Divergence is one of the most powerful signals in technical analysis, but finding it manually is very time-consuming.

Not all Forex traders have the opportunity to constantly be at the computer, monitoring indicator readings. Moreover, some beginners rightfully do not trust their ability to correctly recognize these signals. The solution to the problem was the development of an advanced indicator that independently, automatically tracks divergences on dozens of different charts. Divergence Panel is almost a full-fledged advisor: it supplies up-to-date signals, indicates entry points, and also gives a signal every time there is an opportunity to conclude a profitable transaction in the market. In this article we will analyze this tool in detail and try to understand how effective it is in practice.

Divergence Panel - review of a forex indicator for searching for divergences

Description of the Volume indicator

You may be interested in:Taxes in Dubai for individuals and legal entities. Taxation in the United Arab Emirates

This tool is available on all popular trading platforms. For example, on MetaTrader it is installed by default at the very bottom of the chart and is displayed as a histogram. If a trader changes the timeframe, the indicator values will also change, but it will still be displayed at the bottom of the chart.

The histogram bars have different sizes. The higher they are, the greater the interest (demand and supply) of market participants. Using this tool you can track transaction volumes. When the histogram bars decrease in size, this means that the interest of players has decreased and the volume of positions in the financial market has decreased.

According to technical characteristics, the Volume indicator is an oscillator. Therefore, it has all the advantages, disadvantages and features of this class of trading instruments. It independently performs calculations and generates results directly onto the chart.

In trading, there are 5 types of oscillators based on functionality, which measure:

- Impulses and trend.

- Market volatility.

- Speed within the price range.

- Cycles and their length.

- Volumes.

The Volume indicator refers to an oscillator that measures the volume of positions in the market.

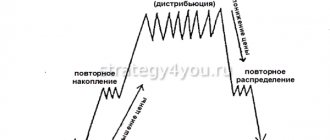

Determination of divergence by stochastic Stochastic Divergence

An indicator that finds divergence using the Stochastic indicator. It is not necessary to install the Stochastic indicator itself, but if you attach it, divergence lines will be drawn on the chart and on the indicator.

Regular divergence is drawn as a straight line, while hidden divergence is drawn as a dotted line.

Classification and types

You may be interested in: OS modernization: step-by-step design instructions and example

Trading volumes in the financial market are very important indicators. They allow traders to track the positions of major players and open trades at the most favorable moments.

Classification of volumetric indicators:

In principle, there are only two types of volume indicators: for obtaining values and their changes inside a candle, that is, a horizontal view, and for determining the volume of oppositions in any period of time. Tick volumes are used only in Forex and binary options. They show how many positions are traded in the required time range.

Types of volume tools:

Functions of a technical tool

The Market Volume indicator performs one of the main functions in trading on the financial market. Depending on its purpose and use by the trader, it performs the following functions:

Using this tool, you can obtain information about the market situation: what is happening on it at the moment, what changes may occur in the future, the interest of players in a certain time period and the opening of transactions by large market participants.

In trading, the volume indicator is quite widely used by traders. Based on it, many trading strategies have been developed that allow them to make stable money in the financial market.

Indicator settings and parameters

You may be interested in: Concept and main types of accounts payable

From the description of the Volumes indicator, which is a standard tool on many well-known trading platforms and is installed for free, you can understand that this tool practically does not need any settings. To attach it to the chart, you just need to make a couple of clicks, that is, select it in the “Tools” and click the “ok” button.

The developers recommend leaving the original settings. The only thing that can be changed at the trader’s discretion is the color scheme of the histogram display and the line thickness. It does not require any additional testing.

Typically, the Volumes indicator has two colors: red and green. If it has more columns of the first option, it means that the market price decreased more often, and if green is superior, it increased. This indicator is installed in a separate window under the chart and does not interfere at all with analyzing market quotes.

Description of Better Volume

This trading tool is a custom technical indicator. All values in it are presented in the form of a histogram, which completely coincides with the Volumes indicators. The Better Volume indicator is an improved version of the standard tool.

