnover is very significant on any stock exchange;

- as a result, financial instruments have high liquidity;

- the average price of futures instruments correlates well with the spot market, which gives the investor greater flexibility and maneuverability;

- the underlying asset is standardized, transactions are made quickly and remotely.

You can enter the market yourself as an individual investor (through a broker) or entrust your capital to professionals:

- private equity funds;

- Mutual funds specializing in oil trading;

- hedge funds.

When engaging in financial speculation, always remember that oil is a volatile and poorly predictable asset, which means you assume all risks. You can lose significant amounts due to price fluctuations.

Before entering the stock market:

- Determine the percentage of capital in your portfolio that you are willing to allocate to oil. Our recommendation is no more than 20%.

- Analyze political news and macroeconomic trends (there is not enough information on the Internet).

- Study the state of affairs not only of potential investees, but also of leading players. Remember that the market is highly concentrated and large players have a significant influence on it.

- Choose the right moment to enter. Consider the seasonality factor (the greatest demand is observed in summer and winter).

- Understand the mechanics of spot and futures contracts thoroughly.

- Choose a reliable intermediary.

Main factors influencing the price of oil

In order to make money, you will have to take into account the main factors influencing the cost. Which of these factors are the most important?

- The first factor is quotas for the production of “black gold” . They are introduced by OPEC. This organization includes the largest exporters, among which Saudi Arabia and other Arab states have the greatest influence. If OPEC decides to cut oil production, this will lead to higher prices, although the total earnings of exporting countries will become less.

- We must not forget about political events. Increasing tensions in exporting countries could lead to a sharp increase in the cost of “black gold.” For example, political events in the Persian Gulf (a region where large oil reserves are concentrated) often cause a significant increase in prices.

- Supply disruptions are just as important, so if one of the oil-exporting countries is unable to meet demand, this can also cause prices to rise.

- The exchange rate of the American dollar deserves special attention , because the price of oil is tied to this currency. If the dollar becomes weak, then oil becomes more expensive. This pattern is a clear example of how important energy resources are for the global economy.

- If a country increases production volumes, it is natural that this leads to lower prices. This is usually what states that urgently need money do. At the height of the recent economic crisis, the Venezuelan authorities did everything possible to increase the volume of production of raw materials, which led to a drop in prices.

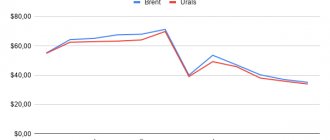

Why use technical analysis for the oil market

The oil market has long been of interest to both professional and private investors around the world. Indeed, like most other commodities, crude oil is considered a particularly interesting speculative asset due to its high volatility, which provides significant benefits. However, the ability to understand the dynamics of bullish or bearish trends will only increase if market reactions are analyzed on charts. Technical analysis is also interesting if you work with trading platform tools such as CFDs, as they will allow you to spot short-term trends and real day-to-day opportunities.

Advantages and disadvantages of investing in oil

Investing in oil has both advantages and disadvantages, so every smart investor should know as much as possible about them.

Advantages:

- High profit . Recently, new technologies have made it possible to significantly simplify the process of drilling new wells and searching for oil even in the most inaccessible places on the planet. This had a very positive impact on investment risks. Currently, shares of commodity companies show growth if they manage to find new deposits, and new technologies have greatly facilitated this process.

- Benefits from the state . Typically, those who invest in shares of oil companies can receive tax benefits, so the investor can earn additional profits.

- Diversification . In order to offset the decline in other areas, you can invest in oil reserves. When energy prices rise, global economic growth tends to slow, so investing in oil is an ideal tool to balance your investment portfolio.

Flaws:

- Political risks arise from the fact that many wells are located in unstable countries. A clear example is Venezuela, where protests have not subsided for many months, and millions of people have been forced to leave this country and become refugees. A similar situation is observed in some African and Asian countries that are exporters of energy resources.

- We must not forget about the geological risks associated with incorrect assessment of oil reserves. Difficult terrain can cause geologists to make mistakes and estimate oil reserves incorrectly. In this case, it will no longer be possible to return the money spent on developing the oil field.

