Swiss franc exchange rate forecast for tomorrow, week and month.

| date | Day | Min | Max | Exchange rate (forecast) |

| 05.27 | Thursday | 80.94 | 83.18 | ▼ 80.94 -1.39% |

| 05.28 | Friday | 78.35 | 83.53 | ▲ 83.53 1.76% |

| 05.31 | Monday | 83.19 | 83.87 | ▲ 83.19 1.36% |

| 06.01 | Tuesday | 82.89 | 83.49 | ▲ 82.89 1.00% |

| 06.02 | Wednesday | 82.84 | 82.94 | ▲ 82.84 0.94% |

| 06.03 | Thursday | 80.67 | 85.01 | ▼ 80.67 -1.73% |

| 06.04 | Friday | 77.89 | 83.45 | ▲ 83.45 1.66% |

| 06.07 | Monday | 83.11 | 83.79 | ▲ 83.11 1.26% |

| 06.08 | Tuesday | 82.27 | 83.95 | ▲ 82.27 0.25% |

| 06.09 | Wednesday | 82.24 | 82.30 | ▲ 82.24 0.22% |

| 06.10 | Thursday | 80.93 | 83.55 | ▲ 83.55 1.78% |

| 06.11 | Friday | 80.53 | 86.57 | ▼ 80.53 -1.90% |

| 06.14 | Monday | 80.34 | 80.72 | ▼ 80.72 -1.66% |

| 06.15 | Tuesday | 79.77 | 81.67 | ▼ 81.67 -0.48% |

Swiss franc to ruble exchange rate today 05/26/2021 in real time

Economy of Switzerland

The Swiss economy is considered one of the most stable in the world. Reliable Swiss banks, as well as policies aimed at long-term monetary stimulation, a well-developed service sector, business sector and financial system as a whole, ensure an influx of investment from all over the world. It is not surprising that Switzerland ranks fourth in terms of foreign investment. In 2013, GDP per capita was 84,815 USD, which is much higher than the average among European Union countries. This value is 80% higher than in the UK, and 64% higher than in France. In addition to the traditional financial sector, a high share of economic activity is provided by exports to the EU (59% exports, 78% imports).

Switzerland GDP 1980-2015

As can be seen in the graph, evidence of stable economic growth can be evidenced by strong GDP growth, even taking into account the presence of global crisis events. In general, not many large countries can boast of such sustainable growth and a rapidly regenerating economy. Switzerland also ranks sixth in the world in terms of direct investment.

The most important economic clusters are: chemistry, pharmaceuticals and biotechnology, followed by medical technology, engineering and metal processing, financial services, traditional watchmaking, information technology, environmentally friendly technology, as well as commodity trading and corporate headquarters.

Long-term Swiss franc exchange rate forecast for 2021, 2021, 2022, 2023, 2024 and 2025.

