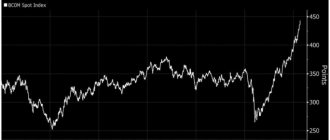

Trading on stock exchanges is a complex and multifaceted process. Traders use a wide variety of strategies and tactics; a huge number of factors influence their actions. There are certain stereotypes of traders' behavior. Stock market players have come up with various names to help describe the strategies and tactics they use.

Most often, players on the stock exchange are called some kind of animal - a bear, a bull, a sheep, a wolf, a hare and many others. Sometimes beginners do not understand anything when they hear such names. Our article is intended specifically for them. It will help you gain the necessary knowledge.

How many traders lose money on the stock exchange?

In fact, there is no definite answer. Moreover, it never existed. There is no institute that would take a sample of traders and say: “According to our research...”. After all, this is impossible to do, since traders are different.

You've probably already heard the version about 98% of traders merging more than once.

98% of traders lose money

Most likely, I have heard about 95% of losing traders.

95% of traders lose money

And even 90% of traders

90% are already losing money

I even heard about 85%. If you dig around, you can find 80% of the leakers.

Here are those on. 85% lose on the stock market

The reason is the difference in statistics - huge. About 20%. That's a lot. What is this connected with? With the fact that there are no such statistics and never have been. Moreover, this is a huge myth in the trading community. It is connected with the fact that a losing trader often forms his opinion on social networks. While the earning trader remains silent. As a result, such a “distortion” occurs. Suddenly it begins to seem like everyone is losing everything on the stock exchange.

There are no statistics on failed traders. At the moment, no one has conducted such studies.

One way or another, there are certain patterns and scenarios that cause most traders to lose on the stock exchange.

Stock exchanges in the Russian Federation

Almost every state has its own operators of activities related to the circulation of securities. There are many stock exchanges in the European Union, developed Asian countries and, of course, the United States. This is due to economic growth, development and great demand for this type of service. As for our state, Russian stock exchanges include six main operators of such activities, but in reality there are many more of them. The chosen service provider will determine the trading conditions, the minimum threshold of funds for transactions, as well as the list of quoted shares. The most famous stock exchanges in Russia are the MICEX (Moscow Exchange, MOEX) and the RTS (Russian Trading System). It should be noted that when working with exchanges there are some nuances, the main one of which is the presence of an intermediary in the form of a broker between the exchange and the client. This is a separate legal entity, has a license and ensures the transfer of information about transactions. The list of brokers with whom we work can be found on the website of a specific exchange. Trading without intermediaries is possible, but requires additional costs, renting server equipment, and in some cases, opening a legal entity and obtaining a license.

The main reasons for failures on the stock exchange.

Let's look at the main reasons for failure:

- Initially negative odds due to commissions.

- High competition for the best price.

- False Expectations (Instant success, luck, holy grail).

- Shoulder too big.

- Too many deals.

- Ignorance.

- Lack of experience.

- Emotions (greed, fear, ego, etc.).

- Lack of a trading plan or system.

- Wrong money management.

Brief summary

The issue of the presence of puppeteers in financial markets, as a rule, worries only the inexperienced trader. Due to lack of experience, he is not able to understand the price movements occurring on the financial market. Professionals do not pay attention to these rumors and make money on any strong stock movements.

So, should we believe in puppeteers or not? Each exchange player must answer this question independently. But all traders should learn about real institutional market makers and their importance for trading platforms. Follow the link and read the detailed article.

Initially negative odds due to commissions.

At the beginning of each trade, you are in the red due to the spread or commissions. A Forex trader always pays the bid/ask spread. Even if you remain at zero in your trading, the spread will do its job. After all, now, remaining at zero on our transactions, we need to cover the spread or commissions of previous zero positions with a subsequent transaction. Some brokers have huge commissions. For example, a large US stock broker charges $6 per trade. And it doesn’t matter what volume it is. Considering that the median trade of a US trader is $500-$1500, $6 is a lot. Especially if the trader trades using day trading.

It's worth noting that brokers and banks typically give significantly lower spreads to larger clients, giving them a cost advantage that you don't have.

At the same time, we are talking about trading to zero. It is advisable, of course, to also earn money. Most lose money by stupidly losing money on commissions.

Large commission solution.

