The Williams Percent Range indicator, also known as WPR, which is able to determine the oversold and overbought conditions of assets, as well as possible turning points, was developed by Larry Williams in 1973.

Today, this tool is used with great success by traders around the world for trading on the stock exchange. The WPR indicator is a dynamic indicator, very similar in principle to the Stochastic Oscillator indicator.

There is only one distinctive feature between them:

- The Williams Percent Range indicator displays an inverted scale,

- and Stochastic uses internal smoothing as its basis.

2 BEST OPTIONS BROKERS YOU CHOSE!

No verification required! | review | reviews | START TRADE WITH 10$ Deposit from 5$. New broker! | review | reviews | TRY SIGNALS

RECOMMENDED: THEY REMAIN LEADERS ON FOREX!

| Deposit from 0$. TOP2 strategies | TRADING TERMS | review | reviews Deposit 100$. TOP3 TS. TRADING TERMS | review/feedback Deposit from $1. How to get $1500? TRADING TERMS | review/feedback

Description of the Larry Williams percentage range indicator

The Williams indicator bears the name of its creator, although it is believed that this instrument has a completely different author. The indicator’s task is to assess oversold-overbought conditions in the market depending on the prices established at the closing of the ranges for the past period.

The main characteristics of the indicator are as follows:

- Able to work effectively across multiple platforms.

- Can be installed on any pair.

- Capable of trading within 24 hours.

- Refers to oscillators.

How to download / install the indicator on a MT4 / MT5 chart

The Williams Percent Range indicator is built into the MetaTrader 5 and version 4 platform. It can be easily found if you refer to the “Insert” section. It is located in the “Oscillators” subsection. In the existing settings, a standard period is set, which can be changed if necessary, and the percentage value can be set in the range from -20 to -80.

The importance of market cycles when choosing a calculation period

A special way to use %R is in Cycle Theory. It is recommended to take 5, 10 and 20 day periods corresponding to calendar periods: 14, 20 and 56. But for a more accurate calculation, a time period equal to 1/2 the length of the cycle is used.

Thus, when calculating the Wilder RSI index, a period of 14 is used, which is half of 28. Suffice it to mention that twenty-eight calendar days (or twenty stock exchange business days) represent the dominant monthly trading cycle, to which other time periods harmoniously subordinate. It is the 28-day trading cycle that explains the proliferation of the five-day stochastic, the ten-day momentum indicator, and the fourteen-day RSI, each essentially covering a period of time equal to 1/4 or 1/2 of that cycle.

Formula and description williams percent range

The formula is:

%R = -(MAX (HIGH (i - n)) - CLOSE (i)) / (MAX (HIGH (i - n)) - MIN (LOW (i - n))) * 100

The indicators that make up the formula are deciphered as:

- CLOSE (i) — closing price.

- MAX (HIGH (i - n)) - the maximum level obtained over a certain period.

- MIN (LOW (i - n)) - the minimum level obtained as a standard in the indicator; for extreme values, an indicator of 14 is taken.

Oscillator indicators range from 0 to -100.

There are enough tools similar in functionality to the Williams indicator; the Stochastic oscillator is closest to it.

- Example strategy - 4 indicators:

Indicator signals

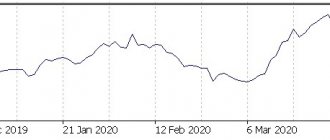

The oscillator works by comparing the value at which the last range was closed. If the numbers we are interested in are located close to the maximum, then the value that the oscillator will indicate will be equal to zero or located in an area close to it. If closing prices are close to the minimum, the value will approach -100.

The state of overbought and oversold asset

The Williams Oscillator also indicates overbought, in which case its indicator becomes above 20. This situation corresponds to a situation when price indicators are approaching their maximum, and it makes sense to consider options for concluding short transactions.

It is said to be oversold when the value is below 80, which is a sign of approaching the minimum. In this case, you need to start purchasing.

The way out of the zone corresponding to overbought or oversold will be to reach a value equal to -50, and you need to familiarize yourself with the readings of other oscillators operating on Forex.

