How does TIPS work?

What is the main difference between TIPS (Treasury Inflation-Protected Securities) and regular bonds?

Ordinary bonds have a fixed par value (which you receive when you redeem the paper) and coupons that do not change throughout the entire circulation period. In long-term securities, the risk of increased inflation may materialize. By buying bonds, you lock in a minimum coupon yield for many years.

As an example : the current yield to maturity of 10-year US bonds is about 1.5% -1.6%. And the expected average annual inflation rate for the same period is about 2%. In fact, investors buying securities now are already receiving negative real returns.

Inflation-protected bonds, as the name suggests, help solve this problem.

The TIPS face value is indexed to inflation twice a year before coupon payments. As a result, the investor can receive double benefits:

- the body of the bond (face value) constantly increases by the amount of inflation;

- Due to the growth of the nominal value, coupon payments also increase.

United States Consumer Price Index (CPI) is used as the basis for calculating inflation

This is what he looks like.

United States Consumer Price Index (CPI)

Looking at the graph, the inflation rate is not entirely clear. To understand, we need to carry out some calculations: look at how much the graph has grown over a period (let’s say over a year), convert this growth into percentages, and only then will we find out the amount of inflation.

Another graph is much more informative - with the usual breakdown of inflation by year.

Inflation in the USA by year

The most important advantage of TIPS for Russian investors:

- Protection against dollar inflation.

- Protection against ruble devaluation.

Why are index funds popular?

Investors love index funds because they offer immediate diversification. With a single purchase, investors can own a wide range of companies.

For example, one share of an index fund based on the S&P 500 index provides ownership of hundreds of companies. While some funds, such as S&P 500 index funds, allow you to own companies in different industries, others allow exposure to a specific industry, country, or even investing style (say, dividend stocks).

The S&P 500 Index Fund continues to be one of the most popular index funds. S&P 500 funds offer good returns over time, are diversified, and have about the same low risk as stock investments. Like all stocks it will fluctuate, but over time the index will return about 10 percent per year. This doesn't mean index funds make money every year, but over a long period of time they will create an average return.

So here are some of the best US ETFs for 2021. These funds are based on the S&P 500 index or contain many stocks in the index.

What to pay attention to

I like the idea of TIPS itself. There is no need to predict the future by trying to guess the rate of inflation. There is a bond that always brings some kind of return above inflation. Isn't this lovely? BUT …

Personally, I noted several points for myself that are worth paying attention to before purchasing a fund.

Preferential taxation

Due to the “correct” registration of the fund, ETF FXTP does not pay taxes on coupon income. And all incoming profits are reinvested in full. There is no doubt that tax savings are a huge plus.

Commission and competitors

The FXTP ETF charges a fee of 0.25% per year. Is it a lot or a little?

This is one of the lowest rates on the Moscow Exchange. Only FXTB (0.2%) is lower. Typically, the rate of bond funds on foreign securities starts from 0.5% and above. Plus, many mutual funds buy bonds not directly, but through foreign funds - as a result, investors bear double expenses.

What's in the West?

For example, several ETFs with a TIPS investment strategy:

- Schwab US TIPS ETF (ticker SCHP) with a capitalization of $17 billion has 46 issues of various bonds. Management fee 0.05%.

- iShares TIPS Bond ETF (ticker: TIP). Commission - 0.19%. Capitalization - $28 billion. 57 securities inside.

- iShares 0-5 Year TIPS Bond ETF (STIP) - 5 billion, 21 securities, commission - 0.05%.

At the start of trading, FXTP was worth $3 million. And 0.25% doesn’t seem like much for such a small fund. However, if you look at it from a different angle, the benefits will not be so obvious.

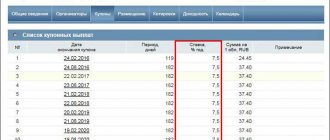

Coupons vs. Management Fees

We go to the index page and in the “Index Composition” tab we look at which securities are included in the FXTP ETF (in fact, there are small differences between the fund and the index, but not critical). Some overweight bonds have a coupon rate equal to or even lower than the fund management fee. In simple words, all coupon income goes to FXTP commissions (and for some issues you will still have to pay).

At the time of writing, the share of such securities in the fund was approximately one third of all assets.

Index composition: bond weights and coupon yield

Return and duration of the fund

On the official ETF FXTP page, the Finex provider always publishes up-to-date information on the fund (for which I greatly respect them). It does not always benefit them, but the guys do not hide all the disadvantages and shortcomings of their products.

So, go to the FXTP page, go to the very bottom - we need “Fund Characteristics”.

What do we see?

The yield to maturity of the FXTP fund is negative. Minus 1.17%

FXTP ETF Features

Also note the modified duration. Its value shows by how many percent the market price will fall if the Fed rate increases by 1 percentage point. I talked about duration in more detail with examples when I pitted two funds FXFA and VTBH.

Periods of zero profitability and drawdown

Let's look at the historical data of the index that tracks FXTP.

