Content

- The coronavirus pandemic has increased the number of voluntary liquidations of banks

- Lending growth in the main segments will continue to be ensured by government support programs

- At the end of 2021, the net profit of the sector will decrease by 20–30%

- In 2021, we expect stagnation in net interest income and an increased role of commission income and income from investments in non-core businesses

- The role of banks in the real sector of the economy is significantly increasing

- Application. Tables

Lyudmila Kozhekina, director, bank ratings

Ruslan Korshunov, senior director, ratings of credit institutions

Alexander Saraev, Managing Director, Bank Ratings

- The coronavirus pandemic has increased the number of voluntary liquidations of banks. As a result, at the end of 2021, for the first time, the number of voluntarily liquidated banks exceeded the number of revoked licenses.

- Despite large-scale concessional loan programs in 2020, the sector’s credit activity indicator (the ratio of the loan portfolio of individuals and legal entities to the funds raised by individuals and legal entities) decreased by 2 percentage points to 76%, as lending grew more slowly than the resource base.

- Lending in key segments will continue to be provided by government support programs, but its growth rate will be lower than last year due to the winding down of a number of programs.

- We expect a deterioration in the quality of about 20–30% of restructured corporate loans and at least 20% of concessional corporate loans, which will require additional provisioning of up to 900 billion rubles.

- Despite the increase in loan rates, banks will not be able to maintain their net interest margin at the 2021 level due to low lending growth rates and a rapid increase in funding costs.

- At the end of 2021, the net profit of the sector will decrease by 20–30% against the backdrop of increased contributions to reserves, a compression of the net interest margin and a decrease in income from foreign exchange revaluation.

- In 2021–2022, we expect stagnation in net interest income and an increased role for commission income and income from investments in non-core businesses. As a result, banks will become one of the key investors in the real sector of the economy.

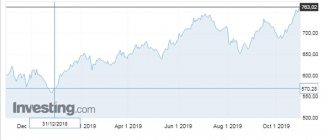

US dollar exchange rate forecast for tomorrow, week and month.

| date | Day | Min | Max | Exchange rate (forecast) |

| 05.27 | Thursday | 72.25 | 74.54 | ▼ 72.25 -1.59% |

| 05.28 | Friday | 69.84 | 74.66 | ▲ 74.66 1.69% |

| 05.31 | Monday | 74.33 | 74.99 | ▲ 74.33 1.26% |

| 06.01 | Tuesday | 72.89 | 75.77 | ▼ 72.89 -0.69% |

| 06.02 | Wednesday | 71.92 | 73.86 | ▼ 71.92 -2.05% |

| 06.03 | Thursday | 69.88 | 73.96 | ▲ 73.96 0.76% |

| 06.04 | Friday | 73.07 | 74.85 | ▼ 73.07 -0.45% |

| 06.07 | Monday | 72.54 | 73.60 | ▲ 73.60 0.28% |

| 06.08 | Tuesday | 73.24 | 73.96 | ▲ 73.96 0.76% |

| 06.09 | Wednesday | 72.28 | 75.64 | ▼ 72.28 -1.54% |

| 06.10 | Thursday | 72.01 | 72.55 | ▼ 72.55 -1.17% |

| 06.11 | Friday | 71.50 | 73.60 | ▲ 73.60 0.28% |

| 06.14 | Monday | 72.66 | 74.54 | ▲ 74.54 1.53% |

| 06.15 | Tuesday | 73.26 | 75.82 | ▼ 73.26 -0.19% |

US dollar to ruble exchange rate today 05/26/2021 in real time

The coronavirus pandemic has increased the number of voluntary liquidations of banks

In addition to the forced revocation of licenses, the trend towards a reduction in the number of banks is intensifying against the backdrop of unfavorable economic conditions, increased competition for quality borrowers and increased requirements for the level of digitalization of banking services. Thus, in the last three years, banks have been actively participating in M&A transactions, and have also begun to consolidate subsidiary banks more often in order to reduce the group’s costs. It is increasingly difficult for small and medium-sized banks to maintain acceptable profitability and business dynamics with weak opportunities to increase their client base, which pushes their owners to exit the banking business by selling it or voluntarily surrendering their license. In 2021, for the first time, the number of voluntary liquidations of 1 credit institutions exceeded the number of revoked licenses (22 credit institutions versus 16). Moreover, the number of banks affiliated with other players over the past three years has been stable (10–12), and the number of banks that voluntarily surrendered their licenses last year has increased noticeably (from 2 in 2019 to 9 in 2020). We expect the number of voluntary liquidations of credit institutions to remain high over a three-year horizon. According to our estimates, at least 15 banks annually will voluntarily leave the market as part of joining larger players or in connection with the voluntary surrender of their license.

Despite the unstable economic situation in 2021, the number of bank ratings upgraded by the Expert RA agency increased slightly compared to 2019, and the number of downgraded ratings decreased by more than three times. The agency's rating actions reflect the banking sector's resilience to the current crisis. The rating upgrades affected banks that have a sustainable business model and sufficient margin of safety to absorb the effects of an economic downturn. At the same time, the agency changed the forecast for the ratings of 26 banks, which is four times more than in 2019, more than half of them were revised downward 2. The change in the forecast to negative affected banks whose business model is most exposed to risks due to the pandemic coronavirus. However, based on ongoing monitoring of the dynamics of their financial stability, we expect that most of them will overcome the current difficulties.

