Stock investments are generally considered risky. You can either earn or lose money at any time. There is some truth in this. When it comes to stock trading, there is a direct correlation between risks and potential profitability. At the same time, there is always the opportunity to earn a stable income, small money, without exposing yourself to any risk. For many years, one of the most reliable ways for stable investments has been investing in blue chips.

- What are blue chips

- Blue Chip Investments

- Russian blue chips

- US blue chips

- Blue chip European companies

- China blue chips

- Japanese blue chips

What are blue chips

Blue Chips are reliable shares of the largest companies in the stock market that show stability and growth in the long term.

Such stocks are also called the “first echelon”: they set trends and are considered indicators of the entire market. Their condition is used to judge the current state of the economy and predict changes.

Second-tier securities are also large companies, but with less stability. They may change the price depending on the value of the blue chips.

There are no strict criteria by which the list of blue chips is determined. But there is a general characteristic:

- The company is well known on the stock market and beyond.

- The company has been on the stock market for a long time.

- The company's shares are highly liquid and low-volatility (volatility is price variability): thus, they are in demand among investors, but do not fall or rise in price much.

- The company has a high capitalization (capitalization is the price of the entire company on the stock market).

Strategies for Selecting the Best Bonds

The main strategies for selecting bonds are the following:

- Blue chips.

- Inflation protection.

- Top in terms of indicators.

- Eurobonds.

To select bonds for these strategies, we will use the Fin-Plan RADAR service, which allows you to effectively search for various assets according to various criteria, including selecting reliable and most profitable bonds for your investment portfolio.

What are the benefits of blue chips?

Blue chip stocks rise because of the company's fundamental business processes, not speculation. They invest money in them because the business of such companies is successful: net profit, revenue and dividends are growing, and debts are decreasing.

Blue chips are one of the safest stock investments. Companies' reserves help them survive crises and quickly adapt to market changes.

Blue chips are liquid. This means that there are almost always those on the market who want to buy or sell these shares, and at a favorable price.

Blue chips pay dividends. Almost all such companies distribute part of the profits among shareholders.

Bond selection strategy “Inflation protection”

This strategy is no less interesting and attractive, especially during times of crisis and growing inflationary pressure. The “Inflation Protection” strategy allows you to earn additional profitability when the inflation rate and the Central Bank discount rate increase.

This protection is achieved through a floating coupon, which is unknown until the end of the circulation period, as it depends on a certain economic parameter. Such a parameter can be the consumer price index, the Central Bank discount rate, the interbank lending rate RUONIA, etc., i.e. when expecting an increase in these economic parameters, you should choose securities with a floating coupon in your portfolio, and when they decrease, the most profitable are securities with a fixed coupon, which allow you to fix a higher level of profitability when the overall level of profitability in the economy decreases. Read more in the article “Bonds with variable coupon”.

Currently, according to the “Inflation Protection” strategy, the bulk of the sample consists of long-term federal bonds (OFZ).

If you adjust the filters by maturity, for example, until 12/01/2023, then the federal bond OFZ 29012 gets to the top.

Let's look at it in more detail.

Blue chips of the Russian stock market

Since such stocks serve as indicators of the market situation, exchanges make indices out of them. An index is a basket of a certain set of securities. Some stocks in the index are falling in price, others are rising in price, and overall the result is an average graph. It shows the general situation in the stock market and partly tells what is happening with the economy or some direction of it. For example, in the USA there is the NASDAQ-100 index - it is calculated based on 100 quotes of American high-tech companies and shows the state of this industry.

The Moscow Exchange calculates the MOEXBC index based on blue chips. It includes 15 companies: 2 banks, 2 retailers, 6 oil and gas, 2 metallurgical, 1 mining enterprise, 1 Internet company and 1 telecommunications company. We will tell you about each of them in more detail.

Strategy for selecting bonds “Top by indicators”

This strategy, in addition to selecting reliable OFZ securities and municipal bonds, allows you to analyze the market in more detail and select bonds of companies that have a high level of financial stability and efficiency. If the “blue chips” strategy dealt only with the securities of the largest Russian companies that occupy a leading position in their industry, while it was assumed that not all of their financial indicators were ideal, then the “Top by Indicators” strategy considers small companies with good financial indicators and, as a rule, higher profitability.

Good financial performance means:

- Revenue growth rate is more than

. If a company's revenue is growing, it means it is developing steadily and is interesting to its key consumers.

- Return on equity

. The level of return on equity indicates the efficiency of the company. The higher the profitability level, the better.

- Share of equity in company assets

.

Since a bond is a debt security, it is important to make sure that the company has enough equity to service its debts. If the share of the insurance company in the assets is more than 50%, then less than 50% will be borrowed funds, which means that the company’s activities are financed primarily from its own funds, and in case of any problems, the company will be able to pay off its debts.