- Incidents often lead to a serious decline in stock prices of commodity companies. The disaster in the Gulf of Mexico in 2010 caused a drop in stock prices for a company that was developing a field in the region.

How to predict changes in oil market prices

The oil market is a very volatile market that sometimes goes up and down. So how can we anticipate and therefore predict the future evolution of the oil market? There are two methods that allow you to predict as many future trends in this market as possible, depending on whether you want to invest short term or long term.

For long-term investment strategies, we will prioritize opportunities for developments in supply and demand. Demand is determined primarily by oil consumption by oil importing countries and industrialized countries. In fact, it is the industrial sector that consumes most of the oil. Thus, periods of economic growth often tend to increase the demand for oil and therefore increase the price of a barrel. By analyzing the growth prospects of industrialized countries, we can predict the trend that global demand will show in the coming years. Analysts are unanimous on this point, as is the International Energy Agency, which, according to a recent report, estimates that oil demand is set to rise until at least 2035, despite increases in other forms of energy. As for supply, this is determined primarily by oil production in OPEC countries, Russia and the USA, which are the main suppliers of black gold. This supply is partly controlled by OPEC, which imposes production quotas on member countries whose main purpose is to prevent barrel prices from falling. In this way, the market is partially protected from falling prices too significantly.

When it comes to short-term strategies, the method that should be used to predict the evolution of the oil market is very different. Of course, it is based mainly on technical analysis, since oil is a speculative asset that greatly influences the psychological effect of the market. Thus, it is necessary to know how investors will take their strategic positions to determine the future trend of oil prices. To do this, you can also use fundamental data, which is known to have an almost immediate impact on prices. This is especially true for the weekly release of US inventories on the economic calendar, the value of the US dollar against the euro, OPEC decisions, as well as geopolitical developments that affect oil exporting countries. While these events have a clear impact on the market, they must also consider investors' expectations of these releases before they take their positions.

Regardless of your investment horizon, you can globally anticipate the evolution of the oil market to establish effective strategies. However, be sure to secure your positions by placing stop orders at high and low levels that you do not want to exceed.

What you need to know about the oil futures market

An oil futures is a contract to buy or sell oil on a specific day at the current market price. All platforms where futures can be purchased are designated by the term “forward market”.

Futures contracts have been among the leaders in volatility for many years. This becomes obvious if you look at the derivatives market of the Moscow Exchange. You can make a lot of money on futures, but to do this you need to have accurate information that oil prices will go up soon. Sometimes investors are willing to pay huge amounts of money for inside information from large oil companies, whose employees may know what actions the company's management will take and what it may lead to.

Buy and manage oil with CFD

The trading instruments best suited to oil speculation are undoubtedly CFDs. These CFDs allow you to take a buy or sell position on the price of a barrel of oil.

Using CFDs is very simple and takes place on the trading platform. It is enough to bet on a buy position at the current price if you foresee that prices will increase, or a sell position if you think they will fall. When you close your position, and if the trend has changed in the direction you predicted, you will receive the difference between the purchase price and the sale price. The leverage effect also allows you to take advantage of all price variations, even the weakest ones. This leverage effect can multiply your investment by 100, 200, or even 400, which also multiplies your profits (but also increases your risk of loss).

Of course, there are many options that allow you to manage the risk level of your positions or schedule them to automatically close when a pre-set limit is reached.

How else can you make money on oil?

Which of all the modern investment tools can be recommended to an individual - an ordinary person who does not have deep knowledge of economics, but wants to become an investor?

Every individual who would like to make money on investments can use both futures contracts and options. To avoid being left in a difficult position, investors are advised to determine in advance how much they can invest. After this, you need to choose the most suitable tool, study the market and (if possible) obtain reliable information about what awaits the energy market in the future.

You can make a profit both by trading futures and by purchasing shares of companies operating in the commodity sector. It is not uncommon for individuals to purchase options or participate in mutual funds.

It will be more profitable for individuals with large capital to purchase shares, but a small capital will not allow them to earn big money from this, because transaction costs will be too expensive.