Lending growth in the main segments will continue to be ensured by government support programs

The forecast of the Expert RA agency assumes the absence of repeated strict quarantine and other significant restrictive measures in connection with the COVID-19 pandemic, as well as the maintenance of sanctions pressure at the current level until the end of 2021. Despite the sharp increase in inflation at the beginning of this year, we believe that the inflation level at the end of 2021 will not significantly exceed the target due to the progressive tightening of monetary policy. At the same time, according to our estimates, the next increase in the key rate will occur no earlier than the 2nd half of 2021; at the end of the year, we expect the key rate to be in the range of 5–5.25%.

Lending growth will continue to be limited by the weak increase in real disposable income of the population (+3 against a decline of 3.5% in 2020) and GDP (+3.2 against a decline of 3.1% in 2020), as their the increase will be restorative and, in fact, will compensate for the decline of last year.

Table 1. Key macroeconomic forecast assumptions

| 2020 (fact) | 2021 (forecast) | |

| Real GDP growth rate, % | -3,1 | 3,2 |

| Inflation rate at the end of the year, % | 4,9 | 4,1–4,5 |

| Key rate of the Bank of Russia (at the end of the year), % | 4,25 | 5–5,25 |

| Brent oil price, dollars per barrel (annual average) | 56 | 62 |

| Average annual exchange rate RUB/USD, rub. | 74 | 72 |

| Real disposable income, % | -3,5 | 3 |

Source: Expert RA forecast

We expect that lending growth rates in 2021 will be lower than in 2020, mainly due to a reduction in the issuance of preferential loans under government support programs, which were the driver of lending growth last year. Concessional lending programs are becoming increasingly important for ensuring economic growth due to the increasing shortage of quality borrowers. Without government subsidies, interest rates on preferential loans do not cover the level of risk and do not provide sufficient margins for banks. At the same time, many borrowers will not be able to service loans at the level of interest rates that banks are ready to offer them on market conditions without government subsidies. Therefore, over the medium term, lending growth in key segments will continue to be ensured by government support programs.

Thus, despite the record nominal growth of the SME loan portfolio in 2021 (+23%) excluding issuances under preferential programs (see Table 2 in the Appendix), the SME loan portfolio, according to our estimates, would have decreased by 7%. In the mortgage and car lending segments, about half of the issuances were also provided by preferential lending programs; excluding them, at the end of 2021, the growth of portfolios was about 11 and 4%, respectively (taking into account state programs, 24 and 8%, respectively). As for the dynamics of lending to large businesses, more than half of the portfolio growth in 2021 was provided by currency revaluation; without taking it into account, the portfolio grew slightly (+4%).

In 2021, only the most marginal lending segments (unsecured consumer loans and car loans) will show growth rates slightly higher than last year’s. According to our estimates, the car loan portfolio will increase by 9%, including due to the extension of the “First Car” and “Family Car” preferential car loan programs; without taking into account these programs, the growth will be more restrained and will be about 5%. The growth of the portfolio of unsecured consumer loans - the only lending segment that is not affected by state support programs - will amount to 10% in 2021 versus 9% in 2020. From the 2nd half of 2021, we predict some slowdown in consumer lending if the regulator decides on the need to disincentivize active issuance of loans to borrowers with a high debt load.

We expect that the preferential mortgage lending program will be extended until the end of 2021, but with significant restrictions (in terms of the number of regions, increasing the down payment amount, and reducing the maximum housing cost limit). In addition, rising interest rates and rising housing costs will restrain the growth of mortgage lending. As a result, mortgages will remain the market driver, however, the growth rate of the portfolio will decrease to 15 at the end of 2021 versus 24% in 2020, while excluding issuances under the preferential mortgage program, the growth will be only 7%.

Against the backdrop of the winding down of a number of preferential lending programs for SMEs 3 in 2021, we expect the growth of the SME loan portfolio to be within 15% compared to 23% last year, without taking into account issues under state support programs, the portfolio growth will not exceed 6%. In turn, the portfolio of loans to large businesses will show dynamics at the level of last year (excluding currency revaluation + 3–4%), since in connection with the coronavirus pandemic, many large companies have cut capital expenditures, which has led to an increase in the volume of free liquidity.

In 2021, according to our estimates, the guarantee portfolio will increase by 12% compared to 10% in 2020. The guarantee market will be supported by an increase in the volume of government procurement against the background of a planned increase in spending on national projects (by 4.4%, to 2.25 trillion rubles), a significant part of which is related to the development of road infrastructure. The guarantee business remains one of the most attractive for banks due to the low default rate. Even with payments rising to a record 0.5% in 2021, default rates on guarantees remain significantly lower than on loans. Due to the stabilization of the economic situation in 2021, according to our estimates, the disclosure of guarantees will noticeably decrease compared to 2020 (to 0.3%), but will remain quite high compared to 2019, since the moratorium period expired at the beginning of 2021 to the bankruptcy of companies from affected industries.

Chart 4. In 2021, the growth rate of the guarantee portfolio will accelerate, and the level of disclosure will decrease

Source: data from the Bank of Russia and public reporting of banks, forecast by Expert RA

Russian banks: financial results of the 1st quarter of 2021

The banking sector emerged from the acute phase of the crisis earlier than the rest of the economy. Corporate lending growth is slowing. Lending to individuals was supported by preferential mortgages. The crisis loan restructuring is basically over. The volume of household deposits is declining. The largest banks earned good profits. Analysis of the main volumes of problem assets is still ahead.