Definition of divergence

In some cases, the oscillator can indicate the onset of divergence. This is an important point for all bidders and cannot be ignored under any circumstances. If the maximum indicators have been updated and the %R value is the highest, then you need to sell.

If the picture is completely different, the existing maximum indicator is greater than what it was before, and prices have changed, then you need to purchase.

Trading with the trend using the r indicator

It is carried out using various types of strategies, the choice of which depends on the trader, and operates on different timeframes. If necessary, additional tools are used, both built into the platform itself and downloaded from other resources.

The effectiveness of using the oscillator changes when the conditions of its use change. Therefore, before you start working with it, you need to be well acquainted with its capabilities and the factors affecting the accuracy of its operation.

All charts produced by the Williams indicator unfold much faster than price charts. Therefore, the signals produced by this tool cannot be used in all cases. In some cases, you should refrain from buying or selling and turn to other types of oscillators built into the trading platform.

History of appearance

The author is the famous financier Larry Williams. The tool works as an oscillator that shows the current oversold and overbought conditions. Alerts issued by such assets help assess the potential profit of the opened order while still “onshore”. Thus, the need to expose funds to risk tends to zero.

Back in the 50s of the last century, traders came to the conclusion that with the help of algorithmic analysis they can increase the likelihood of making a profit even when opening an order. It is important to correctly identify the market trend and act in accordance with it. And the oscillator is perfectly suited for this. Initially, several different calculation methods were created, each of which was given a name in accordance with the letters of the English alphabet - the first one invented was called %A, the second %B, and so on. In the process of working with them, only a few workable modifications were identified - %K, %D and %R. The first two lines are Lane stochastics. The latter is the range we are considering. The broad masses of exchange players learned how to use this asset in 1973.

Thanks to his invention, Williams was able to write a book about how he managed to make a million dollars in the commodity markets in one year. A very large amount for those times, and in our time, many continue to dream of getting closer to the coveted million through trading.

Advantages and disadvantages of the indicator for Forex

There are certain difficulties when working with the data provided by wpr, and they consist in the fact that it is almost impossible to correctly interpret the shifts in the percentage range at the moment when work occurs in the overbought zone or its opposite.

- Example strategy - WPR:

Staying in these areas can be delayed, and the value then moves along the trend. The result of these events is the emergence of many false signals, which sometimes even an experienced trader cannot deal with. Even beginners should act with caution during such periods.

The information provided by an oscillator of this type is necessarily taken into account when operating strategies that use a trend. In this case, large billing periods are involved, and marks equal to -45 and -55 are used for orientation.

In any case, experts advise not to rely only on wpr indicators, but also to resort to other tools used in Forex.

- Example strategy - Leash:

Money management

Professional traders know that the key to success in trading is not only a reliable broker and strict self-discipline, but also conscious capital management, that is, money management. If some traders believe that it is enough to have analytical skills and make correct forecasts of the market state, then the majority of trading participants are sure that this is not so.

A rational approach to capital management means that the player will not lose all his money in case of failures and will be able to make a reasonable decision. Money management in binary options trading is important; it is part of an overall strategy that will help achieve a stable result.

How to work with your funds correctly? Money management is the optimal management of your funds, subject to the main goal of the trading participant: not to lose money on the deposit and increase their number by following the basic rules of money management :

Minimum bets. Minimum funds

When you bid, try to bid the lowest amount possible. You should bet no more than 5% of the deposit. Moreover, entrust your funds to a broker who will guarantee the best profitability on the market.

You should not transfer your entire deposit to one option, because your forecast may be incorrect, and you will be left without money and will not be able to continue trading.

Minimum deposit

When you participate in trading and work with a personal account, determine your free financial range that can be spent and only then transfer money to the deposit. You should not transfer a large amount at once; it should be a minimum amount. Please be aware that your trade may fail and you may need more funds to continue trading.

Minimum assets

When you are just starting your trading journey, you should not participate in all the assets offered by the market at once, although the possibilities of binary options will tempt you to do everything at once. This is not true: more transactions means more load on the deposit. In this case, there is a high probability of not noticing how you will run out of money.