Oil flows through pipes like blood through veins. If problems arise in the oil market, the whole world suffers from it. A clear example is the events of 1973, when a number of European countries suffered from an embargo by Arab states that were dissatisfied with the policies of the West. This has led to a 70% increase in prices, so investing in oil can make fabulous money, provided that you follow the basic rules of investing and know how to analyze market events.

Let's sum it up

Is it possible to make money from oil? The question is rhetorical, but still:

- Direct investments in production are justified provided the deposits have good potential and the ability to organize a transport network.

- Direct investments in processing are justified, but require high costs.

- Long-term portfolio investments are justified only after a thorough analysis of markets and investment objects. At the same time, the investor takes on increased risks due to price volatility.

- Short- and medium-term investments are possible and have the potential to generate excess returns in a few months in any market (falling or rising). A high degree of risk remains - use hedging tools.

The choice is yours.

About the situation with Iran

Bloomberg reported that Iran is making preparatory work to quickly increase oil production if an agreement is reached on a nuclear deal and American sanctions are lifted. According to the most optimistic forecasts, Iran will be able to return to production levels of 4 million barrels per day within three months.

Negotiations are currently underway in Vienna on the return of the United States and Iran to the Joint Comprehensive Plan of Action (JCPOA) on the Islamic Republic’s nuclear program. The previous American President Donald Trump decided in 2021 to withdraw from the JCPOA. This agreement was signed with Iran by the five permanent members of the UN Security Council and Germany in 2015 to resolve the crisis over the Islamic Republic's nuclear development.

Current US President Joe Biden has repeatedly signaled his readiness to return the US to the JCPOA. Iranian President Hassan Rouhani warned in a March 2 phone call with his French counterpart Emmanuel Macron that the only way to preserve the JCPOA is for Washington to lift sanctions against Tehran.

Profitable or not

First you need to consider what a share is and what advantage it gives, as well as how it will bring money to its owner. So, a share is a security; its owner has the right to part of an enterprise or business, and accordingly must receive profit from the activity. That is, the buyer of the shares actually becomes a co-owner of the business, which means that before investing your money in shares you need to make sure that the business is truly profitable.

Buying shares can generate income in two ways. The first type of profit is dividends, or in simple words, part of the profit from the activities of the enterprise; its size will depend on the number of securities. The second way to earn money is by buying shares for the purpose of subsequent resale, and this method is more popular. The scheme is quite simple: an investor buys shares on the stock exchange and when demand, and therefore the price for them, increases, he sells them and makes a profit from the difference in price.

If we talk about benefits, it is almost impossible to predict it. For example, at any time a business may go bankrupt, then the owner will not be able to sell his securities, but will have a profit from the sale of property after liquidation.

Advantages

Many people find investing in stocks quite simple and profitable, and there are several reasons for this:

- To become a business owner, you need to go through the registration procedure, find start-up capital and go through all stages of organizational activities. And purchasing securities allows you to avoid all the difficulties and become a co-owner of an enterprise at the stage of its growth and development.

- Shareholders do not run the business, that is, they do not need to be directly involved in the “life” of the enterprise.

- The investor does not need to keep accounts or report to the tax office.

- For a shareholder, you only need to have money that he will deposit with the help of a broker and will regularly receive profit from it.

In fact, the investor does not need to have high entrepreneurial potential and business skills; at the same time, he becomes a co-owner of a ready-made enterprise.

Where to invest money

In order to correctly choose a business in which it will be profitable to invest money, you need to correctly understand the meaning of investing. First, you need to consider why the company sells shares, and it does this in order to obtain additional funds for growth and development. In simple words, the founder attracts money to his enterprise, uses it to increase production volumes, receives more profit himself and gives part of it to the investor.

The advantage of investing is that the investor himself does not need to invest labor resources in the enterprise; he makes a profit without participating in the process of business management.

The main criterion for choosing an enterprise is stability, that is, it must exist on the market for a long time, grow and develop. So, many choose companies such as Sberbank or Gazprom. There are many other organizations that are ready to sell their securities, the main thing is to carefully search in any available way: through a broker, directly from the company itself, from the owners of the shares.