Greetings, dear traders! The topic of today's article has lived in me for a very long time. Well, there was no way I could structure all my knowledge and put it out there for the public to see. Today I decided: “That’s it, I can’t put it off any longer. I have to write."

Trend change is one of the most important knowledge a trader should have. I have included some of my personal evidence that this point is very important, please read them, and if you have anything to add, I will be glad to read it in the comments.

- Opening a trade at the very beginning of a trend is the best place in terms of profit to loss ratio.

- By correctly identifying a trend reversal in Forex, I eliminate most losing trades.

- By opening a position at the beginning of a trend, you can very quickly move the transaction to breakeven, which will help save your nerves.

- From experience I can say that when you enter the market in its infancy, it is easier to apply methods to support a position.

- Trivial, but still. The earlier you enter into a trade, the more profit you can take.

- And, in the end, it just looks beautiful and there is no shame in showing your results to others.

If you agree with me and confirm that trend reversal is an extremely important component, then let's continue.

There are only two directions for determining a trend, these are:

- Trend determination without indicators;

- Trend determination with indicators.

Each of the methods has its place, but in my personal opinion, a trader must first learn to trade without indicators, and only when there is a clear picture of what is happening, use indicators in the form of additional filters.

Therefore, I will begin to explain how to get trend reversal signals at the very first stages without any indicators, using an almost blank chart.

Determining a trend reversal

Noticing a price reversal within the financial instrument in question in a timely manner is a necessary and important skill for any trader. You can find a lot of diverse information on this topic on the Internet - from theories to practical manuals.

You can determine a trend reversal using graphical methods . They serve as fairly reliable trading signals, and if you practice, say, on a demo account, you can achieve excellent trading results over time.

All technical analysis patterns are confirmed by price, so below we will try to show you the most common Forex patterns and show with an example how to determine a trend reversal using them.

Often, problems related to psychology prevent us from seeing this or a reversal pattern. If we strive to see, for example, a “head and shoulders” figure, then we will see it on almost every currency pair.

It’s the same with the continuation of the trend. If a trader’s Forex strategy is geared specifically towards long-term trending markets, then it is in his interests to see exclusively long-term trends and not fall for reversals.

In other words, if one or another technical analysis candlestick pattern is formed, this does not mean at all that a trend reversal or continuation of the previous one can be expected in the near future.

To increase your chances, you need to see certain conditions that significantly increase the chances of a particular outcome of events.

Important: any figure in technical analysis can, after some time, degenerate into a completely different figure or into obscure zigzags.

But this does not revoke the right to conduct technical analysis on Forex.

A couple of chips

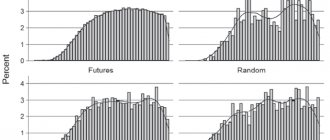

Volumes.

Using volume is a long-standing tool for identifying and confirming turning points in the market. How it works: suppose there is a long upward movement, the volume of ongoing transactions on assets for each candle is approximately equal. Then, at some point, there is a surge in volume. This surge in volume can indicate two things - a major player either bought or sold assets for a large amount. What exactly was done is determined by the color of the candle on which the volume splashed out: a red candle - sold, a green candle - bought. So, if the candle is red, this is a strong signal that the trend will reverse. Since at this moment a major player either closed his bullish position or opened a short position, and major players do not do this just like that.

Using multiple time frames.

The essence of this prima is to use two time frames. On the higher time frame, the moment the trend is determined. The minor one is used to find the most accurate entry point. This method is described in detail in this article.

How to determine a trend reversal without indicators?

The first thing you can do is draw support and resistance lines and trade for a breakout or rebound from these lines:

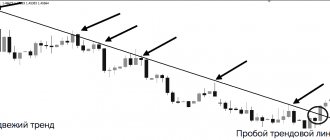

Figure 1. Support/resistance lines and channel breakdown.

As we can see from the screenshot above, as soon as the price breaks through one or another trend line, we consider BUY or SELL, depending on the situation. If the price level is strong enough, there is a high chance that the price will bounce from it for a long time, which plays into the trader’s hands.

