Individuals, in addition to bank deposits, have access to other methods of investing funds. One of them is bonds. This is a reliable financial instrument, the service is offered by commercial banks including VTB. There are different types of bonds, some of them are called perpetual or perpetual. Perpetual VTB Eurobonds can be purchased by individuals, but first of all you need to be aware of the potential risks and returns from the investment. They will be discussed in this article.

What are VTB perpetual bonds

VTB provides brokerage services to individuals. That is, he is an intermediary between a potential investor and exchange platforms. Therefore, if desired, the client can use his services. Here, various financial and investment instruments are presented to the potential investor. By investing money in securities, the client can receive income that exceeds the interest on a bank deposit.

Bonds are a kind of promissory note that gives their owner the right to receive a profit. Eurobonds or Eurobonds are securities that are not tied to the domestic exchange market. They may be in circulation in foreign financial centers. Eurobonds can be issued in any foreign currency: US dollars, euros, pounds sterling.

Sometimes Russian investors deliberately choose such investment instruments. After all, their essence lies in the fact that the Eurobond currency differs from the national currency, and thus the client assumes credit and currency risk. Potential profit can be expressed not only in the value of the coupon, but also in the growth of foreign currency. In other words, if the Eurobond currency increases in price, then the potential investor’s profit will increase due to this.

VTB perpetual bonds are presented to the attention of a potential client of the bank. The choice of a potential investor often falls to him for several reasons. It has a positive reputation, so when using its services, you don’t have to worry about the safety of your savings. The Bank has long been working with securities, the purchase of which fully complies with Russian legislation. It is determined at the legislative level that Eurobonds must have identification numbers ISIN and CFI.

What kind of “eternity”, what kind of “immortality” can we talk about?

Investors will only have a “paper memory” of the “dead man” in their hands. Defenders of “eternal” bonds will tell me that this is not a “paper memory”, but a certificate of the right to participate in a competition for the division of the property of a “dead person”.

We know well that the line of applicants for the property of a liquidated bank is always very long. Some things can only go to the first in this line. And the owners of “eternal” securities, according to the rules of the game, will be at the very end of the queue.

I do not rule out that pension funds, as institutional investors, who today have to choose “between the bad and the very bad” in the financial instruments market, out of desperation may go for the purchase of “eternal” bank bonds. And at some point in time, pension funds may turn out to be “losers.”

However, the “losers of last resort” in this case will be our poor pensioners. Russian bankers and moneylenders, betting on “eternal” securities, can only hasten the death of our elderly.

Risk level

Eurobonds are a flexible investment instrument that is primarily beneficial for the issuer. Investors can expect high profits, but they must take into account some risks, namely:

- each issuer of securities has its own rating, the lower the rating, the higher the risk and the higher the potential income;

- a flexible interest rate indicates that with changes in the issuer's policy, profits may decrease;

- when foreign currency depreciates, the profit of a potential investor decreases;

- Each security, including Eurobonds, has its own liquidity; when it decreases, the risk increases.

Often individuals do not have sufficient knowledge in the field of investments. Therefore, they entrust their savings to trusted intermediaries. The broker's task is to analyze various characteristics and set a plan for the acquisition of investment portfolios.

Emission information

| Borrower | VTB |

| SPV / Issuer | VTB Capital SA |

| Type of bonds | Coupon |

| Special view | Loan Participation Notes |

| Release form | Registered documentary |

| Placement method | Open subscription |

| Type of allocation | Public |

| Purpose of release | ShowPurpose of Issue The gross proceeds from each offering of a Series of Notes will be used by the Issuer for the sole purpose of financing the corresponding Loan to VTB and, if applicable, any corresponding Swap Agreement(s). The gross proceeds of such Loan will be used by VTB for general corporate purposes (unless otherwise specified in the relevant Loan Agreement). In connection with the receipt of such Loan, VTB will pay a facility fee (including the costs of the Issuer entering into any applicable Swap Agreement(s)), as reflected in the relevant Final Terms. |