If spread and commission are a burden for you. You should look for brokers that offer the lowest spreads and/or commissions.

When you day trade the forex market. You need to be right in trades more than 50% of the time. You cannot rely on any subjective sense of the profitability of your system or your own guess.

Instead, you must put in extra effort to ensure that your system is tested. Moreover, testing should be based on a sufficient amount of quantifiable data. This can be done using a backtest, for example. Only after this will it be possible to draw conclusions about your strategy. There is no place for subjectivity and luck in the market.

If the system gives less than 50% of correct transactions, the commissions will be drained.

The fewer positive transactions the system gives, the more the broker’s commission influences the trading result.

Leverage

Leverage is fundamentally evil. Let's look at a simple example. For example, we throw a coin and our opponent and I each have $1000. It's simple: we set 10% of the initial capital, i.e. $100 per throw; heads - we won $100, tails - we lost $100.

After several hundred rolls, everyone should theoretically be left with their money. This is called a game with zero mathematical expectation.

But if we want to double our bets to $200 by taking out a loan of $1,000, it turns out that we will now have to pay money for our game to the one who additionally financed us. This will gradually take money out of the game to pay interest and ultimately both sides will lose.

The loan turned into a game with zero mate. waiting to play with the negative. It’s the same with playing on the stock exchange - you have to pay money for the broker’s funds, which makes speculation generally unprofitable for all participants.

Most traders lose money on the stock exchange because of a big player.

Large traders (banks, corporations and hedge funds) are the sharks in these waters. Sort of big players. Using various puppetry techniques, trading day and night, knowing the pitfalls, they eat the weak. They use complex trading systems and sniff out inexperienced traders. Which place stop orders at obvious support and resistance levels. As a result, they lead this crowd to their feet. Traders also call this a stop loss.

In the market, the trader tries to resist the institutions working for banks and hedge funds, which make up 90% of the liquidity. In such a situation, the playing field is not fair. Most people lose money simply because they don’t understand their fate – a small fish in an ocean with sharks.

The typical trader has limited trading capital, is often inexperienced, and trades with free terminals. He can only spend part of his time trading. A typical large player, on the contrary, is well capitalized. Has significant experience, an advanced terminal and can devote most of his day to trading the market. With more capital, more sophisticated terminals, more experience and education, and more focused trading time. The big players are like sharks in a fish tank, preying on weaker and smaller retail traders. Whose accounts are being swallowed up by their own trading mistakes.

How to get rid of a big player?

Knowing that you are competing against opponents bigger and more dangerous than you is a humbling step in the right direction. It's important to know upfront that you are at a serious disadvantage in terms of experience, education, tools, and time.

In general, experience decides. After all, we are fighting on the same field with a major player. One way or another, he will, in any case, “take you to your feet.” Whether you like it or not. BUT, as you gain experience, you will understand that the devil is not as terrible as he is painted. Over time, you will understand that the big player is also losing money on the stock exchange.

Recommendations from the guru

Receiving recommendations and trading on them is a form of haphazard trading. Recommendations can be obtained from a mentor if they are based on a successful trading system or on in-depth fundamental analysis of a company or industry.

It is worth trading on the basis of recommendations only if they are confirmed by facts and not by the opinions of analysts, and even then, this relates more to investing and not to speculation. In any case, be able to distinguish opinions from facts. Facts reveal numbers, i.e. indicators that are reflected in the balance sheet of companies or calculated based on data from the company’s balance sheet.

False expectations of traders.

False expectations can be divided into:

- The desire to get rich quickly.

- Search for the "Holy Grail"

Forex has gained a reputation as a way to get rich quick. This PR is being promoted by numerous signal provider organizations. Market gurus, even forex dealers and brokers, they are all trying to make money out of naivety and greed. They promote the idea that you can get rich extremely quickly in Forex. Most people lose money thinking that there is incredible profitability. As a result, this forces them to open transactions in larger volumes.

Classics of the genre. Kolya worked in a mine, and then BAM he became a trader

Solution

Keep in mind that success in Forex does not happen overnight. It can take years to gain the confidence, experience, and price understanding to turn trading into a profitable business.