Figure 2. Channel release.

Naturally, within this level, a trend reversal in the Forex market is a rare occurrence.

How to set stop loss correctly?

When it comes to a stop loss, you must place it at a level that will invalidate your trading setup.

Let's say you buy a breakout of a support level. This means that if the breakout is true, the price should not return to the range. Therefore, we can set a stop loss above the resistance level.

Breakout of the price channel

There comes a moment when the price moving in the channel leaves it. In other words, the support or resistance lines will be broken. These are the first signs of a trend reversal and you need to be prepared for this.

At the same time, we should not forget about such a phenomenon in Forex as a false breakout. Like this, for example, here:

Figure 3. Example of a false breakout.

In such cases, it is best to draw the boundaries of this false breakout and place a pending order like Sell Stop below its boundaries.

In other words, in place of the signal candle, we automatically enter the market with a Sell Stop order, since this is a clear sign of a trend reversal. In this case, the Take Profit value can be equal to half or the entire width of the channel. Stop Loss is set for the nearest local price maximum.

Candle combinations

Skilled traders use Japanese candlesticks to determine reversals. They have become widespread among all investors as the most visual representation of price fluctuations, and using them to detect when a reversal occurs is the next level of skill in their use.

Throughout the history of trading, many combinations of candlesticks have been discovered, as well as single visualizations, which clearly signal the end of the current trend and the beginning of a new one in the opposite direction.

Head and Shoulders Figure

Here's how to enter the market by noticing a Head and Shoulders pattern on the chart:

Figure 4. Head and Shoulders figure.

Let us once again draw your attention to the fact that the Head and Shoulders figure is a fairly strong formation. As soon as the neck zone is broken, we can talk about a trend reversal . In this particular example, the trend changed from upward to downward.

We can also observe that after the neck was broken, the price began to consolidate in order to test the neck area. After all, this is where most indecisive traders set Stop Loss. When they were collected, the price turned around and went down.

Identifying weakness in trend movement

We know that any trend consists of the trend movement itself and a period of rollbacks.

A trend movement is a strong phase of the market when the price moves in one direction and consists predominantly of bullish candles. Bullish candles are larger than bearish ones and close near their highs. When bullish candles become smaller, it indicates that buying power is weakening, or there is equal selling pressure.

The size of the candles will not give you a guarantee that the market will reverse. But this is definitely a signal that indicates the weakness of buyers.

A pullback is the opposite of a trend move, where the price moves against the underlying trend. Retracement periods are dominated by bearish candles, which are relatively small and usually close near the middle or low of their range.

When bearish candles become larger, it indicates that selling pressure is increasing as buyers are unwilling to buy at higher prices.

Again, this does not guarantee that the market will definitely reverse. But this is a sure sign that buyers are becoming weaker.

Double top or double bottom

Figure 5. The “Double Top or Double Bottom” pattern schematically.

The graphical analysis pattern called “Double Top or Double Bottom” is a good way to trade on trend reversals, since it, just like the “Head and Shoulders” formation, gives a reliable signal about a trend change.

In an example, this formation looks like this:

Figure 6. Forex Double Top pattern.

As we can observe, the price has drawn a Double Top pattern. After breaking through the support zone, the price moved a certain distance away from it and then began testing. But here the support has already turned into a resistance zone. If it does not break through it and gain a foothold from above, it can be considered a trend reversal.

Knowing these figures of graphical analysis, trading on trend reversals will become even more profitable.

Parabolic SAR

Among technical indicators, Parabolic SAR stands out for its clarity in determining the direction and change of trend. It is in many ways similar to the widely used moving average, with the difference that it has greater acceleration and less lag relative to the price chart. Parabolic points are placed below or above the price chart, which serves as a clear demonstration of the current trend.

