In the comments to articles, you often ask to talk about the Sniper system: does it make sense to trade with it, is it a scam or not, and what reviews are there?

The Sniper trading strategy is an example of a successful combination of common rules of technical analysis with money management tactics and aggressive marketing promotion. As a result, hundreds of people gave their money for classic technical analysis.

Today we will understand the rules of the Sniper system, the secrets of its success among the population, and also look at examples of transactions.

Sniper strategy for Forex - Scam or not?

Who developed the Sniper strategy

The author of the “Sniper” method for the Forex market is Pavel Dmitriev. Little is known about the developer. Pavel himself positions himself as an investor and successful trader. Some users doubt Pavel's existence, but several years ago he was very active on social networks.

Dmitriev still has a group on VK (forex_group_trade) opened in 2013 and a YouTube channel “Pavel Dmitriev”. From the materials posted on social networks, you can find out that the trader has been trading for more than 12 years. On VK you can read positive reviews about the Sniper strategy from Pavel’s subscribers. However, during 2021 there was no activity in the group or on the channel. There are no signs that the situation will change in 2021.

Strategy Developer Sniper

The strategy is popular. It is developing, new versions are appearing. There are modified and improved options - an example is the “Sniper X” strategy, which has undergone major changes:

- the pattern part has been expanded;

- instead of the classical indicators of the total impulse level, the level of a sharp change in trend and others, the term “imbalance level” is used;

- There are now more possibilities for accelerating the deposit (this is interesting not only for Forex, but also for binary options).

The authors of these changes are unknown, but there are traders who name their strategies in harmony. An example is “Sniperbesting” (the author says that he created a unique technique, they just beat him to the name).

Criticism

Traders of the Delai Biznes YouTube channel conducted an investigation and came to the conclusion that Pavel Dmitriev was faking transactions and creating the illusion of successful trading. Details in the next two videos.

The video talks about the technical details that allow you to fake your trading results using screenshots.

The authors of the YouTube channel “Delai Biznes” appeal to the broker with a request to check the trading account of Pavel Dmitriev. The broker confirmed that no commission was debited from the provided trading account and no one traded on it.

In 2015, users became interested in the personality of Pavel Dmitriev. A comprehensive answer was published in the VK group MyMoneyNeverSleeps: Pavel Dmitriev is a project behind which is a team of information businessmen.

Post in the MyMoneyNeverSleeps group.

If you are interested in the history of the investigation, watch the video from the GuruFX profi channel. It tells why Pavel Dmitriev is a fake and how the results of his trading systems are faked.

Why is Pavel Dmitriev a fake? How information businessmen deceive traders.

This leads to the following conclusion: the “Sniper” strategy is an information product for beginners and unskilled traders. The Sniper strategy is promoted by a team of information businessmen who hide their personal data and work under the Pavel Dmitriev brand. The only goal of the Pavel Dmitriev team is to earn more money by selling their product.

Where is the Sniper strategy used?

The main area of application of Sniper is Forex. However, the strategy can be used in other markets, including when trading cryptocurrency or shares on an exchange. The technique works with any financial instruments.

"Forex"

The Sniper strategy eliminates the need to activate indicators when analyzing prices. It eliminates lag; thanks to this system, the trader will find points to open orders in real time. The methodology is based on the cyclical nature of market processes. Designed for intraday trading on Forex, working time frames M1-M5 (from one to five minutes).

Binary options

Despite the general principles of applying the “Sniper” strategy in different markets, differences appear for binary options: trading is carried out on a longer time frame - M30.

Was there a boy?

Today’s material is devoted to the “Sniper” strategy, which over the six years of its existence has become the subject of constant discussion on the Internet. Despite the “long life” and mention of the system in various sources, it is more of a successful marketing product than a “grail”. The creators carefully thought out how to disseminate the strategy among beginners, building it on simple and reliable trading postulates, which they chose beautiful names to break down the associative series and provide “beautiful packaging.” This made it possible to fulfill the desire of the bulk of newcomers coming to the market to “trade right now,” and network distribution with rave reviews provided a clientele.

Due to the lack of indicators, it is impossible to develop clear rules for following the strategy and conduct tests to prevent the threat of losing the deposit. There are also many questions remaining regarding the correct determination of resistance and support levels, as well as flat zones used in trading. The purpose of this material is to show that the rules of the Sniper system are based on simple principles that cannot be improved.