The banking sector returned to normal operations earlier than many sectors of the economy. In the 1st quarter of 2021, key performance indicators of banks grew slowly. According to the Bank of Russia, in the 1st quarter of 2021, bank assets grew by 3.1%, taking into account the impact of currency revaluation, and amounted to 107.7 trillion. rubles

The volume of loans to individuals in the 1st quarter of 2021 increased by 4.4% and amounted to 21.2 trillion. rubles Mortgage remains an important driver of growth in the retail loan portfolio due to the popularity of the “preferential mortgage at 6.5% per annum” program; in total, more than 1.3 trillion in loans were issued during this program. rubles Due to increased consumer activity, the issuance of car loans and unsecured consumer loans has intensified. The share of overdue loans to individuals at the end of the quarter was 4.6%.

The volume of loans to legal entities for the 1st quarter of 2021 increased by 1% and amounted to 46.9 trillion. rubles The share of overdue loans to enterprises amounted to 6.7% at the end of the quarter.

Since April 2021, banks have carried out a large-scale program of restructuring loans to enterprises and individuals totaling 7.4 trillion. rubles, which is about 11% of the total loan portfolio. In total, 1.9 million loan agreements with individuals were restructured for a total of 914 billion rubles. 99 thousand loan agreements worth 907 billion rubles were restructured for small and medium-sized businesses. Loans to large business companies were restructured in the amount of 5.5 trillion. rubles or 15.3% of the total loan portfolio.

According to Bank of Russia forecasts, 20%-30% of restructured loans will turn out to be problematic, which will amount to only 2%-3% of the total loan portfolio.

The capital reserve of the banking system at the end of the 1st quarter of 2021 is estimated by the Central Bank at 6 trillion. rubles or 10% of the consolidated loan portfolio. This is exactly the volume of loans that banks will be able to write off from their own funds, if necessary, without violating mandatory standards. However, the regulator assumes that, taking into account the sale of the pledged property, a much smaller amount will have to be written off. At the same time, in the banking system, the capital stock is distributed very unevenly between banks, and a number of banks may suffer seriously in the process of sorting out problem assets.

Individuals' funds in banks decreased in the 1st quarter of 2021 by 2.6% to 32.1 trillion. rubles excluding balances in escrow accounts. This is explained both by the traditional outflow of deposits in January and by low interest rates. At the same time, both the volume of bank deposits and the balances on current accounts of individuals decreased.

The total volume of deposits and funds of organizations in accounts increased by 1.9% to 33.5 trillion. rubles

The profit of the banking sector for the 1st quarter of 2021 amounted to 578 billion rubles, which is 9% higher than the result of the 1st quarter of 2021. According to the results of the 1st quarter of 2021, 109 banks showed losses. At the same time, the share of assets of profitable banks is 98% of the total assets of the banking system, i.e. It was mainly small banks that were unprofitable.

The situation in the country's largest banks can be found in more detail in the tables below. These data are provided without taking into account the impact of currency revaluation.

Table 1

Banks with the maximum size of loan portfolio to enterprises

| No. | Name of the bank | Loan portfolio size as of April 1, 2021, million rubles | Loan portfolio size as of January 1, 2021, million rubles | Change, million rubles | Change, % |

| 1 | SberBank | 14 799 327 | 14 397 360 | 401 966 | 3 |

| 2 | VTB | 7 308 406 | 7 676 618 | -368 212 | -5 |

| 3 | Gazprombank | 4 293 445 | 4 329 187 | -35 742 | -1 |

| 4 | Credit Bank of Moscow | 2 371 538 | 2 170 426 | 201 111 | 9 |

| 5 | Alfa Bank | 2 281 175 | 2 020 794 | 260 380 | 13 |

| 6 | Rosselkhozbank | 2 231 114 | 2 288 867 | -57 752 | -3 |

| 7 | Bank opening | 1 294 167 | 1 152 424 | 141 743 | 12 |

| 8 | Trust | 984 911 | 898 064 | 86 846 | 10 |

| 9 | UniCredit Bank | 559 325 | 483 215 | 76 109 | 16 |

| 10 | Raiffeisenbank | 528 934 | 519 192 | 9 742 | 2 |

| 11 | Russia | 473 156 | 458 880 | 14 276 | 3 |

| 12 | Sovcombank | 432 036 | 324 021 | 108 015 | 33 |

| 13 | All-Russian Regional Development Bank | 416 142 | 390 909 | 25 233 | 6 |

| 14 | Novikombank | 405 005 | 386 341 | 18 664 | 5 |

| 15 | Saint Petersburg | 356 931 | 359 851 | -2 920 | -1 |

| 16 | Rosbank | 289 121 | 285 661 | 3 459 | 1 |

| 17 | Peresvet | 249 457 | 220 805 | 28 652 | 13 |

| 18 | Bank DOM.RF | 209 060 | 180 890 | 28 169 | 16 |

| 19 | SMP Bank | 150 183 | 120 557 | 29 626 | 25 |

| 20 | Citibank | 141 090 | 118 350 | 22 739 | 19 |

Source – data from the Bank of Russia and the Banki.Ru portal

As we can see, most large banks actively increased corporate lending. In absolute terms, the volume of the loan portfolio to enterprises Sberbank, MKB, Alfa-Bank and Sovcombank significantly increased. A decrease in the volume of the loan portfolio was shown by VTB, Gazprombank and Rosselkhozbank.