Parabolic SAR shows itself even more clearly when the trend direction changes - this is one of its main advantages. In such a situation, the relative position of the indicator and the price chart changes to the opposite: when the “bearish” trend changes to a “bullish” one, the indicator points will begin to be located under the price, similarly, but vice versa, will happen after a reversal of the upward trend. The parabolic has no equal in determining the moment to close a long position.

Triple top or triple bottom

Figure 7. “Triple top or triple bottom” figure schematically.

As you may have guessed, in addition to the “Double Top and Double Bottom” patterns, there are graphic patterns called “Triple Top or Triple Bottom”. This is a modified formation of the head and shoulders chart pattern, as well as the double top.

On a chart in MT4 it might look like this:

Figure 8. Triple Top pattern.

By the way, trading on trend reversals will be carried out according to the following strategy. First, we see that the top reaches the same price value several times and then rolls back, which means we draw a resistance line at their peaks. We do the same with downward price pullbacks - we draw a support line. Then we wait for one of these lines to be broken. After some time, we see that it was the support zone that was broken. Thus, we dare to assume that this was a “triple top” pattern. This gives a strong signal for a price reversal from upward to downward. In addition, when the neckline is broken, increased volumes should be observed.

How to exit the market and take profits?

Your outputs depend on your goals. You can capture the price movement before the first pullback or try to take profits from the entire trend.

For example, you can exit until the price reaches a resistance level:

If you want to capture the maximum of a move, you can move your stop loss as the price moves in your favor. You can use a moving average for this purpose.

Trend reversal strategy

Figure 9. Indicator strategy for trend reversals.

If you are a novice trader and do not have sufficient knowledge of graphical analysis, then you will need the indicator strategy outlined below for trend reversals. Let's look at one of the simple but excellently working strategies, which shows signals on trend reversals. It allows you to calculate the strongest zones where there are overbought and oversold conditions.

This trading tactic involves the use of only two Forex indicators. Its profitability is 75%. One of the 2 instruments of this TS is the modified RSI indicator. The undeniable advantage of the second, channel indicator is that it does not show oversold and overbought areas, but shows price movement in the channel.

The advantage of the second is that it does not demonstrate overbought or oversold zones in a trend, but moves within the channel. With its help, trading on trend reversals will only be a joy, since more than half of all transactions will be closed with profit.

Advantages of the trading system

Let's look at the undeniable advantages of using this trading system:

- Intuitive to use.

- Works well on trading signals regardless of the selected asset and timeframe.

- Signals are not redrawn, as you can see by scrolling through the chart history.

- Despite the few signals, it provides high profitability.

Example of BUY transactions

If we talk about examples of BUY transactions within the framework of a scalping strategy, the following algorithm should be performed:

- Open the M5 timeframe.

- Let's look at the modified RSI indicator. It should break through the lower border of the channel.

- On the price channel, the candle should also break the price channel down.

- We wait for the signal candle to close and enter the market with a BUY order.

Figure 10. Example of BUY transactions.

Example of SELL transactions

To be eligible to consider transactions on SELL, the following conditions must be met:

- We set the timeframe to M5.

- Let's see what the modified RSI indicator shows. It should go beyond the upper boundary of the channel.

- Then we look at the price chart, in particular we pay attention to Japanese candlesticks. They should go beyond the upper boundary of the channel.

- We wait for the signal candle to close and enter the market using SELL.

Figure 11. Example of SELL transactions.

As you can see from the screenshots above, we can use this trading strategy to receive reliable signals for price reversals. Using this system, you can get high-quality and powerful turning points, although there is one drawback - a small number of signals .

You can download the indicator and template for this trend reversal strategy below.

Oscillator signals

Many traders widely use oscillators to identify overbought and oversold zones in order to open or close a position. Oscillators provide additional confirmation to signals received from other sources.

Another interesting property is the determination of a possible trend reversal. To do this, you will need to compare the price chart and the oscillator, connecting local extremes. The resulting discrepancy between the direction of price movement and the indicator movements is a signal for a trend reversal.