Firstly, those who think that investing in an inflation-protected fund guarantees 100% protection against depreciation and losses (sorry for the taftology) are mistaken.

The maximum drawdown of the index during the observation period is 17.82%.

Go ahead. Looking at the index chart, we see that there are (and quite long) time intervals when the index did not show any growth and even decreased.

A striking example is a sideways trend that lasts for as long as 7 years and, as a result, zero profitability. And this does not take into account fund commissions (0.25% x 7 = 1.75%).

The “lucky ones” who invested in securities at the turn of 2012-2013 suffered especially. They spent the next six years in the red and only broke even by mid-2021. Although zero is not the zero that most people thought about.

Index return chart

Do not forget about the dollar inflation itself during this time (on average about 1.5-2% per year). This is at least a 10% loss.

Using the CPI chart, I looked at how much prices increased over the same period. It turned out to be 10.5%

As a result, I don’t really understand how over the years (2012-2019) Tips protected the investor from inflation (if you have an assumption, write in the comments). Zero nominal return + commission costs (1.75%) + inflation losses (10.5%).

As a result: over seven years, minus 12% of real profitability.

Currency revaluation

This is a problem not only for FXTP, but also for all funds with low expected currency returns.

A rise in the dollar exchange rate can easily eat up all the profits and even drive the investor into the red. Tomorrow (in a week/month) the exchange rate will jump by 10% - automatically, when selling an ETF, an investor will automatically be subject to a tax of 1.3% of the amount of assets. Even if the fund itself in dollars has not grown a cent during this time.

Why is currency revaluation dangerous?

Therefore, before starting to invest, I would think about how you can avoid paying taxes. Either use LDV (but in this case invest for at least 3 years), or buy FXTP on a second type IIS (with full tax exemption).

I don’t see the point in just buying a fund (without tax optimization), especially for a short period. For me, it’s better to just keep dollars in your account.

iShares Core MSCI Emerging Markets Index Composition

Since VTBE invests directly in the iShares Core MSCI EM IMI UCITS ETF (ticker: IEMG), we will consider what assets are included in it, what its profitability and prospects are.

The fund is formed by iShares Management Company by replicating (copying) its own iShares Core MSCI Emerging Markets index. It includes more than 2,480 companies. The breakdown by country looks like this:

- China – 29.48%;

- Taiwan – 12.25%;

- South Korea – 11.97%;

- India – 9.4%;

- Brazil – 7.96%;

- South Africa – 5.45%;

- Russia – 3.58%.

As you can see, the lion's share of the index is occupied by Asian countries, with China accounting for the largest part.

In total, the IEMG ETF includes several hundred companies; there is no point in listing them all. I will only indicate the TOP 10 companies that occupy a larger place in terms of capitalization in the index:

- Alibaba – 4.31%;

- Tencent Holdings Ltd – 4.12%

- Taiwan Semiconductor Manufacturing – 3.40%;

- Samsung – 3%;

- Naspers – 1.68%;

- China Construction Bank – 1.21%;

- Ping an Insurance Co. of China – 1.09%;

- Reliance – 0.9%;

- China Mobile – 0.9%;

- Housing Development Finance Corporation – 0.85%.

Since VTBE is a pad for this ETD, we can safely say that the investor who bought shares of the VTBE fund also invests in these companies and participates in the growth of their capitalization.

By the way, if you look at the TOP 100 shares included in the index, it will become clear that these hundred companies account for about 95% of the weight of the entire index. Other companies (and there are more than 2000 of them) do not have a special impact on the index.

To summarize

I personally would view the FXTP ETF as a very conservative investment. With the main goal of preserving the purchasing power of foreign currency capital (as an alternative to the usual storage of dollars). And only for long periods. You definitely can’t make a lot of money with this tool.

Due to possible volatility and risks of currency revaluation, try to avoid investments for short periods.

It is imperative to look at the fund's characteristics before purchasing FXTP. For example, I would be somehow uncomfortable investing in an ETF with a negative yield to maturity.

Happy investment!

Vanguard Total Stock Market ETF

The fund (VTI, founded 2001) invests in a variety of large American companies in various industries. The fund follows the CRSP US Total Market Index, and includes shares of such companies as: Microsoft (MSFT), Amazon (AMZN), Facebook (FB), Alphabet (GOOG), Visa (V), etc. The fund parameters are as follows ↓

| Fund parameters | Meaning |

| Ticker | VTI |

| Type | Large Cap Equity Funds |

| Investment costs (Expense Ratio) | 0,03% |

| Number of assets | 1599 |

| Profitability | |

| Profitability over 5 years | 65,9% |

| Profitability for 3 years | 38,8% |

| Dividends | 1,7% |

| Risk | |

| Volatility (σ) | 10,9% |

| Beta coefficient (β) | 1,03 |

| Multiplier score | |

| P/E | 22 |

Due to its broad diversification, VTI has a flat upward trend with low volatility.

Widely diversified VTI fund. Popular among investors as a benchmark for assessing the effectiveness of their own investment portfolios