Let us remind you that Peresvet Bank is undergoing a financial recovery procedure. And National Bank "Trust" became a bank of "bad debts" that were transferred to "Trust" from the banks of the notorious "Moscow Ring". The reporting of Promsvyazbank, which is now being transformed into a bank for working with defense industry enterprises, has ceased to be published on the Bank of Russia website in full. Therefore, this bank with a large loan portfolio is not included in our rating.

table 2

Banks with the maximum loan portfolio for individuals

| No. | Name of the bank | Loan portfolio size as of April 1, 2021, million rubles | Loan portfolio size as of January 1, 2021, million rubles | Change, million rubles | Change, % |

| 1 | SberBank | 8 628 240 | 8 471 928 | 156 312 | 2 |

| 2 | VTB | 3 387 637 | 3 269 967 | 117 669 | 4 |

| 3 | Alfa Bank | 944 959 | 883 791 | 61 167 | 7 |

| 4 | Gazprombank | 667 966 | 656 069 | 11 897 | 2 |

| 5 | Rosselkhozbank | 568 596 | 555 246 | 13 349 | 2 |

| 6 | Rosbank | 519 067 | 372 208 | 146 858 | 39 |

| 7 | Bank opening | 485 873 | 459 475 | 26 397 | 6 |

| 8 | Tinkoff Bank | 422 557 | 412 706 | 9 851 | 2 |

| 9 | Post Bank | 417 081 | 451 685 | -34 603 | -8 |

| 10 | Sovcombank | 347 876 | 331 850 | 16 026 | 5 |

| 11 | Raiffeisenbank | 316 754 | 320 276 | -3 521 | -1 |

| 12 | Bank DOM.RF | 222 159 | 166 164 | 55 994 | 34 |

| 13 | Bank Uralsib | 174 265 | 170 441 | 3 824 | 2 |

| 14 | Home Credit Bank | 170 670 | 174 104 | -3 433 | -2 |

| 15 | UniCredit Bank | 148 523 | 157 930 | -9 406 | -6 |

| 16 | Setelem Bank | 139 513 | 141 697 | -2 183 | -2 |

| 17 | Credit Bank of Moscow | 138 785 | 136 766 | 2 018 | 1 |

| 18 | Russian standard | 131 873 | 131 001 | 872 | 1 |

| 19 | MTS Bank | 125 988 | 118 228 | 7 760 | 7 |

| 20 | AK Bars | 125 953 | 89 004 | 36 948 | 42 |

Source – data from the Bank of Russia and the Banki.Ru portal

In absolute terms, the portfolio volumes of Sberbank, VTB and Rosbank increased the most. At the same time, the growth of Rosbank’s indicators can be partly explained by the merger of its retail subsidiary Rusfinance Bank in March. The volume of the loan portfolio of market leaders – Sberbank and VTB – still significantly exceeds the volume of loan portfolios of other banks.

In relative terms, the volume of portfolios of Bank DOM.RF and AK Bars significantly increased. Some banks, including those that previously traditionally focused on retail, have noticeably slowed down the pace of portfolio expansion. Let us remind you that Uralsib Bank is undergoing a financial recovery procedure.

Table 3

Banks with the maximum amount of overdue loans in the consolidated loan portfolio

| No. | Name of the bank | Overdue amount as of April 1, 2021, million rubles | Overdue amount as of January 1, 2021, million rubles | Change, million rubles | Change, % |

| 1 | SberBank | 809 193 | 793 445 | 15 747 | 2 |

| 2 | Trust | 711 891 | 694 948 | 16 942 | 2 |

| 3 | VTB | 330 303 | 330 368 | -65 | 0 |

| 4 | Bank opening | 185 444 | 182 973 | 2 471 | 1 |

| 5 | Rosselkhozbank | 153 365 | 161 365 | -8 000 | -5 |

| 6 | Alfa Bank | 148 976 | 146 284 | 2 691 | 2 |

| 7 | Peresvet | 130 478 | 131 737 | -1 259 | -1 |

| 8 | Gazprombank | 106 845 | 146 760 | -39 915 | -27 |

| 9 | Moscow Industrial Bank | 97 384 | 95 364 | 2 019 | 2 |

| 10 | BM-Bank | 84 904 | 85 664 | -759 | -1 |

| 11 | Russian standard | 59 136 | 51 934 | 7 201 | 14 |

| 12 | Roscosmosbank | 55 490 | 55 509 | -19 | 0 |

| 13 | Credit Bank of Moscow | 50 573 | 54 661 | -4 088 | -7 |

| 14 | Sovcombank | 47 120 | 45 329 | 1 790 | 4 |

| 15 | Bank DOM.RF | 45 653 | 45 038 | 615 | 1 |

| 16 | Tinkoff Bank | 45 105 | 39 787 | 5 317 | 13 |

| 17 | Investtorgbank | 43 648 | 45 710 | -2 062 | -5 |

| 18 | Post Bank | 42 415 | 37 679 | 4 736 | 13 |

| 19 | Tavrichesky Bank | 41 178 | 41 224 | -45 | 0 |

| 20 | Moscow Regional Bank | 41 105 | 48 410 | -7 304 | -15 |

Source – data from the Bank of Russia and the Banki.Ru portal

The table shows the total delinquency of banks on loans to enterprises and individuals. Russian Standard Bank, Tinkoff Bank and Pochta Bank significantly increased their overdue volumes in relative terms. And Gazprombank and Mosoblbank were the best at analyzing problem debts. Let us remind you that BM-Bank, Mosoblbank, Investtorgbank, Peresvet Bank and Tavrichesky Bank are undergoing a financial recovery procedure.