If you are a newbie, you must first survive in the market. This is achieved through money management. You need to start by trying not to lose all your money in the first few months or years. Once you find that you are holding at zero on your demo and live accounts. Only then can you consider that you have a chance to turn trading into a profitable business. Just don't quit your regular job. Remember - a beginner often loses money on the stock exchange.

Search for the Grail in the market

If you are a beginner expecting to earn 20-100% of your deposit per month. You already have an incredible goal that is divorced from reality and impossible to achieve. The only way to make such huge profits is to use high leverage or scalping. Both approaches may work for you in the short term, but will eventually destroy your account . You will face the dual dangers of over-leveraging and over-trading, as described below.

One day there was a gentleman on a plane who said that he was going to make a living as a forex trader with a $6,000 account. He was simply naive. To survive in this world, a person usually needs to earn 2 thousand a month. More if he is raising a family. With such a bread and butter deposit, it is easier to make money at work or in business.

Thinking that you can make 2K per month from your initial $6000 is thinking that you can consistently earn 30% per month, which is unlikely. Forex is a very dangerous arena, and trying to increase your deposit by 30% per month to pay bills is a great recipe for disaster.

In fact, traders earn 1-10% per month. Read more about this. However, the main drawback is the lack of systematicity of such earnings.

Solution

Stop thinking that you can make a fortune with your small trading account. Or that you can quit your job trading Forex. No person or system can consistently make the 20-100% per month you need for your monthly expenses. Forex is not a quick money scheme.

However, it is possible for a person or a system to achieve a consistently profitable return of about 1-10% per month. It is possible, but very difficult. This requires knowledge, experience, patience, discipline and a state-of-the-art system. The main difficulty is creating a relatively stable income with low risk.

Finding the ideal trading system.

On the issue of ideal.

Most people lose money because they are looking for the perfect trading system. There were many seekers and to some extent there still are. You can remain optimistic for a long time that somewhere “out there” someone has built a system that can beat the market.

The problem is that 95% of systems are unprofitable for many reasons. A great system today, may be in the trash bin tomorrow. Markets are changing. A system that has been making steady profits for the past six months may suddenly find itself in a severe, unexpected drawdown. This happens even with the best systems that take prizes in competitions. For example in LCHI

Solution

Stop dreaming about just one system. There is no “Holy Grail” system that can beat the market. I'm not saying there aren't good systems. There are some good systems out there, but they're definitely not going to make you 20-100% a month. Moreover, if someone tells you that their system makes 20-100% per month, this should arouse suspicion.

We can say that really good systems give 1-10% per month of consistent returns with drawdowns of less than 20%.

Prioritize your own self-education in and about the market. The more you know and be able to do, the greater the chances of creating a good system.

A good trading system does no more than 10%. The main thing in the system is the stability of income, and not the buildup of the deposit.

PEOPLE ARE STARTING TO RISK SIGNIFICANT MONEY

Very often people in trading try to risk serious money, being mentally unprepared for this. Some unique people even try to use borrowed funds, which is absolutely forbidden to do!

Working not with your own money or if it is significant for you, all this creates strong moral pressure on you, knocking you out of your comfort zone. A person who is outside his comfort zone will not be able to trade efficiently.

ARTICLE: Forex indicators

Any loads need to be increased systematically! If you work perfectly with a deposit of 1000USD, then it’s not a fact that if you are given 100,000USD right away, you will trade just as efficiently!

How to treat? It is worth increasing the deposit amount systematically depending on moral readiness. I strongly advise you to “mentally say goodbye” to the money you used for trading. The loss of such funds should not affect your financial condition.

Traders lose due to high leverage.

The main reason why most people lose money on the stock market is because they are overly active in their trades. Or, in other words, they are undercapitalized relative to the size of the deals they make. With the false expectation that they can make 20-100% monthly profits, the new trader maximizes the available leverage. The end is predictable - he quickly loses his account. The Forex market allows traders to use leverage up to 1000:1, which when fully utilized can lead to huge profits. In some rare cases and dismal losses in most others.

Even with the more common 100:1 leverage offered by most forex brokers, if a trader fully utilizes the 100:1 leverage offered. His entire account could be wiped out in one trade. If a trader had a mini account of $1000 and used 100:1 leverage to buy 1 standard ($100,000) lot. The currency pair would only have to move 100 pips against it before the account would be wiped out (100 pips * $10 per pip = $1000).