| Month | Open | Min-Max | Closing rate (forecast) | Months,% | Total,% |

| 2021 | |||||

| May | 82.06 | 81.80 — 82.32 | ▼ 81.80 -0.32% | -0.32% | 0.63% |

| June | 81.80 | 81.59 — 82.01 | ▼ 82.01 -0.06% | -0.06% | 0.51% |

| July | 82.01 | 80.59 — 83.43 | ▲ 83.43 1.64% | 1.64% | 3.40% |

| August | 83.43 | 80.93 — 85.93 | ▼ 80.93 -1.40% | -1.40% | 5.82% |

| September | 80.93 | 78.92 — 82.94 | ▲ 82.94 1.06% | 1.06% | 4.85% |

| October | 82.94 | 82.64 — 83.24 | ▲ 83.24 1.42% | 1.42% | 0.72% |

| november | 83.24 | 82.24 — 84.24 | ▲ 82.24 0.22% | 0.22% | 2.37% |

| December | 82.24 | 81.19 — 83.29 | ▲ 83.29 1.47% | 1.47% | 2.52% |

| 2022 | |||||

| January | 83.29 | 82.20 — 84.38 | ▲ 82.20 0.17% | 0.17% | 2.58% |

| February | 82.20 | 81.38 — 83.02 | ▼ 81.38 -0.84% | -0.84% | 1.98% |

| March | 81.38 | 79.54 — 83.22 | ▲ 83.22 1.39% | 1.39% | 4.42% |

| April | 83.22 | 82.93 — 83.51 | ▲ 82.93 1.05% | 1.05% | 0.69% |

| May | 82.93 | 82.38 — 83.48 | ▲ 82.38 0.39% | 0.39% | 1.32% |

| June | 82.38 | 82.01 — 82.75 | ▲ 82.75 0.83% | 0.83% | 0.89% |

| July | 82.75 | 81.57 — 83.93 | ▼ 81.57 -0.60% | -0.60% | 2.81% |

| August | 81.57 | 80.39 — 82.75 | ▲ 82.75 0.83% | 0.83% | 2.85% |

| September | 82.75 | 80.96 — 84.54 | ▼ 80.96 -1.36% | -1.36% | 4.23% |

| October | 80.96 | 78.63 — 83.29 | ▲ 83.29 1.47% | 1.47% | 5.59% |

| november | 83.29 | 83.17 — 83.41 | ▲ 83.41 1.62% | 1.62% | 0.29% |

| December | 83.41 | 82.69 — 84.13 | ▲ 82.69 0.76% | 0.76% | 1.71% |

| 2023 | |||||

| January | 82.69 | 82.62 — 82.76 | ▲ 82.62 0.68% | 0.68% | 0.17% |

| February | 82.62 | 80.61 — 84.63 | ▼ 80.61 -1.80% | -1.80% | 4.75% |

| March | 80.61 | 79.02 — 82.20 | ▲ 82.20 0.17% | 0.17% | 3.87% |

| April | 82.20 | 80.56 — 83.84 | ▼ 80.56 -1.86% | -1.86% | 3.91% |

| May | 80.56 | 80.43 — 80.69 | ▼ 80.43 -2.03% | -2.03% | 0.32% |

| June | 80.43 | 78.26 — 82.60 | ▲ 82.60 0.65% | 0.65% | 5.25% |

| July | 82.60 | 82.51 — 82.69 | ▲ 82.51 0.54% | 0.54% | 0.22% |

| August | 82.51 | 80.51 — 84.51 | ▼ 80.51 -1.93% | -1.93% | 4.73% |

| September | 80.51 | 78.20 — 82.82 | ▲ 82.82 0.92% | 0.92% | 5.58% |

| October | 82.82 | 81.58 — 84.06 | ▼ 81.58 -0.59% | -0.59% | 2.95% |

| november | 81.58 | 79.54 — 83.62 | ▲ 83.62 1.86% | 1.86% | 4.88% |

| December | 83.62 | 81.21 — 86.03 | ▼ 81.21 -1.05% | -1.05% | 5.60% |

| 2024 | |||||

| January | 81.21 | 80.50 — 81.92 | ▼ 80.50 -1.94% | -1.94% | 1.73% |

| February | 80.50 | 80.19 — 80.81 | ▼ 80.81 -1.55% | -1.55% | 0.77% |