The situation when the resulting lines diverge is called divergence, and when they converge, it is called convergence. This leads, as a rule, to price adjustments and the market entering a flat state or generally changing the trend in the direction of the indicator movement. Like any other technical analysis signals, divergence and convergence should be confirmed using other tools to ensure greater reliability.

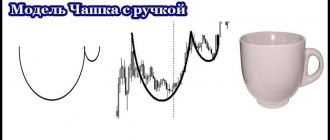

Model “Hound of the Baskervilles” - o

Alexander Elder wrote in the book “Basics of Stock Trading”:

“The signal is named after the Arthur Conan Doyle story in which Sherlock Holmes found a clue when he noticed that the family's dog was not barking at the time of the murder. This meant that the dog knew the killer, and therefore it was a family matter. The signal was the lack of action - the absence of the expected bark! When the market refuses to bark after a completely benign signal, it gives you the Hound of the Baskervilles. If the market refuses to turn and continues to strive upward, then this gives the “Hound of the Baskervilles” signal.

Rice. 5. Model “Hound of the Baskervilles”

Determining the end of a trend. Reversal patterns.

Describing trend behavior is the main task of technical analysis. This task poses two global questions: how to determine the end of a trend and how to determine its continuation. Partially the answer to this question comes from working with support and resistance, and the second way is to work with graphical patterns of trend reversal and continuation.

The following signals are harbingers of a trend reversal:

- Breakout of trend channel lines

- Alternation of high and low extremes

- Contradictions between the price chart and trading volume

- The appearance of reversal patterns of graphical analysis on the chart

In this case, the second and third signals can only be considered additional trend reversal signals. The main reversal signals are the first and fourth.

Reversal patterns are patterns in graphical analysis. Their appearance on the price chart indicates that a trend reversal is likely to occur soon.

There are three main groups of current trend reversal models:

- Double top (or double bottom)

- Triple top (or triple bottom)

- Head and shoulders (or inverted head and shoulders)

When working with trend reversal patterns, it is important to remember that:

- Reversal patterns or patterns are price movements that are counter to the current trend.

- They acquire significance only after a pronounced trend movement. In a sideways market, reversal patterns are not worked out

- These patterns can be used to improve the closing price or enter a position counter to the current trend.

All of the listed reversal patterns are similar to each other in terms of market behavior within the framework of their formation.

A double top is a pattern of completion and reversal of a growing trend.

What it looks like: As part of a growing trend, the price reaches the next local maximum and corrects to the next local minimum. After the correction, growth continues approximately to the level of the previous high, and after reaching it, the price reverses again and reaches the level of the previous low. In case of a breakdown of this level, the double top pattern is considered formed and after the breakdown, a movement begins that is opposite to the current trend.

For a falling trend, instead of a double top, an opposite figure is formed - a double bottom , with the same formation principles and working rules.

Basic rules for forming and working out a double top (double bottom):

- The figure is considered formed only after the line of the figure’s base is broken - the support level drawn along the local minimum between two tops.

- Confirmation of the breakout by volume (an increase in volume at the time of the breakout of the level) strengthens the signal to complete a transaction given by the figure.

- After breaking through the base line, the price is most likely to reach the minimum movement target, equal to the distance from the top to the base line, laid down from the breakout point in the direction of the price movement.

In accordance with these rules, you can formulate trading principles when a double top (double bottom) is formed on the chart:

- Opening a position upon a breakdown of the base line of the figure, confirmed by volume - in the direction of the breakdown

- Stop order for a reverse breakout of the base line according to the standard rules for placing stop orders for trading at support or resistance levels

- Take-profit at the level of the minimum target for the movement of the figure

A triple top is a less common variation of a double top: after reaching the second local maximum of the figure and reversing from it, the price does not break through the base line, but is reflected from it, again makes an unsuccessful attempt to test the local maximum, followed by a breakdown of the base line and a downward movement.

A triple bottom is the opposite of a triple top and appears in a downtrend.

The rules for forming and working out, as well as the principles of trading for this figure are completely identical to the rules described for the double top.