Interestingly, US regulators recently took the additional step of limiting the leverage of US brokerage firms to 50:1 . They did this for the purpose of trying to protect the average investor from harming themselves.

But limiting leverage options will not protect the American client from abuse of leverage and account drain. A greedy American client can still zero out his account if he uses full 50:1 leverage: the only difference now is that he will need 2 bad trades instead of 1 with 100:1 leverage to lose his deposit.

Solving the leverage issue

The market allows traders to take on a huge amount of risk. But in many cases it is up to the trader to limit the use of leverage. Most professional traders use 2:1 leverage, trading one standard lot ($100,000) for every $50,000 in their trading accounts. This equates to one micro lot ($1,000) for every $500 of account value. So if you had a $2000 account, you would be trading up to 4 micro lots (0.04) per trade or less.

Remember that leverage can be a powerful tool for maximizing your profits. This could be your bankruptcy. Leverage is a double-edged sword that magnifies risks as well as adding to potential profits. Use it wisely and sparingly.

Most people lose money on the stock exchange because they use a lot of leverage.

Big risks

Brokers provide the opportunity to take on large leverage. Gambling traders take advantage of this. They may be lucky for some time and the market will forgive excessive risks. But someday a “black swan” will arrive and the deposit will be completely destroyed.

Therefore, one of the important rules to stay in trading for a long time: a reasonable amount of leverage or its absence.

In Forex, leverage reaches 1 to 500. This is simply killer for capital. Stock brokers limit it to 1 in 50.

- Money Management - what is it;

- Margin trading;

Too many deals

The beginner believes that if he can combine the use of high leverage with frequent trading, he can make huge profits. What he fails to notice is that the market is volatile and can change direction dramatically throughout the day.

Up to 90% of day traders fail because they take too much risk and take too many trades. There are many reasons for this; people, as a rule, strive to earn money right away and without thinking, taking impulsive and unthought-out actions. Ultimately, overtrading is the result of a lack of discipline, plan and patience.

Solution

You must strive to stick to the trading plan/system and then be disciplined and patient within the system. The plan and system will force you to trade according to a set of entry and exit rules . You must curb your excitement and adrenaline in trading for every change in direction and place trades only when required by the system. If you've had a bad losing week, don't worry, the worst thing you can do is abandon your money management principles. Even worse is trying to over-leverage or over-trade your account. Additionally, if you miss one trade or trend, you don't have to chase it; you just have to wait patiently for the pullback to come back. Follow the rules of the system or plan, not the micro market fluctuations.

Video on the topic

Averaging losing positions

This mistake is most destructive not in the stock market, but in currencies, cryptocurrencies, and commodities. Averaging losing positions only worsens the trader's position. It is much easier to re-enter the market into a growing asset than to become a long-term investor in a speculative instrument.

Extreme situations can occur in markets. For example, in April 2021, delivery futures for May WTI oil fell to -$40. Everyone who held this position suffered huge losses, as the Moscow Exchange forcibly closed all contracts at a price of -$37. Of course, this is an exception, but such a situation is enough to lose your entire deposit.

If we are talking about the strategy of averaging across a portfolio of shares, then if you are 100% confident in their reliability and stability, then you can hold them. It is better to close all other financial instruments using a stop loss.

By the way, there is a very profitable strategy of averaging positions as the asset grows. This strategy is called pyramiding. If you manage to catch a good trend of at least 5-20% growth, then you can earn huge profits through the use of leverage and consistent entry on drawdowns along this movement.

Ignorance and lack of understanding of the market.

One of the reasons why traders fail is that they do not have enough knowledge. They come to the market without even reading a book or taking a course. Some barely understand what technical and fundamental analysis is and they make trades on a whim, intuition, instinct. Consequently, without knowing how/why prices move, many traders fail.

Solution

A beginner should strive to understand the basic components that make up the market, as well as the main factors that move it. There's a lot to learn. You need to try to learn and become fluent in both technical and fundamental analysis. It is not enough to follow only one school or approach. You must be curious and open-minded enough to explore the many factors that shape and build the market. The more knowledge and information you gain, the better your understanding of the market you are trading. This, in turn, will help you make wiser and more informed decisions. Also, theoretical knowledge alone is not enough; you must constantly develop your experience.