Taking into account the worsening economic situation, the Bank of Russia expects an increase in overdue and problem loans, which will be smoothed out due to the restructuring of some loans within the framework of credit holidays provided for by law or banks’ own programs.

Table 4

Largest banks by volume of enterprise funds

| No. | Name of the bank | Amount of enterprise funds as of April 1, 2021, million rubles | Amount of enterprise funds as of January 1, 2021, million rubles | Change, million rubles | Change, % |

| 1 | SberBank | 10 131 086 | 7 568 170 | 2 562 915 | 34 |

| 2 | VTB | 8 153 185 | 6 072 097 | 2 081 088 | 34 |

| 3 | Gazprombank | 4 395 293 | 3 864 737 | 530 555 | 14 |

| 4 | Alfa Bank | 2 065 621 | 1 791 216 | 274 404 | 15 |

| 5 | Rosselkhozbank | 1 686 910 | 1 418 989 | 267 920 | 19 |

| 6 | Credit Bank of Moscow | 1 502 437 | 1 386 995 | 115 442 | 8 |

| 7 | National Clearing Center | 1 492 021 | 830 863 | 661 158 | 80 |

| 8 | Bank opening | 933 079 | 784 189 | 148 890 | 19 |

| 9 | Russia | 725 782 | 708 590 | 17 192 | 2 |

| 10 | Sovcombank | 711 332 | 496 984 | 214 347 | 43 |

| 11 | All-Russian Regional Development Bank | 695 086 | 629 410 | 65 676 | 10 |

| 12 | UniCredit Bank | 676 989 | 668 898 | 8 090 | 1 |

| 13 | Rosbank | 626 790 | 586 542 | 40 247 | 7 |

| 14 | Novikombank | 479 067 | 458 875 | 20 191 | 4 |

| 15 | Raiffeisenbank | 465 720 | 484 319 | -18 598 | -4 |

| 16 | Citibank | 406 896 | 362 490 | 44 406 | 12 |

| 17 | AK Bars | 361 463 | 372 028 | -10 564 | -3 |

| 18 | BM-Bank | 316 152 | 308 898 | 7 253 | 2 |

| 19 | Bank DOM.RF | 272 876 | 210 881 | 61 995 | 29 |

| 20 | Bank Uralsib | 216 755 | 224 287 | -7 532 | -3 |

Source – data from the Bank of Russia and the Banki.Ru portal

A significant influx of corporate funds was observed in most banks participating in the rating. In absolute terms, the record holders were Sberbank and VTB. A small outflow of corporate funds occurred in Raiffeisenbank, AK Bars and Uralsib Bank.

Table 5

Largest banks by volume of individual deposits

| No. | Name of the bank | Amount of deposits of individuals as of April 1, 2021, million rubles | Amount of deposits of individuals as of January 1, 2021, million rubles | Change, million rubles | Change, % |

| 1 | SberBank | 14 383 170 | 14 800 892 | -417 722 | -3 |

| 2 | VTB | 4 627 619 | 4 640 929 | -13 310 | 0 |

| 3 | Alfa Bank | 1 391 113 | 1 434 739 | -43 625 | -3 |

| 4 | Gazprombank | 1 375 043 | 1 399 193 | -24 150 | -2 |

| 5 | Rosselkhozbank | 1 291 437 | 1 275 138 | 16 299 | 1 |

| 6 | Bank opening | 870 602 | 902 336 | -31 733 | -4 |

| 7 | Raiffeisenbank | 631 171 | 621 887 | 9 283 | 1 |

| 8 | Tinkoff Bank | 469 711 | 458 551 | 11 160 | 2 |

| 9 | Credit Bank of Moscow | 468 115 | 476 895 | -8 779 | -2 |

| 10 | Sovcombank | 459 362 | 446 154 | 13 208 | 3 |

| 11 | Post Bank | 361 515 | 371 775 | -10 260 | -3 |

| 12 | Rosbank | 285 662 | 297 760 | -12 097 | -4 |

| 13 | UniCredit Bank | 258 536 | 263 453 | -4 916 | -2 |

| 14 | Saint Petersburg | 244 821 | 253 322 | -8 501 | -3 |

| 15 | SMP Bank | 177 172 | 179 733 | -2 560 | -1 |

| 16 | Bank Uralsib | 173 147 | 173 152 | -4 | 0 |

| 17 | Citibank | 167 522 | 166 479 | 1 043 | 1 |

| 18 | Ural Bank for Reconstruction and Development | 165 078 | 167 014 | -1 936 | -1 |

| 19 | Russia | 162 963 | 138 302 | 24 661 | 18 |

| 20 | Russian standard | 144 189 | 147 135 | -2 946 | -2 |

Source – data from the Bank of Russia and the Banki.Ru portal

At the beginning of the year, depositors traditionally withdraw part of their funds from banks. However, in the 1st quarter of 2021, the traditional outflow of funds was supplemented by the factor of low deposit rates and a sharp increase in consumer inflation for everyday goods. Noteworthy is the outflow of depositors' funds from Sberbank in the amount of 418 billion rubles, which, however, amounted to only 3% in relative terms.