Get to know the market gradually and slowly, start with two or three assets. Once you get comfortable with trading, you can think about increasing your investment portfolio and try your hand at stocks, futures, etc.

Minimum emotions

When you are exploring the possibilities of trading, turn off your emotions, because they can interfere with your discipline. An experienced market player is a sober player, aware not only of his prospects, but also of the risks. Don’t give in to your worries, don’t follow the strong desire to master everything at once. Remember that bidding is serious work, not a lottery.

The rule of three, which came to options from Forex, will help improve your discipline: according to statistics, three failed or successful transactions, and you are immersed in emotions, your mind turns off and you have a desire to either return everything lost, in case of failed transactions, or, conversely, increase several times the funds won. This behavior will lead to you spending all the funds on your deposit. Learn to tell yourself “stop” after three trades and leave the market, then you will always have the opportunity to continue trading and achieve a better result.

Simple strategies based on the indicator

Option 1:

The r indicator is not only one of the most effective tools, but also one of the simplest. At the same time, it is impossible to build a full-fledged strategy on its basis. Price Action patterns such as doji, rails, engulfing pattern, inside bar, pin bar and others work well with the WPR indicator.

Option-2:

More benefits come from using several tools in parallel. Moreover, the tasks performed by each of them will be different. The first will direct the trend, and the other will give the command to enter.

Option-3:

Another strategy is widespread, and its principle is that one of the oscillators has a period of 14, and the other period is 2 times longer - equal to 28.

In this case, an oscillator with a long period will indicate an upward trend at values above -55, and indicate a falling trend at values below -45.

The signal at which it will be necessary to open a trade will be the moment when the indicator with a shorter period closes higher than with a larger period.

Option-4:

The principle of the strategy using support and resistance lines is that attention is paid to the support and resistance lines, which in turn depend on the last low and high of the price. In this case, the period on wpr is set to 14. Also, the indicator should indicate an exit from overbought. A signal to sell will be a rebound from the resistance line.

Option-5:

Using the Williams indicator with the SMA indicator can be effective, especially if it works on the H1 timeframe. An important point is the correct setting of the tools used. Moving Average works according to the MA method - Smoothed with a period of 25. And the Williams percentage range has a period of 200.

In this case, the Williams indicator accurately determines a reversal or a beginning trend. And the second %R determines the moment of entering trades.

If it is necessary to buy, %R comes out of oversold conditions and crosses the -80 mark from bottom to top. In this case, the bar closes above the MA.

When selling with Williams, originating from the overbought zone, wpr should already cross the -20 level, and the direction will be reversed, and the bar will open below the MA.

Option-6:

Using the Williams percent range indicator together with an exponential moving average works on the H4 time frame. Selling occurs provided that the price is below the EMA and the wpr indicator is directed towards the fall in the area close to the range from -20 to -80. If there is a percentage range from -100 to -80, a purchase occurs.

Option-7:

A strategy using Stochastic and Williams PR and resistance and support lines demonstrates its effectiveness on the interval equal to M15. A signal to sell is the contact of the resistance level, which indicates overbought, like its partner.

Option-8:

When it comes to a strategy with four indicators, in addition to the already familiar wpr, a simple moving average SMA with a set period of 50 and an SMA with a period of 200 are used, as well as the MACD indicator. This method is most often in demand in a volatile market.

A trade is indicated when two SMAs are heading up, the MACD is moving below zero, and the wpr indicator is at or above -80.

When a strategy using the Williams indicator and MACD is preferred, the MACD level is set at 24, 36, 14, and the percentage range of the williams percent range indicator has a period of 28. A similar strategy is recommended to be used in the range from 1H to 4H. The principle of this method is that all indicator values must correspond to MACD readings.

- Step strategy example:

Additional Helpers

In combination with %R it is allowed to use:

- Moving averages. Such lines at the intersection of different intervals indicate entry points. The Williams Channel shows how advisable it is to open a position in the chosen direction.

- Envelopes. With effective channel display parameters, it will help to set strict target levels for position protection and potential profit.

- Volumes. Additional confirmation of the possibility of opening a position based on the current state of the market in terms of the prevalence of buyers over sellers, or vice versa.