In the Fin-Plan Radar service, there are different terms for this “Top in terms of indicators” strategy (up to 5 years, up to 1 year, 1-2 years, 2-3 years, 3-4 years, 4-5 years). Based on this, you can choose high-quality papers suitable for different deadlines.

In this case, we will use the “Top in terms of performance (up to 5 years)” strategy.

Currently, 108 bonds fall under these criteria. Since earlier in the article we have already looked at examples of the best government, municipal bonds and blue-chip corporate bonds, using this strategy we will identify corporate securities of small companies that meet the above indicators of financial stability and efficiency. To do this, we will leave only “corporate” in the filter type of securities.

Currently, according to the latest financial statements after the crisis period in the economy, 11 securities meet these strict criteria.

The TransCo1P1 bond falls to the top of this list. Let's look at it in more detail.

"Sberbank"

- Price December 1, 2014: 73.79 rub.

- Price December 1, 2021: 233.77 rub.

- Return over five years: +216.8%

- Buy shares of Sberbank

The largest bank in Russia, Central and Eastern Europe, 50% owned by the Central Bank of the Russian Federation. According to Brand Finance, in 2021 the Sberbank brand was the most expensive in Russia (company price 842.1 billion rubles).

As part of the IT transformation strategy, the company is increasing the share of non-banking services: logistics service Sber Logistics, product delivery Sber Market, marketplace Beru!, marketplace for medical products DocDoc.

"Lukoil"

- Price December 1, 2014: 2,418.1 rub.

- Price December 1, 2021: 6,159.5 rub.

- Five-year return: +154.72%

- Buy shares of Lukoil

One of the largest Russian oil companies. It explores and produces oil and gas in 12 countries, and processes it at plants in Russia, Bulgaria, Italy and Romania. Lukoil gas stations and other distribution networks operate in 18 countries. The company accounts for about 2% of global oil production.

Magnit2Р03 – corporate bond

This bond was issued by the largest retail chain in Russia, PJSC Magnit. This company is also an issuer of shares and is among the top securities in terms of size and liquidity on the Russian market, i.e. a typical representative of the blue chip class, so the sustainability of this company does not raise any doubts. Also, according to the company’s RAS report for 9 months. 2021, (article “Differences between RAS and IFRS”) the issuer’s equity capital exceeds the company’s borrowed funds (the share of the insurance company in assets is 62.45%), and the profit provides a high level of return on equity - 18.3%, which indicates high efficiency organization of business processes in the company.

The maturity of the bond is about 2.5 years, the maturity date is 05/19/2023. Income is generated through fixed payments in the amount of 29.42 rubles. with a frequency of once every six months (coupon yield 5.83% per annum). Taking into account the current price of the security, the total potential yield is 13.58% (by the maturity date) or 5.62% per annum.

Gazprom

- Price December 1, 2014: 144.1 rub.

- Price December 1, 2021: 254.05 rub.

- Five-year return: +76.3%

- Buy Gazprom shares

Energy company, 50% owned by the state. It explores, produces, stores, processes, transports and sells oil and natural gas. Produces and sells electricity and thermal energy. It has the largest proven gas reserves in the world (16% of total reserves). Gazprom's share in gas production in Russia is 68%, in the world – 12%.

"ALROSA"

- Price December 1, 2014: 48.91 rub.

- Price December 1, 2021: 77.38 rub.

- Five-year return: +58.21%

- Buy ALROSA shares

ALROSA is the largest diamond miner in Russia (95%) and in the world (28%), operating in Yakutia, the Arkhangelsk region and Africa. The company's existing reserves are sufficient for 20-30 years of operation without reducing production rates. ALROSA sells 52% of its raw materials to the Belgian Laurelton Diamonds Inc. – Tiffany & Co. jewelry is made from these diamonds.

X5 Retail Group

- Price December 1, 2014: RUB 2,110.

- Price December 1, 2021: RUB 2,087.5

- Five-year return: -1.07%

A group of retail companies that unites the Pyaterochka, Perekrestok and Karusel chains. As of 2021, X5 Group has 15,750 stores, which are located in 7 of 8 federal districts of Russia.

The chain not only sells consumer goods, but also develops retail technologies. So, Pyaterochka has a store-laboratory where the company tests innovations. In such a laboratory, cameras are installed that monitor the availability and expiration date of goods, remember regular customers and recognize people who have previously been caught stealing. Paper price tags here have been replaced with electronic ones, and the cash register operates without cashiers.

Dividend Aristocrats

These are companies that have been consistently paying and increasing dividends for over 25 years.

There are three additional criteria that such companies must meet:

- Presence in the S&P 500 index.