| Lot of multiples | 1,000 USD |

| Denomination (Eurobonds) | 1,000 USD |

| Minimum trading lot | 200,000 USD |

| Outstanding denomination | 200,000 USD |

| Issue volume | 1,500,000,000 USD |

| Volume in circulation | 1,412,116,000 USD |

| Volume in circulation by outstanding par value | 1,412,116,000 USD |

| End date of placement | **.**.**** |

| maturity date | **.**.**** |

| Floating rate | No |

| Coupon rate | *.**% |

| Current coupon rate | 6,95% |

| Method for calculating NKD | *** |

| NKD | *** (12.04.2020) |

| Coupon payment frequency | 2 times per year |

| Coupon accrual start date | **.**.**** |

| Trading platform, quotation sheet | Moscow Exchange, XS0842078536 |

| Listing | Irish FB |

×

Return on investment

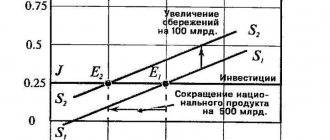

It is not possible to determine the profitability of Eurobonds, since the percentage of profitability will entirely depend on the issuer of the securities. Bonds issued by the government have more or less less risk and stable returns, but the profit on them will be minimal.

When choosing bonds, you should pay attention to large companies. For example, in Russia it is Gazprom or Rosneft. The average yield on their securities ranges from 3 to 8% per annum, plus the cost of the coupon that the issuer pays upon its redemption . The cost of securities will largely be determined depending on the economic situation, exchange rates and other indicators.

Please note: the peculiarity of perpetual bonds is that the issuer is not obliged to accept the coupon for redemption, since there is no set expiration date for it. In order to exit a security, you can use another option - to sell the coupon through the issuer, or to find a buyer on the open market.

Exchange and over-the-counter quotes

| Marketplace | date and time | Buy/Sell Quote (Income) | Indicative price (Yield) iIndicative price is used to calculate effective yields, duration, modified duration and is calculated based on the following price priority: Average price (Average), Market price (Market), Closing price (Close), Accepted price (Admitted) , Average price (Mid), Last price (Last). The indicative yield is calculated based on the following priority of yields: effective yield to maturity, effective yield to offer (put/call), current yield. | G-spread | T-spread, b.p. iT-spread is calculated as the difference between the yield of the issue and the yield on US, UK or German government securities corresponding to the currency of the issue and with a comparable modified duration (the effective yield of the issues is taken into account in the calculations). The indicator is calculated only for issues in USD, EUR, GBP currencies. The “Benchmark T-spread” field indicates the issue for which the T-spread was calculated as of the calculation date. | |

| 10.04.2020 | *** / *** (*** / ***) | *** (***) | *** | *** | Archive | |

| 09.04.2020 | *** / *** (*** / ***) | *** (***) | *** | *** | Archive | |

| 09.04.2020 | *** / *** (*** / ***) | *** (***) | *** | *** | Archive | |

| 09.04.2020 | *** / *** (*** / ***) | *** (***) | *** | *** | Archive | |

| 09.04.2020 | *** / *** (*** / ***) | *** (***) | *** | *** | Archive | |

| iTradegate Exchange is a Berlin-based regulated market. Tradegate's focus is on retail market. | 09.04.2020 | *** / *** (*** / ***) | *** (***) | *** | *** | Archive |

| iQUOTRIX is the electronic trading system of the Dusseldorf stock exchange for private investors. | 09.04.2020 | *** / *** (*** / ***) | *** (***) | *** | *** | Archive |

This action requires registration. Please go to the registration form or log in to the site.

VTB Bank terms and conditions

The bank has personal terms of service for private clients:

- transactions with Eurobonds and shares of foreign issuers are not allowed to be traded on Russian stock exchanges;

- the minimum investment amount for a Eurobond is 50,000 conventional units, the conditions are relevant for users of the personal account and the VTB “My Investments” mobile application;

- You can submit a purchase application through your personal account from 10:00 to 18:00 Moscow time;

In addition, the bank charges a commission for transactions regardless of profitability. when purchasing a portfolio of securities, the commission is 1.5%. When selling securities, the commission is 1% of the transaction amount, depository services are 3.2% per year of the value of the investment portfolio.

Please note that broker commissions are charged regardless of investment performance.