PEOPLE FORGET ABOUT THE IMPORTANCE OF PSYCHOLOGY

Any experienced trader will tell you that the core of trading is psychology. Yes, strategy and money management are important, but they lose their meaning if a trader exhibits psychological instability.

You may have a clear system, structured rules of MM, but you will not follow any of this if you are emotional or undisciplined.

HOW TO TREAT? There must be an understanding that trading is not primarily about knowing the market, but about knowing yourself. If you are not able to clear your mind, act systematically and disciplined, neither strategy nor money management will help you and nothing will help you!

Lack of experience in trading

Often new traders become so enamored with an indicator or system. Of course, they immediately dive into real trading in the hope of getting rich quickly . The allure of quick profits prevents them from waiting patiently and practicing first with demo and micro accounts. Or perhaps they have already practiced with a demo account for several months, made some decent trades and convinced themselves that they or their system can beat the market.

Then they try their hand at a live account and find that greed and fear are getting in the way of their trading and that the market of tomorrow bears little resemblance to the market of the last few months.

Traders' lack of experience makes them undisciplined, impatient and emotional. In turn, this leads to numerous trading mistakes. They lack experience in dealing with multiple forces, as well as the high degree of randomness of the market. Causes them to underestimate and overestimate the market, leading to many false interpretations. Lack of experience in money management forces them to take too much risk. Ultimately, they lose the deposit.

Lack of experience gives rise to “psychology” effects. A vicious circle does not allow a trader to start trading profitably.

Solution

It's best to think of the market as a very dangerous arena that requires years of experience to survive, let alone profit. While you can learn to drive in two months, the market can take years of hard work. Moreover, we are talking about zero for elementary trade, not to mention profit. Keep in mind that the professional trader behind the monitor already has 5 years of full-time trading experience. He works with an equally experienced team of traders with advanced tools and terminals. Try to answer the question - how will you take the money from him?

Compared to a gunfight in the Old West, it's you, a man with a rusty pistol, against a dozen veteran fighters with the most advanced weapons.

The point is that every trader must constantly work hard to become better. There is a well-known rule of 10,000 hours. Which states that the key to success in any cognitive domain is largely a matter of practice. Moreover, a specific task requires a total of 10,000 hours, which equates to 4 hours a day for 10 years.

Success does not always depend on a lot of time spent, but remember that it takes enough time to hone the necessary skills and abilities . Forex is a long journey that requires patience, discipline, self-control, courage and strong motivation to continue to do your daily homework, trade regularly and consistently, and learn all the time.

Emotions in trading are the path to loss.

Humans have a number of weaknesses, most notably greed, fear, ego, addiction and laziness.

Greed: One of the seven deadly sins, this is the main reason why traders lose on Forex. Because of our short lives and the desire to make money quickly. Greed forces us to trade without taking the time to develop the necessary knowledge and experience. It forces us to enter the market too early, when we are not yet ready. Also makes us more aggressive, causing us to over-trade or over-leverage.

Fear: Healthy fear is knowing that markets are dangerous and that you first need the necessary skills and training to survive in them. An unhealthy fear is to think that the market is too dangerous, this fear that paralyzes trading, forcing you to watch the market actions without being part of it. Unhealthy fear also occurs when a trader exceeds risk due to greed. Or, if the market moves in his direction, he exits the trade too early for a small profit, fearing that the market may move against him, preventing profits from growing.

Ego: Ego is overconfidence. Many traders lose money because they have no idea what they are doing. When at the same time they think that they really know. If their ego is big enough and they keep trading the markets and losing, they may even think that their “experience” allows them to write books, create seminars and become “guru” for those newbies who are naive enough to trust their confidence.

PEOPLE TAKE EXCESSIVE RISKS

Very often people enter into transactions with simply unrealistic risks. 20-30-50-100% of the deposit in a transaction is quite commonplace for any beginner. This is where banal greed comes into play. He understands that he has little capital, and he wants to make a lot out of nothing.

It’s trite, inflated risks are a direct path to failure and it’s just a matter of time. The more you risk on each trade, the less chance you have of long-term success.