- Capitalization from $3 billion.

- The average daily trading volume for securities is from $5 billion.

The Dividend Aristocrats list is tracked by the SPDAUDP index, which consists of about 60 companies. Among the long-lived index companies are 3M, Coca-Cola, Colgate-Palmolive, Johnson & Johnson, Procter & Gamble.

"Magnet"

- Price December 1, 2014: RUB 11,840.

- Price December 1, 2021: RUB 3,253.5

- Five-year return: -72.52%

- Buy shares of Magnit

A chain of grocery stores, hypermarkets, cosmetic stores and pharmacies. It is the leader in the number of retail outlets in Russia: 14,500 convenience stores, 470 supermarkets and 5,550 Magnit Cosmetic stores.

Magnit is a company with a developed logistics infrastructure: it operates 38 distribution centers in Russia, and delivers products from its own fleet of 5,700 vehicles.

Khakas2016 – municipal bond

The bond is a type of municipal bond, where the issuer is the government of the Republic of Khakassia. The Republic has significant reserves of natural resources, therefore the production bases of large Russian companies, in particular metallurgical companies, are located in the region. Khakassia, like most Russian regions, is subsidized, however, in 2018-2019 the budget was surplus, and the share of debt obligations in the gross regional product (GRP) was less than 10%.

The maturity date of the bond is almost 3 years (until November 2, 2023). The bond is a leader in potential yield compared to other securities in its class. Profitability is provided by frequent coupon payments (once a quarter) in the amount of 29.17 rubles. (coupon yield - 10.58% per annum).

The bond also has depreciation of its face value (partial repayment during the circulation period. For more details, see the article “Bonds with depreciation”). Now the nominal value of the bond is 1000 rubles, according to the amortization payment schedule, depreciation of 300 rubles is provided. (10/28/2021 and 10/30/2022) and 400 rubles. at the end of the application period (11/02/2023). By reinvesting frequent coupon payments and partial par redemptions, you can further improve your investment performance through reinvestment.

"MTS"

- Price December 1, 2014: 251 rub.

- Price December 1, 2021: 305.85 rub.

- Return over five years: +21.85%

- Buy MTS shares

A telecommunications company operating in Russia and the CIS countries as a provider of satellite and cable television, Internet and mobile operator. There are 86.8 million customers in Russia, Armenia and Belarus.

The company has the largest network of salons in the Russian Federation (5,800 points) that sell mobile phones, financial and banking, and owns two large ticket sales operators - Ponominal.ru and Ticketland.ru.

NOVATEK

- Price December 1, 2014: 478 rub.

- Price December 1, 2021: RUB 1,258.4

- Five-year return: +163.26%

- Buy NOVATEK shares

NOVATEK is a gas company and one of the main producers of natural gas in the Russian Federation. It explores, produces, processes and sells natural gas and liquid carbon. The main place of production is the Yamalo-Nenets Autonomous Okrug.

NOVATEK ranks second in the world in terms of proven gas reserves and seventh in gas production among other public companies.

The founder of the company and chairman of the board is Leonid Mikhelson (No. 1 in the ranking of the richest businessmen in Russia 2021, according to Forbes).

Investments

Russian Blue Chips 2021 | List of blue chips of the Russian stock market for 2021

sova

|

11-10-2020, 00:47 | Good day, dear readers!

The article presents a complete list of Blue Chips of the Russian stock market for 2021.

What are Blue Chips?

In essence, Blue Chips are shares of the largest, most reliable and liquid of all companies on the stock exchange.

They often lead and move forward the industry in which they operate. In the US, blue chips are represented by the S&P 500 index, which tracks the dynamics of the 505 largest public companies (Apple, Microsoft Coca-Cola, etc.) that are publicly traded on the leading trading floors of this country (NYSE, NASDAQ and AMEX). The Moscow Exchange also has its own index consisting of the largest and most reliable companies called the Moscow Exchange Index. The degree of influence on such an index depends on the level of market capitalization of the company. The larger the company, the greater its influence on the index.

For 2021, the list of “Blue Chips” of the Russian stock market includes 15 companies:

1. Sberbank 2. Gazprom 3. Rosneft 4. Novatek 5. Norilsk Nickel 6. Lukoil 7. Polyus 8. Yandex 9. Surgutneftegaz 10. Tatneft 11. Polymetal 12. X5 Retail Group 13. MTS 14. Magnit 15. Mail.ru

Below is a complete list of the best companies on the Russian stock market with a short forecast and a brief description of each issuer. By the way, most of my predictions in last year’s review of blue chips came true, let’s see what happens this year.