Head and shoulders is a reversal pattern that occurs during a rising trend. It can also be called a variation of the triple top. The difference between these patterns is that for a triple top the local extremes (both lows and highs) are approximately at the same price level, while for a Head and Shoulders pattern the first and third highs (right and left shoulders) are located approximately at one level, and the second (head) rises above them.

The figure is formed and worked out as follows. On a growing trend, after reaching two consecutive local maximums, the last of which is higher than the first, the market corrects and makes an attempt to continue growth, which leads to the achievement of a third local maximum, which is approximately at the level of the first. A figure appears on the chart that looks like the outline of a head and shoulders. Local lows between the 1-2 and 2-3 highs are connected by an inclined line (analogous to a support line drawn between two adjacent lows), which is the neck line of the figure. After the formation of the third maximum (right shoulder), the market corrects, breaks through the neckline, after which the current trend reverses.

Like the double (triple) top, the head and shoulders has a minimum movement target equal to the distance between the neck line and the highest point of the head from the breakout point of the neck line.

In a downtrend, an inverted head and shoulders .

Basic rules for forming and practicing the head and shoulders figure:

- The figure is considered formed only after the breakdown of the neck line - the support line connecting two local lows inside the figure.

- Confirmation of the breakout by volume (an increase in volume at the time of the line breakout) strengthens the signal to complete a transaction.

- After breaking the base line, the price is most likely to reach the minimum movement target.

In accordance with these rules, the trading principles when forming a Head and Shoulders pattern on a chart can be as follows:

- Opening a position upon a breakdown of the neckline, confirmed by volume - in the direction of the breakdown

- Stop order for a reverse breakout of the base line - above the right shoulder of the figure

- Take-profit at the level of the minimum target for the movement of the figure

For an inverted head and shoulders figure, the same rules apply in a mirror image.

In general, reversal patterns demonstrate the market's inability to overcome any psychologically important level of support or resistance. Such levels can often be seen on the chart in advance, so it is very important to find a balance between the desire to open a position at favorable prices (at the peak of the second or third peak) and the desire to minimize risks (wait for a breakout of the base or neck line).

To open positions, it is better to use stronger signals (breakout of the lines and the final formation of the figure), however, positions previously opened for the trend can be closed even after another unsuccessful attempt to test the local extremum (at the peak of the second or third peak, without waiting for a correction to the base line).

Determining trend continuation. Continuation models.

Trend continuation signals are the following:

- Reflection from the lines of the trend channel (stable location inside the channel)

- Consecutive increase (decrease) of extrema

- Confirmation of the main trend by volume

- Appearance of trend continuation patterns on the chart

The most important of these are signals 1, 2 and 4; signal 3 can only be considered as additional.

Continuation patterns are patterns of price consolidation within the current trend, a temporary respite before the continuation of the main movement.

The main continuation models include:

- Triangle

- Pennant

- Wedge

- Flag

When working with continuation patterns, it is important to remember that:

- All trend continuation patterns are areas of temporary price consolidation before the continuation of the main trend movement.

- Continuation patterns appear on the chart due to the fact that the main trend movement always alternates with correction phases.

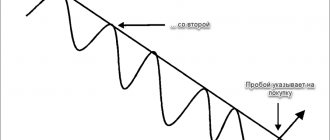

A triangle is an area of temporary price consolidation, which is characterized by the following price behavior (using the example of a growing trend): after reaching the next local maximum, the market corrects, the next local maximum does not exceed the level of the previous one, and the next correction ends at a higher level than the previous one, and so on . As a result, if you connect local highs and local lows with support and resistance lines, they form a triangle or one of its varieties.

The triangle is a long-term pattern. It is formed over a period of 3 months to 2 years and can only be built on a weekly or daily chart. A triangle can be equilateral (two converging lines) or rectangular (one side is an inclined line, the other is horizontal). Inside a triangle, the price usually passes up to ¾ of its area and touches both sides of the triangle a total of 5 times, after which it breaks through one of the sides (usually coinciding with the direction of the current trend), and the trend movement continues.