| March | 80.81 | 78.60 — 83.02 | ▲ 83.02 1.15% | 1.15% | 5.32% |

| April | 83.02 | 82.55 — 83.49 | ▲ 83.49 1.71% | 1.71% | 1.13% |

| May | 83.49 | 82.87 — 84.11 | ▲ 82.87 0.97% | 0.97% | 1.47% |

| June | 82.87 | 82.58 — 83.16 | ▲ 83.16 1.32% | 1.32% | 0.70% |

| July | 83.16 | 82.24 — 84.08 | ▲ 82.24 0.22% | 0.22% | 2.19% |

| August | 82.24 | 80.96 — 83.52 | ▼ 80.96 -1.36% | -1.36% | 3.07% |

| September | 80.96 | 79.00 — 82.92 | ▲ 82.92 1.03% | 1.03% | 4.73% |

| October | 82.92 | 81.89 — 83.95 | ▼ 81.89 -0.21% | -0.21% | 2.45% |

| november | 81.89 | 81.81 — 81.97 | ▼ 81.97 -0.11% | -0.11% | 0.20% |

| December | 81.97 | 81.58 — 82.36 | ▼ 81.58 -0.59% | -0.59% | 0.95% |

| 2025 | |||||

| January | 81.58 | 81.43 — 81.73 | ▼ 81.73 -0.41% | -0.41% | 0.37% |

| February | 81.73 | 80.66 — 82.80 | ▼ 80.66 -1.74% | -1.74% | 2.58% |

| March | 80.66 | 78.42 — 82.90 | ▲ 82.90 1.01% | 1.01% | 5.40% |

| April | 82.90 | 82.61 — 83.19 | ▲ 82.61 0.66% | 0.66% | 0.70% |

| May | 82.61 | 82.57 — 82.65 | ▲ 82.57 0.62% | 0.62% | 0.10% |

| June | 82.57 | 81.35 — 83.79 | ▼ 81.35 -0.88% | -0.88% | 2.91% |

| July | 81.35 | 80.97 — 81.73 | ▼ 81.73 -0.41% | -0.41% | 0.93% |

| August | 81.73 | 80.54 — 82.92 | ▼ 80.54 -1.89% | -1.89% | 2.87% |

| September | 80.54 | 79.03 — 82.05 | ▼ 82.05 -0.01% | -0.01% | 3.68% |

| October | 82.05 | 81.01 — 83.09 | ▼ 81.01 -1.30% | -1.30% | 2.50% |

| november | 81.01 | 80.87 — 81.15 | ▼ 81.15 -1.12% | -1.12% | 0.35% |

| December | 81.15 | 80.15 — 82.15 | ▲ 82.15 0.11% | 0.11% | 2.43% |

| 2026 | |||||

| January | 82.15 | 81.95 — 82.35 | ▲ 82.35 0.35% | 0.35% | 0.49% |

| February | 82.35 | 81.25 — 83.45 | ▼ 81.25 -1.00% | -1.00% | 2.64% |

| March | 81.25 | 78.97 — 83.53 | ▲ 83.53 1.76% | 1.76% | 5.46% |

| April | 83.53 | 80.63 — 86.43 | ▼ 80.63 -1.78% | -1.78% | 6.71% |

| May | 80.63 | 79.73 — 81.53 | ▼ 81.53 -0.65% | -0.65% | 2.21% |

| June | 81.53 | 81.28 — 81.78 | ▼ 81.78 -0.34% | -0.34% | 0.61% |

| July | 81.78 | 80.54 — 83.02 | ▲ 83.02 1.15% | 1.15% | 2.99% |

| August | 83.02 | 80.58 — 85.46 | ▼ 80.58 -1.84% | -1.84% | 5.71% |

| September | 80.58 | 78.37 — 82.79 | ▲ 82.79 0.88% | 0.88% | 5.34% |

| October | 82.79 | 82.01 — 83.57 | ▲ 83.57 1.80% | 1.80% | 1.87% |

| november | 83.57 | 83.24 — 83.90 | ▲ 83.24 1.42% | 1.42% | 0.79% |

| December | 83.24 | 81.98 — 84.50 | ▼ 81.98 -0.10% | -0.10% | 2.98% |

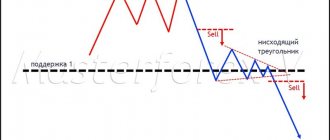

Global trend

If you open the monthly USDCHF chart, it will seem obvious that the global trend for the pair is downward.