1. "Sberbank". The largest Russian bank, the controlling stake (50% plus 1 share) of which belongs to the state. Due to its popularity, it is familiar to almost every resident of our vast homeland. According to 2021 data, the number of active clients of Sberbank PJSC is 98.4 million people. In recent years, Sberbank has been actively transforming beyond the banking business, successfully interning in such areas as e-commerce, brokerage services, cyber security, the entertainment industry, home delivery of food and groceries, taxis, etc. Which has a positive effect on both the level of profitability and the degree of business diversification.

●

General information.

Market capitalization level: 5853 billion rubles. Stock ticker: SBER, SBERP (preferred) Dividend yield for 2021: 18.7 ₽ Payment frequency: once a year

Price chart | Watch online

I expect a correction to the level of 280 rubles with a subsequent increase to 410 rubles per share.

2. Gazprom. Russian transnational energy corporation. Just as in the case of Sberbank, a controlling stake is controlled by the Russian Government. The main vectors of activity include: gas production, storage, transportation, processing and sales. Production and sale of heat energy. The company accounts for about 71% of Russian and 16% of global gas reserves. In 2021, Gazprom made an unexpected decision to increase dividends on shares to 27% of profits, which caused a rapid increase in their value and gave hope that in the future the company will be able to increase payments to 50% of total profits. The main problems of the company, according to many investors, are the inflated investment program and the low profitability of pouring money into “gas pipes” (“Nord Stream”, “Power of Siberia”).

●

General information.

Market capitalization level: 5072 billion rubles. Stock ticker: GAZP Expected dividend yield for 2021: 12.55 ₽ Payment frequency: once a year

Price chart | Watch online

The price of Gazprom shares is growing non-stop after falling in March last year; if the company completely levels it out and consolidates at the level of 270 rubles per share, then it is likely that the growth will continue to reach 316 rubles per share. It all depends on hydrocarbon prices and the success of the Nord Stream and Power of Siberia projects.

3. “NK Rosneft” Oil and gas company with a controlling stake also owned by the state. The main vector of the company's activity is oil production with its subsequent refining. In addition to oil production, the company produces natural gas, but in much smaller volumes. At the beginning of 2019, the international rating agency S&P Global Ratings increased the company’s long-term credit ratings in both national and foreign currencies from “BB+” to “BBB-”; in the future, the agency also predicts the continued sustainable development of the company. In principle, a pretty good company with quite a lot of potential.

●

General information.

Market capitalization level: 4665 billion rubles. Stock ticker: ROSN Expected dividend yield for 2021: 6.94 ₽ Payment frequency: 2 times a year

Price chart | Watch online

Rosneft touched the vertical resistance level three times on the chart with a period of 1 month. On the third touch, the breakdown did not occur, and therefore we can expect a correction to the level of 400 rubles per share, followed by growth and a fourth attempt to break through the vertical resistance level. 4. Novatek Gas company, ranking 2nd in gas production in Russia after PJSC Gazprom. According to data published by Forbes magazine, Novatek managed to take 316th place among the world's largest companies in terms of listing size in 2020. The company's shares were listed on the Moscow Exchange in the summer of 2006. Since then, their price has been steadily increasing. Novatek produces its production at the Khancheyskoye, Yurkharovskoye, Vostochno-Tarkosalinskoye and other smaller oil fields. The largest shareholder (24.76% of the total share) and also the chairman of the company’s board is the founder, Leonid Mikhelson. By 2021, the company's net profit increased 5.3 times and reached 865.5 billion rubles. But by 2021, profit attributable to shareholders decreased by 12.8 times compared to 2021, its size amounted to 67.832 billion rubles. According to some Novatek analysts, unlike its direct competitor, Gazprom PJSC has much more effective management.

●

General information.

Market capitalization level: 3761 billion rubles. Stock ticker: NVTK Expected dividend yield for 2021: 6.94 ₽ Payment frequency: 2 times a year

Price chart | Watch online

I expect the downward trend to continue to the level of 1000-1100 rubles, followed by a slight consolidation and a change in the trend to an upward one.

5. "GMK Norilsk Nickel" Large mining and metallurgical company Russian company. According to the statement of PJSC Norilsk Nickel itself, their company is trying to adhere to the increasingly popular ESGR principles in the world - Environmentally Friendly Production, Social Responsibility and High-Quality Management. It ranks 1st in the world in the production of refined nickel, 1st in the production of palladium and 4th in the production of platinum and rhodium.

●

General information.

Market capitalization level: 3730 billion rubles. Stock ticker: GMKN Expected dividend yield for 2021: 1021.22 ₽ Payment frequency: 2 times a year

Price chart | Watch online

For Norilsk Nickel, I expect a correction (perhaps it will happen after a test of the level of 30,000 rubles) with subsequent growth or a sideways movement.