However, after 2021, the author of the strategy managed to automate its algorithm and diversify it with additional blocks. However, the principles of their construction do not differ from the general postulates of the strategy. Today we will analyze this strategy in more detail.

What are the features of the Sniper strategy?

This is an intraday system, which involves trading with the trend. It is also determined by the direction of the breakdown of the “night flat”, which is further confirmed by the formation of support or resistance boundaries.

The Sniper trading strategy is based on the Dow Jones theory, where market movement goes through three phases:

- accumulation, otherwise called “flat”;

- jerk or impulse;

- reversal, or price correction.

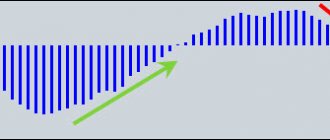

The entry point is determined at the beginning of the day - after European exchanges, which are characterized by high volatility, begin trading. The trade is opened using a strategy called the “London Burst”, designed for momentum after the Asian session. The idea is simple: during this session, all currency pairs, except those that include Asian ones, move mainly in a sideways direction. At the beginning of the European session, the price chart moves sharply in the direction of the main trend. When you see the price breaking out of the range on the candlestick chart immediately after the start of the session, this can be considered a good time to open an order in the given direction.

The author does not recommend opening a large number of transactions during one period, much less doing it simultaneously. The strategy assumes that each trade is held only as long as the trend goes in the right direction. To make it psychologically easier for a trader to trade, the author of the technique suggests moving the stop to breakeven. To do this, you should close 50% of the position and take profit. It is important to calculate everything in such a way as to avoid significant losses. The recommended profit and stop size should be no more than 20 points.

What terms are used in the trading system and what do they mean?

Before using Sniper in Forex or binary options, you need to learn the terminology of this strategy.

TIU

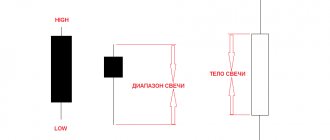

The term TIU stands for total impulse level. Other strategies use similar concepts, but they may be called differently (for example, mirror level). In Sniper, the TIU is built at the highs during an upward trend, and at the lows during a downward trend.

Total impulse level

From a theoretical point of view, this is a line of support or resistance. To plot it on the chart, you need to take several points to which the price of the currency came close, but which it did not overcome, after which a reversal began.

The Sniper strategy involves the use of two terms. TIU is an impulse level of medium strength. It looks like a horizontal line, from which the price seemed to bounce 2 times, and then went beyond it. The easiest way to build it is on the hourly chart before you start trading. A level on any chart is not a clear line, but a range of values, only a narrow one.

But there is also TIUS, that is, the total impulse level. This term is used in cases where the price touches this area at least three times.

PS

IU stands for pulse level. It can be seen on the chart in M1 or M5 timeframes. It looks like a pattern in which the price has reached some border and can overcome it. Further events can develop according to different scenarios. The price may go beyond this level and continue moving, or go sideways, or return to the previous direction.

URST

URST means the level of sharp change in trend. This situation is typical for the market immediately after news release, when price jumps can occur. The Sniper strategy on Forex allows trading in such cases, but it is risky. It should be taken into account that the chart reacts to news very intensively.

Graphically, the URST is displayed as a candle with a long tail. When constructing, you need to take into account that this level should be either at the peak in an uptrend, or at the bottom in a downtrend. That is, the level is a range at the end of the candle, a local extremum that reflects the end of the current trend.

ZK

Another component of the algorithm is the consolidation zone. It implies that the price fluctuates in a narrow range with a sideways direction. This zone is better visible during the Asian or Australian session when the market situation is fairly calm. When plotting on a graph, you need to connect the lower and upper points. Between them there will be a trade channel. An order is opened when the price breaks through its boundaries.

Consolidation zone

The maximum price range for 4-digit quotes is 18 points. If 5-digit quotes are used - 180 points.

BOO

The term BU stands for bank level. Its position depends on the price set by major market players (market makers), who have enough resources to influence its direction. It is customary to build this line based on the closing price of the candle formed at 0:00 GMT (plus 3 hours Moscow).

RU

The reversal level plays an important role, but is not used in the Sniper X strategy. It is simultaneously the boundary of resistance and support. To build it, you need to draw a line from which the price first pushed up and then went down.