Table 6

20 most profitable banks

| No. | Name of the bank | Net profit as of April 1, 2021, million rubles | Financial result as of April 1, 2021, million rubles | Change, million rubles |

| 1 | SberBank | 282 514 | 218 651 | 63 863 |

| 2 | VTB | 77 246 | 38 491 | 38 754 |

| 3 | Bank opening | 25 851 | 2 923 | 22 927 |

| 4 | Alfa Bank | 23 787 | 141 038 | -117 251 |

| 5 | Gazprombank | 16 080 | 8 196 | 7 884 |

| 6 | Tinkoff Bank | 13 853 | 12 210 | 1 643 |

| 7 | Trust | 13 490 | -9 508 | 22 998 |

| 8 | Sovcombank | 12 984 | 291 | 12 693 |

| 9 | Credit Bank of Moscow | 6 714 | 8 403 | -1 688 |

| 10 | Raiffeisenbank | 6 621 | 4 260 | 2 361 |

| 11 | Rosbank | 6 094 | 5 746 | 348 |

| 12 | Russia | 5 759 | 7 513 | -1 753 |

| 13 | National Clearing Center | 5 525 | 4 149 | 1 376 |

| 14 | Bank Uralsib | 5 104 | 1 536 | 3 568 |

| 15 | Rosselkhozbank | 4 751 | 3 150 | 1 601 |

| 16 | UniCredit Bank | 4 666 | 5 184 | -517 |

| 17 | Saint Petersburg | 3 413 | 2 128 | 1 285 |

| 18 | All-Russian Regional Development Bank | 3 387 | 1 865 | 1 521 |

| 19 | Novikombank | 3 028 | 3 421 | -392 |

| 20 | Home Credit Bank | 2 940 | -259 | 3 199 |

Source – data from the Bank of Russia and the Banki.Ru portal

To compare how the profitability of banks changed in the 1st quarter of 2021, the financial result for the same period last year is given. Most of the rating participants showed better results than in 2021. However, traditionally the bulk of the profits of the Russian banking system are generated by Sberbank.

Table 7

20 most unprofitable banks

| No. | Name of the bank | Loss as of April 1, 2021, million rubles | Financial result as of April 1, 2021, million rubles | Change, million rubles |

| 1 | Post Bank | -3 377 | 2 458 | -5 835 |

| 2 | Eastern Bank | -1 569 | 1 220 | -2 790 |

| 3 | Moscow Regional Bank | -1 354 | 6 203 | -7 557 |

| 4 | CentroCredit | -1 212 | -7 476 | 6 264 |

| 5 | RGS Bank | -1 109 | -1 813 | 704 |

| 6 | SME Bank | -907 | 303 | -1 211 |

| 7 | Avtotorgbank | -286 | 79 | -366 |

| 8 | Alef-Bank | -244 | 241 | -485 |

| 9 | Tender-Bank | -224 | -54 | -169 |

| 10 | Gazenergobank | -201 | 244 | -446 |

| 11 | Housing Finance Bank | -201 | 106 | -307 |

| 12 | International Financial Club | -193 | 533 | -727 |

| 13 | Baltinvestbank | -185 | -44 | -140 |

| 14 | Nefteprombank | -164 | 3 | -167 |

| 15 | Ikano Bank | -161 | -118 | -42 |

| 16 | Inbank | -137 | 40 | -177 |

| 17 | J&T Bank | -136 | -13 | -122 |

| 18 | Crown | -102 | 23 | -126 |

| 19 | ING Bank | -81 | -460 | 379 |

| 20 | Northern People's Bank | -66 | 18 | -85 |

Source – data from the Bank of Russia and the Banki.Ru portal

To compare how the performance results of banks changed for the 1st quarter of 2021, the value of the financial result for the same period of 2021 is given. It should be noted that the financial results of most of the banks under consideration worsened compared to the same period last year. Although banks can often turn around a Q1 loss within a year, in 2021 banks will have to make serious efforts to do so.

In general, in the Russian banking sector in the 1st quarter of 2021, there were sharp fluctuations in the values of a number of important performance indicators, which is clearly visible from the financial reporting data presented. This is caused by traditional changes in indicators in January, as well as the slow recovery of business activity in general.

Among the important factors that are not visible in financial statements, one can highlight the increased role of remote banking systems, which received a powerful impetus for development during the coronavirus pandemic. And although after the lifting of strict quarantine restrictions, clients began to visit bank offices again, the share of transactions through remote channels, according to bankers, still exceeds the pre-crisis level.

An important feature of the economic crisis of 2021 was the soft interest rate policy of the Bank of Russia. If in past major crises the regulator sharply raised the key rate, then in the summer of 2021 the Bank of Russia, on the contrary, lowered the key rate to a historically low level of 4.25% per annum. This decision provided significant support to the economy.

Thanks to this policy of the regulator, rates on bank deposits reached historically minimal values in the 1st quarter of 2021. Low rates, devaluation of the ruble and the introduction of a tax on large bank deposits provoked an outflow of deposits, primarily deposits in foreign currency. A significant portion of the withdrawn deposits remained in banks' current accounts and could be withdrawn if the situation in the economy further deteriorates. The funds withdrawn from banks were partially directed by Russians to the stock market. Banks are active participants in this process, offering brokerage services to private clients.

However, in March 2021, the regulator began the transition to a neutral interest rate policy, in which the key rate will be 5.5%-6% per annum. Judging by the latest speeches by the head of the Bank of Russia, Elvira Nabiullina , among the important reasons for this decision are rising inflation and increased geopolitical risks. Banks, as always, change rates on loans and deposits carefully, with a slight delay, following the decisions of the regulator.