6. Lukoil A popular Russian oil company, the name of which comes from the initial letters of the names of the cities of the Khanty-Mansiysk Autonomous Okrug, in which Lukoil was the first to launch full-scale oil production. The second part of the name, the word oil, translated from English means oil. For 2020, the company's total revenue amounted to 5,639.4 billion rubles, decreasing by 28.1% compared to the previous year. Revenue was negatively impacted by the decline in oil prices and the forced reduction in production, production and sales of petroleum products (both wholesale and retail). In addition to the Moscow Exchange, the securities of PJSC Lukoil are also listed on foreign exchanges in London and Frankfurt.

●

General information.

Market capitalization level: 3567 billion rubles. Stock ticker: LKOH Expected dividend yield for 2021: 213 ₽ Payment frequency: 2 times a year

Price chart | Watch online

Lukoil shares are actively growing along with hydrocarbon prices. In my opinion, as soon as oil prices stabilize, and this can be expected in the very near future, the price of shares of this company may decline significantly. Since even in the conditions of rising oil, the company did not manage to fully win back the fall in March 2021. Then, if the growth in hydrocarbons continues, we can expect continued growth in the shares of a Russian gold mining company. The largest in Russia and one of the largest in the world in terms of gold production volumes. It owns the largest gold reserves in the world - about 104 million ounces. The company's main production activities are concentrated in the Krasnoyarsk Territory, Magadan and Irkutsk regions. The company's shares have been traded on the Moscow Exchange since 2006. According to the company itself, the business model of PJSC Polyus includes the full cycle of gold production: exploration, mining and processing of raw ore, sales of the final product, as well as an integrated approach to preserving the environment. The company's strategic priorities are: maintaining its leadership position in terms of production costs, compliance with high standards of corporate governance of the company, labor protection, and expansion of the mineral resource base. In achieving these ambitious growth targets, the company is aided by strict cost controls and a prudent approach to sustainability management.

●

General information.

Market capitalization level: 2080 billion rubles. Stock ticker: PLZL Expected dividend yield for 2021: 387.15 ₽ Payment frequency: 2 times a year

Price chart | Watch online

After rapid growth, Polyus experienced the strongest correction of all time. So, over the course of months, the company’s shares dropped by 4,000 rubles in 9 months. It is possible that the active phase of the company’s growth has ended and now we can expect prices to stabilize and continue to move sideways with boundaries at the levels of 19,000 - the upper limit and 14,000 - the lower limit.

8. “Yandex” A rapidly growing transnational company operating in the information technology industry. Initially, the company’s first and only service was the Yandex Internet search system of the same name. But over the years, the company’s business began to expand and at the moment the company is developing many business areas: providing taxi services, food delivery, media entertainment (“Yandex Plus”, “Kinopoisk”, “Afisha”, “Yandex Music”), etc. d. The amount of consolidated revenue of Yandex based on the results of 2020 amounted to 218.3 billion rubles, which is 24% higher than in 2019.

●

General information.

Market capitalization level: 1647 billion rubles. Stock ticker: YNDX Expected dividend yield for 2021: — ₽ Payment frequency:

Price chart | Watch online

After three months of growth, a prolonged lateral correction is observed. I expect the movement to continue within the corridor with a sudden exit beyond one of the borders. It is not yet clear where exactly down or up.

9. "Surgutneftegaz" Russian oil and gas production company. The third Russian private company in terms of volumes of oil produced was formed in the city of Surgut in 1993 by spinning off from Glavtyumenneftegaz. Surgutneftegaz operates in three Far Eastern oil-bearing provinces. The company's shares have been listed on the MICEX since 2014. The company’s total net profit at the end of 2020 increased by more than 6 times compared to 2021 from 106.162 billion rubles. up to 742.871 billion rubles. - Extremely good results. In the first quarter of 2021, the company's net profit affecting shareholders decreased four times compared to the first quarter of 2021. Its size amounted to 179.6 billion rubles. At the same time, the company’s revenue managed to increase to 34%, reaching 397.3 billion rubles.

●

General information.

Market capitalization level: 1258 billion rubles. Stock ticker: SNGS, SNGSP (preferred) Expected dividend yield for 2020: 0.65 ₽ Payment frequency: once a year

Price chart | Watch online

After a fairly long drawdown, a gradual weakening of the downward trend is observed, and therefore we can expect a quick change in the trend to an upward one.

10. Tatneft Russian oil company. The regional government of Tatarstan owns 36% of Tatneft shares, as well as the so-called “golden share”, which makes it possible to impose a ban on key issues related to the management of the company. According to the results of 2019, the company’s total share in Russian oil production is 5.3%, in the field of oil refining - 3.53%. Tatneft is one of the few “Dividend Aristocrats” of the Moscow Exchange, directing the payment of dividends to at least 50% of the company’s net profit from 2021.