Reversal level

Optimal time period for work

The system is intraday, that is, all open transactions must be closed, and they cannot be transferred to tomorrow. This already follows from the description of the “Sniper” strategy. Trading is carried out only on junior charts.

The author himself says that a minute or M5 timeframe is enough for successful trading. But many users believe that such a game requires too much psychological stress. Sometimes a second of delay is enough to miss the benefit. A comfortable option is the M15 gap. Moreover, it is not always profitable to play on very short time frames, since the volatility there is rarely high enough.

This applies to Forex transactions. The Sniper strategy for options offers longer periods - M30.

How to build levels in the Sniper trading system

Some beginners find this strategy difficult, since it is difficult to build a complete set of levels without training. You can follow this algorithm:

- Start trading a few hours before the London Stock Exchange opens.

- Start with the definition of the Asian flat. To do this, place all perpendicular lines on the graph at the maximum and minimum values. If the difference between extreme values does not exceed 18 points based on 4-digit quotes (ZK), get ready to make a transaction.

- Set the BU based on the closing price of the candle created at 00:00 GMT (at this time the clock will be 3:00 Moscow time).

- On the senior chart, look for the TIU and identify the reversal candle. If you outline its shadow with a rectangle, you can get the desired zone on the junior chart.

It is convenient to determine other levels on the working chart during online trading.

Rules for beginners

- Open the chart at 08:00-09:00 Moscow time and look for ZK. Situations are detected 2-3 times every 30 days. To increase the number of signals, we recommend using several assets, but no more than three. Otherwise the signals will become intertwined.

- When a lock is detected, limit the area with a rectangle and wait for one of the limiting boundaries to be broken by a sharp impulse of more than 4 points.

- Entry - the price is fixed after the line is broken on a short flat. Open two orders. SL are installed on the opposite ZK line to the broken one.

- TR for the 1st order - 15 points, for the 2nd - according to the closest value of TIU, URST, SPL. Professionals do not set TP for the 2nd order - exit from the market occurs when the signal is opposite to the strategy. For days when a lock is observed, the chart can move for a long time in the horizontal direction without changing the trend.

Meaning and application of MRE

This is an important element; it is necessarily present in the strategy description. Its role is to display the behavior of a large number of players. MP3 is a point on the chart at which a price reversal and trend change occur. There are many protection orders placed here, they are triggered under certain conditions, and this leads to a change in trend. The point may coincide with the position of the TIU. The level is determined on senior charts taking into account the top price position.

Meaning and application of MRE

Entry points for the Sniper trading system

To describe the system in your own words, the Sniper strategy does not imply clear rules for determining entry points. Trading comes down to the fact that the player monitors the direction of price movement, but reacts to changes according to the situation. Entry points should be formed near the levels listed above - TIU, URST, BU, etc. The consolidation zone is largely responsible for exiting the flat movement.

Basic

Abbreviated as BTV. This point appears when a number of conditions are met:

- the price chart fits the levels listed above - TIU, URST, etc.;

- a reversal level is formed;

- the price breaks through RU and is fixed behind it.

During a bullish trend, the pattern resembles the letter M in shape and is built to the maximum. In a bearish pattern, the pattern looks like a W and is based on the lows. According to the rules of the strategy, entry can be made either after a breakout, or a pending order can be formed.

Basic entry point

Retest

This type of entry point is used when you need to quickly get out of a drawdown. Then the trader has the opportunity not only to cover losses, but also to earn some amount on top of this.

The name itself suggests that a repeated action occurs - in this case, the price is thrown beyond the previous extreme, sometimes by several points. On the graph, the overall movement will be visible not as an inclined line, but as a broken line. Changes can be sudden, so they are difficult to see over short periods of time.

The Sniper strategy should not use indicators. But experienced retest traders still recommend using Fractals. When a marker appears above the candle, you can enter the market.

BTV

Retest

Breaking through and continuing the movement

When, during a trending movement, the price breaks through several resistance or support lines and continues to move in the same direction, you have the opportunity to open several trades and take profits from them.

The algorithm of actions will be as follows:

- Wait for the breakdown of the total impulse level. If there is no clearly defined trend (the price sometimes goes beyond this level, then it returns), you cannot enter the market. But this only applies to Forex: when trading on the stock market, nuances are possible.

- When a return to the level occurs and it is tested, you can open a trade, since there is a high probability of continued movement in this direction. Touching the level is a risky option for entering the market. It’s better to wait for a signal confirming the breakout.