VIDEO

How to treat? For example, a trader who risks 20% of his capital on each trade will essentially not be able to even open 4 trades after a loss. In fact, even an experienced trader can fall into a series of losses that can even exceed 4 trades in a row. This must be understood! The optimal risk is 1% per trade, if you are confident in it, then you can try a risk of 3%. Some people call the maximum amount 5%, but I think that it is too high.

The market constantly tests the trader.

The fact is that every transaction puts your knowledge and experience into direct question. Just when you think you know enough, the market will force you to reconsider, go back to the drawing board and learn a little more. It's best to be a humble trader, manage your trading in a humble way, and be willing to learn new things every day and with every trade. You need to be prepared for the worst and make the most of your failures. Too much ego creates constant illusion and denial, which kills the learning process.

Dependency: I think you are familiar with the situation when you cannot close a losing trade, averaging, topping up . You must remember that trading is not about betting to make quick money. It's a slow business and you have to put in the time and effort to become a good trader. People very often lose money because they do not close unprofitable positions, hoping for a reversal.

Laziness: Most people never use their brain's full potential. Our brains are more powerful than the most powerful of computers, but we need sufficient motivation to work. Lazy traders almost never do their homework, never analyze their trades and mistakes. Their profitable trades are the fruit of luck; in the end, they lose capital, unable to assess the current situation and draw conclusions from mistakes. After failing in hand trading, they then place all their hopes on automated trading, but even there they do not put enough effort into testing, which again leads to losses.

Solving the emotional factor on the stock exchange.

The only way to overcome the above human limitations is to recognize their existence and work hard to avoid them. To do this, one must strive to develop a sound trading plan and system that forces the trader to be patient, calculating, free from emotions and ego.

A person cannot live without emotions. However, emotions in trading directly lead to losses. A smart trader tries to control his emotions.

What else is important to know

You should be wary of various “teachers”, paid “miracle signals” and other dubious things. As they say, free cheese is only in a mousetrap. And in our case, you will also have to pay for falling into this same mousetrap. However, if a novice trader studies conscientiously, reads useful literature and really loves this type of activity, then he will definitely achieve certain success. There is a huge amount of information available in the public domain. The main thing is, do not take advice from strangers and do not buy anything from them. You should also be wary of calls from various managers. They, as a rule, impose services or engage in outright fraud, but this is more common in the foreign exchange market, in particular Forex.

No trading plan or trading system

Many traders trade without a plan or system. They do not set specific risk and reward goals before trading. Even if they develop a plan, they don't stick to it.

Failure to follow a disciplined trading plan or system results in large losses and small profits. Many do not create positive and negative scenarios. They allow their emotions to overcome their intellect when the markets move for or against them.

The solution is to write a trading plan.

You need a good trading plan for every trade . The system should be clear and understandable, without being rigid and inflexible. The prerequisites for entering a transaction must be specified, the lot size and exit from the transaction must be determined. A good trading plan will transform an ordinary trader into more of a trading robot, trading according to a set of rules and conditions without emotion or greed. Adapt your plan to suit you. Each person is unique and each needs a different approach to trading. Some people are successful at scalping, but that doesn't mean it's for you, it's up to you to figure out what suits you best.

A good trading plan will take a significant amount of time, discipline and patience to stick to. After all, for many reasons, a person sometimes fails to stick to a trading plan. If you feel that you are unable to stick to the rules, it is best to concentrate on robotic trading.

In addition, you should not jump from one system to another. Each strategy brings unprofitable trades; you should not immediately plunge into the maelstrom of new strategies after a short series. First, carefully study what the problem may be, go to the demo.

PEOPLE COMPLETE THE TRADING APPROACH

Find any strategy on the forum with its discussion. Look at the first page of the discussion and what the system looked like there, then look at the end of the discussion. You will suddenly find that the system will be changed beyond recognition.

ARTICLE: Traces on the Internet

They hang a bunch of strange indicators and other things on it. Complex strategy is not good! It should be simple, logical and most understandable!

How to treat? The more complex the system, the greater the chances of getting confused in its own rules. You can attach hundreds of indicators to a strategy, introduce a bunch of new rules, but this still will not protect you from losses, because they are an integral part of trading.

Wrong money management. The reason why most people lose on the stock market.