●

General information.

Market capitalization level: 1113 billion rubles. Stock ticker: TATN, TATNP (preferred) Expected dividend yield for 2020: 12.3 ₽ Payment frequency: 3 times a year

Price chart | Watch online

At the moment, I expect a continuation of the correction in the rocks of the long-term downward movement, a retest of the low, the formation of the “Double Bottom” pattern, followed by a reversal in the direction of the trend movement to an upward one.

11. "Polymetal" An excellent mining company engaged in geological exploration and production of gold, silver and copper ores. According to data for 2014, Polymetal was the largest silver producer in Russia and the 3rd largest in the world and the 2nd largest gold producer in Russia in terms of volumes of gold produced. The company's shares have been listed on the Moscow Exchange since the beginning of 2013. As for the dividend policy, they account for 50% of the company’s adjusted net profit. Payment occurs twice a year. In 2021, against the background of rising gold prices, the company managed to demonstrate record profitability - net profit amounted to $483 million. By 2025, production is projected to increase from 1.5 million ounces to 1.75 million ounces of gold. The company has at its disposal 9 active gold and silver deposits, and a fairly good portfolio of development projects.

●

General information.

Market capitalization level: 797 billion rubles. Stock ticker: POLY Expected dividend yield for 2021: 31.5 ₽ Payment frequency: 2 times a year

Price chart | Watch online

After a long downward trend on the monthly chart, you can notice a slight upward correction, after which the downward movement is likely to continue. In my opinion, it is worth starting to buy shares of this company at the level of 1200 rubles.

12. "X5 Retail Group" A retail company that owns grocery retail chains: Pyaterochka, Perekrestok and Karusel. According to data for 2021, X5 managed to take 3rd place in terms of revenue among all Russian companies. The company's share of the retail product market in the same year was 11.5%. The total market volume is 17.7 trillion rubles. The company is constantly expanding and increasing the number of its points in “old cities” and is conquering new ones. So in 2021, the company opened 3 Pyaterochka supermarkets in Kaliningrad and 6 more supermarkets of the same chain in the Kaliningrad region. In general, at the end of 2021, the company managed to increase the number of stores by 8.7% to almost 18 thousand points throughout the country. In the coming years, X5 is going to conquer Irkutsk and the Irkutsk region.

●

General information.

Market capitalization level: 747 billion rubles. Stock ticker: FIVE Expected dividend yield for 2021: 110.49 ₽ Payment frequency: once a year

Price chart | Watch online

The company's shares have been losing value for the past 8 months. And they come close to the long-term support level of 2000 rubles. Where, in my opinion, you can start shopping. I wouldn’t count on any special growth in the absence of third-party triggers. Most likely, the company's shares will continue to move sideways.

13. MTS A large telecommunications company providing its cellular, digital, retail and media services in Russia and the CIS countries. MTS was the first Russian telecom operator to decide to go beyond the boundaries of traditional business and begin to build an entire ecosystem, starting to provide its services in such areas as IT, Internet banking, telemedicine, online broadcasting (WASD service), ticket aggregator, etc. The net profit of MTS at the end of 2021 reached 61.4 billion rubles, which is 13.2% higher than the figures for 2019.

●

General information.

Market capitalization level: 656 billion rubles. Stock ticker: MTSS

Expected dividend yield for 2021: 26.51 ₽ Payment frequency: 2 times a year

Price chart | Watch online

As you can see on the monthly chart, since 2008 the price of the company's shares has been within a narrowing corridor (the price increases, the range of fluctuations decreases). At the moment of reaching the maximum narrowing, a strong shot occurs in one of the sides; as a rule, the direction of the breakout is set by the vector for the trend that follows the breakout. As I already mentioned, a breakdown of the narrowing can be both upward and downward, but it seems that the company is doing well, and therefore, in my opinion, the probability of an upward breakdown is still higher.

14. “Magnit” A chain of retail stores located in 3.7 thousand settlements in Russia. According to data for 2021, Magnit has about 15,000 mini-markets, 500 supermarkets, 5,000 cosmetics stores, 1,000 pharmacies scattered throughout almost all corners of our country. In addition to retail stores, the company owns its own vehicle fleet and greenhouse complex. The company was founded in 1994 by Sergiy Galitsky, and now it manages to control 9.6% of the retail market.

●

General information.