- Place your stop after the breakout of the level by 4 points. Set the take profit in the same way as when determining the base entry point.

The author of the strategy recommends using a breakout only of the first two levels, which are based on local minimums and maximums. In the future, the chances of making a profit decrease.

Modified retest

The modified retest is a fairly rare design. When this happens, the BTV stop is triggered. It is very important to re-enter the market to compensate for losses. The ability to quickly get out of a drawdown is one of the advantages of the Sniper strategy. And this is achieved due to the presence of such points as a modified retest.

The scheme boils down to the following:

- A BTV is formed, a breakdown of the reversal level occurs, the price is fixed to it, and when returning to the RU, the trader can open a standard deal.

- The price does not reach the take profit, and in this case you can use the Safe rule to close 50% of the volume, and thanks to the stop loss for the second half, reach breakeven.

- A reversal occurs, the chart begins to move in the opposite direction - and conditions appear for the retest point described above.

- When the stop loss is triggered, the movement occurs in the same direction.

- The trader calculates the distance between the RUZ and the extremum level: usually it is several points. The formed section is called a head in slang. From the RUZ, 1.5 such distances are plotted on the graph - a point is obtained that can be used for a re-entry.

All this works well in cases where the price movement occurs sharply. The ideal option is the presence of a pronounced impulse with a quick rollback.

How are transactions supported using the Sniper strategy?

With the right approach, even a small capital can be increased 5-7 times in a short time. To do this, you need to understand how transactions are supported. This strategy uses the same techniques as other trading systems, but there are some nuances.

The main ways to support transactions are stop loss and take profit, hedging and trailing stop.

Stop loss is a technique that is familiar even to beginners. After a trader opens a trade, he must set up two orders. They are needed so that the position can be closed automatically. Triggering one of them provides a fixed amount of profit. The second minimizes potential losses.

There are options here. So, you can set only a stop loss order to reduce the risk of losses, and not use take profit. This is advantageous in that the profit margin is not limited; the trader will be able to take more. There is a second way - set only take profit. This entails high risks because you can lose a significant part of your deposit.

Trailing stop is a separate category. This type of transaction support assumes that the trader takes an active part in trading. It is necessary to monitor the price movement, and if it has passed a certain number of points in the desired direction, the stop loss should be moved to achieve breakeven. If the price moves further in the same trend, then this order can be transferred to profit and not use take profit.

The transaction is carried out manually, so continue to move the stop loss, following the price. This will allow you to take large profits before the first significant correction. Some trading robots have this function.

Hedging is another way to minimize risks. Suitable for those who have significant resources. In simple terms, you need to open a second position for the same amount, but in the opposite direction.

Completion

The Sniper trading tactic is a bit time-consuming, as it requires you to spend at least 3-4 hours a day on trading. But this is by far the most profitable strategy on the exchange, both among scalping ones and in general. At the same time, the risk level is reduced to almost 0 percent, provided, of course, that all rules are followed. In addition, many flats here are cumulative, which also creates prospects for capital growth. Another big plus is that beginners can also use it, and if it’s difficult at first, you can use the appropriate strategy advisor.

What is the safe rule?

The classic version of the system and the modified trading strategy “Sniper X” suggest using the safe rule to reduce risks. The principles are:

- A signal is generated to conclude a deal.

- When the basic entry point for this strategy is determined, instead of one trade, open two simultaneously, each for 50% of the total volume.

- After entering the market, set stop loss and take profit as usual.

- When the price reaches 30% of the way to the TR, close one trade, leaving only the second. Move the stop to the position opening level.

You can rest assured, because even if the schedule does not reach the TR, there will be no losses. In the worst case scenario, the second trade will close in a break-even position.

This approach also has disadvantages. Profit on transactions where the chart reaches the TR level decreases. Experienced traders advise considering such a reduction as a payment for minimizing risks.

High/Low of the previous day

It is from these levels that in most cases a trend reversal or strong correction begins.

Transactions are supposed to be opened at the max/min closing price of the previous trading day in anticipation of a breakout or rollback from these price levels. The entry point is determined more accurately on short periods using additional tools. Stop loss is set at approximately 15-25 points.

Entry strictly based on daily levels, as a rule, does not guarantee a big profit, but can be used in conjunction with other strategy methods.

How and when is deposit acceleration applied?