Most traders completely forget about risk while at the terminal, thinking only about profit and never planning for the worst. And yet the worst happens more often than it seems. Every trade has the potential for a sharp reversal at any given time. If you trade with high leverage and no stops, without knowledge of money management, you will lose everything in one trade. No amount of prayer, hope, luck or patience can make a losing trade turn around. This is an undisciplined approach and the trader is required to stick to a system with a clearly defined stop loss.

The information in this article is just a drop in the bucket. All the most interesting things are in the chic “ABC of Trading” section.

Go to the ABCs of trading and change the way you think about trading

Even worse than having no stops is adding to a losing position through grids and martingales. Some traders make it difficult to trade without a stop loss by adding to their losing trades. Either the same lot size at different intervals (grid), or adding a multiple of the initial lot size at different intervals (Martingale).

While these strategies can sometimes turn bad trades into their favor, they can also speed up the multiplication of an account by zero if the retracement move is strong enough. Unfortunately, this is often how traders lose money.

Money management limits the risk on each individual trade so you can trade tomorrow, next week, month and next year. The goal of money management is to protect you from taking too much risk and therefore protect your profits. Without knowledge of money management, you can quickly lead your account to deplorable

The solution is proper money management.

Professional traders use money management techniques to protect their portfolio. They provide a certain guarantee of maintaining the account in order to stay in business longer. Some key risk management techniques:

1) Trade only money you can afford to lose

2) Avoid high leverage.

3) Cut the losses, let's go to the profits. Use clearly defined stop losses and do not close profitable trades too early, you must have a plan for both losses and profits.

I offer a great mutually beneficial deal

I have great free video lessons:

- About a major player

- About market mechanics

- About levels

Subscribe to our newsletter

It takes half a minute to subscribe and immediately after subscribing you receive an email with a link to the lessons.

Miracle indicator or how to calculate the doll?

On thematic websites or forums, traders may be offered to download an indicator designed to search for traces of the puppet master. On some resources such algorithms are available for free, on others you will have to pay a hefty sum for such an “assistant”.

The logic of the sellers of these indicators is this: if you learn to see the actions of the doll, you can make money from it. We do not recommend believing such promises. As practice shows, not a single indicator in the world will help with a high probability of finding the trace left on the market by a major player. At best, this can be done after the fact; it is impossible to synchronize actions with the market maker.

There is a simple but reliable way to help identify a major player. Observe the chart of the asset you are interested in. When there is a colossal volume on the stock exchange that was not provoked by news, then it is likely that a major player was acting.

As an example, let us cite the recent situation that has developed on the Russian stock market in relation to Magnit shares.

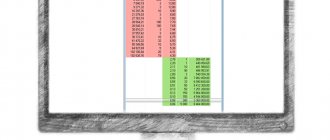

The prices of the asset in question have stagnated in a narrow flat pattern for a long time. Neither sellers nor buyers could gain the upper hand. The flat continued for 8 trading sessions. Then from 14 to 15 hours on December 4, 2021 there was a huge volume. There was no news that affected PJSC Magnit or retailers in general. This is a classic situation where a large player has bought a large volume of shares of a particular issuer.

Overview of the main tools and platforms

There are several ways to play with the stock exchange. All securities with which transactions are made are called trading instruments. The most popular of them are:

- stock;

- futures;

- currency.

You can play with shares on the stock exchange online and offline. The acquisition of these securities is tantamount to contributing funds to the capital of the company. You can earn income from securities in two ways - by buying and selling them or receiving dividends. The first type of trading is called speculation, the second is investment.

A special group of securities exchanges consists of futures. This term is usually understood as the obligations of the parties for a certain time interval and at a fixed price. The moment a futures contract is redeemed on the exchange is called its expiration date. The sale of these securities does not mean that the buyer will receive oil or precious metals for them. On the expiration day, the futures are redeemed, and the owner receives a profit or loss depending on the value of the security at that point in time.

You can play with stocks and futures on the stock and commodity markets. In Russia, the leading role belongs to the merger of 2 large platforms - the Moscow Interbank Currency Exchange (MICEX) and the Commodity and Raw Materials Systems (RTS). Today this is the best financial exchange for beginners.

Trading operations with currency pairs are carried out on the Forex market. A special feature of the work here is the ability to make transactions with leverage. At the same time, your own funds may be small - 100-200 dollars.