Advantages of the indicator:

Experts recognized this tool as the best for determining vertical volumes.

Sound notification

Sound alerts in the Delta indicator

As in the previous version, the sound notification when certain conditions occur remains, but has undergone a number of changes. Firstly, the format for entering values has changed, and the ability to set your own ringtones for alerts has been added.

To set a positive level at which a sound alert will occur, you must enter a positive value instead of 0. To set a negative level, upon reaching which an alert will occur, you must enter a negative value instead of -0.

In square brackets, instead of the word default, you can write the name of the melody that will play when the specified level is reached. As you can see in the “Delta Alert [wav]” parameter, there are 2 default words in the value, the first is responsible for the positive level, and the second is responsible for the negative level. Thus, one melody can be set to achieve a positive level, and a second melody can be set to achieve a negative level. You can also configure each indicator separately.

Suppose the indicator is installed on Sberbank paper, melody A is set to alert when a positive level is reached, melody B is set to alert when a negative level is reached. The second indicator is installed on Gazprom paper, melody C can be set when a positive level is reached, and melody D when a negative level is reached. You can do the same with other papers by setting EFG ringtones, etc. for alerts.

The “Volume Alert” parameter works in a similar way, but you can only specify a positive level and a melody that will be played when the specified level is reached.

Ringtones must be placed in the Kwik terminal directory at the following path: k-pavel \ sounds by default there is one melody there, default.wav

Please note that only wav format melodies will play, mp3 files will not play

Indicator explanation

Since it is displayed on a graph, more precisely, in a separate window in the form of a histogram, the bars have the following meanings:

- Red color. Appears after large volumes. If a signal is formed at a peak, it may indicate a change in trend or momentum, as well as a correction. They are shown especially well by the Better Volume 1 5 indicator with a period of 15.

- Yellow. It is an auxiliary signal, usually formed at the end of a correction or impulse. It indicates their completion and informs the trader that at this time there are no people willing to make any purchases or sales on the market.

- Green color. This is a reversal signal. It usually signals the exit of large players from the market and is a powerful indicator. He informs the trader that large participants have begun to fix their profits and are leaving the market, transferring it to smaller players.

- Blue. A neutral signal that means practically nothing. It shows changes in ticks.

- Brown color. Formed upon completion of a downward direction. It can usually be seen after large volumes. If this signal appears at the end of an upward movement, then it should be ignored.

In addition to the color marking of the histogram, the indicator has the MAPeriod parameter, which shows the period value for the moving average. You can install it yourself. This line is also displayed in the indicator window below the chart. Its function is to indicate the significance of the volume and the probability of the truthfulness of the histogram signals. If it is above the bars, then the value of the technical instrument is greater than the average, below it is less.

Features of the Delta 5.0 indicator

During the existence of previous versions of the indicator, I received a large number of proposals for the implementation of various functions. Some proposals cannot be implemented due to technical feasibility, since the QUIK terminal does not allow us to implement exactly everything we want, but at the same time, it does not have such serious restrictions that it is impossible to implement anything at all. Many proposals have been implemented and added as additional functionality in the indicator.

!

If you have suggestions for improving this indicator, you can write me an email and explain the essence in detail, I will carefully read it and, if possible, implement it in a new version.

The first thing that was inconvenient about the indicator was changing parameter values. The fact is that the QUIK terminal does not allow you to create a drop-down list from which the user could select the desired value. In previous versions, you had to manually write the name. The first problem was that the user simply did not know what exactly could be written in this parameter. Another problem was that when writing a value you could make a mistake or leave a space; as a result, the indicator did not understand the parameter and did not display anything on the chart.

To solve problems and inconveniences, I decided to change the way of entering values into the indicator parameters.