Market capitalization level: 553 billion rubles. Stock ticker: MGNT Expected dividend yield for 2021: 245.31 ₽ Payment frequency:

Price chart | Watch online

Since its placement on the Moscow Exchange, the company's shares experienced rapid growth until 2021, then there was a fall and a return to 2011 levels. Apparently, someone from the management misunderstood the slogan and decided to adjust the share prices according to it. Joke. Seriously, in general, the long-term forecast for Magnit shares is positive, since the company’s shares have been in decline for a very long time, and despite the rebound that has already occurred, there is clearly room for growth.

15. "Mail.ru". A Russian high-tech company whose assets include Mail.ru mail, social networks VKontakte and Odnoklassniki, online games, online advertising service Yula, Citymobil taxi, YouDrive car sharing service and food delivery. Delivery Club. “Mail.ru” was born as a mail service in 2000, since then the company has managed to develop into a huge business empire and go “offline”. Mail.ru Group's total net profit for 2021 decreased by 32.1% to 10 billion rubles compared to 2021, then the company's total net profit reached 15.65 billion rubles

●

General information.

Market capitalization level: 419 billion rubles. Stock ticker: MAIL Expected dividend yield for 2021: — ₽ Payment frequency:

Price chart | Watch online

Over the course of six months, the company's shares have been rapidly plummeting. Most likely this is caused by the lack of a clear strategy; in my opinion, the company should try to update the composition of strategists and visionaries. There are many examples when a change in the head of a company led to a sharp jump in the value of their shares (for example, Intel). But one way or another, as the company’s management, I am betting on growth. In my opinion, we can expect growth from current levels of 1516 rubles to 1800 rubles in the near future and a return to 2000-2500 rubles per share in the long term.

We recommend How to buy blue chips | How to invest money in blue chips

"Rosneft"

- Price December 1, 2014: 233.5 rub.

- Price December 1, 2021: 435.45 rub.

- Five-year return: +86.49%

- Buy shares of Rosneft

Rosneft is one of the main oil companies in Russia. It searches for and extracts oil, processes it, and then sells petroleum products through its network of gas stations.

The company operates in 25 countries and 78 regions of the Russian Federation. Its share of oil production is 41% of the total share in Russia and 6% of world production. The company has 13 oil refineries in Russia.

Geography of exploration and production: Western and Eastern Siberia, the Urals, the Far East, the Komi Republic, plumes of the Russian seas, Latin America and Southeast Asia.

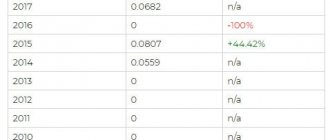

Dividend Stability Index

The DSI index shows how regularly a company pays dividends and increases their size. The indicator is historical, that is, it does not include the risks of future changes in dividend policy.

The closer the DSI is to one, the better: this indicates that dividends have been regularly paid and increased for seven years in a row. This means there is a high probability that this trend will continue. If the DSI value is from 0.3 to 0.6, then the company pays dividends irregularly.

For example, Novatek and Lukoil are among the most stable payers: the DSI values for them are 1 and 0.93, respectively.

This index can be used by investors as one of the criteria when selecting securities for a dividend portfolio.

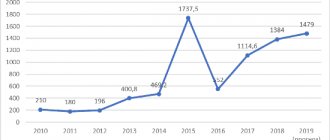

Blue Chip Index Returns

| 2018 | 15,5% |

| 2019 | 31,8% |

| 1st quarter 2021 | −20,5% |

1st quarter 2021

−20,5%

Blue Chip Index Structure

| Energy resources (oil and gas) | 51,9% |

| Metals and mining | 17,3% |

| Finance | 15,3% |

| Consumer sector | 12,2% |

| Telecommunications | 3,3% |

Energy resources (oil and gas)

51,9%

Consumer sector

12,2%

Structure and profitability of the Russian blue chip index. Source: Moscow Exchange

Dynamics of dividend growth of one of the blue chips - Lukoil. The DSI index is 0.93. Source: "Income-ru"

"Tatneft"

- Price December 1, 2014: 260 rub.

- Price December 1, 2021: 747.9 rub.

- Return over five years: +187.65%

- Buy shares of Tatneft

Tatneft produces oil at 77 fields. Main production regions: Tatarstan, the Republic of Kalmykia, Orenburg, Samara, Ulyanovsk regions and the Nenets Autonomous Okrug.

The company sells petroleum products through its retail network of gas stations, which has 713 points in Russia, Belarus, Ukraine and Uzbekistan.

"VTB"

- Price December 1, 2014: 0.0468 rub.

- Price December 1, 2021: RUB 0.0449

- Five-year return: -4.06%

- Buy VTB shares

Public joint stock company, commercial bank, 60% owned by the state. The second bank in Russia in terms of assets and authorized capital after Sberbank.

The structure of the company includes enterprises operating in the field of insurance, brokerage and investment, and owns 17.28% of Magnit shares. Since April 2021, he has owned the Moscow football club Dynamo.