In 2021, the growth of unsecured retail lending slowed sharply due to earlier measures taken by the Central Bank aimed at limiting the credit debt of Russians, due to quarantine measures, as well as due to more careful consideration by banks of loan applications and a tougher approach to risks. In 2021, consumer lending has picked up, but its rapid growth this time is constrained by the stagnant incomes of the majority of Russians. Lending to corporate borrowers in 2021 is still sluggish. Companies are cautious about starting new projects, and banks are even more cautious about financing them.

In addition, it must be remembered that due to regulatory relaxations introduced by the Bank of Russia, negative trends in the economy have not yet been fully reflected in bank reports. Banks still have to sort out bad debts, which, based on the experience of past crises, will take up to one and a half to two years. According to the regulator, the current safety margin of the banking sector in terms of capital is sufficient to cover potential losses.

The liquidity situation in the banking sector has worsened. The volume of highly liquid ruble assets amounted to 15.4 trillion at the end of the period under review. rubles A significant part of it falls on market assets, against which banks can, if necessary, obtain funds from the Bank of Russia. The volume of highly liquid foreign currency assets of the country's banking system amounted to $52.7 billion, which is enough to cover 16% of all liabilities in foreign currency.

At the same time, state banks, large private banks and subsidiaries of foreign banks have an excess of cheap liquidity. The largest banks benefit the most from the placement of free budget funds by the Ministry of Finance. At the same time, small private banks are sometimes forced to hold increased liquidity reserves.

In 2021, the Bank of Russia continued to clear the sector of weak players. The first to leave the market were small banks, to which the regulator had serious questions regarding the cleanliness of their operations and compliance with banking standards.

The concentration of assets in the largest banks is growing. The 12 systemically important banks (with their subsidiaries credit institutions) together account for more than 75% of the assets of the banking sector. At the same time, the top 10 by assets includes only 3 banks that are not controlled by the state, and in some sectors of the market state banks already occupy a virtual monopoly position.

The profit volume of the Russian banking system for the 1st quarter of 2021 for the most successful banks was even slightly higher than for the corresponding period last year. But the bulk of profits are traditionally concentrated in several largest banks, primarily in state banks.

This time, banks approached the crisis in much better shape than, for example, in 2014. The Central Bank's removal of weak players from the market and increased requirements for the quality of work of other banks have borne fruit. However, the slow recovery of the Russian economy will definitely affect the pace of development of the banking sector in 2021.

At the end of 2021, the net profit of the sector will decrease by 20–30%

In 2021, the share of overdue debt in the loan portfolio of legal entities and individual entrepreneurs remained virtually unchanged: for loans to large businesses it increased by only 0.2 percentage points, to 7.3%, and for SME loans the share even decreased by 0.9 percentage points. p., up to 11%. The share of overdue debt was partially eroded by a significant increase in preferential lending (for SME loans), as well as currency revaluation (for loans to large businesses). However, in our opinion, the greatest impact was made by government support measures, which made it possible to postpone the reflection of the deterioration in loan quality in reporting. Thus, the share of restructurings due to COVID-19 in both the SME loan portfolio and the large business loan portfolio exceeded 15%. At the same time, the share of overdue debt in personal loans increased by 0.4 percentage points, to 4.7%, despite a significant increase in the portfolio, which was due to a significantly lower volume of restructured retail loans compared to legal loans (4.3% as of 01/01/2021).

We expect that the main negative effect of the economic downturn due to COVID-19 will be reflected in the sector's profits this year after the end of the moratorium on bankruptcy of legal borrowers and the cancellation of relief on the provisioning of restructured legal loans, the volume of which exceeded 6 trillion rubles. In connection with this, we see the greatest risks of increasing provisioning this year in terms of loans to legal entities.

Chart 5. In 2021, the share of overdue debt in corporate loans remained virtually unchanged due to large-scale loan restructuring

Source: Expert RA calculations based on Bank of Russia data

We expect a deterioration in the quality of about 20–30% of restructured corporate loans and at least 20% of concessional corporate loans, which will require additional provisioning of up to RUB 900 billion. An increase in the default rate will significantly affect the share of overdue debt on SME loans this year. However, this increase in reserves will be spread over two to three years. Thus, the share of overdue debt on loans to large businesses will increase gradually over several years, as banks will continue to restructure some loans to large businesses, and some large loans will be assigned to third parties as part of clearing the balance sheet of problem assets. According to our estimates, in 2021 the volume of net contributions to reserves will increase to 1.9–2 against 1.5 trillion rubles in 2021, which will lead to an increase in the cost of risk from 2.6 in 2020 to 3.1% in 2021.

In 2021, the profitability of the sector was significantly supported by positive currency revaluation, amounting to more than 270 billion rubles (without taking it into account, the profitability of the sector was about 13%). According to our estimates, at the end of 2021, the net profit of the sector will decrease by 20–30%, to 1.1–1.2 trillion rubles due to an increase in contributions to reserves, a compression of the net interest margin and a decrease in income from currency revaluation. As a result, the sector’s profitability in 2021 will decrease from 16 to 10–11%.

In 2021, there will be an increase in interest rates for most categories of borrowers due to an increase in the key rate and a gradual decrease in the volume of state support in certain lending segments (mortgages, SME lending). For mortgage loans and loans to large businesses, the growth may be up to 0.5 percentage points, for consumer loans and loans to SMEs – up to 1.5 percentage points. Banks will increase interest rates on borrowed funds more restrainedly, however, taking into account market expectations for further increase in the key rate, the increase in the cost of funding will be at least 0.5–0.75 percentage points.