Statistical indicators

| Sharpe ratio Shows the excess of the mutual fund's profitability over the profitability of a deposit in a reliable bank relative to the risk of the fund's portfolio. More details 0.203 Good control efficiency | Alpha coefficient A positive value means that the return was higher than the return of the reference portfolio. Negative is the opposite. More details 0.974 Returns outperform market index | Beta Coefficient A value greater than one means risk is greater than the market average. A value less than one means, on the contrary, the risk is below average. More details 1.027 The risk is higher than others |

These indicators are calculated for 3 years.

Is it worth investing in VTB perpetual bonds?

The product attracts the attention of a potential investor because its value is expressed in foreign currency. And, given its rapid growth, investors can profit from price fluctuations. The par value of the coupon increases the investor's capital. But given the perpetuity of the security, sometimes the prospect of making a profit is very doubtful.

In addition, other factors also influence the success of investments, including the situation on the securities market. Considering that the brokerage company's analysts take into account potential income, the level of risk is minimized. Eurobonds are a long-term investment; the holding period for securities usually ranges from one and a half to two years. It is impossible to calculate the income from them, but if the business is successful, you can earn up to 30% of the initial contribution amount.

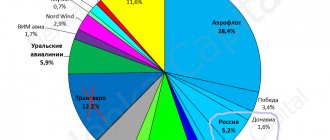

Similar mutual funds

How do we determine the similarity of mutual funds to each other?

| Name | Management Company | Profit |

| Alfa Capital Liquid shares | Alfa Capital | -0.02% |

| Otkritie - Foreign ownership | Opening | 1.24% |

| SAN – Mixed investments | SAN | -0.07% |

| MDM-World of shares | MDM | 0.61% |

| URALSIB Debt markets of developing countries | Management company URALSIB | 1.56% |

| Capital-Prospective investments | Kapital | 0.53% |

| Ingosstrakh MICEX Index | Ingosstrakh-Investments | 0.05% |

| OLMA – RTS INDEX | Olma-finance | 0.46% |

| Gazprombank-Shares | Gazprombank-Asset Management | -0.17% |

| Raiffeisen-MICEX Blue Chip Index | Raiffeisen Capital | 0.92% |

Show all mutual funds from the database

Paper payment schedule

*****

| Coupon expiration date | Date of actual payment | Coupon rate, % per annum | Coupon amount, USD | Redemption of par value, USD | |

| Show previous | |||||

| 1 | **.**.**** | **.**.**** | *,*** | * ***,* | |

| 2 | **.**.**** | **.**.**** | *,*** | * ***,* | |

| 3 | **.**.**** | **.**.**** | *,*** | * ***,* | |

| 4 | **.**.**** | **.**.**** | *,*** | * ***,* | |

| 5 | **.**.**** | **.**.**** | *,*** | * ***,* | |

| 6 | **.**.**** | **.**.**** | *,*** | * ***,* | |

| 7 | **.**.**** | **.**.**** | *,*** | * ***,* | |

| 8 | **.**.**** | **.**.**** | *,*** | * ***,* | |

| 9 | **.**.**** | **.**.**** | *,*** | * ***,* | |

| 10 | **.**.**** | **.**.**** | *,*** | * ***,* | |

| 11 | **.**.**** | **.**.**** | *,*** | * ***,* | |

| 12 | **.**.**** | **.**.**** | *,*** | * ***,* | |

| 13 | **.**.**** | **.**.**** | *,*** | * ***,* | |

| 14 | **.**.**** | **.**.**** | *,*** | * ***,* | |

| 15 | **.**.**** | **.**.**** | *,*** | * ***,* | |

| 16 | **.**.**** | **.**.**** | *,*** | * ***,* | |

| 17 | **.**.**** | **.**.**** | *,*** | * ***,* | |

| 18 | **.**.**** | **.**.**** | *,*** | * ***,* | |

| 19 | **.**.**** | **.**.**** | *,*** | * ***,* | |

| 20 | **.**.**** | **.**.**** | *,*** | * ***,* | *** *** |

| Show next |

This action requires registration. Please go to the registration form or log in to the site.