President and Chairman of the Board – Andrey Kostin.

Bond selection strategy "Eurobonds"

Eurobonds are bonds denominated in currencies (dollars and euros). As a rule, Eurobonds are mainly presented in dollars on the Moscow Exchange, and they are used by investors as currency diversification for the protective part of a bond portfolio.

When choosing Eurobonds, structural Eurobonds should be excluded. These are risky bonds, the main income of which is tied to various underlying assets. You can read more in the article – “Structural bonds”.

Currently, 17 Eurobonds fall under these criteria.

The principle of choosing Eurobonds is similar to the principles of choosing ordinary corporate securities. Next, we exclude financial companies (banks, investment companies) from the analysis, since at the moment the maximum risks are concentrated in this sector. From the remaining list of the resulting sample, we choose Eurobonds SCF-23. Let's look at it in more detail.

"Yandex"

- Price December 1, 2014: RUB 1,283.

- Price December 1, 2021: RUB 2,620.6

- Five-year return: +104.26%

- Buy Yandex shares

The company's main asset is the Yandex search engine. It is fourth in the world in terms of the volume of processed search queries and the most popular website in Russia. The search engine is integrated with dozens of related company services in the fields of finance, transport, retail and logistics. The company is registered in the Netherlands, but its headquarters are in Moscow.

Yandex became the leader of the Russian media market in 2012, when it overtook Channel One in terms of audience size, and in 2013 - in revenue. In 2021, this is the most valuable company on the Runet, according to Forbes.

Severstal

- Price December 1, 2014: 484.15 rub.

- Price December 1, 2021: 885 rub.

- Five-year return: +82.79%

- Buy shares of Severstal

A mining and steel company whose main enterprise is the Cherepovets Metallurgical Plant. It makes metal and steel pipes for construction companies, the automotive and oil and gas industries, household, agricultural and heavy equipment. Produces iron ore and coking coal.

The company is controlled by Alexey Mordashov, who owns 77.03% of Severstal.

Which companies can receive this status?

What the assignment of this status means for Russian and international organizations is not difficult to understand. This is evidence of their compliance with the accepted high requirements, and meeting only a few of them is not enough.

The enterprise must be characterized by:

- stability of income for several years;

- high capitalization rates;

- timely and stable payment of dividends;

- sufficiently long presence on the market;

- high liquidity of shares;

- the absence of crisis situations over the past 10–15 years that would have affected the price of shares;

- popularity in the market;

- low volatility of shares - their value should not change significantly over time;

- state interest in the development of this industry.

"Norilsk Nickel"

- Price December 1, 2014: RUB 9,640.

- Price December 1, 2021: RUB 17,094.

- Five-year return: +77.32%

- Buy Norilsk Nickel shares

Norilsk Nickel is the largest miner of precious and non-ferrous metals in Russia, palladium and refined nickel in the world. Norilsk Nickel enterprises generate up to 2.4% of Russian exports. The company's mining and processing complexes operate in Taimyr, the Kola Peninsula, the Trans-Baikal Territory, Finland, South Africa and Australia.

TransKo1P1 – corporate bond

The issuer of this bond is the largest container operator TransContainer PJSC. The company, according to its latest reports, demonstrated revenue growth, the company's profit provides a high level of return on equity (about 18%), the share of equity in assets is more than 60%.

The bond term is about 4 years, until October 16, 2024. The bond issue involves paying a coupon twice a year in the amount of 36.4 rubles. (until April 2023). Further, the issue provides for partial depreciation of the face value and, accordingly, lower payments in absolute terms.

"Surgutneftegaz"

- Price December 1, 2014: 30.28 rub.

- Price December 1, 2021: 43.27 rub.

- Five-year return: +42.9%

- Buy shares of Surgutneftegaz

A joint stock company with 7 oil producing companies. It produces oil and natural gas in the Komi Republic, Eastern and Western Siberia.

Owns the Kirishi oil refinery in the Leningrad region - the largest complex for deep oil refining in Europe. It produces jet fuel, diesel fuel, paraffin, motor fuel, roofing and waterproofing materials.

How to invest in blue chips

Earnings on blue chips consist of two types of income: price growth and dividends. The price of such shares usually increases slowly but constantly. And dividends are paid consistently.

How to buy blue chip stocks:

- Choose a reliable broker with low service fees.

- Open a brokerage account or IIS. You can open an account remotely by signing documents electronically and waiting for the courier. To open an account, you will need a passport.

- After opening an account, the broker will provide you with access to your personal account where you can buy or sell securities.

- To buy blue chips, fund your brokerage account, select the companies you want, the number of shares, and make your purchase.

Read our guide on how to buy stocks and make money on investments to learn more about this.