This tactic helps the trader to quickly accumulate a large amount on his own deposit. It also minimizes risks. You can open just one or two trades per session and still make a big profit.

Deposit acceleration is called risk-free, and it is a type of hedging technique.

First, open your initial position. When it closes, determine the take profits closest to the bank level. When the price movement chart reaches them, open a second position. It must be set in the opposite direction and will require twice the volume of the original deal.

Set the stop loss so that no matter what the outcome, you will make a profit or at least be in a break-even position, no matter in which direction the price moves further. Usually the stop loss for the second trade is where the take profit for the first position was. Set TP at the level of the first SL. This creates a price range, which not only insures against losses, but also increases profits.

The Sniper strategy is designed for intraday trading. This means that in such a period of time the size of the accelerating position can exceed the size of the initial transaction only twice. But this tactic is used in other systems as well. Then the position size can be increased by 5-10 times. The risk level practically does not increase, and the profit increases - sometimes by 1.2-1.5 times.

3consolidation

We consider the consolidation zone to be a strong price level and wait for the entry point after the breakout and consolidation of the price beyond the channel border. We place a stop loss behind the opposite border, but not more than 25 points.

Trading situations where the price channel breaks out are the most profitable for trading using this method. A successful entry after breaking through the consolidation zone allows you to take a profit of 70-80% of the entire movement of the trend day.

Sniper strategy advisor and its capabilities

To automate trading, you can use the Sniper advisor. To use it, it is advisable to undergo training to understand how the strategy works.

The advisor is built on the same principles as the entire trading system. The robot operates with the impulse levels described above and other concepts. Just as with manual trading, entry points are determined and displayed on the chart.

The user can set the following settings:

- Settings that control the appearance of graphs, including line thickness and color. The operation of the advisor does not depend on these settings, but it is more convenient to use the program.

- A search function for data on market makers, which helps to monitor the positions of major players.

- Parameters responsible for analyzing data and determining entry points.

- Choosing a trading method, including aggressive or conservative.

- Installation of auto trading. If you leave the value “No”, then the system only gives signals, and the final decision is made by the trader.

Testing shows that the advisor functions better in semi-automatic mode. The explanation is simple: it is very difficult to configure everything so that the system makes the right decisions itself. After all, there are more than a hundred parameters, and it is not always clear how changing one will affect the work as a whole.

There are other trading programs based on this strategy. But experienced traders do not recommend using them. For Sniper, trading in manual mode is a more effective option, especially in cases where the trader uses transaction support not provided by the robot developers.

MetaTrader allows beginners to test a strategy and learn its intricacies without risking a real deposit. The program has a demo account with virtual money that you are not afraid to lose. While a trader is gaining experience, he does not feel confident enough and often makes mistakes. In this case, the advisor helps you get comfortable, understand the methodology for opening orders, and learn to read charts. After the trader has sufficiently tested the system, he will be able to independently trade using a real deposit.

Feedback on the Sniper strategy

Traders who have analyzed all the patterns of the Sniper X trading strategy and its predecessors speak positively about the system. They say that it does not have a standard set of indicators, and this significantly increases reliability. There is also no subjectivity characteristic of graphical analysis.

The system uses simple tools, so even novice players will find it easy to understand everything - but only in theory. In fact, beginners may have difficulty reading a chart, especially at short intervals. At the beginning, mistakes are possible while the trader has not yet acquired enough experience. But there are no big losses - the player loses money, but less than when using traditional trading systems.

Reviews

However, do not forget that most of the detailed reviews are published on the pages of companies that offer training on this strategy or sell a trading advisor. The comments posted there can hardly be considered objective.

The strategy works well over short time periods, provided that the trader has enough knowledge and experience to understand it.

Summary

This trading strategy is good because it leaves no ambiguity. There is no subjectivity inherent in graphical analysis, nor is there an abundance of complex indicators. In TS Sniper, the emphasis is on simplicity, reliability and efficiency, and the authors managed to achieve success in all 3 areas.

This is one of the best trading systems in the Forex market, so if you are still undecided on your trading style, we recommend that you pay attention to it. It’s best to start with the free version, it talks about the basics of sniper trading, gives basic terms and concepts, and explains the most optimal entry points.

Download 10 videos on Sniper for free here

To receive the training course, just enter your email (the link is above). The training is conducted in video format; after subscribing, lessons will begin to arrive by email, there are 10 in total.