A triangle is considered formed only after the price has exited it by breaking through one of the sides - until this happens, it is premature to trade using triangle signals. For a triangle, just as for reversal models, there is a minimum movement target level equal to the maximum height of the triangle, laid down in the direction of price movement from the breakout point.

A figure similar to a triangle can also appear on smaller time frames (1 hour, 15 minutes, and so on), but in this case it is called a pennant .

For a pennant, all the same rules apply as for a triangle, with the exception of two: for a pennant, the price does not have to pass up to ¾ of the area of the figure, and the price can touch the borders of the pennant any number of times (not necessarily 5).

Another type of triangle is a wedge .

A wedge, just like a pennant, can appear on charts with any time frame, and the same rules of formation and processing apply to it as for a pennant. The peculiarity of the wedge is that its sides (support and resistance lines) are directed in one direction, and in the opposite direction relative to the current trend.

A flag is a section of the corrective movement of the price chart, a kind of mini-trend that can be limited by a small trend channel. In this case, the moment of the final formation of the flag and the signal to open a position is the breakdown of the flag border in the direction of the current trend, after which the price moves in the corresponding direction to at least the height of the flag laid down from the breakout point.

Basic rules for forming and practicing continuation patterns:

- The figure is considered formed only after the price leaves the figure. In this case, the exit, as a rule, occurs in the direction coinciding with the direction of the trend.

- An increase in trading volume at the time of the breakout strengthens the signal to complete a transaction given by the figure.

- After breaking the line, the price is most likely to reach the minimum movement target.

Trading principles when forming continuation patterns on a chart can be as follows:

- When continuation patterns are formed on the chart, it is not advisable to close previously open positions (coinciding with the direction of the trend).

- It makes sense to open new positions in the direction of the trend (or increase existing ones) only when the price goes beyond the figure in the direction of the trend.

- The stop order must be placed on the reverse breakout (under the opposite side of the figure).

- Take-profit at the level of the minimum target for the movement of the figure.

Graphical models of technical analysis generally provide good, reliable signals for both opening and closing positions. At the same time, the reliability of signals increases if you use volume confirmations and make transactions only at the moment of the final formation of the figure.

The minimum movement target is the minimum level that must be worked out by the market after the formation of the model.

With a strong trend movement, the price can go much further than the minimum target of the movement, so it is advisable not to place an order to close a position at the level of the minimum target, but to more clearly monitor the market dynamics when it is reached, or place a dynamic order to close a take-profit type in the system QUIK.

False chart patterns

In practice, situations are possible when the minimum goal of the movement is not achieved. In this case, we can talk about a false graphical model.

Such models can be divided into two types:

- Conditionally false model. It occurs when we take an unformed figure as a graphic model.

- False model. It occurs when the figure is fully formed, but after breaking through the base line, the goal of the movement is not achieved.

Using volume confirmations allows you to eliminate false reversal patterns.

For graphical patterns of reversal and continuation, the following rule for volume confirmations can be formulated: volume decreases when a pattern is formed and increases when exiting it.

On the chart, during the formation of the head and shoulders figure, the volume increased, and when the neck line was broken, it sharply decreased, and continued to decrease as the price moved down. In such a situation, when the neck line is broken out, it is better not to open positions in the direction of the breakout at all or to open for a smaller volume, since the likelihood of not achieving the goal of the movement and the formation of a false figure increases.

Candlestick trend continuation patterns

I most often trade the continuation of the trend. This is much easier to do, and you can earn more consistently. Reversals are used by professionals who monitor one asset for 10 years and feel when the mood of the participants changes there. Let's consider several models.

Candle windows

At its core, a window is a gap or price gap. It is a strong signal of trend continuation.

Candlestick windows are rare in Forex today as the market has become more efficient. However, they can be found from Friday to Monday, i.e. after the weekend at the market opening.

A gap is a strong signal, but you should not rely solely on it. Additional filters will be required to form a working strategy based on this formation.