Despite a noticeable increase in loan rates, banks will not be able to maintain their net interest margin at the 2021 level due to low lending growth rates (the total loan portfolio of legal entities and individuals will increase by 7%). Therefore, issuing loans at higher rates will not be able to compensate for the increase in funding costs. In addition, the urgency of the sector’s resource base is significantly less than the urgency of the loan portfolio: thus, as of 01/01/2021, the share of funds raised by legal entities and individuals with a maturity of up to six months is 46%, and the share of loans with a maturity of more than one year is 76%. Thus, the increase in the cost of borrowed funds will occur much faster than the increase in the profitability of the loan portfolio. As a result, in 2021 we expect the net interest margin to contract by 0.2 percentage points to 3.8%.

Analyze

Citizens! Never buy signals from Telegram and YouTube that guarantee “100% per month” or any magical robots. All this is bullshit, designed for suckers. There are and cannot be any guaranteed signals in the foreign exchange market .

Even the leading banks on the planet do not know where the market will be and do not manage it. Study their analytics to make this clear once and for all. Banks that form this market, as well as analytical companies, can only guess and nothing more. This is the art of forecasting. The market is a theory of probability, before which everyone is equal. These assumptions are available, for the most part, free of charge in the form of analytical reports. Which is what you should use.

If your pocket is full of money, then give it to me. The best use for it is purchasing access to analytics from the same Sberbank CIB or purchasing a professional terminal like Thomson Reuters Eikon. It will be expensive ($1800 per month), but you will get a terminal that is used in banks and hedge funds. Which is jam-packed with extensive analytics and news that are displayed many times faster than on retail sites.

But even this is not necessary, since the main analytical theses are available for free on banking websites and in global financial media such as Bloomberg. Only the opinions of banks, both commercial and leading central banks of the world, should interest you. And then only as food for your mind, as a fundamental basis from which you can grow your personal, individual understanding of the market.

All the other stories about “guaranteed incomes” and songs about how “we know where the market will be tomorrow”, all the signals for the poor and uneducated citizens, all this is designed only to get deeper into your pocket. Which is already full of holes with credit patches. Therefore, use strictly official banking analytics, and send all other air sellers on a three-letter walk and spit in their wake.

The role of banks in the real sector of the economy is significantly increasing

Against the backdrop of declining margins in the traditional banking business and increasing competition for clients with fintechs, banks are forced to look for new sources of income. Many large banks are increasing investments in related sectors of the financial market, for example, leasing and insurance business. Thus, over the past five years, the share of bank leasing companies in the volume of new car leasing business, which is the most diversified and attractive in terms of profitability, has increased from 39 to 50%.

In addition, in order to expand their client base and increase business profitability, banks are increasingly providing clients with non-banking services. In this regard, banks are becoming one of the key investors in modern technologies and are actively acquiring businesses in the most promising areas of the economy (commodity marketplaces, construction, services, catering, transport, etc.). Also, banks often become owners of non-core businesses as part of the settlement of debt on loans from large problem borrowers.

Such a strong interest of banks in non-core business could lead in the medium term to a noticeable nationalization of the real sector of the economy, since the backbone of the banking system is state banks (they account for about 74% of banking sector assets as of 01/01/2021).

Application. Tables

Table 1. Key financial indicators of the banking sector

| Table 1. Key financial indicators of the banking sector Indicator | 01.01.2019 | 01.01.2020 | 01.01.2021 | 01/01/2022 (forecast) |

| Loans to large businesses, billion rubles. | 29 157 | 29 040 | 31 958 | 32 917 |

| nominal growth rate, % | 12 | -0,4 | 10,0 | — |

| growth rate excluding currency revaluation (Expert RA estimate), % | 11,1 | -2,1 | 4,5 | 3 |

| excluding preferential lending | 3,9 | — | ||

| Guarantees | 5,6 | 6,4 | 6,9 | 7,8 |

| growth rate, % | -1,0 | 14 | 9 | 12 |

| SME loans, billion rubles. | 4 215 | 4 737 | 5 811 | 6 511 |

| growth rate, % | 1,1 | 12,4 | 22,7 | 15 |

| excluding preferential lending, % 4 | 7,1 | 23,9 | -7,2 | 6 |

| Mortgage loans, billion rubles. | 6 410 | 7 492 | 9 305 | 10 701 |

| growth rate, % | 23,6 | 16,9 | 24,2 | 15 |

| excluding preferential lending | 11,1 | 7 | ||

| Car loans, billion rubles | 817 | 955 | 1 031 | 1 124 |

| growth rate, % | 15,5 | 14,0 | 7,9 | 9 |

| excluding preferential lending, % | 4,4 | 5 | ||

| Unsecured consumer loans of individuals, billion rubles. | 7 386 | 8 926 | 9 707 | 10 678 |

| growth rate, % | 22,2 | 20,8 | 8,8 | 10–12 |

| Profit before taxes (without IFRS 9), billion rubles. | 1 345 | 1 600 | 1 574 | 1 100–1 200 |

| ROE (profit before taxes without IFRS 9), % | 13,8 | 14,6 | 15,9 | 10–11 |

| NIM, % | 4,4 | 4,1 | 4,0 | 3,8 |

| COR, % | 1,7 | 2,1 | 2,6 | 3,1 |

Source: data from the Bank of Russia and public reporting of banks, forecast by Expert RA