But after the events of January 15, 2015, everything changed. Now the USDCHF trend is upward, as indicated by the strong dollar policy.

Of course, this is just my opinion, but I believe that in the long term it is worth focusing on the growth of USDCHF.

General strategy

What news affects the franc? First of all, these are NonFarm Payrolls, FOMC, speeches of politicians. That is, all the red news that affects the dollar also affects USDCHF. Significant news related directly to the franc is very limited and generally difficult to track. This could be, for example, elections in Switzerland, or such loud statements as the incident on January 15 - that is, extremely rare events that either cannot be predicted, or everyone will know about it in advance. That is, just watch the news on the dollar.

As for swaps, they are very, very small. That is, you shouldn’t even try to make money on swaps, nor try to somehow avoid long-term transactions due to high overhead costs. That is, we simply don’t pay attention to them.

The cost of one point is approximately 1 dollar, that is, approximately the same as that of EURUSD.

Since the pair is part of the group of major currency pairs, the same rules apply to it. Accordingly, the main trading sessions are London and the beginning of New York.

At the same time, please note that USDCHF exhibits smooth and smooth trend movements not only during the main trading sessions, but also during the Asian session. Therefore, strategies associated with the Asian flat on the franc are definitely not worth using. But any trend strategies can be traded almost around the clock.

Since the pair is one of the main ones, then, in principle, the entire standard arsenal of technical analysis works quite well. The pair has quite a lot of liquidity, as well as trading volumes - many people trade currencies all over the world. Therefore, there are not so many specific moments.

So what should you use? First of all, these are trend strategies with small goals. Why? Because it is very easy to get into a flat. In general, you trade the franc according to your strategy and if you receive a signal and the price does not move anywhere within 5 candles, then you can safely exit.

Seasonal patterns

Our seasonal currency movements service allows you to calculate patterns, that is, repeated currency movements over many years and, accordingly, use them in trading.

So, here we have curves for the average price movement of the franc for 5, 10, 15 years and the current year. First, we see a noticeable drop in April in all curves. Secondly, there was a noticeable increase in May, more in the first half. Thirdly, we can pay attention to the fall in July and, in general, the last week is the most noticeable. We also see an increase in August, starting from the second half. And fourthly, growth in the first week of November. This is what we can discern from the seasonal patterns for this pair.

This should be taken into account by those who trade on daily charts and above.

Correlation

Everyone knows the correlation between EURUSD and USDCHF. This is a textbook example that is always given when it comes to correlation. Therefore, almost every novice Forex trader knows about this “EURUSD down / USDCHF up” relationship. This pattern persists to this day, and accordingly, it can be used for analysis.

But a slightly less well-known correlation is USDJPY with USDCHF. They often walk quite similarly. Here we have a direct correlation, and not an inverse one, as is the case with the euro. This can also be applied in various strategies.

Also, there is a high level of correlation with gold, financial policy and geopolitics.

Key levels

After the events we repeatedly mentioned on January 15, a channel was formed, approximately from 0.9080 to 1.0200. And the price has been in this channel for almost 2 years. It is unknown when she will come out of it. But in the coming months it is definitely worth focusing on these boundaries of the specified channel. If the price approaches one of the channel boundaries, then you should wait for a rebound, since in the case of levels, as we remember, a rebound is always more likely than a breakdown.

Of the important levels, this is, of course, 1.0000. Although its price has passed, parity with the dollar remains a strong level, and when the price reaches it again, there will be quite a struggle.

Another important level is 1.2000, the old limit that was set by the Swiss bank. If the price does reach this level after some time, then we should also expect a fierce struggle. But so far we are far from reaching these levels.

And finally, the most terrible level is 0.666. This is the very bottom to which the USDCHF rate fell on that fateful day. I don’t know if there is a secret meaning to this, but the fact remains that the level below which the USDCHF price did not fall is 0.666. If the rate ever returns to this level, traders will obviously be afraid of it.