Delta 5.0 indicator parameters

Pay attention to the first parameter Delta Mode . This means that this parameter allows you to switch the indicator to construction mode using “Volumes” and using “Transactions”. Values are separated from each other by a vertical bar. The currently selected value is marked with an asterisk (*). Thus, the indicator is currently being built using volumes. In order to switch the Delta Mode to the “Trades” value, you must remove the asterisk in front of the volumes value and install an asterisk in front of the deal value.

Delta 5.0 indicator parameters

We’ve figured out how to change parameter values, now let’s move on to looking at the parameters themselves and what they are responsible for.

Description of Volume Profile

Along with vertical volumes, horizontal indicators are widely used in trading. The Volume Profile indicator allows you to analyze price levels and find out what the current market situation is between buyers and sellers. Horizontal volumes are one of the important parameters for predicting market movements.

Once attached to a chart, Volume Profile displays its values directly on market prices. It is depicted as a horizontal histogram for each level. The larger the volumes, the longer the indicator bar. Using this tool, traders determine the balance between placed buy and sell positions.

Application area

You may be interested in:Credit account: definition, meaning, how to open or close a credit account

All volume indicators are used to quantify positions at a price level or per unit of time. Special trading strategies have been developed based on horizontal and vertical volumes.

These technical instruments, based on their indicators, determine trading signals for entering and exiting the market. They are widely used during trading and for analytical forecasting of market movements.

In addition, volume indicators can be used in trading as filters to filter out false signals for other instruments.

Divergence indicator MACD Divergence

Many trading systems include the use of the MACD indicator. It is very popular among traders, which is why it is often used to find diversion. The MACD Divergence indicator automatically detects the divergence between price and MACD readings. Lines and arrows are drawn on the chart where you can potentially enter a trade. Installation is standard, the indicator is suitable for the MT4 terminal

MACD Divergence - indicator for MetaTrader 5

MACD Divergence 2.1 - indicator for MetaTrader 4

Using Volume in trading on the financial market

The Volume indicator is used in trading as a tool that confirms and determines the seriousness of the intentions of market quotes. If prices are characterized by high volumes, then the continuation of such a movement will have a much greater chance than with low values.

In situations where the market price has made a sharp leap in one direction, but its volume indicators are small, this jump should be regarded as an accident. That is, such a phenomenon has the lowest probability of continuation of the direction. Therefore, in trading, Volume is used as a tool for confirming trading signals, candlestick patterns, technical analysis figures and divergence.

For example, the “Head and Shoulders” graphic figure is always accompanied by large volume values, which determines a high degree of probability of its triggering. In this situation, Volume acts as a confirmatory signal for a reversal of market movement.

In candlestick analysis, it is also used as a filter to filter out false signals in combinations and configurations. For example, a “Shooting Star” pattern formed in the market. If at the same time the volumes of positions shown by Volume have increased significantly, then such a signal (for a movement reversal) can be considered confirmed and an order can be opened.

Features of the volume tool

The Volume technical indicator, as well as other tools developed on its basis, show the interest of players in a particular movement in the direction of the market price. Horizontal volumes allow you to analyze the market by price levels, while vertical volumes allow you to analyze the market in a certain time range.

The greater the interest of market participants in any movement, the greater the likelihood of continuation of this movement increases and the higher the value of the volume indicator. The features of volume oscillators (if we compare them with other indicators) include their ability to anticipate future events and signal in advance about changes in market quotes.

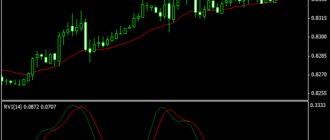

Forex divergence indicator Divergence Viewer

Another indicator that will show divergences between the indicator and the price and find divergences of 4 types: A, B, C and hidden. When divergence is detected, the indicator gives a signal, an alert.

]]>

]]>

Discrepancies are looked for with the following standard indicators built into the terminal:

- RSI

- MACD

- Momentum

- RVI

- Stochastic

- Standard Deviation

And two original ones:

- Derivative

- William Blau

The Divergence Viewer indicator has advanced functionality and easy configuration compared to similar indicators.